The older you get, the extra you’ll worth life as a result of you’ve got much less of it. If you wish to stay longer, you must intention to develop richer and stay in a extra hospitable place. As you will notice on this article, the correlation with life expectancy, wealth, and placement is powerful.

Sadly, life expectancy at beginning fell in 2021 to its lowest stage since 1996 in response to the Facilities for Illness Management and Prevention. This virtually one-year decline in life expectancy in 2021 adopted a 1.8-year life expectancy decline from 2019 to 2020.

The CDC attributes roughly half of the life expectancy decline to COVID-19. Due to the virus, roughly 20 years of life expectancy progress was worn out.

Different causes for the dramatic life expectancy declines embody: Unintentional accidents (16%), which embody drug overdoses, coronary heart illness (4.1%), power liver illness and cirrhosis (3%), and suicide (2.1%).

Given the pandemic has waned, we will count on life expectancy to stabilize and even rebound again to an upward pattern. Nonetheless, as somebody who values life an excessive amount of to depart residing to likelihood, let’s discover direct options to enhancing our personal life expectancy.

Easy Methods To Improve Life Expectancy

Primarily based on the above causes for shorter life expectations, if we need to stay longer, we should always do the next:

- Enhance our psychological well being to scale back our possibilities of suicide

- Eat more healthy and train extra to scale back our danger of coronary heart illness

- Drink much less alcohol to scale back our danger of liver illness

- Cease taking unlawful medication and eat authorized medication carefully

- Drive much less, drive extra rigorously, take part in lower-risk actions

Fairly easy proper? The opposite clear answer to rising life expectancy is to get richer. You are able to do so by signing up for my weekly publication and studying my guide on constructing extra wealth.

Not let’s have a look at life expectancy differentials by state. The variations are surprising.

Enhance Your Life Expectancy By Residing In The Proper State

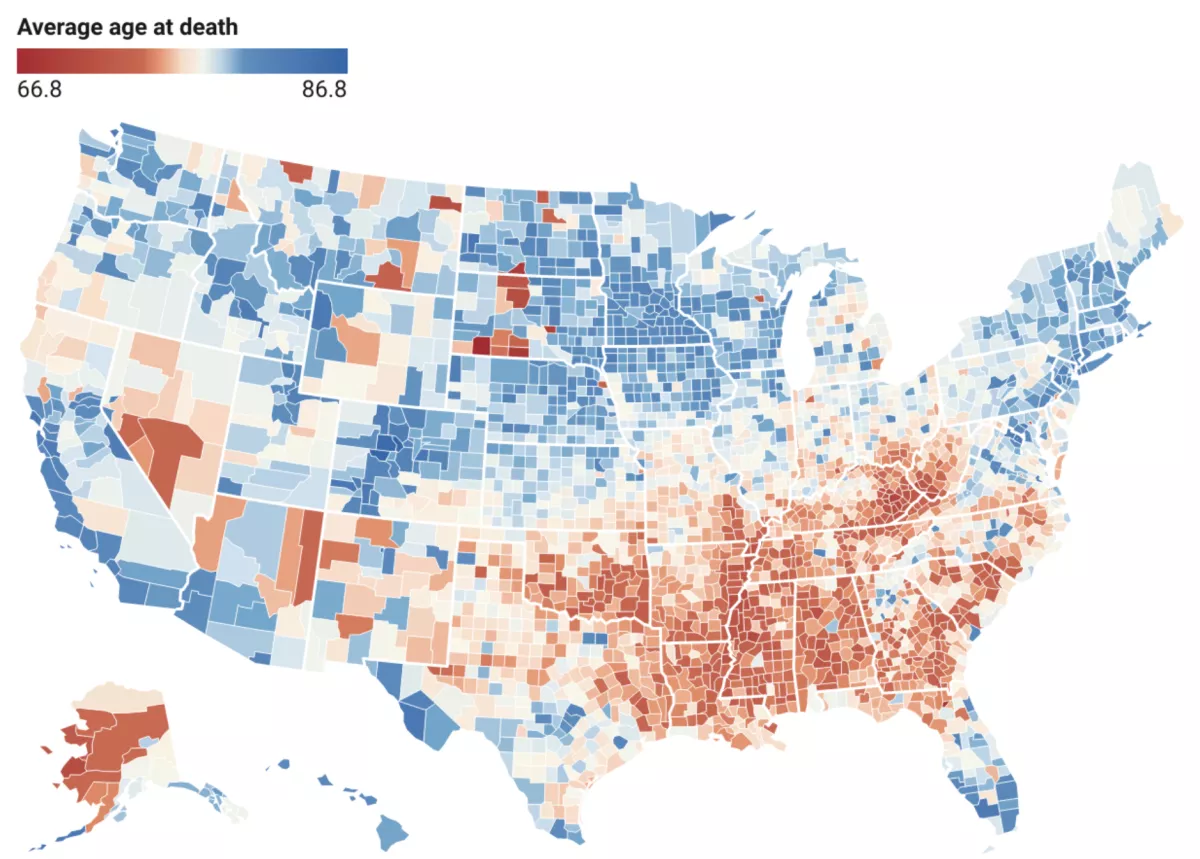

In response to this life expectancy chart by the World Well being Knowledge Alternate and Jeremy Ney, it’s clear some residents in sure states stay longer.

We’re speaking a couple of 20-year life expectancy hole between states with the shortest life expectations and states with the longest life expectations! Due to this fact, if you wish to enhance your life expectancy, contemplate relocating to states with the very best common age at dying.

Positive, it might be costlier to stay in California than Mississippi, however how a lot is life value to you? The place you need to stay is as much as you. This isn’t an article about the place you must stay. As an alternative, that is an article about the place you would possibly need to stay to increase your life. Each state has its execs and cons.

It might be too tough to relocate throughout your working years, until you’re capable of work remotely. Nonetheless, relocating to a high-life-expectancy state for retirement could also be extra possible. Whenever you’re older, you’ll doubtless be extra motivated to increase your life as effectively.

States With The Highest Life Expectations

To stay longer, you could need to stay in Hawaii, California, Washington, Colorado, Minnesota, Southern Florida, and the Northeastern States. Residents in Utah, Iowa, and Wisconsin even have comparatively lengthy life expectations.

My favourite state is Hawaii. As quickly as I step off the airplane at Honolulu Worldwide Airport, my stress stage drops by one other three factors out of ten. There’s one thing magical concerning the scent of plumeria flowers and feeling the ocean breeze that makes residing in Hawaii so fantastic.

As a resident of San Francisco, California since 2001, I’m glad residing right here as effectively. San Francisco is likely one of the least expensive worldwide cities on this planet with a torrent of fortune-making alternatives.

Though each massive metropolis has its issues, I benefit from the nature, scenic magnificence, variety, actions, and delicacies of San Francisco. Having two younger kids has additionally elevated my appreciation of residing in San Francisco given we don’t must fly wherever to have an incredible trip.

States With The Lowest Life Expectations

If you’re OK with residing a probably shorter life, you could need to stay in Alaska, Nevada, Northern Arizona, New Mexico, Northern and Japanese Texas, Oklahoma, Arkansas, Louisiana, Mississippi, Alabama, Georgia, Northern Florida, Tennessee, Kentucky, South Carolina, North Carolina, and West Virginia.

My favourite states on this group are Alaska and Louisiana. Mountain climbing and fishing in Alaska are superb experiences. I extremely advocate visiting Mt. Denali Nationwide Park for the wildlife. I’ll always remember taking a ship airplane to some distant lake and tenting with no one round for tons of of miles.

I additionally love Louisiana due to New Orleans. The meals is unimaginable, the tradition is fantastic, and so are the folks. I’m positive if I lived in New Orleans, I’d acquire at the least ten kilos and nonetheless be glad. Sugar-coated beignets crammed with jam or chocolate for the win!

Why Are Life Expectations So Totally different By State?

In response to Robert H. Shmerling of Harvard Medical Faculty, “People with the shortest life expectations are likely to have essentially the most poverty, face essentially the most meals insecurity, and have much less or no entry to healthcare. Moreover, teams with decrease life expectancy are likely to have higher-risk jobs that may’t be carried out just about, stay in additional crowded settings, and have much less entry to vaccination, which will increase the chance of changing into sick with or dying of COVID-19.”

No matter your views on vaccinations are, there does clearly appear to be a correlation with larger vaccination charges and longer life expectations.

Coverage choices on the state stage matter.

Social Determinants Of Well being

The place you reside might have an effect on what the CDC calls “the social determinants of well being” — “financial insurance policies and programs, growth agendas, social norms, social insurance policies, racism, local weather change and political programs.”

For instance, right here in San Francisco, virtually no one smokes. Due to this fact, there’s larger strain on you to not smoke as effectively. In Los Angeles, there are super-fit folks all over the place given the fixed sunshine and leisure scene. In consequence, you’re feeling extra motivated to remain in form.

Given this can be a private finance web site, what I’m most all for is the correlation between wealth and life expectancy. I need to know whether or not it’s value grinding laborious to make and save as a lot cash as potential. Or whether or not the extreme pursuit of cash will finally result in a poorer way of life.

I consider within the easy speculation that the wealthier you might be, the longer your life expectancy as a result of larger schooling and higher medical providers. Let’s check out earnings and wealth by state and evaluate the information to life expectations by state.

Common Family Earnings By State

Beneath is a map of the common family earnings by state. As you possibly can see under, there’s a excessive correlation between longer life expectations and better common family earnings. The typical family earnings ranges from $60,923 to $127,264 as of 2019. For 2023, we will assume 10% larger earnings ranges.

The southeastern states all have the bottom common family incomes in America. Montana can also be one of many lowest family earnings states, nevertheless its life expectancy is common. Therefore, good on Montana for offering life extending insurance policies and social customs.

The state that fascinates me essentially the most is Virginia, the state the place I went to highschool and school. I attended to McLean Excessive Faculty in Northern Virginia and graduated from William & Mary in Williamsburg, southeastern Virginia.

Virginia has one of many highest common family incomes in America, but is a combined bag when it comes to life expectancy. Wealth is concentrated in Northern Virginia, close to Washington D.C, the place life expectancy is excessive. Nonetheless, the nearer you get to southwestern Virginia, the poorer its residents and the decrease the life expectancy.

Therefore, I see Virginia as an incredible instance to reveal the sturdy correlation between life expectancy and earnings. I visited all corners of Virginia throughout my highschool and school years, and will clearly see the variations in wealth and well being throughout the state.

The larger your earnings, the better it’s to afford healthcare, stay in a pleasant home, eat more healthy meals, and pay for schooling.

Utilizing an excessive instance, some households I do know pay greater than $75,000 a yr for personal concierge well being service. Discuss an unaffordable luxurious for many households.

Common Internet Price By State

Along with family earnings by state, let’s have a look at the common internet value by state in response to Empower. I’ve used Empower’s (previously generally known as Private Capital) free monetary instruments to trace my internet value since 2012 and was a shareholder.

As soon as once more, you will notice a excessive correlation between life expectancy and internet value. The states with larger common internet worths have larger life expectations and vice versa.

On the finish of the day, you need to construct as giant a internet value as potential with a purpose to generate as a lot passive earnings as potential. As a result of finally, we’ll all tire or be unable to work. If you’re out of labor or unable to work, your life expectancy might endure.

| Rank | State | Quantity |

| 1 | California | $884,003 |

| 2 | Connecticut | $873,746 |

| 3 | Washington | $865,309 |

| 4 | New Jersey | $810,106 |

| 5 | Massachusetts | $787,154 |

| 6 | New Hampshire | $735,968 |

| 7 | Vermont | $730,730 |

| 8 | Virginia | $716,643 |

| 9 | Colorado | $711,968 |

| 10 | Illinois | $690,464 |

| 11 | New York | $690,037 |

| 12 | Oregon | $666,247 |

| 13 | North Carolina | $653,513 |

| 14 | Alaska | $652,999 |

| 15 | Maryland | $650,616 |

| 16 | Minnesota | $648,178 |

| 17 | Pennsylvania | $636,880 |

| 18 | Nevada | $636,385 |

| 19 | Texas | $634,048 |

| 20 | Idaho | $626,599 |

| 21 | Florida | $619,275 |

| 22 | South Dakota | $614,059 |

| 23 | Washington, D.C. | $611,898 |

| 24 | Arizona | $605,953 |

| 25 | Iowa | $600,063 |

| 26 | South Carolina | $587,075 |

| 27 | Georgia | $568,001 |

| 28 | New Mexico | $553,107 |

| 29 | Wisconsin | $553,086 |

| 30 | Michigan | $550,298 |

| 31 | Ohio | $545,090 |

| 32 | Kentucky | $544,334 |

| 33 | Delaware | $542,743 |

| 34 | Tennessee | $530,092 |

| 35 | Kansas | $523,916 |

| 36 | Rhode Island | $523,710 |

| 37 | Hawaii | $518,417 |

| 38 | Wyoming | $516,292 |

| 39 | Nebraska | $504,347 |

| 40 | Missouri | $504,319 |

| 41 | Indiana | $497,440 |

| 42 | Maine | $494,845 |

| 43 | Montana | $490,433 |

| 44 | Alabama | $481,228 |

| 45 | Utah | $474,093 |

| 46 | Louisiana | $459,770 |

| 47 | Oklahoma | $448,494 |

| 48 | Arkansas | $439,790 |

| 49 | Mississippi | $407,691 |

| 50 | West Virginia | $376,690 |

| 51 | North Dakota | $339,955 |

Outlier States With Weak Correlation With Internet Price And Life Expectancy

The largest outliers above are North Carolina (#13 rank, $653,513 internet value), Alaska (#14 rank, $652,999 internet value), Nevada (#18 rank, $636,385 internet value), and Texas (#19 rank, $634,048 internet value). Regardless of comparatively excessive common internet worths, the life expectations in these states are under common.

We are able to make the belief that after a sure stage of internet value, cash doesn’t matter as a lot if state insurance policies and social influences will not be conducive to more healthy existence. For instance, of the 20 states with the worst life expectations, eight are among the many 12 states that haven’t applied Medicaid growth underneath the Reasonably priced Care Act.

On the flip aspect, the common internet value in Hawaii is simply $518,417 (#17 rank), nevertheless, Hawaii residents stay the longest. One might argue the slower way of life, higher year-around climate, state insurance policies, and more healthy social influences are the explanations for the life expectancy outperformance.

In the course of the pandemic, for instance, Hawaii barred vacationers and different non-essential vacationers from coming to their islands. No different state took such drastic measures to guard its residents from the virus.

Lastly, one of many best determinants of a excessive internet value is proudly owning your major residence. It’s no coincidence the states with the very best internet worths even have the very best median residence costs. Therefore, if you wish to construct extra wealth, personal actual property.

How A lot Would You Pay To Dwell Longer?

The life expectancy unfold between states with the very best and lowest life expectations is between 10 to twenty years. You’ve obtained to ask your self how a lot you’d be keen to pay to have 10 to twenty years extra of life?

At age 45, I’d be keen to surrender 70% of my internet value for 10 extra years of life and 90% of my internet value for 20 extra years of life. I’ve thought-about giving up all my internet value to stay an additional 20 wholesome years, nevertheless, then I wouldn’t have the ability to care for my household.

If life is priceless, paying extra to stay in an costly metropolis and state is value it. For many who can’t afford to stay in the most costly cities and states, good factor there’s a plethora of lower-cost choices akin to Colorado, Minnesota, Iowa, and Southern Florida.

Beneath is a tragic chart that reveals the US spending essentially the most per capita on well being whereas having the bottom life expectancy amongst nations with related GDP per capita.

Make investments In Low Value, Excessive Life Expectancy States

As the common age of People will get older as a result of declining beginning charges, the investor in me thinks there shall be a larger move of capital to states with larger life expectations. In consequence, you could need to put money into actual property and corporations primarily based in states with the very best life expectations.

Particularly, you need to concentrate on investing in lower-cost states with excessive life expectations. These states are: Colorado, Nebraska, Minnesota, Wisconsin, Iowa, and Thought.

Increased life expectations additionally create the necessity for extra service-related companies that cater to the aged. Therefore, investments in retirement properties, neighborhood residing properties, low-impact sporting amenities, wellness facilities, and leisure ought to increase.

Residing Longer In Hawaii Is My Objective

Personally, we plan to retire to Hawaii, the place half my household is from. The issue is making the transfer since we’ve grown roots in California since 2001. Our window of alternative could also be in 2025, when our daughter is eligible for kindergarten. If 2025 doesn’t work, we’ll contemplate 2031, when our son is eligible for highschool.

Given the sturdy correlation between wealth and life expectancy, I now have a further motivation to write extra books and articles about learn how to construct extra wealth. Longer life expectations result in larger happiness and extra contributions to society.

Now these are issues value residing for!

Reader Questions and Ideas

Do you consider there’s a sturdy correlation with wealth and life expectancy? What do you suppose are the most important causes for such large life expectancy discrepancies amongst states? What are some stuff you plan to do to extend your life expectancy?

Choose up a replica of Purchase This, Not That, my instantaneous Wall Road Journal bestseller. The guide helps you make extra optimum funding choices so you possibly can stay a greater, longer, extra fulfilling life.

Constructed extra wealth utilizing Empower’s free monetary instruments. With Empower, you possibly can keep on high of your internet value, x-ray your investments for extreme charges, and higher plan for retirement.

For extra nuanced private finance content material, be part of 60,000+ others and join the free Monetary Samurai publication and posts through e-mail. Monetary Samurai is likely one of the largest independently-owned private finance websites that began in 2009.