Manufacturers and companies that undertake and embed ESG (environmental, social and governance) elements into their technique usually tend to create worth and speed up development, whereas minimizing their authorized and regulatory dangers, in keeping with a brand new report from international legislation agency Dechert and advisory agency StoneTurn.

The brand new report, Are You Prepared for ESG as a Vital Enterprise Crucial?, based mostly on a sequence of occasions and a pulse survey of executives in attendance, discusses the impression of ESG throughout enterprise and the evolving regulatory and authorized setting. It exhibits that integrating ESG and regularly reassessing ESG technique is a future-proofing funding that may create worth, drive value reductions and enhance productiveness and development, with the potential to be a strong enterprise power for good.

Demonstrable motion wanted

With tighter regulation coming into play and stakeholder and activist teams demanding elevated ESG accountability, the report emphasizes that corporations should reveal actual motion now on points together with sustainability and provide chain due diligence.

The heartbeat survey signifies that many corporations have some option to go to fulfill these elevated calls for. It discovered that fewer than one in three respondents say their group has carried out a threat evaluation to establish ESG dangers of their provide chain prior to now two years, whereas 60 p.c didn’t combine ESG due diligence into wider due diligence actions and compliance measures.

Failure to embrace and embed ESG

The report highlights how a failure to embrace and embed ESG into your corporation technique and processes might have critical monetary and reputational penalties, which can embrace litigation, regulatory motion, and the restriction of entry to capital as lenders begin to cost greater premiums and rates of interest to organizations with poor ESG threat score. Markets are additionally responding, with shares which have constructive ESG rankings driving share worth and dividend development.

“Integrating a transparent and sturdy ESG technique will go a protracted option to making certain that companies don’t run afoul of tighter rules, thereby minimizing the potential for litigation, in addition to assembly the calls for of each stakeholders and activist teams for elevated accountability,” stated Matthew Banham, a associate at Dechert specializing in corruption, fraud and monetary providers regulatory enforcement, in a information launch. “This could lead to higher ruled organizations that may protect their worth and guarantee their viability in years to come back.”

Tradition is important to the success of an ESG technique

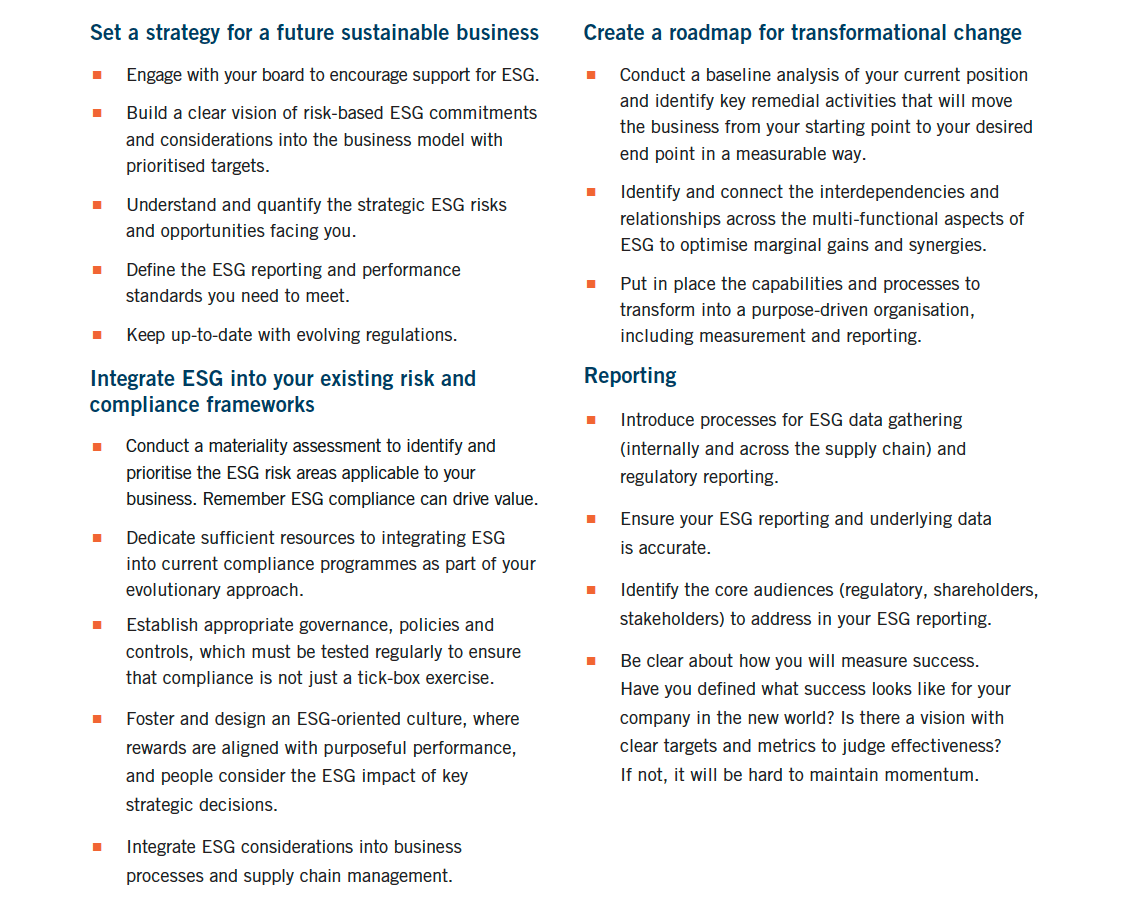

The report identifies key issues and affords sensible recommendation on the best way to maximize the success of ESG enterprise commitments, together with emphasizing {that a} values-focused enterprise tradition permeates a company to allow a constructive setting for change. Factors embrace:

- Robust route, a strong tone from the highest and moral dedication from enterprise leaders, bolstered by aligned company governance assist companies in delivering sustainable priorities.

- Companies ought to rethink company goal and the enabling tradition of the group, so that everybody is obvious about what’s the ‘proper factor’ to do. Solely 43% of pulse respondents stated this was the one greatest driver of change, which signifies that over 50% see ESG as solely a compliance or regulatory initiative.

- Navigate and establish the evolving regulatory panorama because the scope of reporting expands to cowl areas corresponding to setting, nature, anti-corruption and bribery, and variety – inside organizations and throughout their stakeholders and worth chains.

- Shine the ESG highlight on all relationships: mother or father, subsidiary, and contracting third events. Though courts are historically reluctant to ‘pierce the company veil’ and discover a mother or father liable the place it was not a celebration to the contract in query, current case legislation signifies that, when the details are proper, courts will probably be extra keen to increase potential legal responsibility to mother or father corporations.

- Combine ESG into a company’s present threat and compliance framework and set up correct and dependable information gathering processes for important ESG-related metrics.

Key motion gadgets from the analysis:

“Tradition and good company governance could make or break a company’s skill to ship on their strategic ESG priorities,” stated Tracey Groves, associate at StoneTurn, within the launch. “Partaking the entire enterprise in not simply what must be finished, however why it issues and the way it aligns to the values and goal of the group, will probably be important to securing buy-in and dedication to doing the suitable factor from all stakeholders. An enabling and empowering tradition doesn’t occur by default, it should be designed and formed with intention and goal.”

Obtain the total report right here.

Within the first half of 2022, Dechert and StoneTurn held a sequence of digital and stay occasions exploring the longer term impression of ESG throughout enterprise and the evolving regulatory and authorized setting for organizations and their administrators. In these occasions, we used stay on-line polling to seize information round how far down the road organizations are of their ESG journey. 114 individuals had been polled over a two-month interval.