Authored by Lance Roberts by way of RealInvestmentAdvice.com,

Shares are rallying on hopes that Jerome Powell and the Fed will cease growing rates of interest this fall, pivot, and begin lowering them subsequent yr. For worry of lacking out on the subsequent nice bull run, many buyers are blindly shopping for into this new Powell pivot narrative.

What these buyers fail to comprehend is the Fed has an issue. Inflation is raging, the likes of which the Fed hasn’t handled since Jerome Powell earned his legislation diploma from Georgetown College in 1979.

Regardless of inflation, markets appear to imagine that at the moment’s Fed has the identical mindset because the 1990-2021 Fed. The previous Fed would have stopped elevating charges when shares fell 20% and definitely on the second consecutive destructive GDP print. The present Fed appears to need to hold elevating charges and lowering its steadiness sheet (QT).

The market-friendly Fed we grew accustomed to over the previous couple of a long time is probably not driving the ship anymore. Yesterday’s funding methods might show flawed if a brand new inflation-minded Fed is on the wheel.

In fact, you may ignore the realities of at the moment’s excessive inflation and take Jim Cramer’s ever-bullish recommendation.

When the Fed will get out of the best way, you have got an actual window and also you’ve obtained to leap by way of it. … When a recession comes, the Fed has the nice sense to cease elevating charges,” the “Mad Cash” host stated. “And that pause means you’ve obtained to purchase shares.

Shifting Market Expectations

On June 10, 2022, the Fed Funds Futures markets implied the Fed would elevate the Fed Funds price to three.20% in January 2023 and to three.65% by July 2023. Such suggests the Fed would elevate charges by nearly 50bps between January and July.

Now the market implies Fed Funds will probably be 3.59% in January, up .40% within the final two months. Nevertheless, the market implies July Fed Funds will probably be 3.52%, or .13% lower than its January expectations. The market is pricing in a price discount between January and July.

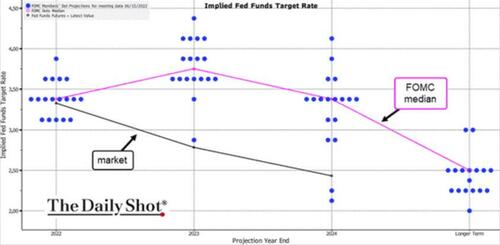

The graph beneath highlights the latest shift in market expectations during the last two months.

The graph beneath from the Every day Shot reveals compares the market’s implied expectations for Fed Funds (black) versus the Fed’s expectations. Every blue dot represents the place every Fed member thinks Fed Funds will probably be at every year-end. The market underestimates the Fed’s resolve to extend rates of interest by about 1%.

Brief Time period Inflation Projections

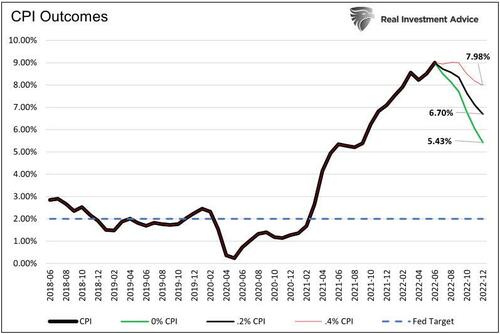

The largest flaw with pricing in predicting a stall and Powell pivot within the close to time period is the doable trajectory of inflation. The graph beneath reveals annual CPI charges based mostly on three conservative month-to-month inflation information assumptions.

If month-to-month inflation is zero for the rest of 2022, which is very unlikely, CPI will solely fall to five.43%. Sure, that’s significantly better than at the moment’s 9.1%, however it’s nonetheless properly above the Fed’s 2.0% goal. The opposite extra doubtless eventualities are too excessive to permit the Fed to halt its battle in opposition to inflation.

Inflation by itself, even in a rosy situation, isn’t more likely to get Powell to pivot. Nevertheless, financial weak point, deteriorating labor markets, or monetary instability may change his thoughts.

Recession, Labor, and Monetary Instability

GDP simply printed two destructive quarters in a row. Some economists name {that a} recession. The NBER, the official determiner of recessions, additionally considers the well being of the labor markets of their recession decision-making.

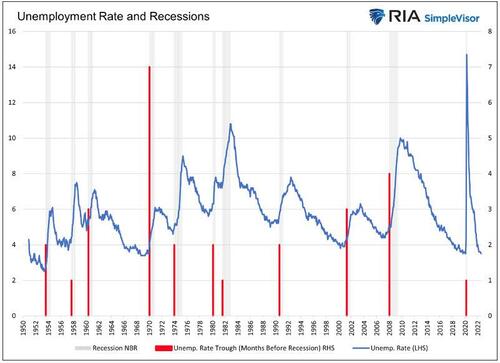

The graph beneath reveals the unemployment price (blue), recessions (grey), and the variety of months the unemployment price troughed (purple) earlier than every recession. Since 1950 there have been eleven recessions. On common, the unemployment price bottoms 2.5 months earlier than an official recession declaration by the NBER. In seven of the eleven situations, the unemployment price began rising one or two months earlier than a recession.

The unemployment price might begin ticking up shortly, however take into account it’s presently at a traditionally low degree. At 3.5%, it’s properly beneath the 6.2% common of the final 50 years. Of the 630 month-to-month jobs stories since 1970, there are solely three different situations the place the unemployment price dipped to three.5%. There are zero situations since 1970 beneath 3.5%!

Regardless of some latest indicators of weak point, the labor market is traditionally tight. For instance, job openings slipped from 11.85 million in March to 10.70 in June. Nevertheless, as we present beneath, it stays properly above historic norms.

A decent labor market that may result in greater inflation by way of a price-wage spiral is of concern for the Fed. Such worry provides the Fed ample cause to maintain tightening charges even when the labor markets weaken. For extra on price-wage spirals, please learn our article Persistent Inflation Scares the Fed.

Monetary Stability

Moreover financial deterioration or labor market troubles, monetary instability may trigger Jerome Powell to pivot. Whereas there have been some rising indicators of economic instability within the spring, these warnings have dissipated.

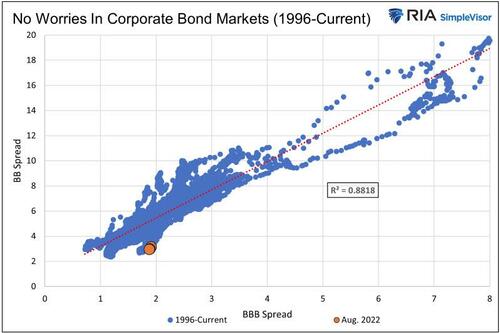

For instance, the Fed pays shut consideration to the yield unfold between company bonds and Treasury bonds (OAS) for indicators of instability. They pay explicit consideration to yield spreads of junk-rated company debt as they’re extra unstable than investment-grade paper and infrequently are the primary belongings to indicate indicators of issues.

The graph beneath plots the each day intersections of funding grade (BBB) OAS and junk (BB) OAS since 1996. As proven, the OAS on junk-rated debt is sort of 3% beneath what ought to be anticipated based mostly on the strong correlation between the 2 yield spreads. Company debt markets are exhibiting no indicators of instability!

Shares, however, are decrease this yr. The S&P 500 is down about 15% yr to this point. Nevertheless, it’s nonetheless up about 25% for the reason that pandemic began. Extra importantly, valuations have fallen however are nonetheless properly above historic averages. So, whereas inventory costs are down, there are few indicators of fairness market instability. Actually, the latest rally is beginning to elicit FOMO behaviors so usually seen in speculative bullish runs.

Declining yields, tightening yield spreads, and rising asset costs are inflationary. If something, latest market stability provides the Fed a cause to maintain elevating charges. Ex-New York Fed President Invoice Dudley just lately commented that market hypothesis a few Fed pivot is overdone and counterproductive to the Fed’s efforts to carry down inflation.

What Does the Fed Assume?

The next quotes and headlines have all come out for the reason that late July 2022 Fed assembly. All of them level to a Fed with no intent to stall or pivot regardless of its impact on jobs and the economic system.

- *KASHKARI: 2023 RATE CUTS SEEM LIKE `VERY UNLIKELY SCENARIO’

- Fed’s Kashkari: regarding inflation is spreading; we have to act with urgency

- *BOWMAN: SEES RISK FOMC ACTIONS TO SLOW JOB GAINS, EVEN CUT JOBS

- *DALY: MARKETS ARE AHEAD OF THEMSELVES ON FED CUTTING RATES

- St. Louis Fed President James Bullard says he favors a method of “front-loading” huge interest-rate hikes, repeating that he needs to finish the yr at 3.75% to 4% – Bloomberg

- FED’S BULLARD: TO GET INFLATION COMING DOWN IN A CONVINCING WAY, WE’LL HAVE TO BE HIGHER FOR LONGER.

- “If you need to lower off the tail of a canine, don’t do it one inch at a time.”- Fed President Bullard

- “There’s a path to getting inflation underneath management,” Barkin stated, “however a recession may occur within the course of” – MarketWatch

- The Fed is “nowhere close to” being carried out in its battle in opposition to inflation, stated Mary Daly, the San Francisco Federal Reserve Financial institution president, in a CNBC interview Tuesday. –MarketWatch

- “We predict it’s essential to have development decelerate,” Powell stated final week. “We really assume we want a interval of development beneath potential, to create some slack in order that the availability aspect can catch up. We additionally assume that there will probably be, in all probability, some softening in labor market circumstances. And people are issues that we anticipate…to get inflation again down on the trail to 2 p.c.”

Abstract

We’re extremely uncertain that Powell will pivot anytime quickly. Supporting our view is the latest motion of the Financial institution of England. On August 4th they raised rates of interest by 50bps regardless of forecasting a recession beginning this yr and lasting by way of 2023. Central bankers perceive this inflation outbreak is exclusive and are caught off guard by its persistence.

The economic system and markets might take a look at their resolve, however the specter of a long-lasting price-wage spiral will hold the Fed and different banks from taking their foot off the brakes too quickly.

We shut by reminding you that inflation will begin falling within the months forward, nevertheless it hasn’t even formally peaked but.