When most individuals consider checks, in addition they consider dinosaurs, dodo birds, and different long-dead issues. However whereas paper checks have one foot within the grave, eChecks are alive and thriving. The truth is, there have been 29.1 billion eCheck funds made in 2021, in response to Nacha, the group that maintains the eCheck community.

If you need your online business to get in on a few of these billions, learn on to study what eChecks are and the way they work. Then we’ll cowl solutions to the commonest questions on eChecks, and present you how one can get began accepting eChecks in minutes.

What’s eCheck cost processing?

An eCheck is a kind of digital funds switch (EFT). As an alternative of filling out a paper verify, you enter your banking info into a web site or cost gateway. On-line invoice pay is one instance of eCheck processing. eChecks use the Automated Clearing Home (ACH) community, in order that they’re sooner and safer than paper checks.

How does eCheck work?

eChecks permit banks to switch cash straight from one account to a different. To do that, they use an digital community known as the Automated Clearing Home or ACH. The ACH community connects all banks throughout the U.S., and strikes round $72.6 trillion per 12 months, in response to Nacha (previously the Nationwide Automated Clearing Home Affiliation).

To ensure all that cash will get the place it’s alleged to, the eCheck course of takes a number of steps:

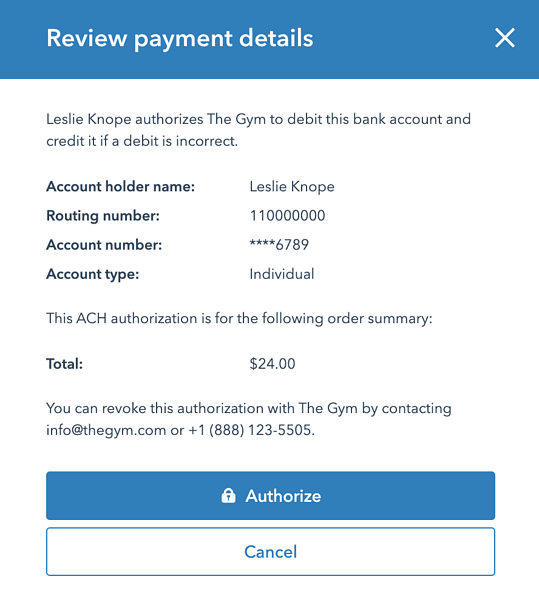

- Fee Authorization – First, the client enters their checking account info and authorizes cost. That is often performed by means of an on-line cost gateway. The authorization might be for a one-time buy or a recurring subscription.

- Fee Request – The enterprise’ cost processor makes use of the client’s account information to create a cost request. At sure instances every day, the processor sends batches of those requests to the Automated Clearing Home.

- Fee Affirmation – The ACH kinds the batches and forwards the cost request to the client’s financial institution. The financial institution verifies the small print and confirms the funds can be found.

- Fee – As soon as the transaction is verified, the cash is transferred from the client’s account to the enterprise’ account.

Right here’s a screenshot of what an authorization may seem like.

eChecks may work in reverse; for instance, with direct deposit payroll or on-line tax refunds. On this case, the recipient supplies their checking account info and authorizes a deposit as an alternative of a withdrawal.

These steps might sound sophisticated, however they’re nonetheless sooner than processing a paper verify. And in contrast to a paper verify, which passes by means of a number of palms, the banking information is encrypted all through all the course of.

Advantages of eCheck Fee Processing

eChecks include a wide range of perks that make them engaging to companies and prospects alike. In the event you’re fascinated about accepting this sort of cost, contemplate the next:

- They’re safer than paper checks or bank cards. In keeping with the Federal Reserve, funds made by means of the ACH community have the bottom price of fraud by worth.

- They price lower than bank cards. eCheck charges usually fall between 0.5% to 1.5% of the transaction quantity. Evaluate that with bank card processing charges which common 1.5% to three.5%.

- They allow recurring funds. eChecks are an inexpensive method to supply your prospects month-to-month subscriptions or auto-pay choices.

- They’re extra dependable than playing cards for recurring funds. eChecks depend on checking account info, as an alternative of bank card numbers that may get misplaced, stolen, or expired. This implies funds are much less prone to be rejected.

- They’re sooner than paper checks. eChecks usually take 3-5 enterprise days to course of. They’re often performed earlier than a paper verify even arrives within the mail.

Ceaselessly Requested Questions About eChecks

How a lot does eCheck price?

The price of eCheck processing depends upon the cost processor you select. Some cost a flat price, which often runs between $0.20 to $1.50 per transaction. Most cost a share of the transaction quantity, which averages between 0.5% to 1.5%.

For instance, with HubSpot funds, you pay solely 0.5%, with a cap of $10 per transaction.

Are eChecks processed instantly?

ACH guidelines require cost requests to be processed inside 24 to 48 hours. That’s to not say you’ll obtain your cash that shortly. After the request is made it have to be processed by each banks, in addition to the ACH community itself.

How lengthy does eCheck take to course of?

Usually, eCheck funds take 3-5 enterprise days to course of. As soon as a cost request is made, it have to be despatched by means of the ACH community, then verified by the client’s financial institution. After that, the service provider’s financial institution might maintain the cash for twenty-four hours whereas it performs its personal safety checks.

Is eCheck Safe?

eChecks are probably the most safe strategies of cost accessible. The truth is, they’ve the lowest price of fraud by worth, in response to the Federal Reserve. Funds made by ACH common solely 8 cents of fraud for each $10,000.

Is eCheck the identical as a debit card?

Although they each join on to your checking account, eCheck isn’t the identical as a debit card. Debit playing cards depend on a bank card community, whereas eCheck funds undergo the Automated Clearing Home (ACH) community.

Because of this, debit card funds can be found a lot sooner however will usually incur larger charges.

What’s the distinction between ACH and eCheck?

The phrases eCheck and ACH are sometimes used interchangeably. Technically, ACH refers back to the community that’s used to make funds, whereas eCheck refers back to the cost itself. For that reason, eChecks are additionally generally known as “ACH funds.”

The way to Ship an Digital Verify

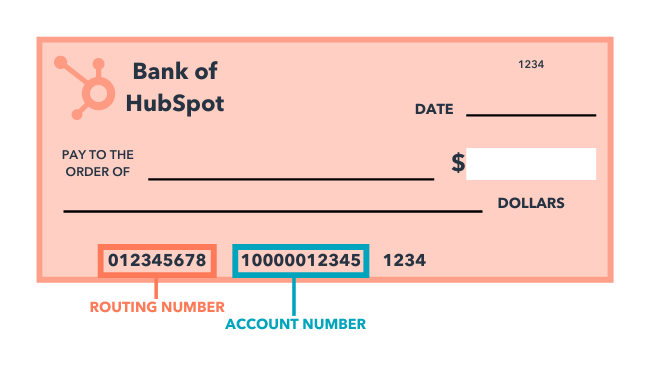

To pay by digital verify, or eCheck, you’ll want the identical info discovered on a paper verify. This contains your title, checking account quantity, and routing quantity. The enterprise may have an internet type or cost gateway to enter the info. When you authorize a purchase order or subscription, the cost processor handles the remainder.

The way to Settle for eCheck Funds

To get began accepting eChecks, you’ll want a service provider account or third-party cost processor. You’re most likely already accustomed to processors like PayPal, Stripe, or Sq..

Subsequent, you’ll want a method to securely accumulate your prospects’ banking info. This includes a little bit of software program known as a cost gateway. The gateway generally is a type that lives in your web site, or a button that redirects to a safe checkout web site. Most cost processors will supply a gateway as a part of their service, or for an added price.

Professional Tip: Gross sales Hub customers with a Starter account or above can get each of those companies at no further cost.

The HubSpot funds software enables you to settle for eChecks proper out of your web site. Or ship your prospects a safe cost hyperlink inside a quote, bill, or electronic mail. And because it’s already built-in with the HubSpot CRM, you may arrange automated cost workflows, or immediately replace your buyer accounts with cost historical past.

There aren’t any month-to-month charges, setup costs, or minimums. You pay solely 0.5% of the transaction quantity, capped at $10 per transaction, so that you solely pay for eCheck processing while you want it.

Organising your account takes solely minutes, and most companies can begin accepting eChecks inside 1-2 enterprise days.

eChecks Make it Straightforward

With eChecks, you’re not doomed to the dinosaur age. The low charges and excessive safety make it straightforward and inexpensive to supply your prospects extra cost choices.