As an entrepreneur, it’s important to maintain your present property excessive if you wish to preserve your small business working at a gentle tempo.

Whether or not you want new gear for your small business or a bigger workplace area, you want money for a wide range of bills. To get this money, you’ve a couple of choices. You may faucet into your checking account, elevate funds, and even take out a enterprise line of credit score. Or, you’ll be able to depend on present property to pay for these investments.

Let’s go over what precisely present property are and examples of this essential enterprise accounting time period.

Desk of Contents

What’s a present asset?

Present property are money and short-term property that may be shortly transformed to money inside one yr or working cycle. They’re additionally known as liquid property. When an asset is liquid, it may be transformed to money in a brief timeframe.

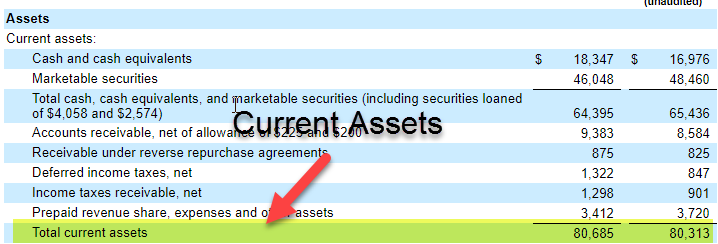

Beneath is an inventory of present property typically listed on an organization’s stability sheet:

- Money.

- Money equivalents.

- Accounts receivable.

- Stock.

- Pay as you go bills and liabilities.

- Quick-term, liquid investments.

Present property will flip into money inside a yr from the date displayed on the high of the stability sheet. A stability sheet is a monetary assertion that reveals a enterprise‘ property and the way they’re financed, by means of debt or fairness.

The stability sheet stories on an accounting interval, which is often a 12-month timeframe. Present property might be discovered on the high of an organization‘s stability sheet, they usually’re listed so as of liquidity.

Non-current property (or mounted property) are long-term investments that usually can’t be became money inside a yr. Examples of non-current property embrace actual property, land, gear, intangible property, emblems, copyrights, and patents.

Should you want a fast technique to bear in mind what’s thought of non-current, assume property, plant, gear, and intangible property. Property that fall inside these 4 classes typically can’t be bought inside a yr and became money shortly.

What are you able to do with present property?

Conserving present property excessive is essential if you wish to run a wholesome enterprise. Present property can fund day-to-day operations or short-term bills that preserve your small business working. Some issues chances are you’ll use present property to pay for embrace:

- Day-to-day operations (stock, workers, and many others.).

- Enterprise investments (gear upgrades, new workplace, and many others.).

- Debt funds (payments, mortgage funds, and many others.).

Subsequent, let’s take a deeper look into various kinds of property so as of liquidity.

Forms of Present Property

Understanding what varieties of property you’ve provides you with a clearer thought of which of them might be transformed to money to fund your small business endeavors.

Money

Money is the first present asset, and it‘s listed first on the stability sheet as a result of it’s probably the most liquid. It consists of home and overseas forex, a enterprise checking account that is used to pay bills and obtain funds from prospects, and some other money readily available.

It additionally consists of imprest accounts that are used for petty money transactions. This money is used for small funds like donuts and low for a morning assembly, reimbursing an worker for a minor business-related expense, or buying a low-cost provide, like paperclips or stamps.

Money Equivalents

Money equivalents are almost as liquid as money. These are thought of liquid property as a result of they will shortly be transformed into money when wanted. Money equal property embrace marketable securities, short-term authorities bonds, treasury payments, and cash market funds.

Accounts Receivable

Accounts receivable are the cash prospects owe the vendor or enterprise. Since most buyer funds are transformed to money inside a yr, it is listed as a present asset. For instance, a furnishings firm designs a sofa for a buyer with the settlement that the client will likely be billed as soon as the sofa is delivered. The fee owed might be recorded underneath accounts receivable.

If a very good or service takes over a yr to transform to money, it will be thought of a long-term asset and would not be reported underneath present property. As an alternative, it will be categorized as a non-current asset.

Stock

Your enterprise’ uncooked supplies and any unsold merchandise are referred to as stock. These things are thought of liquid as a result of the merchandise is usually bought inside a yr. Stock is a present asset that must be monitored intently.

If in case you have an excessive amount of stock, your gadgets may turn out to be out of date and expire (e.g., meals gadgets). You‘ll spend an excessive amount of cash on manufacturing and storing the merchandise. And if you happen to’re quick on stock, you‘ll lose gross sales and sure have pissed off prospects who can’t buy your product as a result of it is out of inventory.

Examples of Present Property

Now that we higher perceive the various kinds of present property accessible, listed here are a couple of examples of present property and the way they can be utilized to fund your small business.

Quick-term Investments

Quick-term investments are money equivalents which might be thought of liquid property. Money equal property embrace shares, bonds, financial savings accounts, and mutual funds.

Pay as you go Bills

Pay as you go insurance coverage is recorded as a present asset on the stability sheet. It is the time period used to explain advance funds for insurance coverage protection. Insurance coverage premiums are sometimes paid earlier than the interval lined by the fee. And all the quantity is often paid off inside a yr.

Lease can be thought of a present asset. Should you‘re making a hire fee earlier than the interval it’s due, that is thought of pay as you go hire. It‘s a present asset that’s reported on the stability sheet.

The fee is taken into account a present asset till your small business begins utilizing the workplace area or facility within the interval the fee was for. For instance, a enterprise pays its workplace hire for November on October thirtieth. As soon as they start utilizing the workplace area on November 1st, the fee would then be reported as an expense.

Tools

It is essential to notice right here that gear is not thought of a present asset as a result of it is a mounted, long-term asset.

Tools consists of equipment used for operations and workplace gear (e.g., fax machines, printers, copiers, and computer systems). These are mounted property, as they’re used long-term, and their utilization interval is often longer than one yr.

Managing Your Present Property

Present property are important for any wholesome enterprise. Whether or not you’re employed with an accountant or have an inside workforce run your numbers, each enterprise stability sheet should monitor present property.