Studying Time: 11 minutes

Web banking and digital funds have turn out to be more and more widespread currently. 73% of shoppers globally use on-line banking at the least as soon as a month. 38.4% of smartphone shoppers make in-store funds at the least twice a 12 months. The whole variety of international on-line banking clients will exceed 3.6 billion by 2024.

On-line banking has turn out to be widespread as a result of shoppers love comfort, safety, and the big selection of monetary providers out there on their computer systems and smartphones. The adoption of digital types of banking is now widespread, peaking in some northern European international locations the place the adoption is near 100%.

Listed below are a number of the key the reason why clients are more and more preferring web banking:

- Safety Assured: On-line banking is very safe, as banks use encryption to guard consumer info and forestall safety breaches

- Simple Entry: On-line banking permits for transactions anytime from the consolation of residence, with out the necessity to bodily go to the financial institution

- No Hidden Charges: Making on-line transactions is handy and doesn’t contain hidden charges, solely a nominal transaction comfort cost

- Comfort Assured: On-line banking eliminates the necessity to wait in lengthy queues on the financial institution, making banking extremely handy

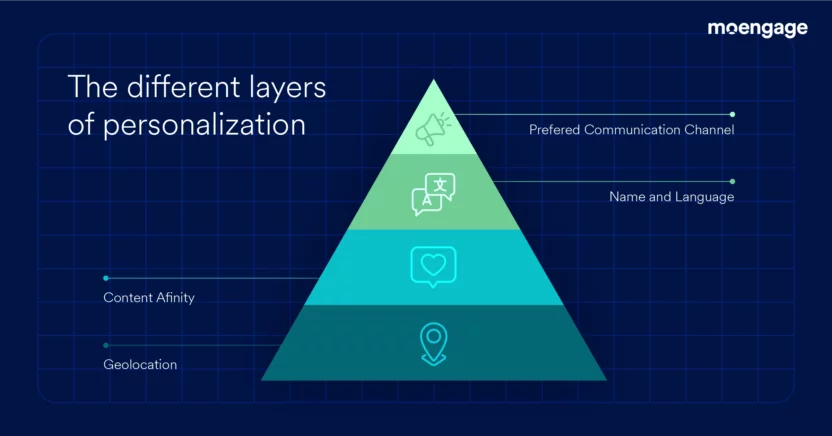

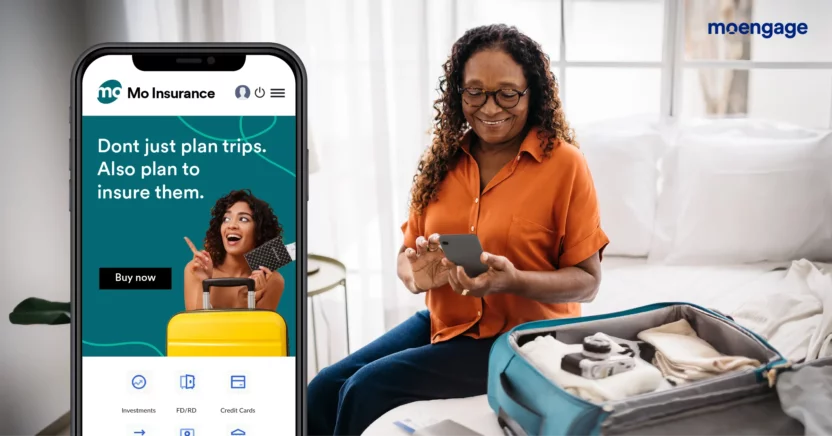

With digital finance on the rise, firms search a differentiating issue to enhance the shopper expertise and engagement on the apps/web sites. To facilitate extra digital transactions, specializing in one key differentiating issue, web site personalization for BFSI manufacturers, is vital.

Let’s learn extra about it and the way MoEngage can supercharge these for you.

Web site Personalization For BFSI Manufacturers Primarily based On Personalised Buyer Experiences

Web site personalization for BFSI manufacturers entails enhancing the onboarding completion charges and minimizing drop-offs by welcoming clients and guiding them by the setup course of is important in constructing long-term buyer relationships. Personalised messages enable the dialog to proceed on different channels to deliver again clients who dropped off.

For BFSI manufacturers, this contains sending customized messages corresponding to invoice cost notifications, and mortgage {qualifications}, or discovering a close-by department location based mostly on earlier transactions and looking historical past, location, and utilizing personalization finest practices to win again your inactive or misplaced clients, increase buyer engagement, and conversions.

An effective way to do that is by letting an AI-powered platform, corresponding to MoEngage by customized provides, assist present predictive suggestions to stimulate upsells or cross-sells, and way more!

The Benefits Of Web site Personalization With MoEngage For BFSI Manufacturers

- Develop built-in reporting, consider buyer actions, and reply instantly, multi function place

- Generate buyer experiences which can be custom-made and charming

- Anticipate and cease clients from leaving your web site or app

- Improve buyer involvement and increase the shopper lifetime worth

Let’s take a deep dive into the assorted use circumstances the MoEngage empowers for BFSI manufacturers.

Web site Personalization Use-cases For BFSI Manufacturers

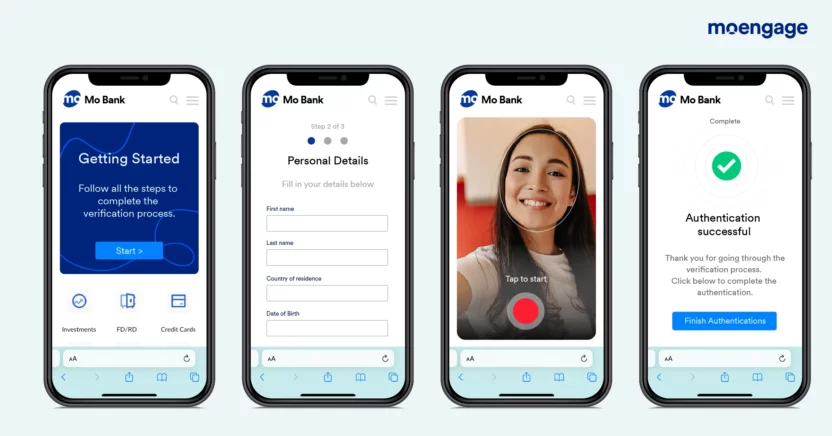

Onboarding and KYC

Advantages:

- Personalization can assist scale back friction within the sign-up course of by pre-filling kinds with identified info

- Custom-made messages and providing assist in enhancing app set up charges and sign-ups

How To Do It With MoEngage

Journey stage: Onboarding

Objective: To assist new and present clients full their KYC / onboarding rapidly

Eventualities and Options:

|

State of affairs 1: For Current clients – Banks need to encourage their clients to digital adoption, i.e., set up the app and do their KYC to allow them to start transacting digitally. Resolution: Banks can provide customized suggestions based mostly on the transaction historical past of their present clients. Common communication by e-mail, SMS, or push notifications to tell clients of latest options and enhancements within the app may present the required nudge to the purchasers. State of affairs 2: New Clients: Banks need to encourage new clients to finish their KYC rapidly and easily. Resolution: Banks can simplify onboarding, present incentives corresponding to cashback or rewards, and provide customized suggestions. Banks may leverage social media and different advertising channels to boost consciousness of their digital choices. |

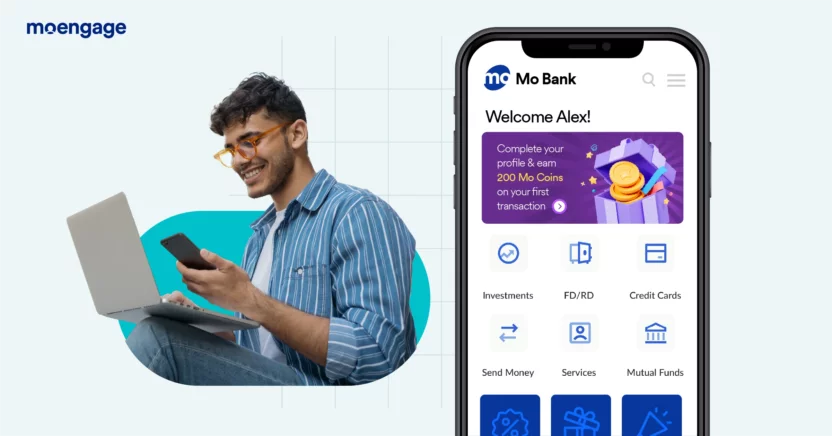

Nudge Clients In direction of First-use With Personalization

Advantages:

- Extra transactions imply extra in-app engagement and an improved Buyer Acquisition Price (CAC)

- Custom-made provides end in extra visits and transactions on the corporate’s web site/app

- Encourages first-time shoppers to finish their KYC course of and begin transacting in your app/web site

How To Do It With MoEngage

Journey stage: Onboarding

Objective: Nudge clients towards activation

State of affairs and Resolution:

|

State of affairs: New clients are in your web site, however need assistance understanding the core objective / AHA second of what your web site provides. Resolution:

|

Create Tailor-made Experiences Primarily based On Visitors Supply

Advantages:

- Focused commercials and related messaging on the touchdown web page will enhance on-site engagement and expertise

- Pre-filled software particulars and unique provides can enhance conversion charges

How To Do It With MoEngage

Journey stage: Engagement and retention

Objective: Enhance buyer expertise and create symmetric experiences

Eventualities and Options:

|

State of affairs 1: Clients go to your web site from a social media advert that talks about bank card rewards. Resolution: Personalizing communication and provides based mostly on visitors sources can assist create a extra focused and related expertise for potential clients. For instance, if the shopper has come after watching a rewards-based bank card commercial, then you may present customized suggestions for related reward-based playing cards on the touchdown web page. State of affairs 2: Clients go to your web site after clicking on an affiliate e-mail about Residence Mortgage pursuits. Resolution: You may improve the probabilities of a profitable conversion by displaying customized messaging and provides associated to residence loans. Sending follow-up communication by e-mail or SMS can assist maintain the buyer engaged and knowledgeable all through the mortgage software course of. |

Interact Returning Guests With Personalised Content material

Advantages:

- Affords and reductions on a specific providing can enhance conversion charges on the app/web site

- Providing free academic content material will enhance buyer expertise and increase general engagement

How To Do It With MoEngage

Journey stage: Engagement and retention

Objective: Enhance buyer experiences. Nudge in direction of activation/transaction

Eventualities and Options:

|

State of affairs 1: A buyer with product buy intent revisits your web site. Resolution: Utilizing information on their earlier looking habits and product curiosity, you may showcase a banner highlighting related merchandise or provides that align with their intent. For instance, if the shopper had beforehand considered a particular product, you could possibly showcase a banner that gives a promotion or low cost on that product, incentivizing them to make a purchase order. State of affairs 2: A buyer with no buy intent revisits the location – and is proven a promotion provide crafted for the shopper. Resolution: By utilizing the purchasers’ looking historical past or demographics, you may create a customized provide that aligns with their pursuits or wants. For instance, you could possibly provide them a promotion for a free e-book or report associated to their monetary pursuits. |

Encourage Current Engagement With Web site Personalization

Advantages:

- Ongoing engagement can assist nurture leads and construct stronger relationships with potential clients, ensuing within the ultimate strategy of the mortgage

- Common engagement can assist maintain your model prime of thoughts and encourage guests to return to your web site or app

How To Do It With MoEngage

Journey stage: Reactivation

Objective: Full buy / submit the appliance

Eventualities and Options:

|

State of affairs 1: A buyer fills the mortgage calculator with private mortgage, residence mortgage, and Deserted mortgage (PL, HL, AL) particulars and doesn’t full the shape and drops off. Resolution: You may ship follow-up communication, provide customized help, simplify the appliance course of, and spotlight the advantages of the mortgage calculator. As soon as the shopper revisits the location, they’re nudged to finish the shape together with beforehand crammed and filled-in variables. State of affairs 2: A buyer fills within the mortgage calculator particulars on the location however doesn’t apply. Resolution: Attempt to present extra info, provide help, simplify the appliance course of, and spotlight the advantages of the mortgage. Present them a customized banner based mostly on buyer on-line variables corresponding to mortgage quantity, tenure, rate of interest, and EMI. |

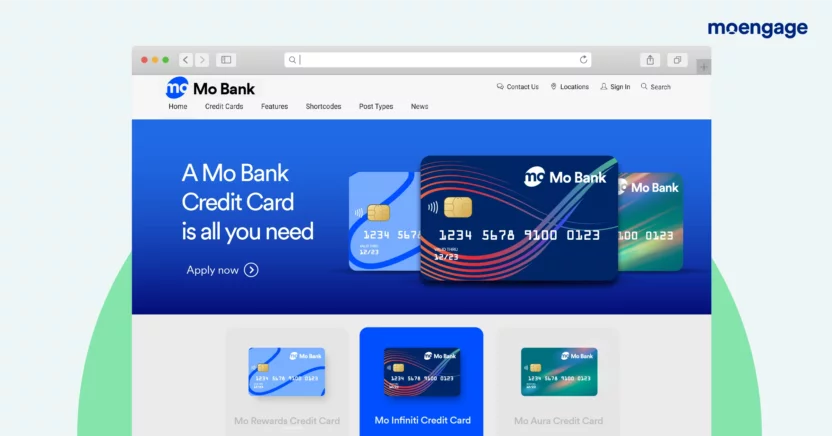

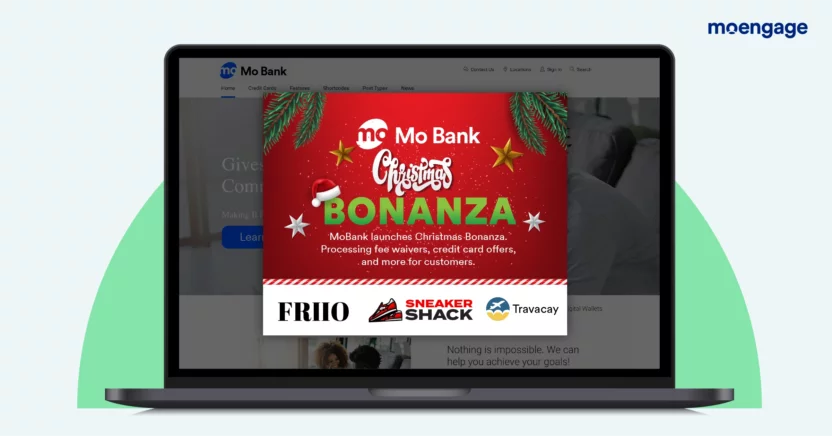

Upsell And Cross-sell Primarily based On Buyer Tier

Nudge clients to improve their accounts, apply for a higher-tier bank card, share unique mortgage provides, and verify their credit score scores.

Advantages:

- Personalised provides will end in extra visits and extra conversions on the web site

- Clients availing unique reductions would possibly end in elevated repurchase charges from the identical card

How To Do It With MoEngage

Journey stage: Retain and develop

Objective: To get clients to buy extra services and products from the financial institution and encourage them to make use of their playing cards

Eventualities and Options:

|

State of affairs 1: The shopper is comfy with transacting digitally. The financial institution desires to up-sell/ cross-sell different merchandise. Resolution: As soon as clients are comfy transacting digitally, it is a wonderful alternative to cross-sell/ up-sell different monetary merchandise based mostly on their a/c stability, borrowing historical past, credit score historical past, and extra. Banks can ship clients customized communication highlighting the advantages and supply time-sensitive provides. Banks may interact them with provides which can be relevant solely to their playing cards. Professional tip: Use RFM (recency, frequency, financial) evaluation to know who’re your loyal clients to supply a customized expertise nudging them to sign-up on your loyalty program. RFM considers three components: how not too long ago clients have made transactions, how often they transact, and the way a lot they spend. RFM evaluation can assist you optimize your loyalty program and increase buyer engagement. |

Personalize Primarily based On Person Attributes

Advantages:

- A extra customized expertise enhances the customer’s notion of your model and builds loyalty over time

- Personalised communication based mostly on particular teams and their intentions will improve engagement in your web site

How To Do It With MoEngage

Journey stage: Upsell, retain, develop

Objective: To get clients to search out what they’re in search of and get them to buy extra services and products

Eventualities and Options:

|

State of affairs 1: Web site guests are from completely different geographies concerned with curated services or products based mostly on location. Resolution: Personalizing the web site expertise to showcase content material, merchandise, and provides based mostly on customer location can enhance the relevance and enchantment of your web site to the customer. By leveraging the customer’s location information, you may show info that’s particular to their location, corresponding to native information, occasions, or promotions. State of affairs 2: You may have a number of merchandise and need to showcase completely different merchandise based mostly on buyer intent, age, and banking tier. Resolution: By leveraging customer attributes, you may show info and provides which can be particularly tailor-made to their wants and pursuits, rising the probability of engagement and conversion. For instance, if the shopper is a senior citizen and belongs to the financial institution’s highest tier of consumers, the web site may show details about particular financial savings accounts with increased rates of interest for seniors. |

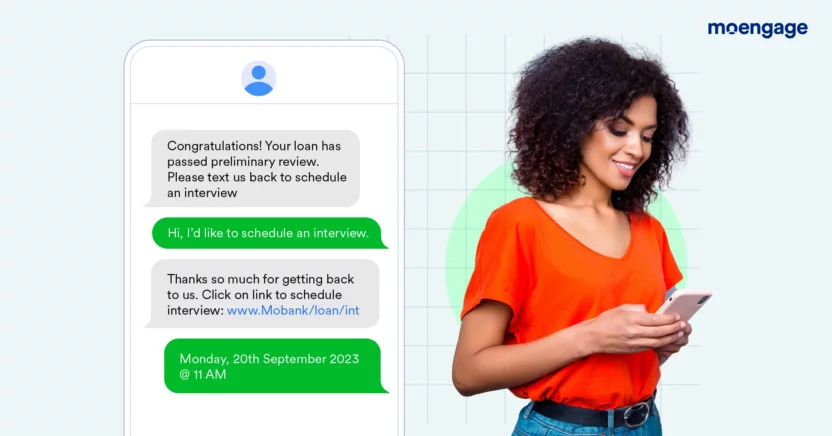

Cut back Conversion Funnel Abandonment With Actual-time Messaging

Advantages:

- Steady nudges and help will possible end in lowered drop-offs out of your web site/app

- Further info and provides will enhance on-site conversion

How To Do It With MoEngage

Journey stage: Acquisition and retention

Objective: Enhance on-site conversion and scale back web site drop-offs

Eventualities and Options:

|

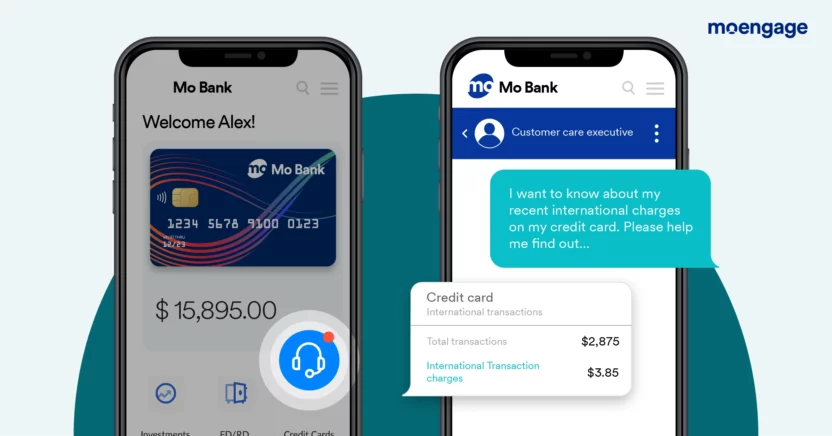

State of affairs 1: Monetary choices will be tough – they contain a deep stage of reasoning and evaluation, calculations that usually require increased cognitive efforts. In consequence, clients might not all the time convert in your web site and drop off. Resolution: By triggering customized messaging on key pages, occasions, or when they’re idle, banks can proactively interact with clients and provide related assist. For instance, when a buyer is looking a web page associated to loans, the financial institution can set off a customized message providing to reply any questions they might have or present extra details about the completely different mortgage choices out there. Professional tip: Take an omnichannel method with a customized message to create a extra linked expertise. Be taught how one can create linked experiences with MoEngage’s Google Adverts Viewers Sync. |

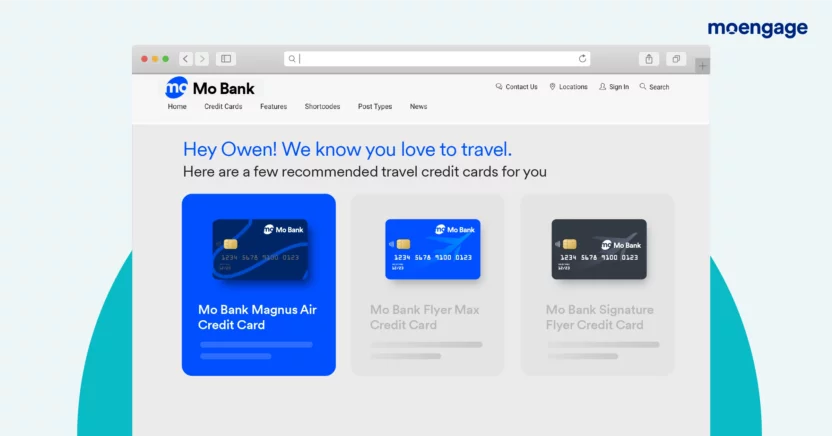

Product Suggestions

Create customized product suggestions based mostly on intent, account info, earlier transactions, and the present context.

Advantages:

- Tailored suggestion to new customers helps enhance conversion charges and reduces the Price of Acquisition (CAC)

- By offering present clients with favorable provides, organizations can improve the LifeTime Worth (LTV) of consumers

How To Do It With MoEngage

Journey stage: Acquisition, upsell

Targets:

– Purchase new clients

– Upsell/cross-sell to present clients

Eventualities and Options:

|

State of affairs 1: An present buyer with product intent revisits the web site. Resolution: Banks can provide customized suggestions by leveraging the shopper’s present banking tier and merchandise considered. For instance, suppose a buyer is looking bank card choices on a financial institution’s web site. In that case, the financial institution can present a bank card with the next cash-back charge for purchasers who often use their card for on-line buying or a journey rewards card for purchasers who often journey overseas. State of affairs 2: A brand new prospect re-visits the web site. Resolution: Personalised product suggestions could be a highly effective approach for BFSI firms to have interaction new prospects and provide them related services and products. For instance, if a brand new prospect is looking a financial institution’s web site and exhibits an curiosity in financial savings accounts, the model can use location information and looking habits to suggest a financial savings account with a aggressive rate of interest. Professional Tip: MoEngage’s Dynamic Product Messaging (DPM) is constructed that can assist you talk related services and products out of your present catalog based mostly on the shopper’s earlier looking historical past by internet or app push notifications and emails. It’s constructed upon MoEngage’s proprietary Sherpa Interplay Graph, which connects every buyer’s habits along with your catalog’s merchandise/providers/content material and recommends these product suggestions. |

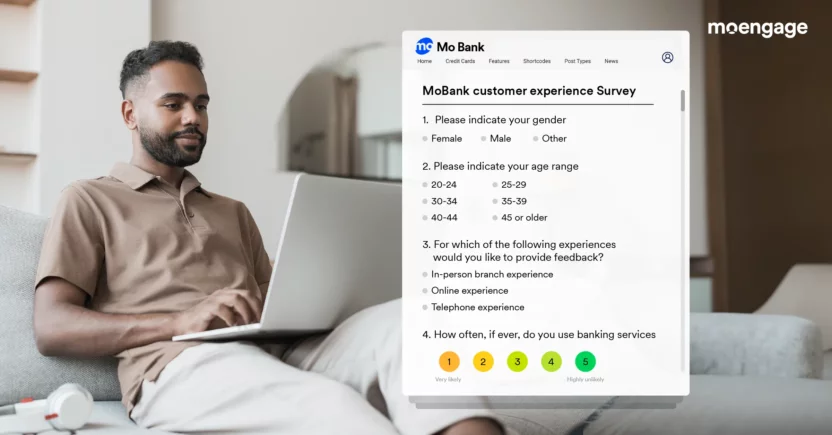

Self-Segmentation Surveys

Advantages:

- Understanding the preferences of the shopper helps organizations enhance their web site expertise, thus rising buyer engagement

- Offering related provides means extra conversions and lowered Price of Acquisition (CAC)

How To Do It With MoEngage

Journey stage: Acquisition, onboarding

Objective: Enhance buyer acquisition and onboarding expertise

State of affairs and Resolution:

|

State of affairs 1: A brand new prospect or present buyer visits the web site. Nonetheless, after spending a while on the location, they’re unable to search out what they’re in search of. Resolution: Triggering a time-based self-segmentation survey will be an efficient approach for banks to personalize the web site expertise for brand spanking new prospects. By permitting these new clients to pick out “what’s best for you,” banks can acquire insights into their preferences and tailor the web site expertise accordingly. The survey would possibly ask the brand new prospect about their monetary objectives, funding preferences, and threat tolerance. Primarily based on their responses, the financial institution can personalize the web site expertise to showcase services and products which can be most related to them. |

Web site personalization for BFSI manufacturers is changing into more and more vital because it gives a strategy to tailor buyer experiences, improve engagement, and enhance buyer satisfaction. Superior analytics and machine studying algorithms allow monetary establishments to anticipate the wants of their clients and supply them with related services and products.

With web site personalization, banks and monetary establishments may enhance their buyer retention charges by predicting and stopping buyer churn, in the end driving elevated buyer lifetime worth (LTV). Web site personalization for BFSI manufacturers is now a key differentiator for manufacturers trying to stand out in a aggressive market and ship superior buyer experiences.

About MoEngage

MoEngage’s AI-driven, customized messages embody invoice cost notifications, mortgage {qualifications}, and discovering a close-by department location. The platform helps banks to nudge new and present clients in direction of activation, enhance buyer expertise, and create symmetric experiences based mostly on the visitors supply.

Furthermore, you may create extremely focused segments of consumers that share the same app or internet habits, corresponding to finishing an onboarding marketing campaign or a financial institution switch inside the final week. We show you how to schedule and automate campaigns to achieve your clients on the proper time and proper channel to drive optimum worth and outcomes.

That will help you with this, MoEngage Person Paths helps visualize how your clients work together with each model contact level, from onboarding by engagement and development. This lets you spot friction areas and optimize your marketing campaign’s efficiency and outcomes.

MoEngage Personalize allows you to accomplish these objectives rapidly and effectively with out requiring any coding. Are you keen to find how your model can incorporate web site personalization? For those who’re a buyer, please attain out to your favourite buyer success supervisor. For those who’re new to MoEngage, you may seek the advice of with our specialist right here.

Bonus Reads

- What Is Conversational Commerce and How Can It Assist Your Enterprise?

- Web site Personalization Examples: How Are Main Manufacturers Doing It?

- Personalization: Lacking Ingredient of a Nice Buyer Expertise Technique

- MoEngage Flows: Create Personalised Experiences With An Enterprise-Prepared Automated Buyer Journey Builder

- [Customer Spotlight] How GIVA Recorded 120% Uplift in Conversions Utilizing MoEngage’s Newly Launched Good Suggestions!

The publish Web site Personalization For BFSI Manufacturers: How To Tailor Personalised Monetary Internet Experiences For Clients appeared first on MoEngage.