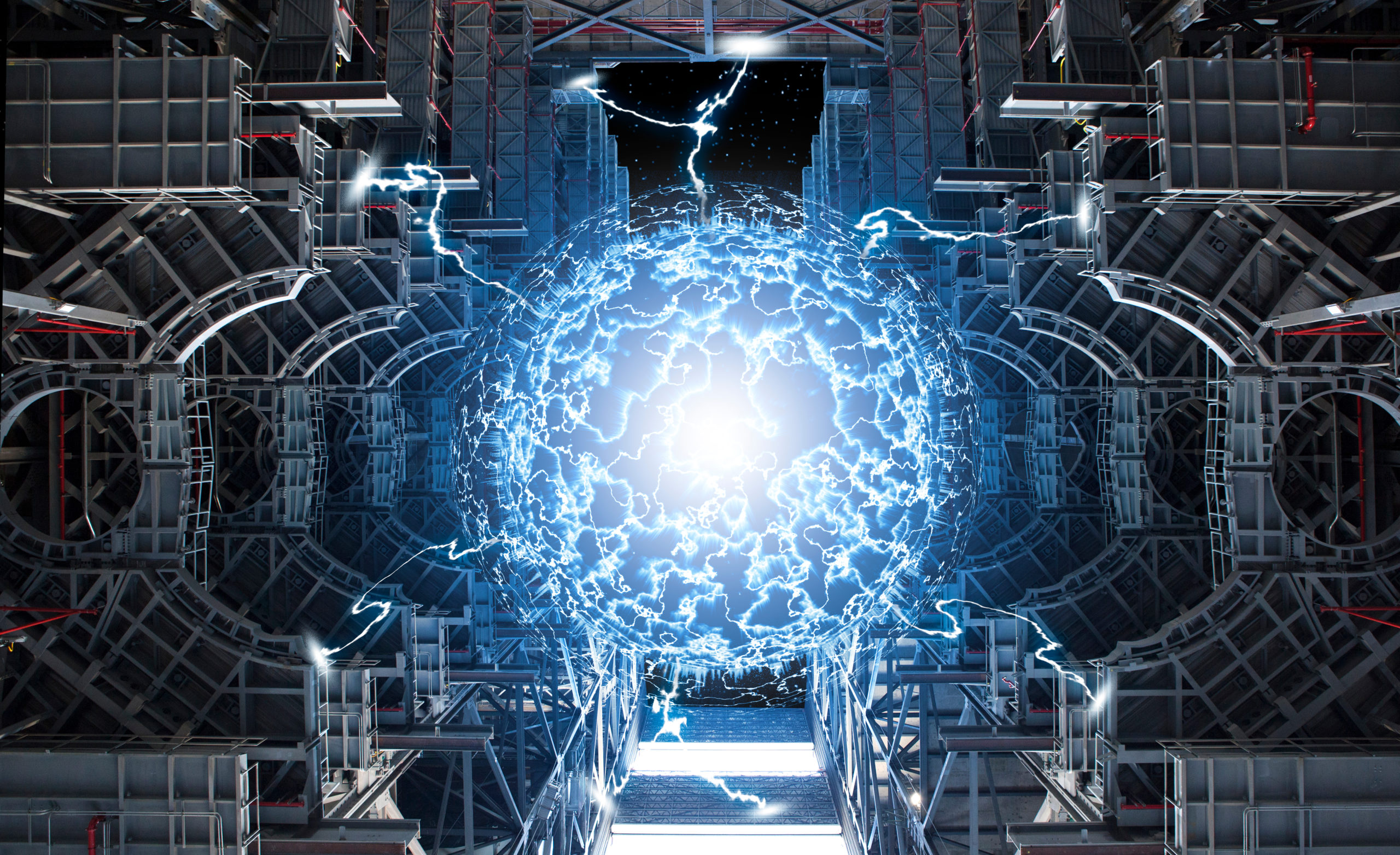

A 70-year-long effort to harness nuclear fusion reactions to generate limitless clear vitality is lastly taking form. For the primary time in historical past, U.S. authorities scientists have generated extra vitality from a managed response than it consumed. Whereas the nuclear fusion trade continues to be personal, there nonetheless is a superb likelihood for retail buyers trying to money in on the breakthrough through Chevron (NYSE:CVX) and Amazon (NASDAQ:AMZN).

The breakthrough was achieved on the Lawrence Livermore Nationwide Laboratory final Tuesday after efficiently simulating the photo voltaic reactions.

The web vitality achieve that the experiment achieved paves the way in which for an considerable provide of dependable, clear, and sustainable options to fossil gasoline. If usually achieved, web vitality beneficial properties can curb local weather change (if not reverse it within the very long run), oil sector-induced inflation could be tamed, and the world can ultimately be weaned off its dependence on fossil fuels.

Taking a look at this, it’s protected to say that the “holy grail” of unpolluted and sustainable vitality has come inside attain.

Now that we all know how nuclear fusion will profit the setting, let’s shift our consideration to the shares which might be very more likely to allow the method to learn buyers’ pockets.

Chevron (CVX)

One of many world’s largest vitality corporations, Chevron, has made a number of important investments within the space of unpolluted vitality. On this regard, the corporate began the Chevron Know-how Ventures funding fund, which allocates its investments to a number of low-carbon vitality sources. The fund presently has 10 investments in a number of progressive vitality applied sciences.

The fund’s funding in Zap Vitality, an organization that’s growing nuclear fusion-related expertise, can present Chevron’s buyers important publicity to this space. Furthermore, its funding plans in increasing its hydrogen capabilities additionally communicate of its dedication to enhancing clear vitality.

Other than its investments in clear vitality, Chevron’s sensible capital spending methods and price management measures can gasoline strong long-term progress. Sturdy money movement producing functionality permits the corporate to up its oil manufacturing stage, cut back its debt, and improve shareholder worth. Chevron is well-positioned to develop within the typical oil and vitality sector as a lot as it’s when clear vitality begins getting commercialized.

Is CVX a Sturdy Purchase, Based on Analysts?

Wall Road analysts, on common, suppose CVX inventory can attain $188.08 over the subsequent 12 months, a achieve of 10.45%. Coming to what analysts take into consideration the long term, the consensus continues to be cautiously optimistic, with a Average Purchase ranking primarily based on 5 Buys, six Holds, and one Promote.

Amazon (AMZN)

At first look, Amazon appears to be an uncommon selection of inventory in relation to the method of nuclear fusion. Nonetheless, diving deeper, expertise is a really intricately interconnected marvel; and being one of many greatest tech giants, only a few technological developments can escape Amazon’s investments.

Corporations dabbling in nuclear fusion immediately are wanting ahead to creating practical reactors within the subsequent few years. Though it’s doubtless that nuclear fusion expertise commercialization received’t occur till the top of the last decade, one of many industries that is perhaps among the many first to leap on the bandwagon is information facilities.

Information facilities run on excessive quantities of energy due to the sheer quantity of knowledge that types the spine of tech. For that motive, information facilities are present in less-populated areas and have already got the infrastructure to assist new mills; thus ticking two essential packing containers for putting a nuclear reactor (the phrase “information is the brand new oil” now is sensible).

Now, Amazon already has billions invested in its AWS information facilities and is continuous to increase its footprint on this market. On this case, it won’t come as a shock if Amazon, given its exceptional sources, adopts nuclear fusion expertise to enhance its value effectivity and revenues.

Is Amazon a Purchase or Promote, Based on Analysts?

Evidently, Amazon is a Sturdy Purchase on Wall Road, supported by 33 bullish analysts with a Purchase ranking and three cautious analysts with a Maintain ranking. Furthermore, within the subsequent 12 months, analysts see the inventory value rising to $140.50, 55.6% increased than present ranges.

Takeaway: Chevron and Amazon Might Profit Considerably from Nuclear Fusion

It has been established that regardless of the current breakthrough, nuclear fusion expertise nonetheless has a while till it’s extensively commercialized. Nonetheless, when it occurs, Chevron, with its rising investments in clear vitality, and Amazon, with its rising footprint in information facilities, stand to achieve massively from the proliferation of the brand new expertise.