No person is having fun with this inventory market. Perhaps not the worst ever…however positively not numerous enjoyable. So let’s speak about what’s making the S&P 500 (SPY) fall decrease and decrease. And lets speak about what lies about what buyers ought to do know to excel within the weeks and months forward. Learn on under for the complete story.

I’ve at all times stated that an unsure and risky market is absolutely the worst. Sure…even worse than a bear market.

That is as a result of with a bear market there’s a clear development you can lean into. Comparable to shopping for inverse ETFs to generate profits because the market declines.

However a risky vary sure market, corresponding to this one, is only a pure headache for buyers. A lot of whom are simply giving up as will be seen in lots of metrics of inventory analysis exercise and buying and selling volumes.

The secret is understanding the character of the present volatility and what doubtless comes on the opposite aspect. Appreciating that’s one of the simplest ways to align your portfolio now for positive aspects within the weeks and months forward. That will probably be our focus right now.

Market Commentary

First, the inventory rally as much as 4,600 for the S&P 500 (SPY) in late July was simply too excessive given the muted earnings progress because of the Fed’s hawkish insurance policies to deliver inflation again to the two% goal. In order that was a pure time for a spherical of revenue taking and sector rotation earlier than the subsequent leg increased.

However simply as shares seemed able to bounce…bond charges began to blow up increased. Not due to the Fed as they have not raised charges shortly. Moderately due to different dynamics at play that we’ll merely describe as Price Normalization. (Extra on that subject on this commentary).

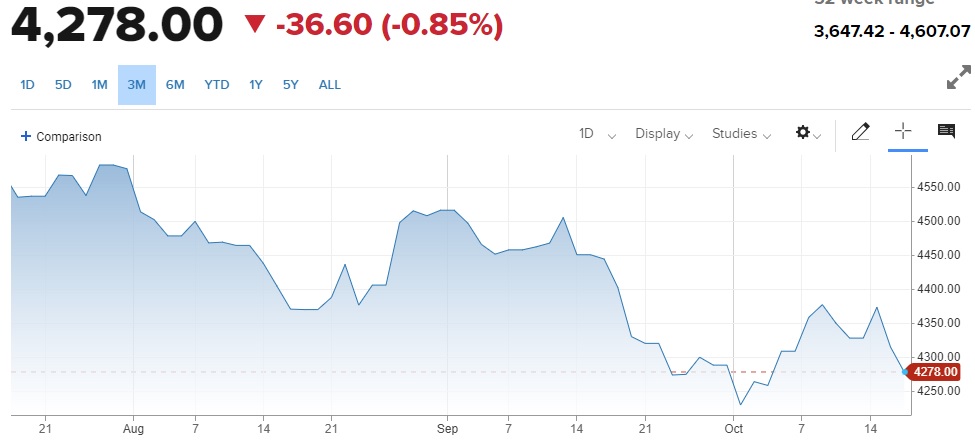

This dynamic has led to the unattractively risky, vary sure market you see within the 3 month chart under:

Sure, one may say it is a case of decrease highs and decrease lows. And thus doubtlessly a bearish sign.

Nonetheless, with the S&P 500 nonetheless above the 200 day transferring common and 20% above the earlier bear market low…then technically nonetheless bullish.

The rationale I’m not significantly involved about extra draw back is due to the present energy of the financial system. Positive, you possibly can parade out a statistic right here or there that exhibits weak point. That’s the reason we’re going to talk about the broadest measure of well being…that being GDP.

The GDPNow mannequin from the Atlanta Fed stands at +5.4% for Q3 whereas the Blue Chip Economist Consensus at 3.5% (doubtless extra on the right track). We are going to know for certain subsequent Thursday 10/26. Pardon me however there’s simply no method to have a look at these revered estimates and really feel bearish.

Maybe much more essential than the GDP report subsequent week is the PCE Inflation studying that will get launched alongside aspect of GDP. Because the Fed has acknowledged many instances over their studying of Core PCE is their most popular technique of studying the state of inflation. That’s anticipated to drop from 3.7% to three.1% which is transferring ever nearer to the two% goal of the Fed.

The above explains why buyers are actually 92% certain the Fed will maintain price regular for a second straight assembly on November 1st. Be aware {that a} month in the past there was over a 30% expectation of a price hike on the best way in November.

This all appears to fly within the face of the latest discussions of upper bond charges disrupting the inventory market. I talked about that in nice element in my final commentary.

Warning: Traders Put together for “Sea Change”

The fundamental story is that charges have been artificially suppressed by the Fed. In order their insurance policies modified, with much less manipulation to decrease charges, then charges are rising increased. What actually is a normalization of charges which resets the bond vs. inventory investing equation.

My sense is that 5% on the ten 12 months Treasury (which we’re touching now) will probably be a degree of resistance for buyers. Most actually will contact it…in all probability a smidge increased…then issues consolidate round and even beneath 5% for some time. If true, then much less purpose to hit the promote button for shares particularly with the financial system trying so sturdy presently.

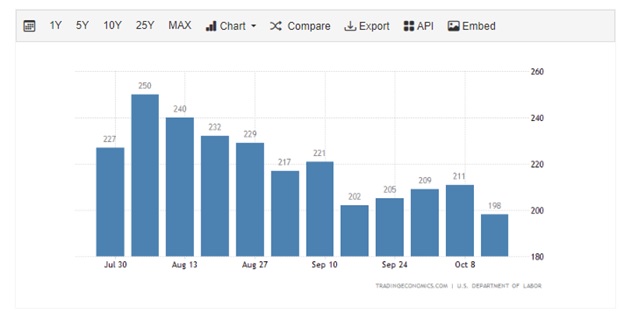

Most individuals are ready for employment image to lastly buckle as an indication the financial system is prepared for a downturn. Nonetheless, the most effective ahead trying indicator or the unemployment price is the weekly Jobless Claims report. The nearer that will get to 300K…the extra doubtless that the unemployment price is able to rise. Nonetheless, as you will note within the chart under this indicator is definitely getting more healthy. That features Thursdays dip beneath 200K.

So if there is no such thing as a recession on the horizon. And buyers are simply adjusting to this Price Normalization, then there could certainly extra volatility forward. However past that part most indicators level bullish.

WHEN can we emerge into that subsequent bull run increased?

Unknown and unknowable presently. But I sense that after buyers see charges degree out or pull again…then shares will probably be again in style as soon as once more.

DO NOT EXPECT a roaring bull market. Greater charges will result in a decrease earnings progress setting which mutes inventory returns. Gladly these with a bonus will have the ability to simply prime the modest returns of the S&P 500.

Sure, now we have such a bonus with our POWR Scores. Extra on these prime picks within the subsequent part…

What To Do Subsequent?

Uncover my present portfolio of seven shares packed to the brim with the outperforming advantages present in our POWR Scores mannequin.

Plus I’ve added 5 ETFs which are all in sectors properly positioned to outpace the market within the weeks and months forward.

That is all based mostly on my 43 years of investing expertise seeing bull markets…bear markets…and every part between.

In case you are curious to be taught extra, and wish to see these 12 hand chosen trades, then please click on the hyperlink under to get began now.

Steve Reitmeister’s Buying and selling Plan & High Picks >

Wishing you a world of funding success!

Steve Reitmeister…however everybody calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Whole Return

SPY shares have been buying and selling at $423.52 per share on Friday morning, down $2.91 (-0.68%). 12 months-to-date, SPY has gained 11.97%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

In regards to the Creator: Steve Reitmeister

Steve is healthier identified to the StockNews viewers as “Reity”. Not solely is he the CEO of the agency, however he additionally shares his 40 years of funding expertise within the Reitmeister Whole Return portfolio. Be taught extra about Reity’s background, together with hyperlinks to his most up-to-date articles and inventory picks.

The submit The Worst Inventory Market Ever? appeared first on StockNews.com