Think about you run a brick-and-mortar retailer and a buyer comes into the store and needs to pay for a product. However, they don’t have any money and want to pay with a bank card. To just accept the shopper’s fee, you’ll want a fee gateway, or level of sale (POS) terminal to acquire fee info by card or cellular system.

In the event you can’t settle for their card, you may lose them as a buyer to the competing retailer subsequent door.

Need to launch an e-commerce retailer as effectively? You’ll additionally want a fee gateway to simply accept prospects’ funds.

An internet fee gateway takes the type of a checkout portal like HubSpot’s One Web page Pay the place prospects can enter bank card or fee gateway service supplier info. Common fee gateway service suppliers embody PayPal and Apple Pay.

Finally, any enterprise that desires to simply accept bank cards and on-line funds wants a fee gateway.

On this information, we cowl all the pieces it’s essential to find out about fee gateways:

What’s a fee gateway?

A fee gateway transfers a buyer’s fee info to a vendor’s checking account, making certain the shopper has sufficient funds to make a fee.

Fee gateways are sometimes confused for fee processors, however there’s a distinction. A fee gateway is the expertise sellers use to simply accept funds, transmitting the shopper’s fee info to the vendor to get the vendor paid. A fee processor transfers transaction information, dealing with the change of knowledge between the shopper and the vendor.

How a Fee Gateway Works

A fee gateway performs an integral function within the general fee processing system. It’s the front-end expertise that sends the shopper’s fee info to the vendor’s buying financial institution.

As expertise evolves, so do fee gateways. Up to now, POS terminals used magnetic strips and the vendor collected paper signatures from prospects. At present, chip applied sciences and contactless purchases like Apple Pay expedite the fee gateway course of.

Fee Gateway Examples

Beneath is a fast checklist of a few of the fee gateways you may work together with each day.

- PayPal: PayPal is among the hottest redirect fee gateways that’s geared up with a strong anti-fraud workforce. With forex and cart compatibility, retailers additionally select PayPal for its versatility.

- Apple Pay: Apple Pay funds are processed via a appropriate bank card. Many brick-and-mortar retailers use Apple Pay for its ease of use.

- Sq.: It is a common fee gateway for cellular and in-person transactions.

- Stripe: Retailers select Stripe for simple setup and customization choices. Stripe additionally boasts ways that simplify the checkout course of, like one-click checkouts.

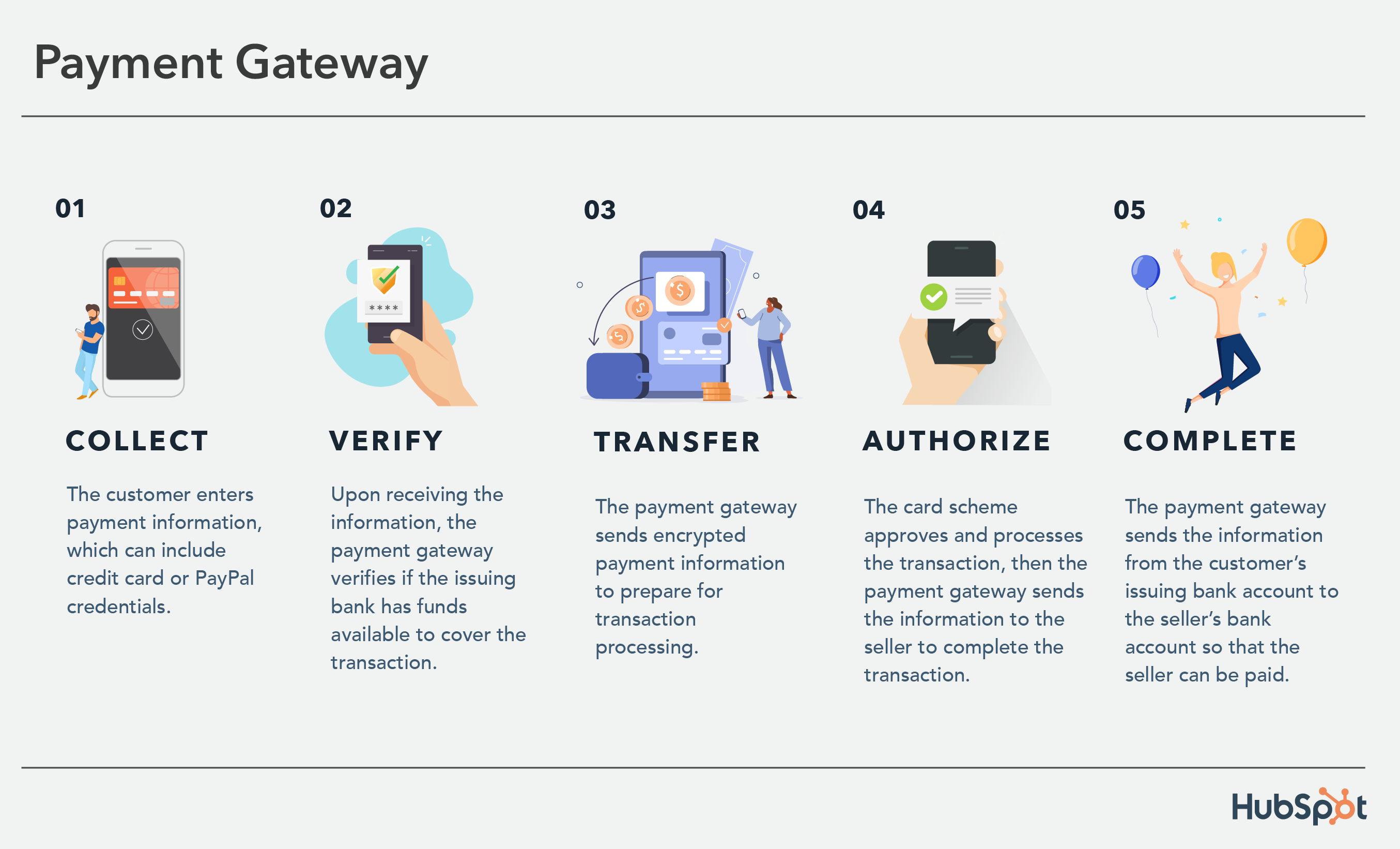

The expertise powering a fee gateway might sound sophisticated, however a fee gateway transfers the shopper’s fee to the vendor’s checking account inside seconds. The graphic under breaks down the steps concerned.

Fee Gateway Steps

Gather

The client enters fee info, which may embody bank card or PayPal credentials.

Confirm

Upon receiving the knowledge, the fee gateway verifies if the issuing financial institution has funds obtainable to cowl the transaction.

Switch

The fee gateway sends encrypted fee info to organize for transaction processing.

Authorize

The cardboard scheme approves and processes the transaction, then the fee gateway sends the knowledge to the vendor to finish the transaction.

Full

The fee gateway sends the knowledge from the shopper’s issuing checking account to the vendor’s checking account in order that the vendor could be paid.

Who’s concerned in a fee gateway?

There are a number of actors concerned in a fee gateway: vendor, cardholder, issuing financial institution, card scheme, and buying financial institution. On this part, we’ll break down the roles they play.

Vendor

The vendor, or service provider, is the entity that’s paid for promoting a services or products. The vendor accepts the fee from the cardholder or buyer.

Cardholder

The cardholder is the shopper buying a services or products from the vendor. Purchases can occur in-store or on-line.

Issuing Financial institution

The issuing financial institution is the financial institution that’s accountable for the shopper’s account.

Card Scheme

A card scheme is the bank card firm that manages the bank card. Examples embody Uncover and Visa.

Buying Financial institution

The buying financial institution is the financial institution that’s accountable for the vendor’s account. The vendor’s account receives cash from the shopper’s account via a fee gateway switch.

Kinds of Fee Gateways

There are a number of several types of fee gateways: redirects, front-end checkout, and on-site. Every methodology has distinctive advantages and challenges.

Redirects

A redirect fee gateway takes the shopper to a fee web page to complete the transaction. PayPal is a well-liked instance.

Supply: PayPal

When the vendor makes use of a redirect fee gateway like PayPal, PayPal handles the transaction processing, which may alleviate the burden on the vendor’s finish. Nevertheless, it’s an additional step for the shopper to go to a distinct fee web page.

Entrance-end checkout

Supply: Stripe

With a front-end checkout, the checkout happens on the vendor’s web site, however the fee processing takes place within the backend. Stripe is an instance of a front-end checkout fee gateway.

On-site

An on-site fee gateway handles your complete checkout course of on the vendor’s web site. Due to the complexity, this methodology is most popular by giant companies. With this methodology, the vendor has extra management over the method, but additionally extra duty in sustaining the front-end and backend.

Incessantly Requested Questions About Fee Gateways

Right here, we reply a few of the commonest questions retailers could have about fee gateways.

What’s the distinction between a fee gateway and a fee processor?

A fee gateway is the expertise that transfers a buyer’s fee info to the vendor so the vendor can receives a commission. A fee processor strikes the transaction via the processing community and sends the billing assertion.

Why use a fee gateway?

Sellers can save time through the use of a fee gateway since they don’t need to manually enter buyer info; a fee gateway automates that course of. This frees up time for the vendor to deal with their enterprise as an alternative of duties that may be dealt with with expertise.

When a buyer makes a purchase order, a fee gateway encrypts delicate info like bank card funds, making certain a safe transaction. A fee gateway additionally offers prospects extra fee choices: extra fee choices means a bigger buyer base.

How can a vendor accommodate prospects’ totally different fee choices?

Stacking fee gateways means incorporating a number of fee gateways in your web site to accommodate totally different buyer wants.

A Baymard institute research discovered that 9 p.c of shoppers abandon their cart throughout checkout as a result of there usually are not sufficient fee choices. Moreover, Practically 30 p.c of Individuals don’t have a bank card, based on a Nilson report. By together with each bank card funds and digital fee choices like PayPal, Apple Pay, and Google Pay, prospects have extra fee choices.

What makes a fee gateway safe?

A fee gateway has to adjust to Fee Card Business Information Safety Requirements. One in every of these requirements is encryption: a fee gateway makes use of their very own code to encrypt buyer information.

Encryption means concealing the information in order that it’s unreadable to entities aside from the fee gateway. Tokenization protects prospects’ bank card info by changing their information with a singular identifier known as a token. The token securely shops information the shopper must make a future buy.

How a lot does it value to arrange a fee gateway?

Anticipate to pay a setup charge, month-to-month charge, and small transaction charge. Costs range relying on the fee gateway.

Fee gateways are important for companies.

It doesn’t matter what trade you are in, or how large or small your enterprise is, having a fee gateway is a crucial a part of the fee processing system.

The seamlessness of a fee gateway that automates processes, secures delicate buyer info, and offers prospects with extra fee choices can enhance buyer satisfaction and even profit your backside line.

Fortunately, it isn’t too sophisticated to arrange a fail-proof fee gateway. To study extra about HubSpot’s new B2B Funds options, click on the banner under.