Your clients deserve the very best. After they’re glad, your enterprise will flourish.

So it’s necessary to decide on a cost service that won’t solely enable your clients to pay conveniently — but additionally defend them from fraudulent transactions.

Shoppers have gotten extra assured in making each on-line and in-store purchases with their financial institution playing cards. This pattern is predicted to develop by 90% over the following few years — surpassing $1.6 trillion by the tip of 2022.

From accepting credit score and debit playing cards to processing cardless transactions and in-store funds, the very best cost gateways will help you maximize conversion charges and ship the very best buyer expertise.

On this in-depth information, I reviewed the ten most dependable cost gateways.

What Are The Finest Fee Gateways For 2023?

Listed under are the ten trusted cost gateways for your enterprise:

- Paytm For Enterprise

- Stripe Join

- PayPal

- Payoneer

- Apple Pay For Retailers

- Flutterwave

- GoCardless

- RazorPay

- Authorize.web

- Sensible

What’s a Fee Gateway?

A cost gateway is a expertise offered by an ecommerce software service supplier that lets retailers settle for debit or bank card purchases from clients.

Fee gateways are necessary in ecommerce — when it comes right down to it, it’s about making buying out of your retailer safer and fewer of a problem to your clients.

For instance, if a possible buyer trusts and likes utilizing PayPal, not providing that resolution may flip a buyer in direction of one in every of your opponents.

It’s necessary to do your homework and perceive precisely what every cost gateway brings to each your retailer and your clients.

Fortunately, we’ve achieved a part of that give you the results you want.

The Finest Fee Gateways (Reviewed)

Right here’s the breakdown of the completely different cost gateways which might be utilized by each massive and small ecommerce companies:

1). Finest For On-line & In-Retailer Funds (Paytm For Enterprise)

Paytm for Enterprise presents a one-stop resolution for each on-line and in-store funds, with options tailor-made to your enterprise wants.

Paytm for Enterprise presents a one-stop resolution for each on-line and in-store funds, with options tailor-made to your enterprise wants.

Whether or not you’re a service provider or enterprise companion, this resolution helps you develop your enterprise, handle day-to-day funds, and disburse funds.

Use Paytm for Enterprise to gather recurring funds, generate cost hyperlinks, and ship invoices to your shoppers.

Paytm for Enterprise gives you with a centralized ledger of funds. You may monitor settlements and obtain month-to-month statements.

You may even have entry to the service provider helpdesk. This lets you resolve buyer points and entry real-time stories.

Along with this, you’ll be able to monitor your transactions with out ready for affirmation.

You may even manually switch cash to your financial institution accounts — with zero transaction price.

Execs

- A safe bank card processor

- Straightforward-to-use cellular cost processing app

- Seamless integration with third get together functions

- Helpful UPI transaction on the go

- A number of cost choices

Cons

- The net interface might be extra intuitive

- Transactions might be quicker

- The On-line Comfort charge is a bit excessive in comparison with some cost gateways

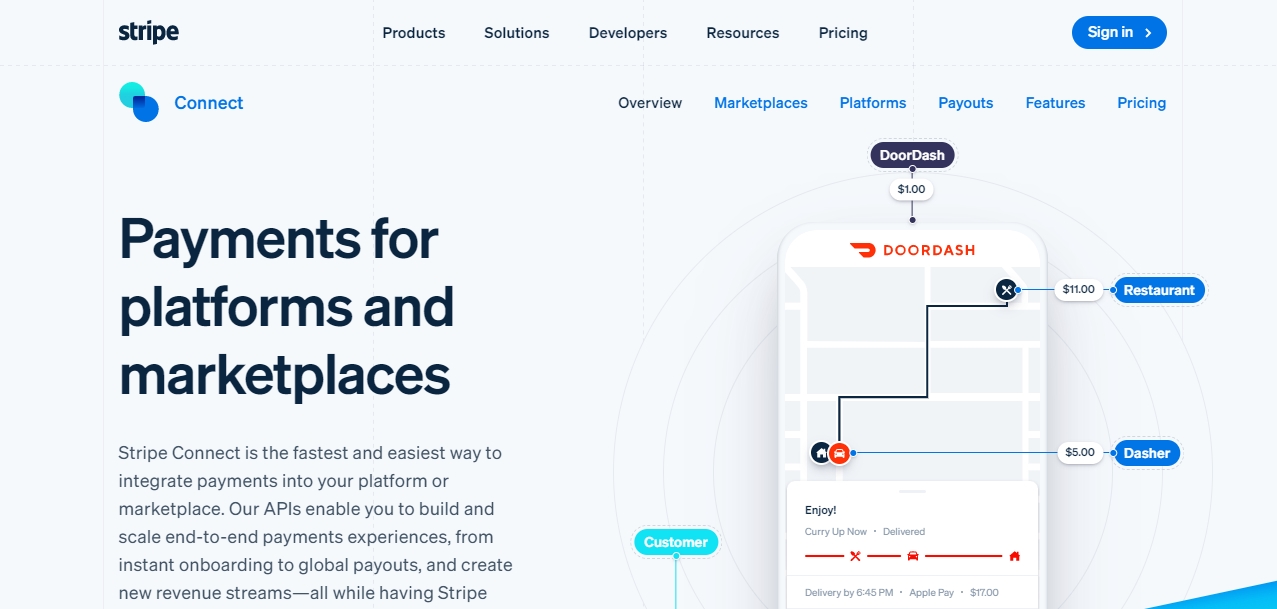

2). Finest Fee Gateway for Platforms (Stripe Join)

Stripe Join presents intuitive cost options for platforms and marketplaces.

Stripe Join presents intuitive cost options for platforms and marketplaces.

You may rapidly construct and scale end-to-end cost experiences, with out going via the difficult backend.

Moreover enabling ecommerce functions to simply accept funds, Stripe

Join additionally gives an easy-to-use API for integration with different techniques and helps meet cost compliance necessities.

Its options embody cost logging, cost rollback, and payouts.

It additionally permits customers to set a separate cost for subsites and cost fee for paid subscriptions.

It helps one-to-many funds. It handles cost compliance, person onboarding, account administration, and payouts.

Its buyer help is offered across the clock. It additionally has an easy-to-use billing module that fosters recurring enterprise relationships.

Relying in your cost wants, you’ll be able to create a customized account.

The related account sort is probably the most simple route for many customers. It offers you full management over your person expertise.

Get began with the free commonplace plan, which presents zero platform charges. You get a co-branded dashboard to your clients. Paid plans begin at $2/month-to-month energetic account.

Execs

- Straightforward integrations with pre-built ecommerce plugins

- Tremendous easy-to-use credit score and debit card processor

- Plenty of cost choices — together with digital wallets, automated funds, and many others.

- Glorious buyer help

Cons

- It might probably’t solely be utilized by retailers within the U.S. and 44 different international locations

- Restricted in-person transactions

3). Finest All-in-One Fee Answer (PayPal)

Whether or not you are a purchaser or a vendor, PayPal is a secure option to obtain and ship cash on-line.

Whether or not you are a purchaser or a vendor, PayPal is a secure option to obtain and ship cash on-line.

It has been round for practically 20 years. It is one of many largest on-line cost platforms on the planet, with over 450 million energetic accounts.

Whereas you should utilize PayPal for private functions, the enterprise account presents sturdy options for retailers.

It’s simple to simply accept bank cards or debit playing cards on the go along with your PayPal enterprise account. You can even entry your buy historical past, add new financial institution accounts, and do much more.

For private accounts, you’ll be able to select between three account varieties. These embody a free private account, a free “fundamental” account, and a “professional” account.

In terms of PayPal charges, they will range so much relying on the supply of the funds.

As an illustration, there isn’t any cost for purchasing or promoting gadgets, however you do must pay a 2.9% processing charge for sending cash. Worldwide transactions may incur as much as a 5% charge for worldwide transactions.

Execs

- A safe cost gateway that doesn’t reveal your bank card particulars

- Allows finish clients to pay over a number of months — providing you with the liberty to mechanically supply that choice.

- Quick on-line and in-person cost instruments

- Helpful service provider help instruments

- Accepts cost from world wide

Cons

- Disputes take time to resolve

- Annoying customer support

- Prospects are dropping confidence in PayPal as a result of seizure of funds

4). Finest For Cross-Border Companies (Payoneer)

Payoneer is an all-in-one cost platform for cross-border companies.

Payoneer is an all-in-one cost platform for cross-border companies.

Together with your Payoneer account, you acquire entry to a wide range of providers similar to on-line cash transfers, worldwide funds, funding alternatives, and many others.

Whereas Payoneer can be utilized by people, additionally it is a well-liked instrument amongst companies.

Firms and repair suppliers use Payoneer’s sturdy cost gateway to handle their working capital. It’s a good way to obtain funds from clients from all around the world.

The Payoneer system is simple to make use of. You may monitor your account stability and transaction charges, and you may even obtain free cash transfers — through P2P.

Payoneer opens your enterprise to the world. It permits you to ship and obtain cash throughout 200 international locations.

You can even obtain a free pay as you go MasterCard bank card. This card can be utilized to withdraw cash from ATMs in most international locations.

Execs

- Quicker processing of funds

- No setup charge

- Glorious buyer help that listens to clients

- Distinctive U.S. and U.Okay financial institution accounts even for non-residents of those international locations

- Cross border funds made simple

Cons

- Verifying accounts takes lots of time

- Frequent technical points when making funds

- Restricted integrations with third-party apps

5). Finest for Making Fee on the Go (Apple Pay for Retailers)

Offering your clients with a cost choice similar to Apple Pay for Retailers is a good way so as to add worth to your retailer.

Offering your clients with a cost choice similar to Apple Pay for Retailers is a good way so as to add worth to your retailer.

Apple Pay For Retailers is a handy option to obtain funds on-line, in shops, and in-apps. It is simple to arrange, non-public, safe, and quick.

It presents flexibility and personalization to your clients. They may really feel extra comfy making a purchase order and you will note improved conversions.

There are a number of steps to take earlier than you’ll be able to start accepting funds utilizing Apple Pay.

First, you will have a cost processor that helps Apple Pay and an NFC-enabled POS terminal.

Subsequent, you will have to generate an Apple ID for your enterprise. This will probably be used throughout a number of apps. Additionally, you will must get a cost processing certificates.

These certificates are used to safe your transaction knowledge.

As soon as you’ve got accomplished these steps, you’ll be able to add Apple Pay to your web site or app.

Execs

- Handy and safe cost service

- No hidden charges

- No web connection is required to finish a cost

- Nice for in-store cost transactions

- Transactions might be accomplished rapidly

Cons

- The setup course of is difficult

- Primary person interface (it may be improved).

- Potential safety breaches

6). Finest Fee Gateway for Rising Markets (Flutterwave)

Flutterwave is a robust cost gateway that gives countless potentialities for your enterprise.

Flutterwave is a robust cost gateway that gives countless potentialities for your enterprise.

It means that you can promote services and products on-line, course of funds securely, construct monetary merchandise, and acquire entry to service provider instruments designed to enhance your enterprise.

As a fintech firm, Flutterwave gives cost infrastructure for international retailers.

It really works with a number of banks throughout a number of international locations — with workplaces within the US, the UK, and a number of other African international locations.

It additionally helps cellular funds, digital greenback playing cards, and internet funds.

Flutterwave focuses on rising markets. Its most important operations are in 11 African nations.

Whereas its headquarters is situated in San Francisco, it has plans to develop to Canada and different Asian international locations.

When you’re tight on finances, Flutterwave presents a free on-line retailer to assist companies handle their funds — particularly on the early development levels.

New customers can begin with a free trial to see how the cost instrument works earlier than upgrading to a professional plan with various transaction charges.

Execs

- Clear and trendy person interface

- Integrates properly with PayPal for worldwide cost transactions

- A handy cost processor in rising markets

- An additional layer of safety protects buyer transactions

Cons

- It doesn’t help all African international locations

- Buyer help might be extra responsive

- The KYC (know your buyer) course of might be irritating

7). Finest for Automated Funds (GoCardless)

GoCardless is a cost processing service that permits companies to simply accept debit funds.

GoCardless is a cost processing service that permits companies to simply accept debit funds.

With GoCardless, you’ll be able to settle for direct financial institution funds with no card charges or delays.

This methodology of cost is just not solely cheaper than bank card networks, however it additionally eliminates the trouble of coping with banks. It’s fairly simple to make use of, and it is out there in over 30 languages.

The GoCardless cost service is primarily designed for firms that invoice clients repeatedly.

They gather funds from buyer financial institution accounts and launch cash in keeping with assortment dates.

The corporate presents completely different cost plans to swimsuit a wide range of wants. They cost a set share charge per transaction, however this will range relying on the dimensions of your enterprise.

Smaller companies would possibly pay larger charges, as they’re much less more likely to course of as many transactions. There is not any setup price, however a 1% + £/€ 0.20 transaction charge applies.

Execs

- The setup and onboarding course of is simple

- An intuitive and clear person interface

- Wealthy reporting of transactions

- Helps a number of languages and currencies

Cons

- Reconciliation of cost may very well be quicker

- Buyer help is nearly non-existent

8). Finest For Monitoring Funds Effectively (Razorpay)

Razorpay is a fast-growing cost processing firm in India. It’s thought-about the most important fintech success story in India.

Razorpay is a fast-growing cost processing firm in India. It’s thought-about the most important fintech success story in India.

The corporate was began by a bunch of younger entrepreneurs. They needed to create a easy cost gateway for companies. They contacted the RBL financial institution and acquired a license to course of funds.

With Razorpay, retailers can course of credit score and debit playing cards, eWallets, and UPI.

It helps main digital wallets similar to FreeCharge, OlaMoney, and PayZapp. Its API permits companies to simply combine its providers with different techniques.

It’s additionally advisable for automating and monitoring funds to distributors and staff.

Razorpay presents two completely different plans, one for rising firms and the opposite for small and medium-sized companies. Every plan comes with a separate account supervisor.

The management panel is user-friendly and means that you can entry key statistics. It might probably allow you to to handle your funds, course of refunds, and generate invoices.

Execs

- Quick and safe cost processor

- Consumer-friendly dashboard

- Simply processes refunds in real-time

- Shortly generate visually-appealing invoices to your shoppers

Cons

- It takes 8 to 10 days to get your service provider account accredited.

- Restricted pockets and EMI choices

- Flat cost fees are larger than among the opponents’

9). Finest for Prospects Utilizing Cellular Units (Authorize.web)

Authorize.web is a trusted cost gateway for accepting bank cards, processing contactless funds, and facilitating eChecks in individual.

Authorize.web is a trusted cost gateway for accepting bank cards, processing contactless funds, and facilitating eChecks in individual.

Not like some cost options, Authorize.web has been round, weathered the storm, and helped tens of millions of retailers previously many years to course of funds.

Utilizing a service similar to Authorize.web will help you to receives a commission on time, each time.

Whether or not you are a start-up trying to develop, or a seasoned enterprise government, you’ll be able to depend on their cost options to care for the heavy lifting.

You may discover the corporate’s sturdy suite of cost providers to be each dependable and cost-effective, and their dedication to customer support is unmatched.

Because the go-to cost processor for lots of the largest banks and credit score unions within the nation, you’ll be able to relaxation simple figuring out that they will care for the small print for you.

Based in 1996 as Authorize.web, Inc., the corporate is a subsidiary of Visa Inc.

There is not any setup charge and month-to-month gateway pricing begins at $25.

Execs

- Straightforward to arrange

- Prospects find earlier transactions with ease

- Superior fraud detection instruments

- Helps multi-currencies

Cons

- Poor buyer help

- Reporting might be improved

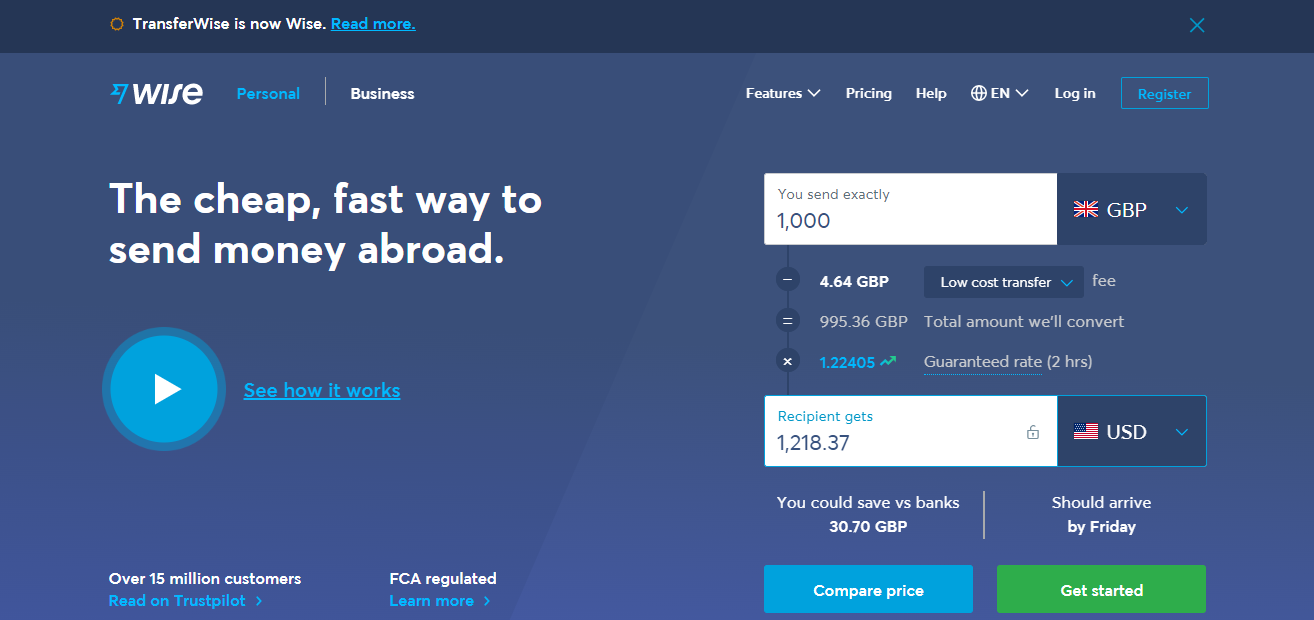

10). Sensible (previously TransferWise)

Sensible (previously TransferWise) presents an reasonably priced and quick cost resolution.

Sensible (previously TransferWise) presents an reasonably priced and quick cost resolution.

It’s greatest fitted to sending or receiving funds overseas.

The service presents a fast and simple option to make cash transfers, and the funds normally arrive inside 1 enterprise day for wire transfers and 1 to three enterprise days for ACH transfers.

There aren’t any hidden charges.

Not like different cash switch providers, Sensible makes use of an actual change fee.

It fees a small share for fee, and the charges are calculated upfront, so what you might be paying.

Sensible presents a multi-currency account that means that you can maintain cash in over 50 currencies.

You may obtain funds from overseas international locations with out paying any charges. It’s simple to fund your transactions with a bank card or debit card.

Execs

- Low transaction charges and cheap charges

- Quick and simple signup course of (with no advanced KYC verification)

- Simply pay for transfers in money or credit score

- Borderless and trusted cost resolution

Cons

- Switch pace could also be low (typically)

- Account deactivations (with no prior warnings)

- Sensible doesn’t settle for all forms of credit score/debit playing cards (sadly)

Conclusion

Basically, the price of utilizing a cost gateway will range relying on what number of transactions you make, in addition to the worth of every transaction.

A few of these prices embody a set-up charge, a month-to-month charge, and a transaction charge.

Your cost gateway also needs to be PCI-compliant. It is a safety commonplace developed to guard the privateness of your clients’ data.

Finally, you’ll want to discover a cost gateway that’s simple to make use of and has a fast and handy checkout expertise.

It’s even simpler to decide on when you think about what your ecommerce tech stack already integrates with. You’ll desire a cost gateway that performs good and integrates seamlessly along with your ecommerce platform, in addition to your advertising and marketing automation resolution.

Drip presents a whole lot of integrations with the cost gateways and ecommerce instruments that you just’re doubtless already aware of.

One of the best half? You may attempt it free for 14 days!