In contrast to a few of its rivals, US electrical automobile pioneer Tesla (NASDAQ:TSLA) has been making strikes to safe provide of the uncooked supplies it wants to satisfy its manufacturing targets.

In recent times, lithium has caught the eye of CEO Elon Musk. Again in 2020, lithium had a highlight second at Tesla’s Battery Day, when Musk shared with buyers that the corporate had purchased some tenements in Nevada and was searching for a brand new strategy to produce lithium from clay — a course of but to be confirmed at industrial scale.

Since then, lithium costs have been on an uptrend, hitting all-time highs and at present holding on to features. On account of worth spikes, not just for lithium however different key battery metals, battery prices have elevated. Uncooked supplies at present make up about 80 p.c of battery prices, up from round 40 p.c again in 2015, in response to Benchmark Mineral Intelligence.

“Worth of lithium has gone to insane ranges,” Musk tweeted again in April. “There is no such thing as a scarcity of the factor itself, as lithium is sort of all over the place on Earth, however the tempo of extraction/refinement is gradual.”

Most lithium mining occurs in Australia, from arduous rock, and Chile, from brines. However lithium refining is dominated by China, which at present accounts for greater than 75 p.c of world lithium processing capability.

“I’d prefer to as soon as once more urge entrepreneurs to enter the lithium refining enterprise. The mining is comparatively simple, the refining is far more durable,” Musk stated on a July earnings name, including there are software-like margins to be made in lithium processing. “You may’t lose, it’s a license to print cash.”

Do Tesla batteries have lithium and cobalt?

It wasn’t simply lithium that noticed costs climb final 12 months — cobalt doubled in worth in 2021. Most cobalt mining takes place within the Democratic Republic of Congo, which has been usually related to baby labour and human proper abuses, fueling considerations over provide of this battery steel in the long run.

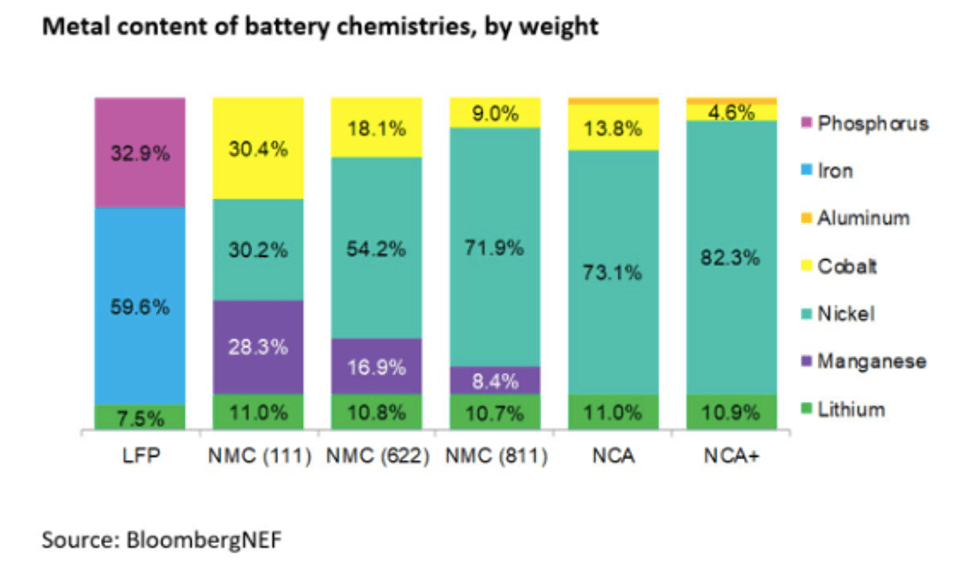

In its batteries, Tesla is understood for utilizing nickel-cobalt-aluminum (NCA) cathodes developed by Japanese firm Panasonic (TSE:6752). The sort of cathode has greater vitality density and is a low cobalt possibility, however has been much less adopted by the trade in comparison with the extensively used nickel-cobalt-manganese (NCM) cathodes. These aren’t the one cathodes containing cobalt that Tesla plans to make use of; South Korean LG Power Options is engaged on supplying Tesla with batteries utilizing nickel-manganese-cobalt-aluminum cathodes.

That stated, not all Tesla’s batteries include cobalt. For its standard-range autos, Tesla stated final 12 months it was altering the battery chemistry it makes use of to lithium-iron-phosphate (LFP) cathodes. The sort of cathode is cobalt- and nickel-free. On the time, the corporate was already making autos with LFP chemistry at its manufacturing facility in Shanghai, which provides markets in China, the Asia-Pacific area and Europe.

How a lot lithium is in a Tesla battery?

For these within the electrical automobile area, it’s a honest query to ask — how a lot lithium is there actually in a Tesla battery? The reply is that although it may not be large in comparison with different uncooked supplies, it will probably turn out to be a hurdle for any EV maker if there’s not sufficient, and sufficient of the appropriate high quality.

Again in 2016, Musk stated batteries do not want as a lot lithium as they want nickel or graphite — describing lithium as “the salt in your salad” — saying it’s about 2 p.c of the cell mass.

Metallic content material of battery chemistries by weight.

Chart by way of BloombergNEF.

However a key issue to recollect is quantity — given the quantity of batteries Tesla must ship its bold targets, if it will probably’t safe a gentle provide of uncooked supplies, it might hit a bottleneck. After all that is true not only for Tesla, however for each carmaker producing EVs at this time and setting targets for many years to come back.

The truth is, demand for lithium is predicted to soar in coming years. By 2030, Benchmark Mineral Intelligence forecasts lithium demand will attain 2.4 million metric tons (MT) lithium carbonate equal — a lot greater than the forecasted 600,000 MT of provide anticipated to be produced in 2022.

Which lithium firms provide Tesla?

There’s not just one firm that provides lithium to Tesla. On the finish of 2021, Tesla inked a contemporary three-year lithium provide take care of high lithium producer Ganfeng (OTC Pink:GNENF,SZSE:002460). The Chinese language firm will present merchandise to Tesla for 3 years ranging from 2022. Prime lithium producers Livent (NYSE:LTHM) and Albemarle (NYSE:ALB) even have provide contracts in place with the US EV maker, and China’s Sichuan Yahua Industrial Group (SZSE:002497) agreed to produce battery-grade lithium hydroxide to the EV maker again in 2020 for a interval of 5 years.

The corporate additionally holds offers with junior mining firms for manufacturing that’s but to come back on stream. Australia’s Liontown Assets (ASX:LTR) is ready to produce Tesla with lithium spodumene focus from its AU$473 million Kathleen Valley undertaking. The deal is for an preliminary 5 12 months interval set to start in 2024, conditional on Liontown beginning industrial manufacturing by 2025.

Core Lithium (ASX:CXO), one other ASX-listed firm, additionally signed a take care of Elon Musk’s Tesla to produce the automobile firm with as much as 110,000 MT of lithium oxide spodumene focus from its Finniss lithium undertaking over 4 years. Core will start supplying Tesla within the second half of 2023.

Though Tesla has secured lithium from all these firms, the EV provide chain is a little more advanced than shopping for lithium straight from miners. Tesla additionally works with battery makers, resembling Panasonic or CATL (SZSE:300750), which themselves work with different chemical firms that safe their very own lithium offers.

Will Tesla purchase a lithium mine?

For carmakers, securing lithium provide to satisfy their electrification targets is changing into a problem, which is why the query on whether or not they would turn out to be miners sooner or later continues to come back up.

As talked about earlier than, again in 2020, on the firm’s Battery Day occasion, Musk stunned the lithium trade by saying Tesla had acquired rights to lithium-rich clay deposits in Nevada, saying it had discovered a strategy to mine the fabric in a sustainable and easy means — utilizing desk salt and water.

However mining lithium is just not a simple process and one which, regardless of hypothesis, is difficult to think about an automaker being concerned in, SQM’s (NYSE:SQM) Felipe Smith stated at an occasion in June.

“It’s a must to construct a studying curve — the sources are all totally different, there are various challenges when it comes to know-how — to succeed in a constant high quality at an affordable value,” he stated. “So it is tough to see that an OEM, which has a very totally different focus, will actually interact into these challenges of manufacturing.”

Unique tools producers (OEMs) are coming to the belief that they could have to construct up EV provide chains from scratch after the capital markets’ failure to step up, in response to Benchmark Mineral Intelligence’s Simon Moores. Moreover, automotive OEMs which can be making EVs will in impact should turn out to be miners.

“I do not imply precise miners, however they’re going to have to begin shopping for 25 p.c of those mines in the event that they need to assure provide — paper contracts will not be sufficient,” he stated.

Remember to comply with us @INN_Resource for real-time updates!

Securities Disclosure: I, Priscila Barrera, maintain no direct funding curiosity in any firm talked about on this article.

Editorial Disclosure: The Investing Information Community doesn’t assure the accuracy or thoroughness of the data reported within the interviews it conducts. The opinions expressed in these interviews don’t mirror the opinions of the Investing Information Community and don’t represent funding recommendation. All readers are inspired to carry out their very own due diligence.

From Your Web site Articles

Associated Articles Across the Internet