Visitor Publish by David Stockman from Contra Nook:

The Nice Central Financial institution Pivot is now underway across the globe, but it surely’s not the one Wall Road has been praying for. As an alternative of one other spherical of easing juice to brake the apparent fall in financial exercise, central banks en masse are racing to goose rates of interest by 75 and even 100 foundation factors at a clip with a purpose to quash the inflation surge.

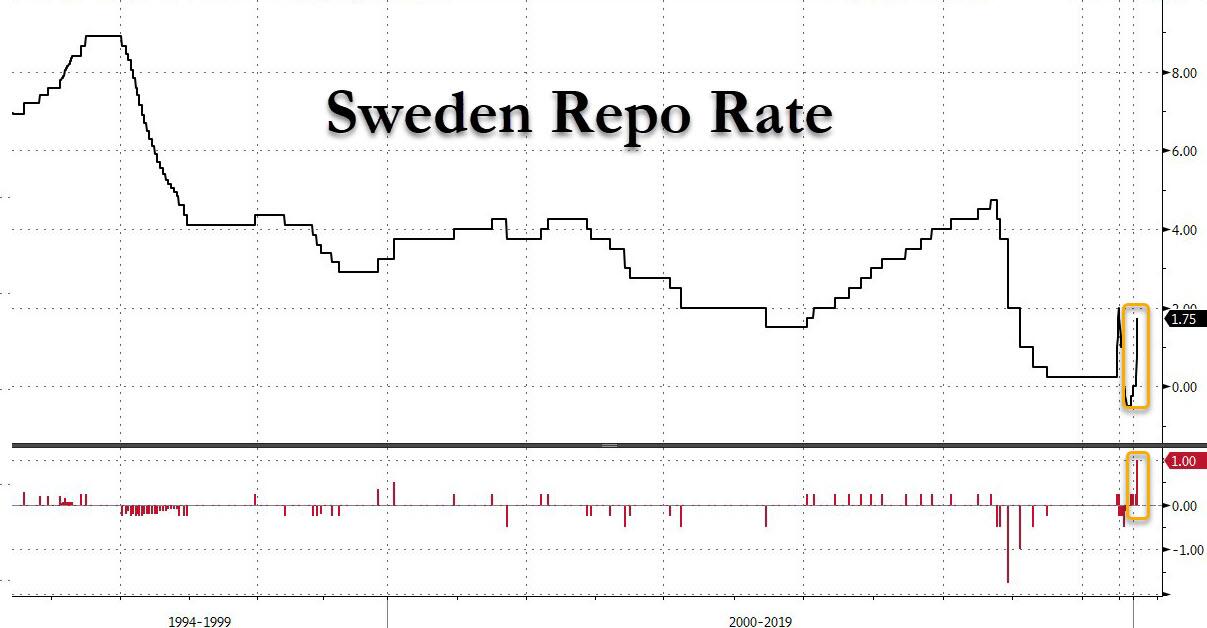

Simply yesterday, as an example, the heretofore dovish Riksbank of Sweden raised its goal charge by 100 foundation factors, stunning the market. Not that way back, against this, the Swedish central financial institution seemed to be locking into zero rate of interest (ZIRP) coverage perpetually.

However right here’s the factor: Even after a 100 foundation level rise, the Riksbank’s goal charge can be simply 1.75% in a context wherein the Swedish CPI for August got here in at 9.8% Y/Y.

That’s proper. The Swedish inflation charge has been accelerating at a hellish tempo, however till yesterday the central financial institution was complacently sitting on primarily a zero charge coverage, thereby giving the notion of being “behind the curve” an altogether new definition.

Furthermore, this inflation acceleration wasn’t the results of simply power or different exogenous pressures arising from world markets. As one analytical service defined, Sweden’s inflation surge is broadly primarily based throughout most sectors:

It was the very best inflation charge since June of 1991, with the costs of meals and non-alcoholic drinks leaping 14%, probably the most since February 1984 (vs 13.5% in July). Extra upward pressures additionally got here from value of housing and utilities (15.1% vs 9.1%), transport (9.6% vs 12.4%), recreation and tradition (3.9% vs 3.8%), eating places and accommodations (9.8% vs 8.9%), and miscellaneous items and providers (5.1% vs 5.4%).

Y/Y Change In Sweden CPI

supply: tradingeconomics.com

The Riksbank’s motion, subsequently, is symptomatic. World central banks have been chasing the chimera of “lowflation” for years now. So doing, they flooded the monetary markets with large quantities of extra liquidity and credit score, whereas getting additional and additional behind the curve on the inflation that was implicitly constructing within the system.

As a reminder, the mixed stability sheets of the world’s central banks stood at $4.7 trillion in 2003 and now complete practically $43 trillion. That gusher of liquidity, in flip, set the financial desk for hovering inflation–first in monetary asset costs, and now in items and providers owing to commodity market disruptions triggered by Washington/NATO’s unhinged Sanctions Warfare towards Russia and the Covid-induced ructions within the world provide chains.

So central banks have pivoted practically on a dime, switching from stimulating extra inflation to a determined try and quell inflationary pressures which are quick changing into embedded within the wage value construction.

Certainly, that was the center of the Riksbank’s stunning 100 foundation level charge improve:

…..“It could be much more painful for the Swedish financial system if inflation had been to stay on the present excessive ranges,” officers mentioned. “By elevating the coverage charge extra now, the chance of excessive inflation in the long run is lowered and thereby the necessity for a good higher financial tightening additional forward.”

The above rationale is the important mantra of all of the central banks together with the Fed. Till they’ve definitive proof that wage-cost pressures are abating, they are going to carry on rising charges. In spite of everything, just like the proverbial carpenter, when your solely software is a hammer, you retain on pounding the nail.

Within the case of the Riksbank’s main motion, in truth, there was an additional straw within the wind. To wit, in contrast to the Fed, the ECB and different behind-the-curve central banks now hitting the brakes, Sweden’s central financial institution additionally predicted that subsequent yr would carry an outright recession:

The Riksbank lower all its development forecasts, and now expects the Swedish financial system to contract 0.7% subsequent yr as a substitute of increasing by that quantity.

In fact, there’s all the time one actor that doesn’t get the message—on this case it’s the financial basket case often called the BOJ (Financial institution of Japan). It’s nonetheless sticking to its insane dedication to “yield curve management”, which means that it’s going to purchase limitless quantities of presidency debt with a purpose to maintain the 10-year bond charge pegged on the ridiculous stage of 0.25%.

However the BOJ’s obstinance isn’t really an outlier or aberration. On the contrary, it’s symptomatic of the place all of the world’s Keynesian dominated central banks had been just some months in the past: That’s, hung up on the wrong-headed notion that the development stage of inflation was too low as a result of the indices had been coming in under their sacred 2.00% targets.

Now, nonetheless, even Japan’s CPI is surging. Thus, Bloomberg in the present day famous that,

Japan’s inflation quickened to the quickest tempo in over three a long time excluding tax-hike distortions, creating complications for the central financial institution this week because it seeks to elucidate why it must proceed with financial stimulus when inflation is way above its 2% aim.

Actually, the Y/Y improve within the headline CPI has surged from 0.2% in September 2021 to three.0% in August 2022. That’s a 15X achieve within the second order spinoff.

Y/Y Change In Japan’s CPI, September 2021-August 2022

supply: tradingeconomics.com

However, BOJ head Kuroda and his parrots within the monetary markets really imagine that Japan’s underlying inflation remains to be too low, and that the BOJ ought to carry on pumping large quantity of fiat credit score into the system till central bankers conclude that inflation has reached the sacrosanct 2.00% goal on sustainable foundation.

“The present cost-push inflation is dangerous for shoppers, however the BOJ will maintain easing, hoping it’ll finally flip into optimistic inflation,” mentioned economist Yuichi Kodama at Meiji Yasuda Analysis Institute. “The central financial institution’s coverage received’t change till Kuroda’s time period ends as that is the final, massive alternative for Kuroda to really revive inflation”.

Within the final 4 bolded phrases you’ve the true ailment of the current period. The financial central planners bought hooked on the absurd notion that the job of central banks is to make extra inflation. Even 25 years in the past the very notion would have been laughed out of city—even by Keynesian economists.

However groupthink is a contagious factor, and over the past 20 years it has completely contaminated each one of many world’s important central banks. Consequently, unhinged money-pumping has gone far past something beforehand imagined.

What which means, in fact, is that taming this spherical of worldwide inflation is a completely new ball sport. The approaching monetary and financial carnage, subsequently, will make even Volcker’s crushing of inflation speculators 4 a long time in the past look like a Sunday College picnic.

For need of doubt, simply think about how quickly rates of interest are rising with no slowing of the inflation momentum but seen. Yesterday, the two-year yield, which is far more delicate to near-term rate of interest expectations, climbed to 3.946%, its highest settle since 2007.

Extra importantly, the chart under makes evident that the federal government debt merchants at the moment are approach out in entrance of the sleepwalkers on the Eccles Constructing. That’s, the two-year treasury be aware has risen practically 400 foundation factors from its Covid-low in comparison with simply 215 foundation factors for the Fed funds charge.

Said in a different way, the bond merchants are waking up from their multi-decade slumber. The Fed “put” below the bond market, in any other case often called quantitative easing (QE), isn’t any extra, even because it launches $95 billion per 30 days of bond-selling (QT) in its determined effort to wrestle inflation to the bottom.

What’s hanging concerning the chart under, nonetheless, is the pace and amplitude by which the beforehand somnolent 2-year be aware market adjusted to the actual central financial institution pivot now underway. And there’s a lot extra of that to come back.

Accordingly, hovering rates of interest in an woke up and un-pegged bond market is what is definitely coming down the pike. In an financial system burdened with $88 trillion of private and non-private debt that’s certainly a recipe for carnage.

2-Yr Treasury Notice Yield, February 2020 to September 2022

Likewise, the yield on the 10-year U.S. Treasury be aware is coming to life as nicely. Yesterday it rose to three.489%–its highest settlement stage since 2011, and up from 3.447% on Friday. However that was only a warm-up for in the present day when the 10-year benchmark broke out of its buying and selling vary, breaking above 3.60% at its excessive.

Evidently, there’s nonetheless a protracted solution to go with a purpose to get the federal government’s benchmark safety again to a yield that’s in sustainable territory in actual (inflation-adjusted) phrases. In flip, which means massive time bother for the inventory market, even on a technical foundation.

That’s to say, the notorious TINA (there isn’t any various) commerce is about prepared to affix Queen Elizabeth within the afterlife. Already, fewer than 16% of S&P 500 shares have dividend yields higher than the yield of the two-year U.S. Treasury be aware and fewer than 20% have dividend yields higher than the yield of the 10-year be aware, in keeping with Strategas.

These numbers mark the bottom share since 2006, and but the Fed’s inflation-battle is simply getting began.

To make sure, the perma-bulls aren’t but prepared to surrender the ghost, and are relentlessly ingenious with regards to recognizing false proof that inflation is popping the nook and that the Fed will quickly be free to revert to the money-pumping modality of the final three a long time.

However we’d say not so quick. Inflation is a fancy, multi-vectored phenomena. Simply because month-to-month numbers can all the time be cherry-picked which suggest inflationary pressures are abating, that doesn’t imply that the battle has been received.

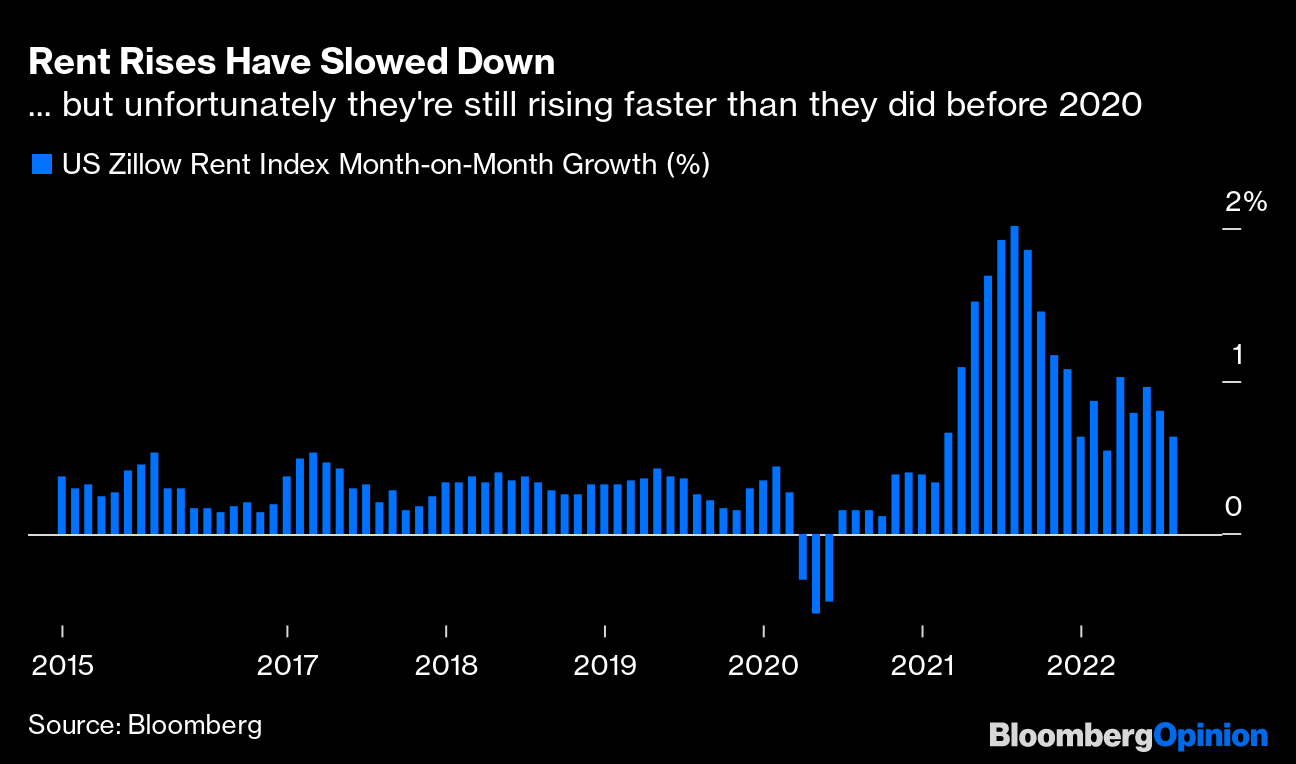

As an example, a brand new canard is that rising rental charges are lastly abating, owing to the current sharp weakening of the housing market. As proven by the blue bars under, the month-to-month charge of change remains to be very excessive by the requirements of current historical past, however it’s down considerably from the height ranges of final fall.

True sufficient. However the issue is that each one of these hovering blue bars on the right-hand facet of the chart are cumulative. Precise households at the moment are dealing with annual lease will increase which are greater than double these of the current previous on a Y/Y foundation.

It’s these massive bites out of paychecks which have despatched wage calls for hovering, thereby fueling the wage-cost-price spiral that now has a powerful head of steam. And it’s the spiral, in flip, which can extend the interval of excessive inflation and maintain the Fed’s toes firmly on the financial brakes.

Y/Y Change In CPI For Dwelling Rents, 2018 to 2022

Because it occurs, the Fed ought to comply with the Swedish instance tomorrow and go the complete monte at 100 foundation factors. We don’t assume they’ve the gumption, in fact, however that really makes no by no means thoughts.

In the end, rates of interest should attain ranges that restore actual, after-inflation returns to really buyers, versus the central financial institution fiat credit score issuers who’ve cleared the market at false ranges for years.

And that’s the actual which means of the Nice Central Financial institution Pivot.