40 yr funding veteran Steve Reitmeister doesn’t purchase the bullish argument that’s gaining pace because the S&P 500 (SPY) closes above 4,200. In actual fact, he says the arrange for a severe correction and thus warns buyers to not get SUCKED into this rally because the rug is about to get pulled out. Uncover why together with a well timed buying and selling plan within the contemporary commentary beneath.

The headlines on Friday are bragging about shares making new highs for the reason that bear market started a yr in the past. That is breeding a contemporary spherical of optimism that the brand new bull market is quickly at hand.

Sure, technically talking shares are up over 20% on the S&P 500 from the October lows. However digging beneath the floor exhibits a a lot much less bullish image making this really feel like one more in an extended line of sucker’s rallies earlier than shares head decrease once more.

Full particulars on why that’s the case together with buying and selling plan to observe on this week’s market commentary.

Market Commentary

Let’s begin with the headline statements.

That being with the S&P 500 (SPY) closing at 4,205 right this moment it has risen simply over 20% from the October lows of three,491.

Second, the S&P 500 is up +9.5% in 2023 alone and made new highs right this moment.

These are each very bullish statements and can make some bears take into account dropping by the wayside. However earlier than doing that please take into account the next chart evaluating the equally balanced model of the S&P 500 (RSP) versus the index which is dominated by know-how mega caps:

Sure, that -0.4% loss for the equal weighed model of the S&P 500 gives a stark distinction from the bullish model of the market that some are attempting to promote us.

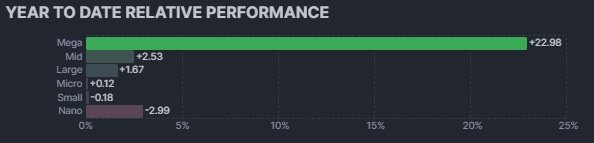

Now let’s share some corresponding info from FinViz as we break down yr up to now outcomes by market cap:

There we see that the S&P 500 achieve of 9.5% on the yr is a complete fallacy as it’s ONLY accumulating to the few mega caps which have bolted forward by 23%.

These strikes had been solely amplified this week as NVDA had that stellar beat on Wednesday night engorging the mega caps as soon as once more into the Friday shut.

What Does It REALLY Imply?

That buyers are in really in Threat Off mode. That they solely really feel secure invested in a small group of the perfect long run holdings like FAANG and some of their closest buddies. Only a few different teams are feeling the love…and thus, laborious to say that this looks like the beginning of the brand new bull market.

Keep in mind that new bull markets are introduced on by BROAD BASED shopping for of shares with smaller, growthier shares main the best way. That’s as a result of those self same shares had been probably the most crushed down permitting for dramatic bounces from oversold bottoms.

THAT IS NOT HAPPENING NOW!

And thus, there may be simply no method for me to be bullish. Particularly because the current spherical of enthusiasm was in regards to the decision of the debt ceiling deal which I mentioned earlier within the week as a facet present distraction.

This looks like there are solely 2 decisions from right here:

First, the bull market is actual which results in a broadening out of inventory teams shifting larger. Particularly small caps which once more are flat on the yr.

For this to occur bears would want to throw within the towel. That is going to be laborious to do in the meanwhile with the Fed dedicated to larger charges by finish of the yr the place they even admit that they besides a recession to occur earlier than inflation is lastly beneath management.

A real Fed pivot to begin reducing charges is the possible catalyst to get the bears on board of the bullish bandwagon. These pondering that can occur on the upcoming assembly on June 14th are hitting the meth pipe a bit too laborious given an array of current statements from a number of Fed officers that they’ve MORE WORK TO DO.

Additionally emboldening the Feds view was a better than anticipated PCE Value Index report on Friday. With the Fed being “knowledge dependent” this signal of inflation nonetheless being too sizzling will solely additional embolden them to maintain charges aloft by finish of the yr.

The second, and extra possible end result, at this stage is that we’re getting arrange for a severe correction. That is the place this mega cap mirage of a runs rally out of steam permitting the actual Threat Off trepidation of buyers to go right into a broad based mostly retreat for the general market.

And sure, this dump might lengthen to a return of the bear market…however for that to occur we have to see stronger proof {that a} recession is a close to certainty reawakening the bear from its current slumber.

The rationale for PROOF of recession is that buyers are bored with listening to in regards to the “risk” of recession. That’s sort of just like the Boy Who Cried Wolf at this stage. Buyers might want to see blood dripping from these fangs to imagine recession is really right here and thus time to dump shares in earnest.

For me this continues to be the very best possible end result. I defined it in full on this current article: Why Steve Reitmeister is Turning into Extra Bearish.

The faster model is to remind people that 12 of the final 15 instances the Fed has raised charges they created a recession…not a delicate touchdown as supposed.

This time across the Fed is enacting probably the most aggressive charge mountain climbing regime in historical past. And so they admit {that a} recession is the possible end result to place an finish to inflation.

So, if the Fed is predicting this end result…and often turns into worse than they anticipate…they usually have their palms on the driving wheel…then recession and deeper bear market is the more than likely end result.

That potential correction in all probability begins as soon as the Debt Ceiling deal is finished and buyers go searching to seek out nothing extra to cheer. Or maybe its proper after the 6/14 Fed charge hike announcement the place Powell has to remind buyers ONCE AGAIN that their work is much from performed…and charges is not going to go down til 2024…and sure, they nonetheless predict a recession earlier than all is finished.

Once more, I believe that is the more than likely end result. However nonetheless potential that recession by no means comes and an actual bull market emerges. The surroundings for that simply shouldn’t be at hand…and thus warning people to not get pulled into the suckers rally underway now.

How must you make investments right now?

Extra on that within the part beneath…

What To Do Subsequent?

Uncover my balanced portfolio method for unsure instances. The identical method that has crushed the S&P 500 by a large margin in current months.

This technique was constructed based mostly upon over 40 years of investing expertise to understand the distinctive nature of the present market surroundings.

Proper now, it’s neither bullish or bearish. Relatively it’s confused and unsure.

But, given the info in hand, we’re more than likely going to see the bear market popping out of hibernation mauling shares decrease as soon as once more.

Gladly we will enact methods to not simply survive that downturn…however even thrive. That’s as a result of with 40 years of investing expertise this isn’t my first time to the bear market rodeo.

If you’re curious in studying extra, and wish to see the hand chosen trades in my portfolio, then please click on the hyperlink beneath to begin getting on the fitting facet of the motion:

Steve Reitmeister’s Buying and selling Plan & High Picks >

Wishing you a world of funding success!

Steve Reitmeister…however everybody calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Whole Return

SPY shares rose $0.53 (+0.13%) in after-hours buying and selling Friday. Yr-to-date, SPY has gained 10.25%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

In regards to the Creator: Steve Reitmeister

Steve is healthier identified to the StockNews viewers as “Reity”. Not solely is he the CEO of the agency, however he additionally shares his 40 years of funding expertise within the Reitmeister Whole Return portfolio. Be taught extra about Reity’s background, together with hyperlinks to his most up-to-date articles and inventory picks.

The publish The Fallacy of the Bullish Argument appeared first on StockNews.com