The SaaS income mannequin provides huge potential for companies — with the fitting method.

Given the continuing nature of software-as-a-service (SaaS) investments and help, it’s attainable for corporations to show preliminary gross sales into continuous income streams that each increase buyer satisfaction and pave the best way for sustained success.

However.

This doesn’t occur in a single day. SaaS promoting — and SaaS income — are distinctly totally different from conventional gross sales and require a brand new method to maximise their potential. On this piece, we’re diving into the SaaS income mannequin: What it’s, the way it works, and the way your enterprise can earn more money.

What’s a Income Mannequin for SaaS?

A income mannequin for SaaS is the follow of first promoting a SaaS resolution after which supporting it over time to drive ongoing ROI.

In follow, this implies connecting with potential clients to show the advantages of your SaaS resolution (or a resale SaaS providing), making the sale, after which delivering superior service and help to maintain purchasers completely happy and hold income flowing.

SaaS as a Predominant Mannequin for Enterprise

The software-as-a-service mannequin acquired off the bottom with cloud computing adoption and is now leveraged by corporations worldwide to entry key software program instruments and options that assist streamline enterprise operations.

SaaS’ main draw is the power for corporations to entry key providers with out the necessity to bodily set up software program on all on-premises units. As an alternative, providers are accessed by way of the cloud wherever, anytime, and on any machine. SaaS suppliers deal with all updates and upkeep — companies merely pay the month-to-month subscription price for software program entry and use what they want, once they want it.

Software program-as-a-service additionally comes with the advantage of on-demand scalability. If corporations want extra room for storage or want extra options to enhance performance, they merely contact their supplier relatively than buying a completely new piece of software program.

Moreover, SaaS makes it attainable for corporations to shift away from capital expenditure (CapEx) fashions to working expenditure (OpEx) fashions. In follow, because of this relatively than paying for software program licensing up-front, corporations pay monthly for what they use, in flip permitting better management over spending and the power to simply add extra software program cases — generally known as “seats” — as required.

Knowledge makes it clear that SaaS is succeeding: The market is at the moment rising 18 p.c yr over yr, and 99 p.c of companies now use no less than one SaaS resolution.

For corporations that provide a SaaS resolution, the character of the market requires constructing and sustaining a dependable income stream. This begins by making a stable SaaS bundle that clients need to purchase. SaaS companies also needs to make a concerted effort to determine dependable contracts, establish and convert new clients, and improve month-to-month income era by each upselling and cross-selling.

Right here’s what that appears like in follow.

Unpacking the SaaS Income Mannequin

So what does the SaaS income mannequin appear to be? Initially, it’s very similar to conventional gross sales: Groups join with clients, establish their ache factors, and shut the deal on a SaaS resolution.

Not like the standard method, nonetheless, SaaS income doesn’t cease after the contract is signed and the (digital) handshakes are executed. As an alternative, the SaaS income method comes with three distinct phases:

Preliminary Contracts

Preliminary contracts are the primary part of SaaS promoting. Very similar to conventional gross sales approaches, these contracts present a stable start line to assist get your SaaS income mannequin off the bottom. The caveat? They don’t herald as a lot cash upfront as conventional gross sales.

Right here’s why: In a conventional gross sales mannequin for a services or products, consumers would possibly pay for all the buy up-front or signal long-term annual contracts that supplied regular income over time. The elemental function of SaaS, nonetheless, is its flexibility — corporations don’t need to be locked in for years of service. As an alternative, they need the choice to opt-out as wanted if providers don’t meet their expectations. In consequence, whereas preliminary contracts herald some income, they’re simply the start line.

Ongoing Retention

To assist stabilize income, ongoing buyer retention is essential. This requires taking a step again from the preliminary sale and assessing how finest to serve clients over time to extend their lifetime worth.

Take into account an preliminary sale of $1000 for the primary month of service and $1000 each month thereafter. Whereas that’s an incredible start line, what occurs if clients cancel service after simply three months? That’s $3000 in income however a misplaced long-term alternative.

Ongoing retention focuses on maintaining clients completely happy over time in order that they keep for one yr, two years, or 5 years — in flip producing $12,000, $24,000, and even $60,000 in income. This implies checking in to make sure clients are happy with their service and ensuring that SaaS options are frequently up to date and maintained to offer optimum service. Ongoing help can also be essential; clients should have the ability to get in contact along with your model as wanted to resolve issues and remedy key challenges.

Expanded Gross sales

Merely put, stable SaaS income relies on scale. Very similar to the software program supply mannequin itself, scale is the place SaaS income shines. This implies on the lookout for methods to develop present choices that encourage extra funding from clients. For instance, new storage, evaluation, or safety features provide upselling alternatives with present purchasers.

Cross-selling can also be essential. For those who can ship a superior expertise backed by very good customer support, your purchasers will discuss to different companies of their business, in flip making it attainable to leverage phrase of mouth into extra income alternatives.

The best way to Forecast SaaS Income

Whereas it’s inconceivable to foretell the longer term, it’s attainable to usually forecast your SaaS income.

Right here, two elements are essential: Contract values and month-to-month recurring income (MRR).

Contract values confer with the income worth of any contracts signed with clients for a selected interval. For instance, when you have a contract with an organization for 12 months throughout which they pay you a complete of $12,000, that is the annual contract worth. Including up all of your present contract values supplies a baseline for short-term income.

MRR, in the meantime, speaks to the month-to-month income earned from energetic SaaS subscriptions. These subscriptions will not be below contract, which means they arrive with better variability however are nonetheless a essential part of income forecasting.

To forecast your income with MRR, first add up your present subscriptions. In follow, because of this when you have 10 subscriptions valued at $500 monthly, your current MRR is $5,000. Subsequent, that you must assess the potential for brand spanking new income as a part of your forecast.

This begins with new MRR — new subscriptions acquired in the previous few months. By making a baseline for brand spanking new subscription knowledge, you may higher assess your potential for ongoing income. Subsequent is growth MRR: This refers to extra income earned out of your current MRR base by upselling them to larger product tiers or cross-selling them to new merchandise inside your SaaS stack. Lastly, that you must account for contraction MRR, which is the lack of income on account of service downgrades or the lack of subscription clients.

Combining each contract and MRR values, corporations can each pinpoint present income values and create a dependable income forecast that informs advertising, gross sales, and customer support efforts.

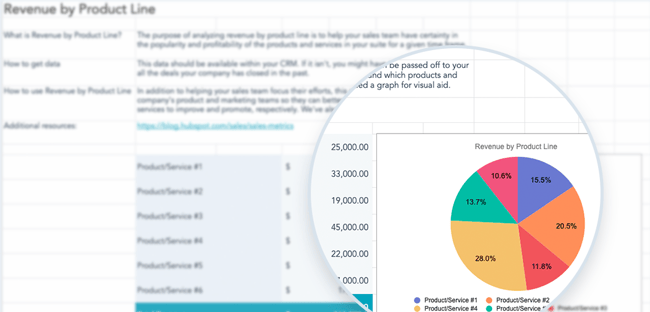

SaaS Income Mannequin Template

On the lookout for a SaaS income mannequin template that will help you get began? HubSpot has you coated.

Along with QuotaPath, we created a Free Gross sales Metric Calculator — an easy-to-use Excel template that allows you to calculate common deal sizes, win-loss charges, churn charges, CAC-to-CLV, buyer retention fee, and extra.

Get the calculator right here.

SaaS Income Mannequin Suggestions

Income technique is one factor, however how do suppliers successfully promote SaaS options to potential purchasers? Begin with these strategic promoting ideas.

1. Create trial durations.

Attempt-before-you-buy choices might help potential clients discover one of the best match to your SaaS resolution with out the necessity for any financial dedication.

The size of a trial interval that works to your product usually relies on its complexity. In case your providing is straightforward and easy, a 7-day trial is sufficient for corporations to get a way of what your product does. Multi-tiered or extra advanced merchandise could profit from a 14-day trial, whereas a 30-day trial is an effective method for in-depth enterprise choices.

2. Keep in touch.

Subsequent up? Be sure to keep in touch with potential consumers each throughout their trial durations and after they make a purchase order. Discover out what’s working, what isn’t, and what you are able to do to assist. Retaining in contact may also enable you to customise choices to fulfill their distinctive wants.

3. Present easy demos.

Easy on-site demos of your product present clients with a fast overview of what your resolution does and if it’s a great match for his or her enterprise. Plus, it requires nothing however a couple of minutes of time out of your potential consumers, making demos an incredible introductory method to your product.

4. Take into account annual choices.

Whereas SaaS merchandise are sometimes offered on a month-to-month foundation, it’s also possible to provide annual pay as you go subscriptions that include a reduction however provide the advantage of income up-front. These plans are sometimes most popular by corporations who need to discover their best-fit resolution however don’t need to fear about managing it each month.

5. Ask for suggestions.

At all times ask for suggestions. Ask for it after corporations view demos, once they begin and finish free trials, and through their subscription interval. Not solely does this suggestions assist tailor your resolution to their particular wants, but it surely additionally lets your crew establish and remediate recurring issues which might be constantly talked about by clients.

6. Preserve observe of the small print.

Lastly, leverage a sturdy CRM resolution to maintain observe of all the small print. This contains shopper numbers, subscription sorts, and renewal dates. Complete CRM instruments additionally make it attainable to streamline help and make sure that clients are getting the assistance they want, once they want it.

Key SaaS Income Mannequin Metrics

Even armed with a stable promoting method and the fitting income mannequin in place, SaaS corporations can’t relaxation on their laurels. To make sure gross sales are on observe for sustained success and continued development, companies should monitor key SaaS metrics. Among the most related embrace:

Buyer Churn

What number of clients are staying after their trial interval? What number of depart after three months? Six? A yr? Understanding what number of clients you’re shedding — and why they’re leaving — might help reduce buyer churn and improve sustainable income.

Buyer Lifetime Worth (CLV)

CLV is a measure of how a lot a median buyer is value to your organization over time. This quantity helps inform your advertising and gross sales technique. For instance, in case your CLV is low since you’re centered on entry-level merchandise with a minimal bar to entry, then discovering and changing new clients is essential to success.

In case your CLV is excessive, in the meantime, it’s extra essential to retain the shoppers you’ve got relatively than spending money and time trying to find new prospects.

Buyer Acquisition Value (CAC)

CAC is the quantity it prices to amass a brand new buyer. For instance, for those who’re spending $100,000 monthly on advertising, gross sales, and different capabilities to amass 100 clients, your CAC is $1,000.

If every of those clients pays $100 monthly to your product over a yr, you make $120,000 in opposition to $100,000 in spending. In consequence, it’s essential to frequently monitor this metric and evaluate it in opposition to present income streams to make sure the quantity spent on acquisition doesn’t exceed the quantity generated by SaaS contracts.

Buyer Engagement Rating

Buyer engagement rating is a measure of how engaged clients are along with your firm and your product. Frequent elements embrace product and repair engagement, advertising engagement, group engagement, and advocacy engagement.

Whereas scoring scales and weighs will differ for every firm — for instance, for those who’re centered on increasing present gross sales, group and advocacy engagement could also be your priorities, whereas service engagement could also be most essential for those who’re seeking to increase retention — a stable buyer engagement framework might help quantify key tendencies and inform strategic decision-making.

Making the Most of Your SaaS Income Mannequin

SaaS is taking the market by storm. In consequence, there’s huge income potential on this market — if corporations take the fitting method. A profitable SaaS income mannequin acknowledges the shift in gross sales from one- to three-phase fashions, implements stable gross sales techniques, and provides ongoing success by monitoring key SaaS metrics over time.

![Download Now: Sales Conversion Rate Calculator [Free Template]](https://no-cache.hubspot.com/cta/default/53/059a7eef-8ad9-4bee-9c08-4dae23549a29.png)