PayPal is without doubt one of the largest fee platforms available on the market. Nevertheless, there are a number of PayPal options you must think about using, too. Whereas PayPal facilitates funds for greater than 28 million companies, a few of these options would possibly higher match your online business wants.

Your online business wants would possibly embody:

- Vendor safety for digital items

- Decrease charges for chargebacks

- Quicker turnaround for withdrawn PayPal funds (PayPal can take as much as 4 enterprise days to indicate up in your account)

- A extra hands-on buyer success workforce

Fortunately, we have gathered the highest PayPal options listed beneath. From Bitcoin-friendly to global-ready — discover a resolution that works for you, your online business, and your clients.

Finest PayPal Alternate options

- Google Pay

- WePay

- 2CheckOut

- Authorize.Internet

- Skrill

- Intuit

- ProPay

- Dwolla

- Braintree

- Stripe

- Payoneer

- Amazon Pay

- Sensible

- Venmo

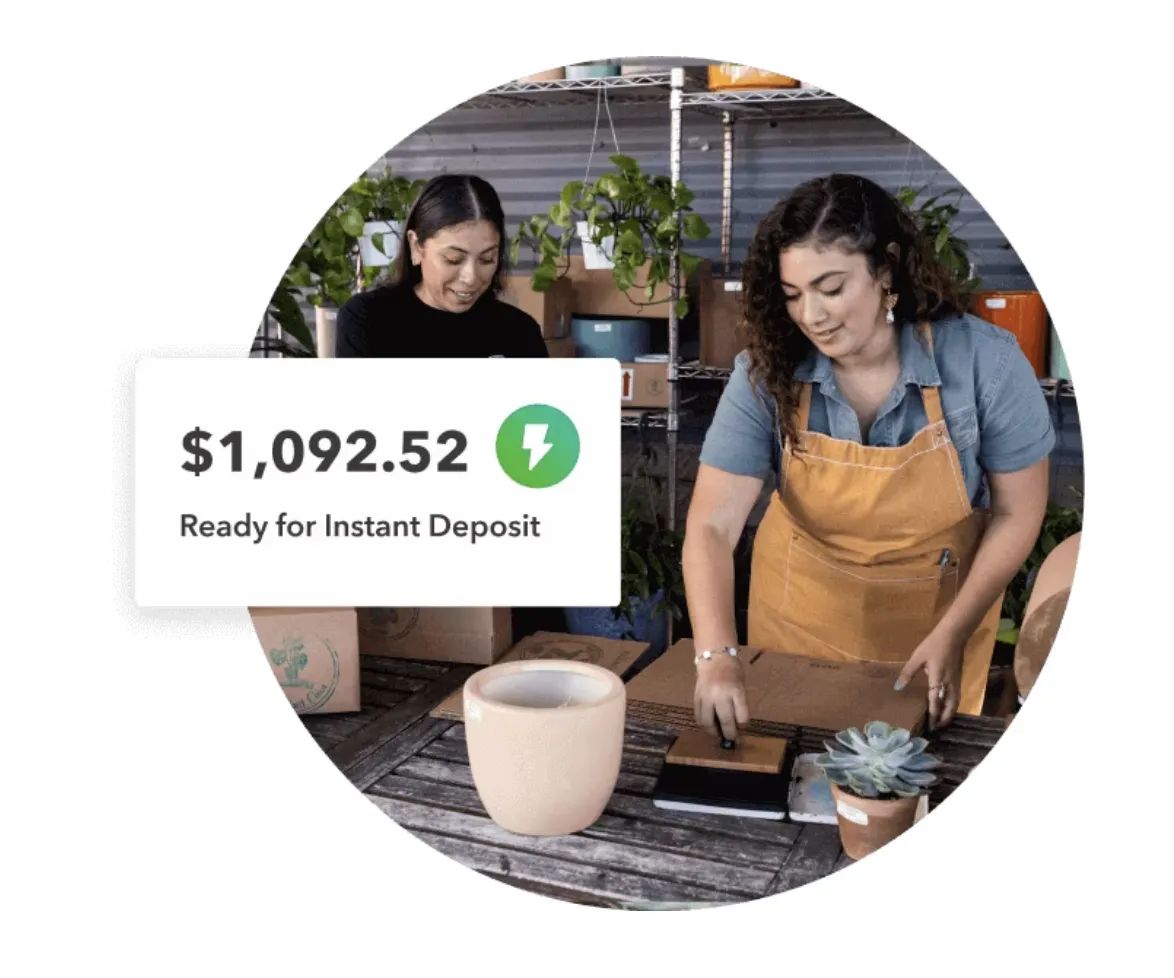

- Sq.

- Payline

- Shopify Funds

- BlueSnap

- Viewpost

- FastSpring

- Ayden

- Fattmerchant

- Klarna

- Propay

- Adyen

- Stax Pay by fattmerchant

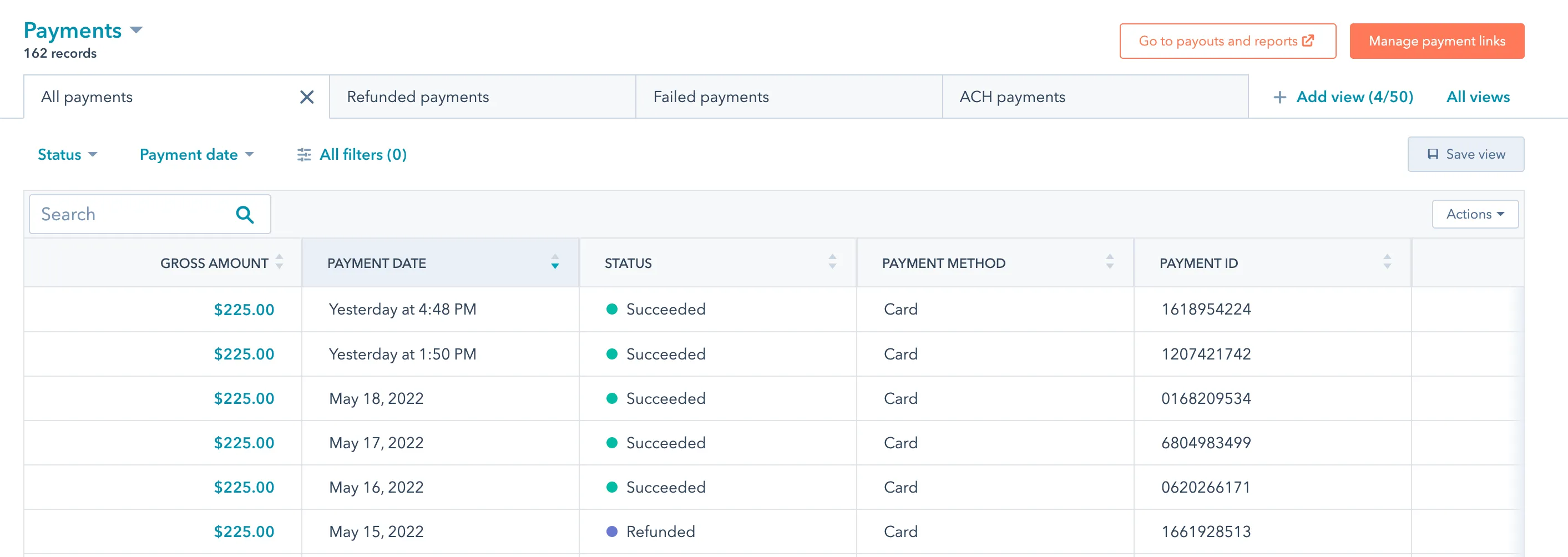

1. HubSpot Funds

Get began with HubSpot’s Funds device.

For those who’re already utilizing a HubSpot CRM, it solely is sensible to include HubSpot Funds. HubSpot Funds simply streamlines fee processing, making it simpler to obtain your funds.

Your gross sales workforce can create fee hyperlinks that don’t require an entry code — that means you may place fee hyperlinks wherever you may embed a hyperlink, similar to in conferences, quotes, varieties, invoices, and so on.

- Pricing: There aren’t any month-to-month charges or minimums to make use of Funds. Nevertheless, it’s essential to have a Starter+ HubSpot account.

- ACP funds: (0.5%) of the transaction quantity, as much as $10.

- Playing cards: 2.9% per transaction

Get began streamlining your fee processes with HubSpot’s Fee device.

2. Google Pay

Your clients pays in-app, in-store, or in your web site. Google Pay permits companies to allow purchasing throughout all units, decreasing the frequency of forgotten passwords and missed conversions. You can too ship customized cellular gives and suggestions to your clients, share loyalty and present playing cards, and cut back the necessity for ticketing.

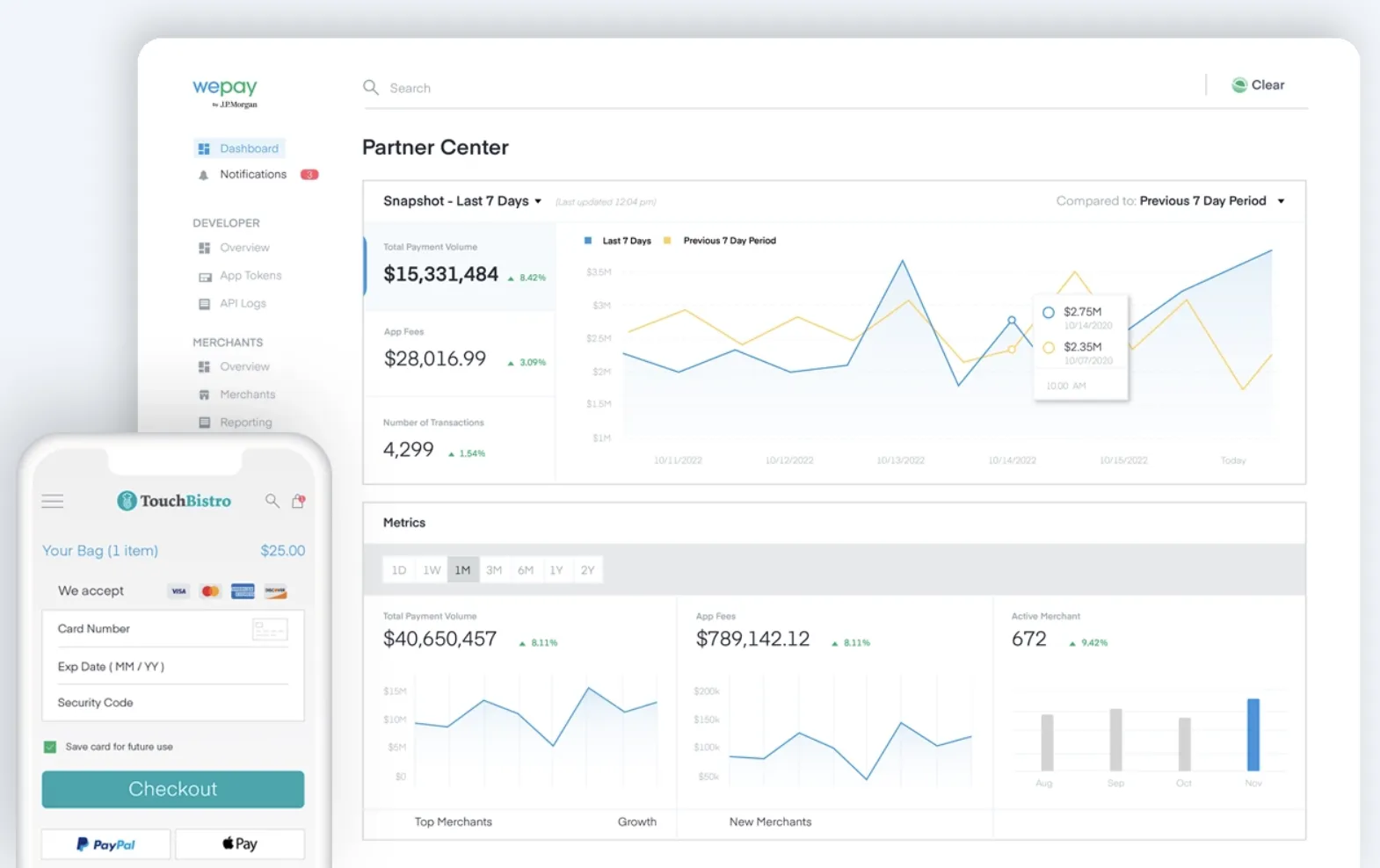

3. WePay

WePay gives built-in funds for platforms. It’s constructed to allow immediate onboarding and processing “with the size of JPMorgan Chase.” Specializing in distinctive on-line, POS, and omnichannel software program platforms, WePay allows companies to embed transaction and payout functionality with a single integration.

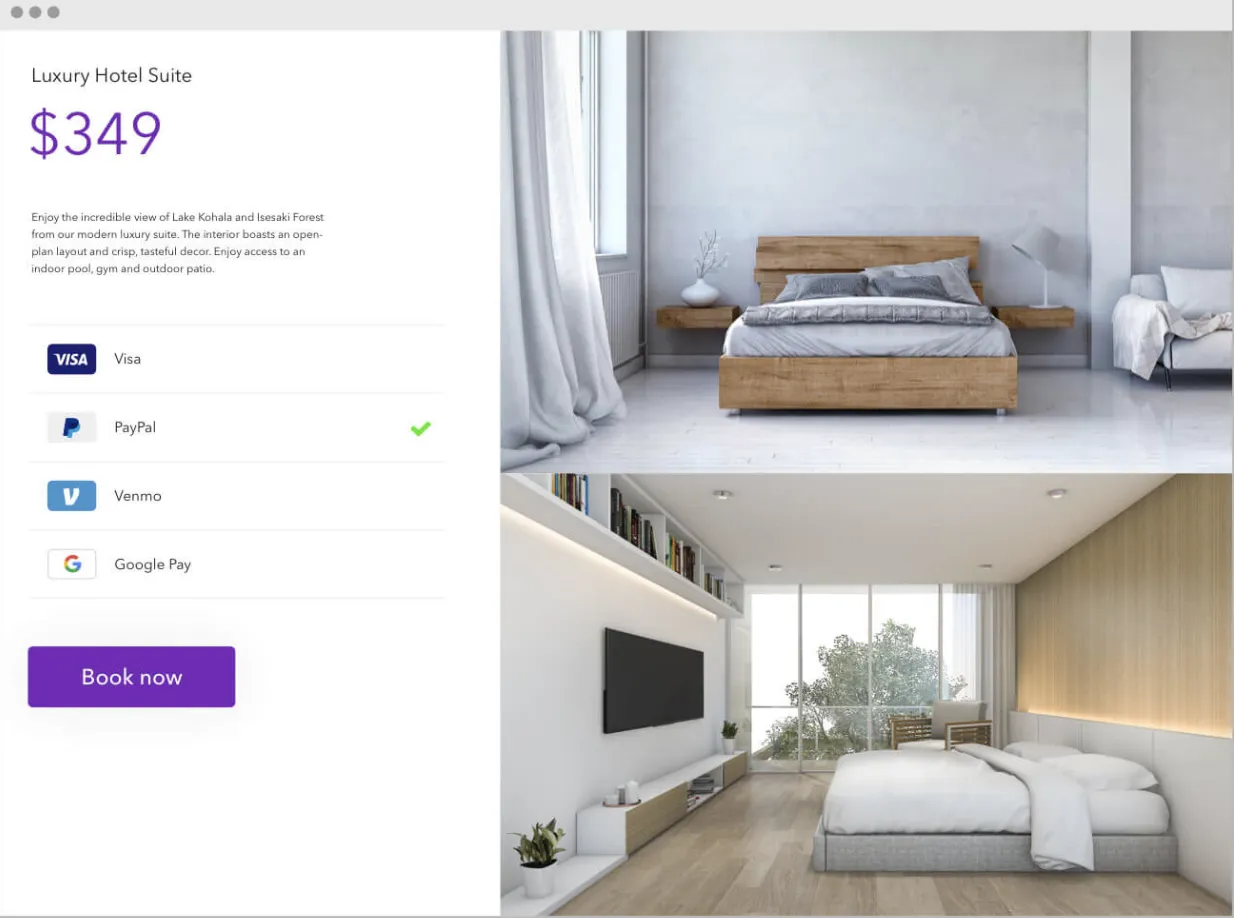

4. 2CheckOut

In search of a world possibility? Take into account 2CheckOut, which gives eight fee sorts, 15 languages, and 87 forex choices in additional than 200 world markets. The platform gives a mobile-friendly expertise with branding custom-made to your online business.

Plus, you’ll take pleasure in 300 fraud guidelines per transaction, greater PCI compliance, and straightforward integration with greater than 100 on-line carts and intensive documentation.

- Implementation: Developer documentation

- Pricing: Varies by plan

- 2SELL, 3.5% + $0.35 per profitable sale

- 2SUBSCRIBE, 4.5% + $0.45 per profitable gross sales

- 2MONETIZE, 6.0% + $0.60 per profitable sale

5. Authorize.Internet

Settle for digital and bank card funds in-person, on-line, or over the cellphone with this fee gateway service. Working with small companies since 1996, Authorize.Internet has greater than 43,000 retailers, handles multiple billion transactions, and facilitates $149 billion in funds yearly.

It’s a subsidiary of Visa and offered by way of resellers, together with Unbiased Gross sales Organizations, Service provider Service Suppliers, and monetary establishments. You’ll obtain free, 24/7 help and an award-winning API integration.

In addition they combine simply with PayPal, Apple Pay, and Visa Checkout, permitting you to just accept buyer funds worldwide — so long as your online business relies in america, Canada, United Kingdom, Europe, or Australia.

- Implementation: Developer documentation

- Pricing: Varies by plan

- All-in-One: no setup payment, $25monthly gateway, 2.9% + $0.30 per transaction

- Fee Gateway Solely: no setup payment, month-to-month gateway $25, $0.10 + a each day batch payment of $0.10

- Enterprise Resolution: tailor-made pricing, information migration help, interchange plus choices

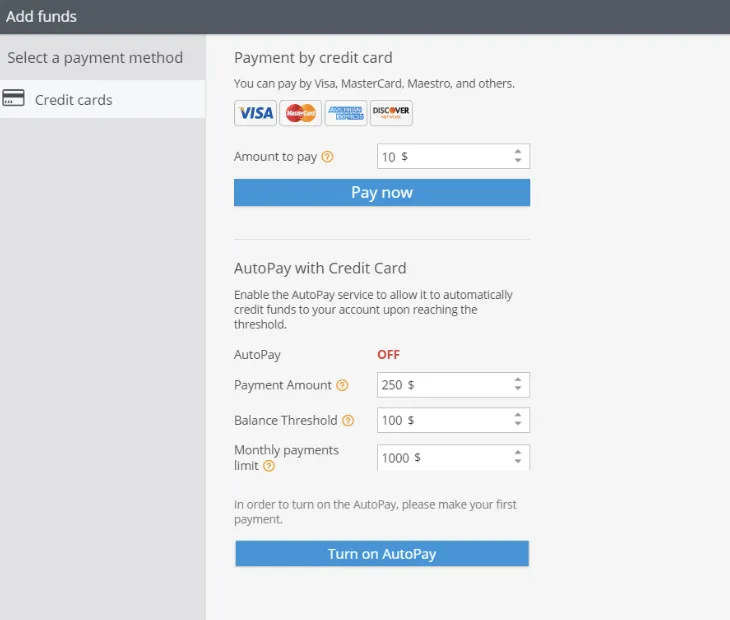

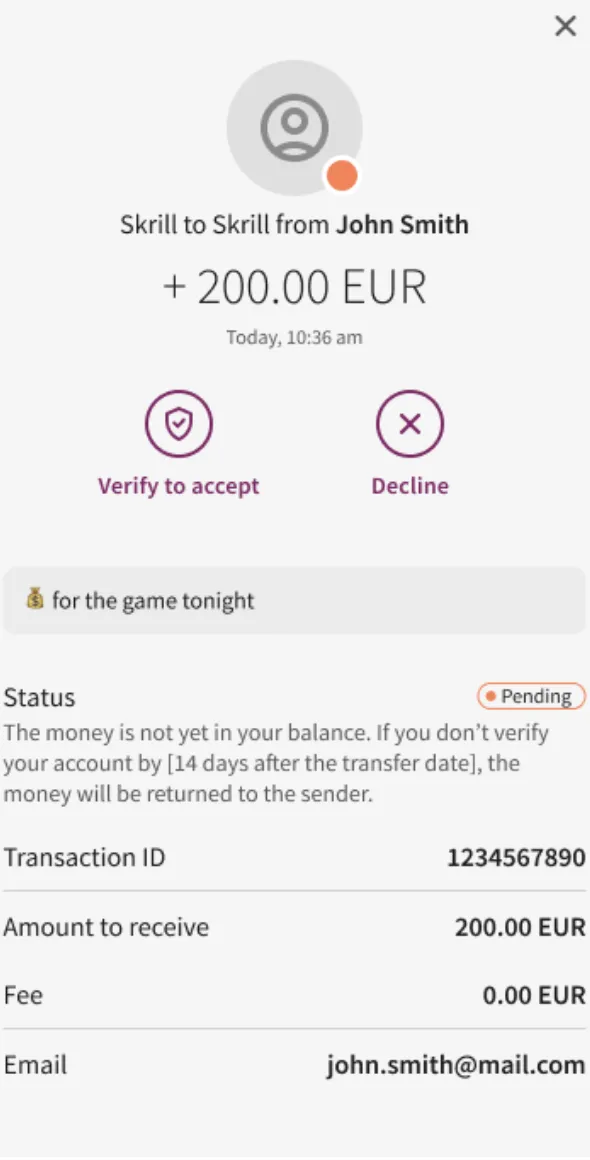

6. Skrill

Skrill lets you ship and obtain cash, retailer playing cards, hyperlink financial institution accounts, and make funds with simply your e-mail handle and password. Skrill “pockets holders” additionally solely pay charges of 1.45%, so that you get to maintain extra of the cash from each transaction. Whether or not you’re utilizing Skrill for enterprise or private use, you’ll obtain entry to world help in additional than 30 international locations.

7. Intuit

QuickBooks Funds guarantees you’ll receives a commission twice as quick in case you use their service. They mean you can take cellular card funds, ship invoices on-line, and arrange recurring billing.

You’ll get real-time alerts when clients view or pay invoices — and fee reminders are all automated. And all that bill information entry? It seems in QuickBooks in real-time with no need any changes from you.

- Pricing: Varies by plan

- Pay as you go, $0 per thirty days — Financial institution transfers (ACH), free

- Card — Swiped, 2.4% + $0.25 per transaction

- Card — Invoiced, 2.9% + $0.25 per transaction

- Card — Keyed, 3.4% + $0.25 per transaction

8. ProPay

ProPay gives fee options for small companies, enterprise companies, and a wide range of industries, together with direct promoting, auto sellers, and authorized. They facilitate bank card fee and fee processing and provide world disbursement and fee fee choices.

ProPay additionally gives fee options for SaaS platforms, marketplaces, and software program suppliers by way of pay-by-text or “one-click” e-mail funds.

9. Dwolla

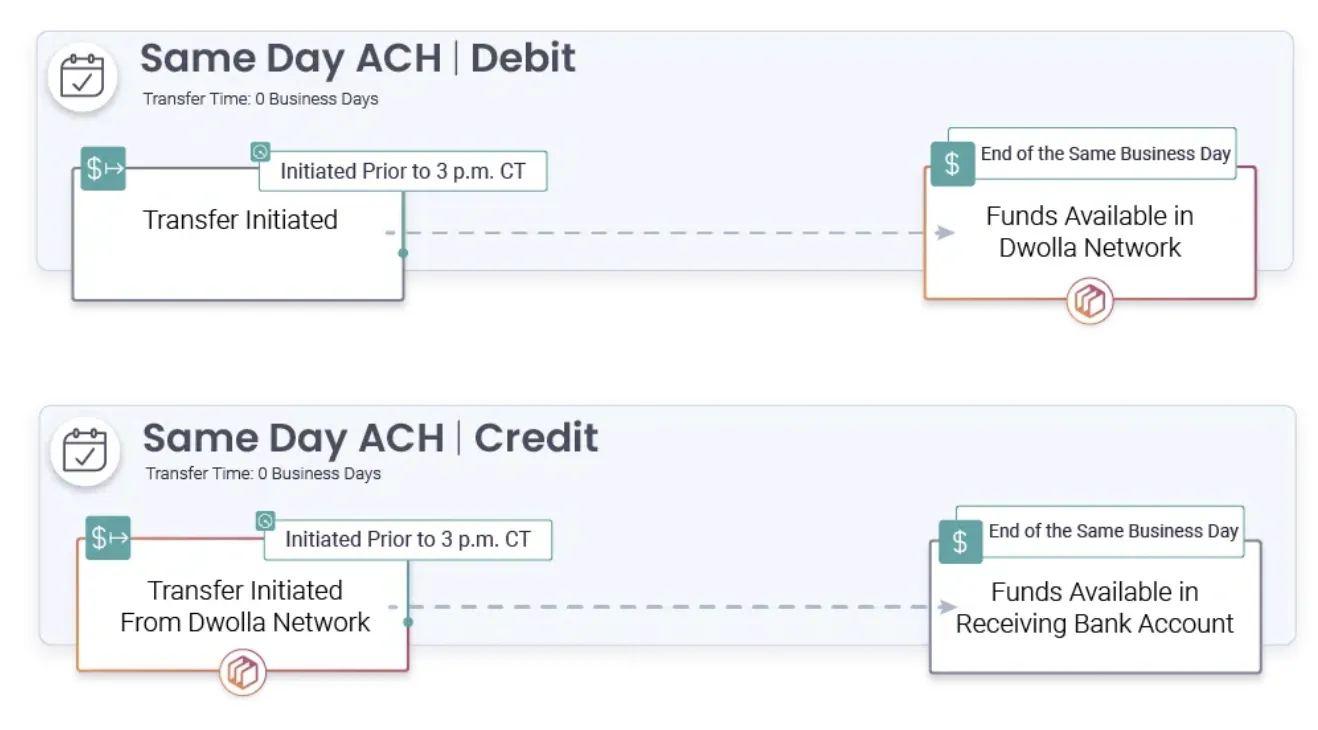

Dwolla prides itself on being developer-friendly and simply built-in along with your utility. It has a white-label API, which implies your clients all the time work together with the interface they belief — yours. Buyer id is verified with out third-party web site involvement, and it’s straightforward so as to add financial institution accounts.

Dwolla may even automate your funds and ship as much as 5,000 funds with a single API request. It additionally boasts a 99.9% uptime, refined safety, predictable pricing, and a hands-on buyer success workforce.

10. Braintree Picture Supply

Picture Supply

Braintree is definitely a PayPal service. Braintree Direct, Braintree Market, Braintree Auth, and Braintree Lengthen provide fee options custom-made to the distinctive wants of your online business.

It makes it straightforward to just accept on-line and cellular funds in additional than 130 currencies and greater than 45 international locations. And including Hosted Fields to its Drop-in UI means your customers will take pleasure in a seamless checkout expertise.

- Implementation: Developer documentation

- Pricing: Varies by plan:

- Customary pricing, 2.59% + $0.49 per transaction

- Customized pricing obtainable upon request

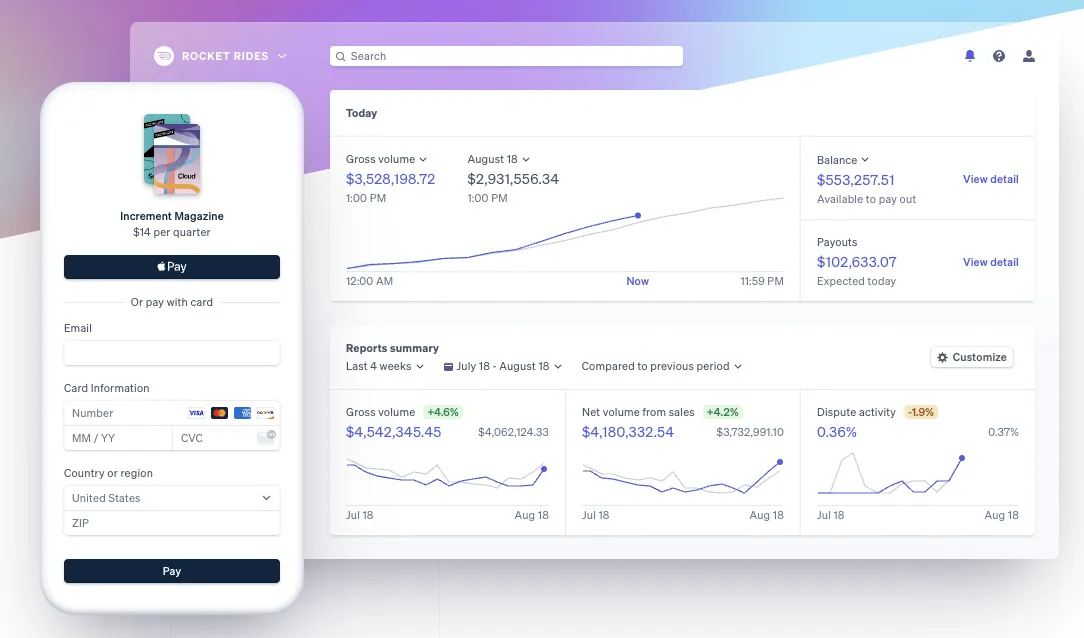

11. Stripe Picture Supply

Picture Supply

Operating an web enterprise? Stripe could possibly be best for you. It is a “builders first” firm that believes “funds is an issue rooted in code, not finance.” With its straightforward API, you may have Stripe up and operating in simply a few minutes.

- Implementation: Developer documentation

- Pricing: Pay as you go:

- 2.9% + $0.30 per profitable card cost, + 1% on worldwide playing cards

- 0.8% and a $5 cap on ACH debits

- Customized pricing obtainable upon request

12. Payoneer

Whether or not you are a enterprise proprietor, freelancer, or skilled, Payoneer may also help you receives a commission rapidly, securely, and at a low price by worldwide shoppers. It makes a speciality of various markets and industries, so it doesn’t matter whether or not your organization is targeted on e-commerce, internet marketing, or trip leases.

Payoneer has 4 million customers in additional than 200 international locations and might deal with your online business with ease. Merely join Payoneer, start receiving on-line funds to your Payoneer account, and withdraw funds out of your native financial institution or ATMs worldwide.

- Pricing: Funds from different Payoneer clients, free

- Receiving accounts utilizing Payoneer’s International Fee Service, free

- Funds instantly out of your clients, 3% on bank cards in all currencies, and 1% on eChecks

- Funds through different marketplaces and networks, pricing varies

- Apps: iOS | Google Play

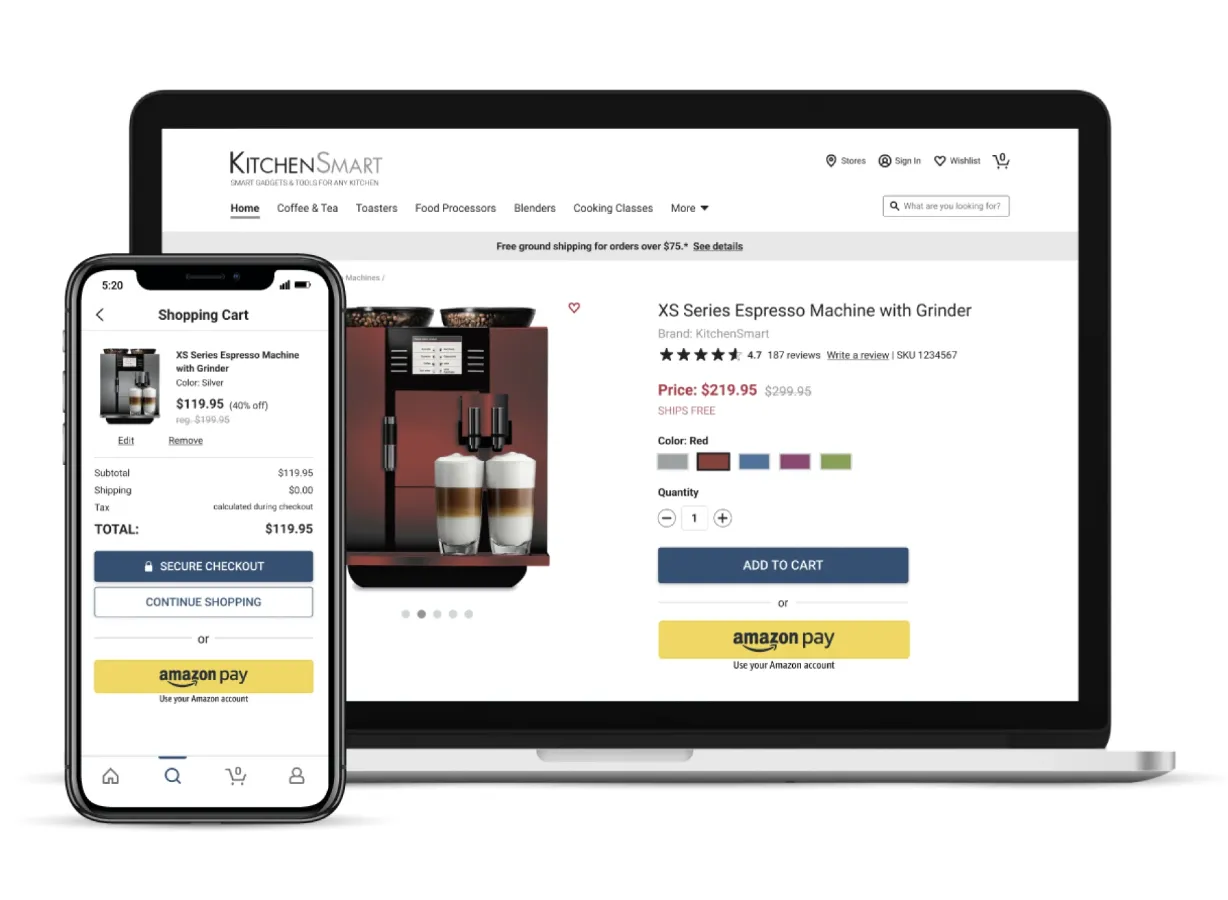

13. Amazon Pay

Amazon has portals for retailers, buyers, and charities. Your clients will discover it straightforward to make use of as a result of they’ll log in utilizing their Amazon account info and take a look at utilizing the identical Amazon course of they already belief.

Plus, you get the additional safety of Amazon’s fraud safety at no further price. All transactions are accomplished in your web site, and Amazon Pay integrates along with your current CRM. It’s additionally obtainable throughout units, so you may handle funds on the go.

- Implementation: Developer documentation

- Pricing: 2.9% + $0.30 cents per home U.S. transaction, 3.9% for cross-border processing payment, and $20 for disputed fees

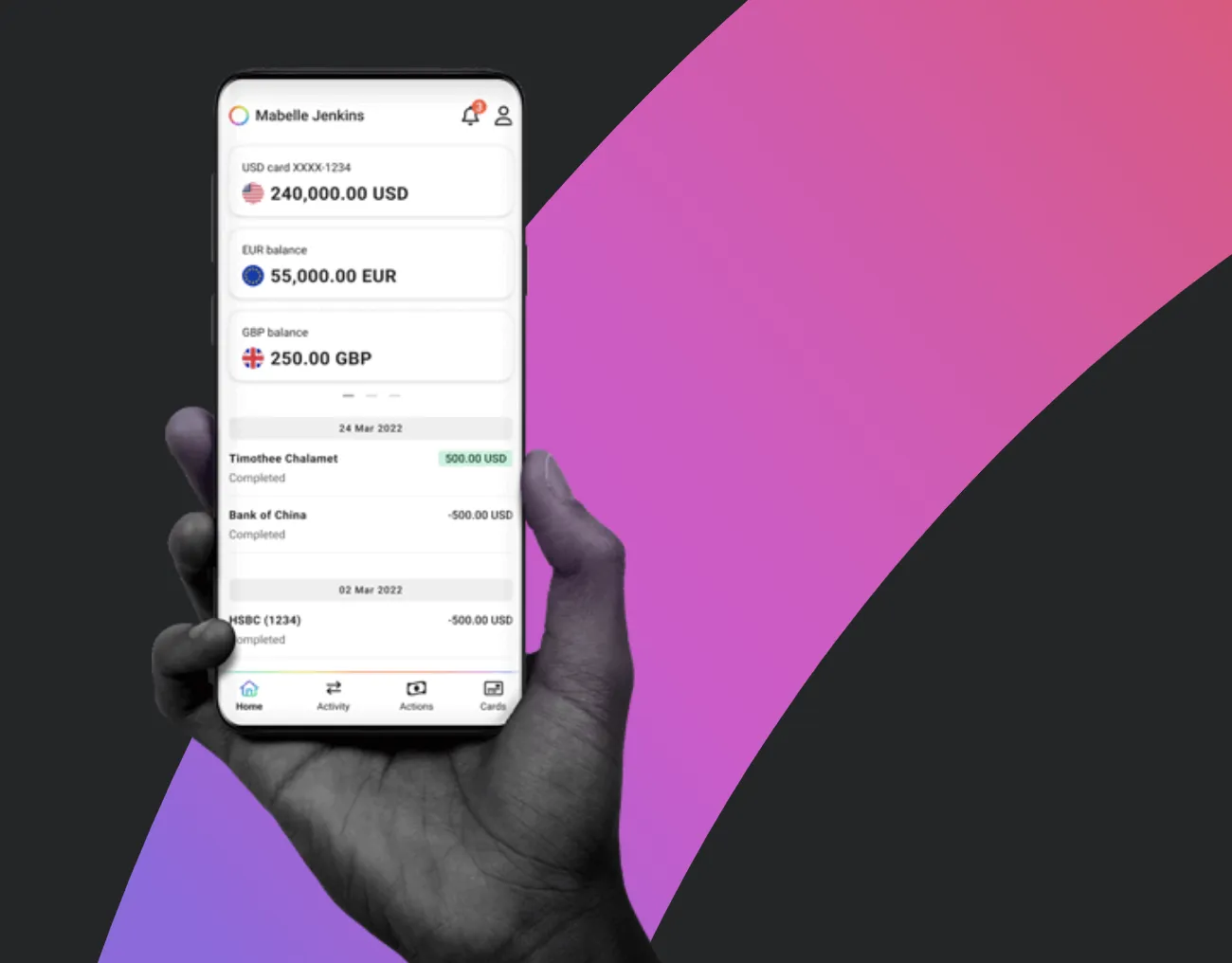

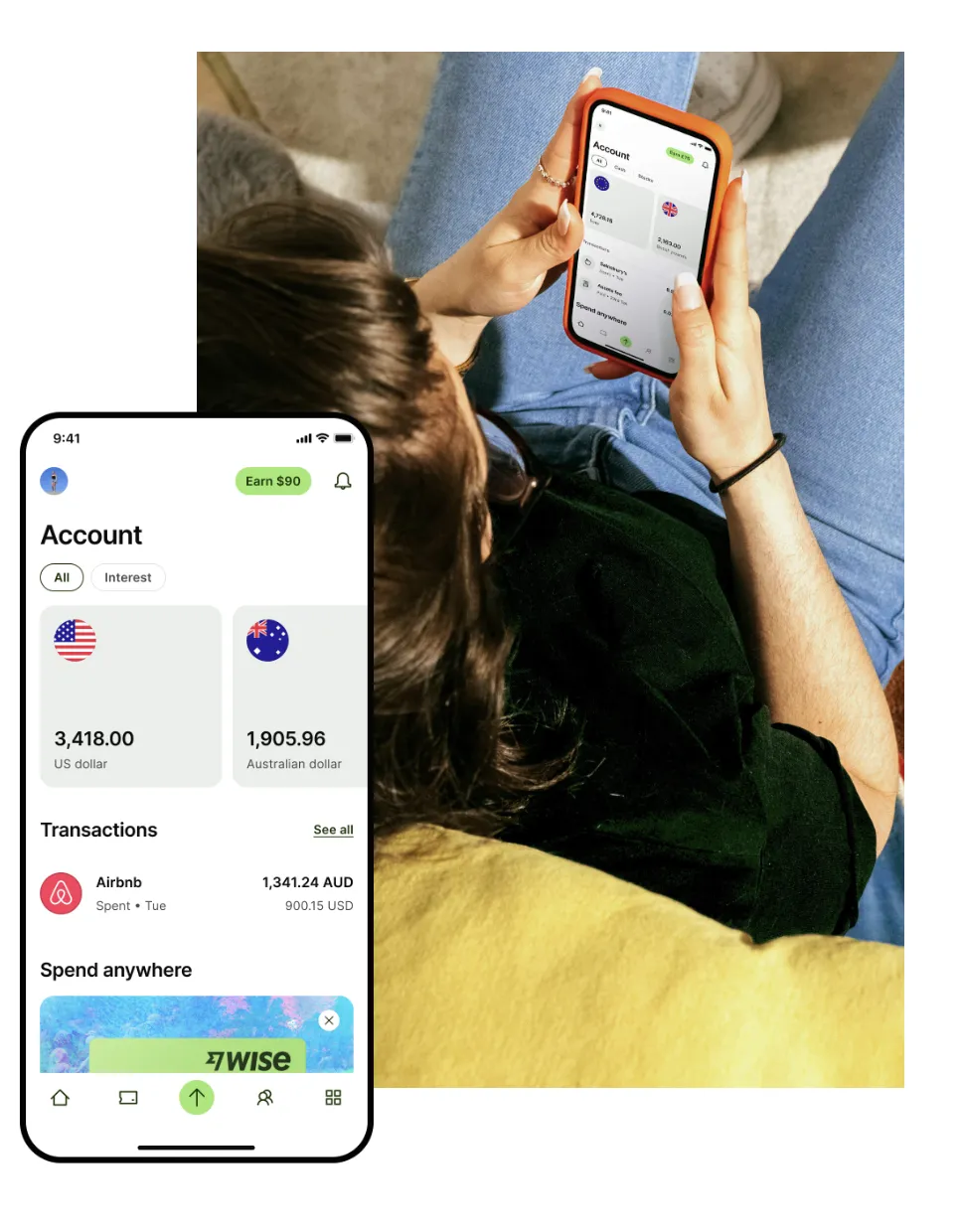

14. Sensible

Sensible payments itself as “a less expensive technique to ship cash internationally.” Ship and obtain cash with a Sensible borderless account, be part of the waitlist for a Sensible debit card, run payroll or batch funds, receives a commission as a freelancer, and even discover the payouts API.

It additionally claims to have the fairest change price, banishes hidden charges, and completes 90% of transfers from the U.Okay. to Europe in a single enterprise day. For those who conduct a excessive quantity of worldwide transactions, Sensible is price testing.

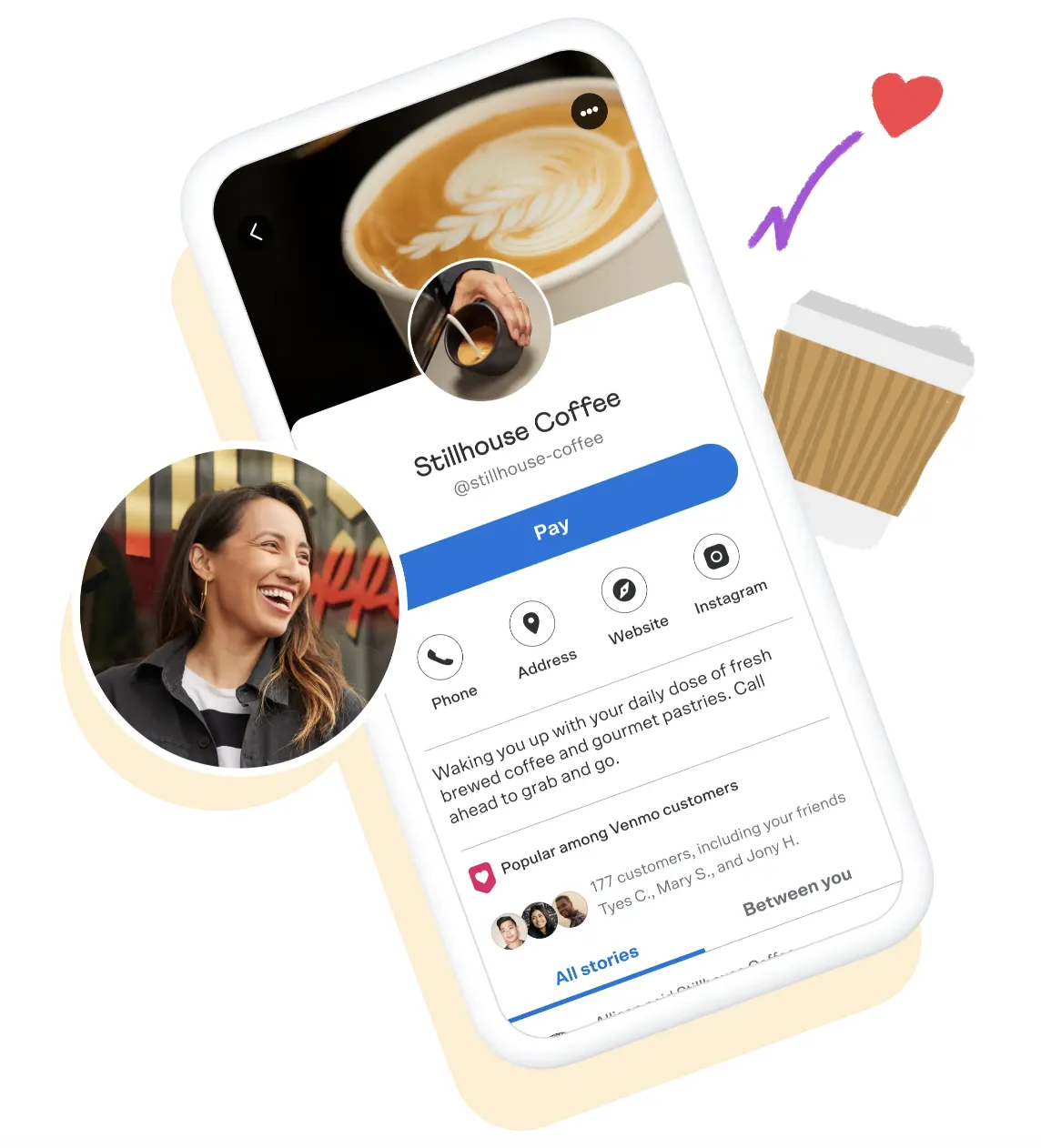

15. Venmo

You’ve most likely used Venmo to pay a buddy again for pizza or live performance tickets — however do you know Venmo works for enterprise transactions as nicely? Add the platform to your cellular web site or app and use Venmo’s social advantages as bonus advertising for your online business.

You’ll have to combine with both Braintree or PayPal Checkout so as to add Venmo as a fee possibility, but when the social facet of funds intrigues you, Venmo is price a glance.

16. Sq.

Choose your online business dimension and sort, and also you’re signed up for Sq.. It really works greatest for retail and in-person transactions and gives two fundamental plans. Sq. Level of Gross sales lets you settle for playing cards, money, examine, and even present playing cards, print or digitally ship receipts. You can too course of invoices and recurring funds.

A giant bonus right here? You can too swipe playing cards and not using a connection, so that you by no means have to fret about dropping enterprise from outages once more.

Sq. for Retail lets you promote sooner with a search-based level of sale, monitor, alter, and switch stock, handle your distributors, and create buyer profiles with each sale. You can too create price of products offered studies, ship buy orders, and arrange worker time playing cards and permissions.

17. Payline

Payline gives merchandise that match your online business — whether or not you’re in-store, cellular, or on-line. Payline has varied partnership choices that mean you can customise your plan.

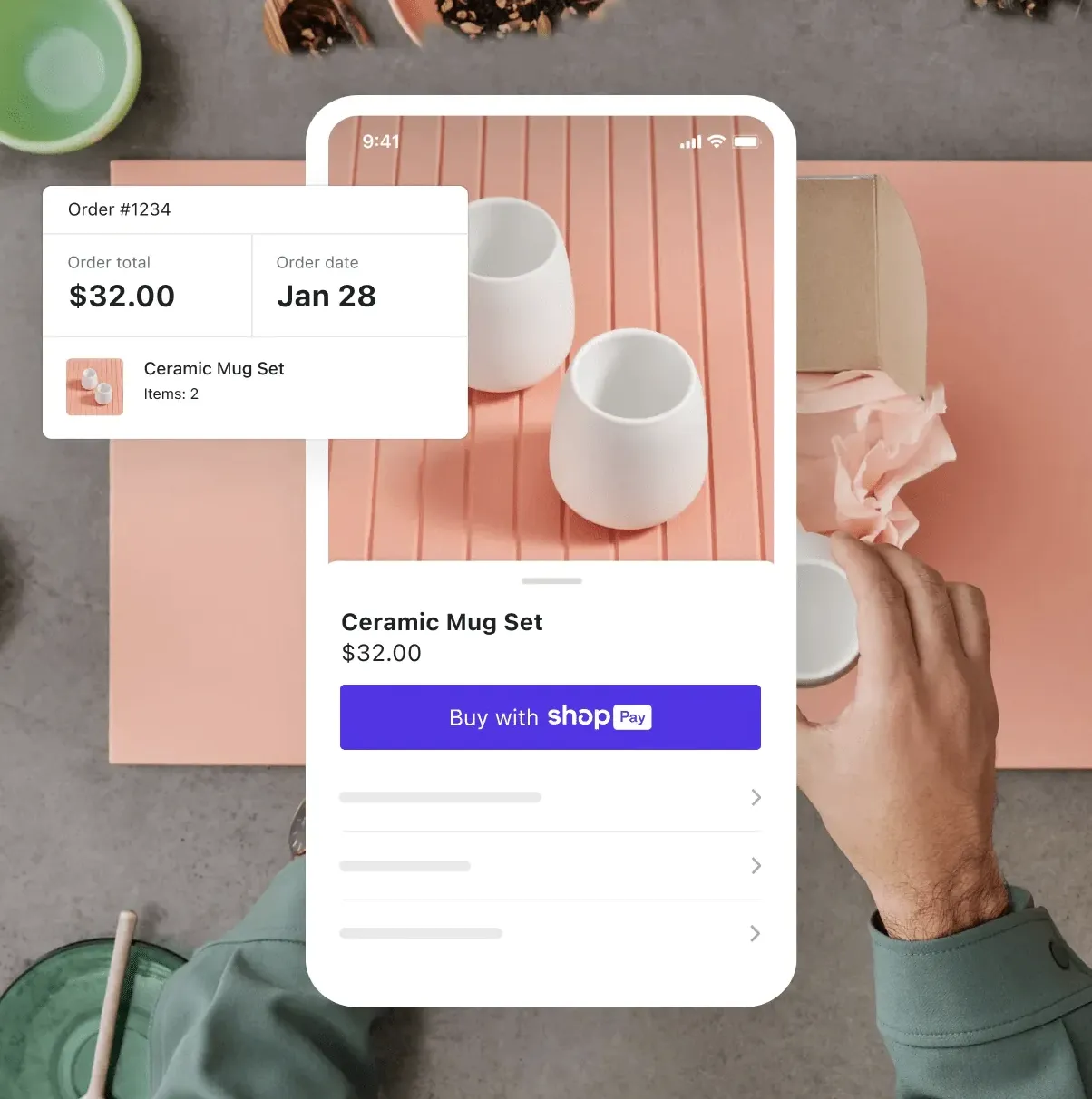

18. Shopify Funds

Settle for bank cards instantly with Shopify, no third-party required. Monitor your stability and fee schedule from a handy retailer dashboard and get e-mail alerts when new funds arrive in your checking account. Shopify POS makes it doable to just accept bank cards — whether or not you’re on the go or in a retail retailer — all whereas profiting from charges as little as 2.4% + $0.30.

Shopify additionally facilitates Pinterest Buyable Pins, Fb retailers, Fb Messenger, Amazon, eBay, and Enterprise-level accounts.

- Pricing: Varies by plan:

- Primary Shopify, $39 per thirty days, on-line bank card charges of two.9% + $0.30, in-person bank card charges of two.7%

- Shopify, $105 per thirty days, on-line bank card charges of two.6% + $0.30, in-person bank card charges of two.5%

- Superior Shopify, $399 per thirty days, on-line bank card charges of two.4% + $0.30 cents, in-person bank card charges of two.4%

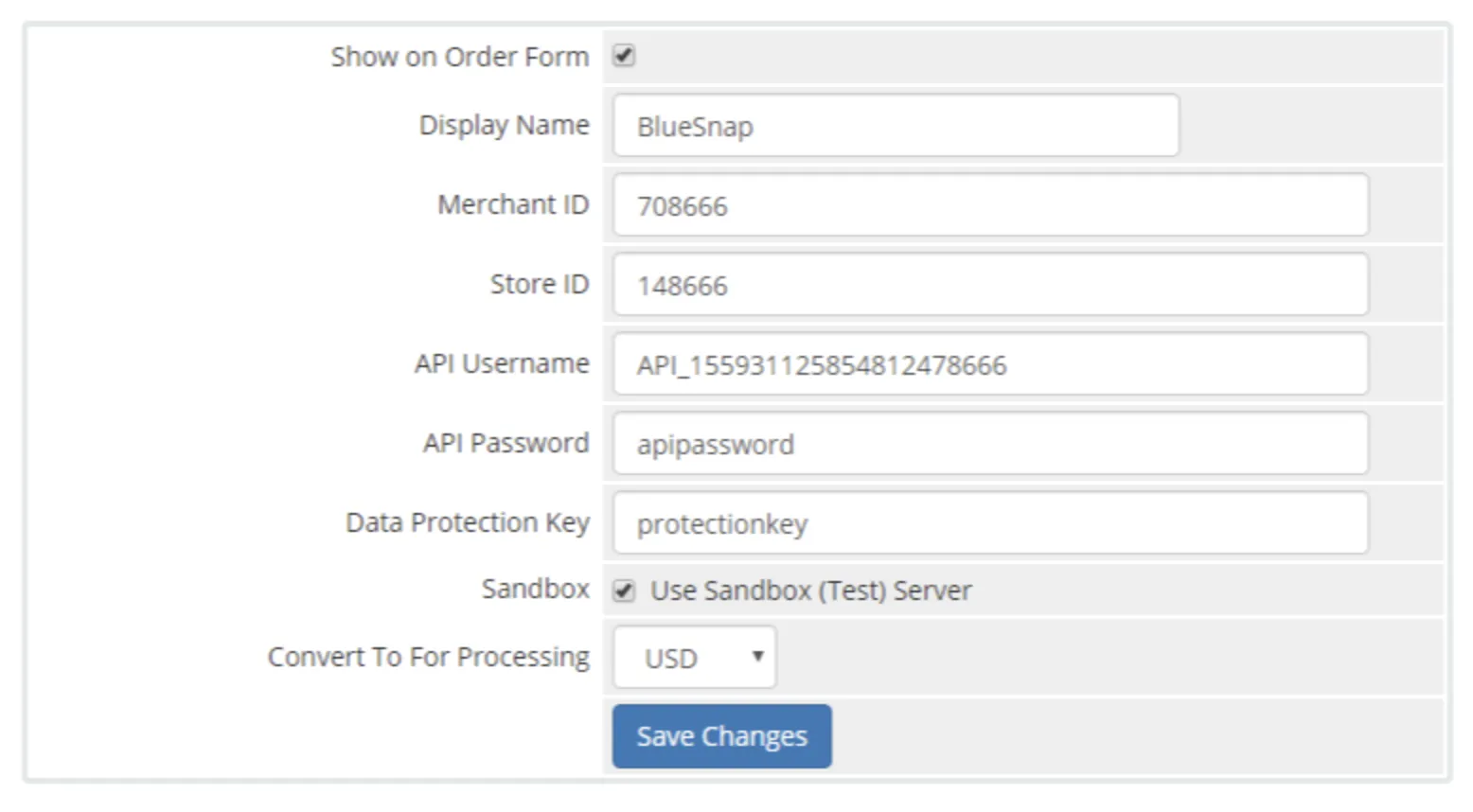

19. BlueSnap

Get a fee gateway resolution, service provider account, and different options that can assist you develop your online business. Clever fee routing gives optimized conversions, fee analytics, chargeback administration, danger administration, and the flexibility to course of greater than 100 world funds.

BlueSnap additionally integrates with the platforms you already use, together with your purchasing cart, ERP, and CRM techniques, to make implementation a breeze.

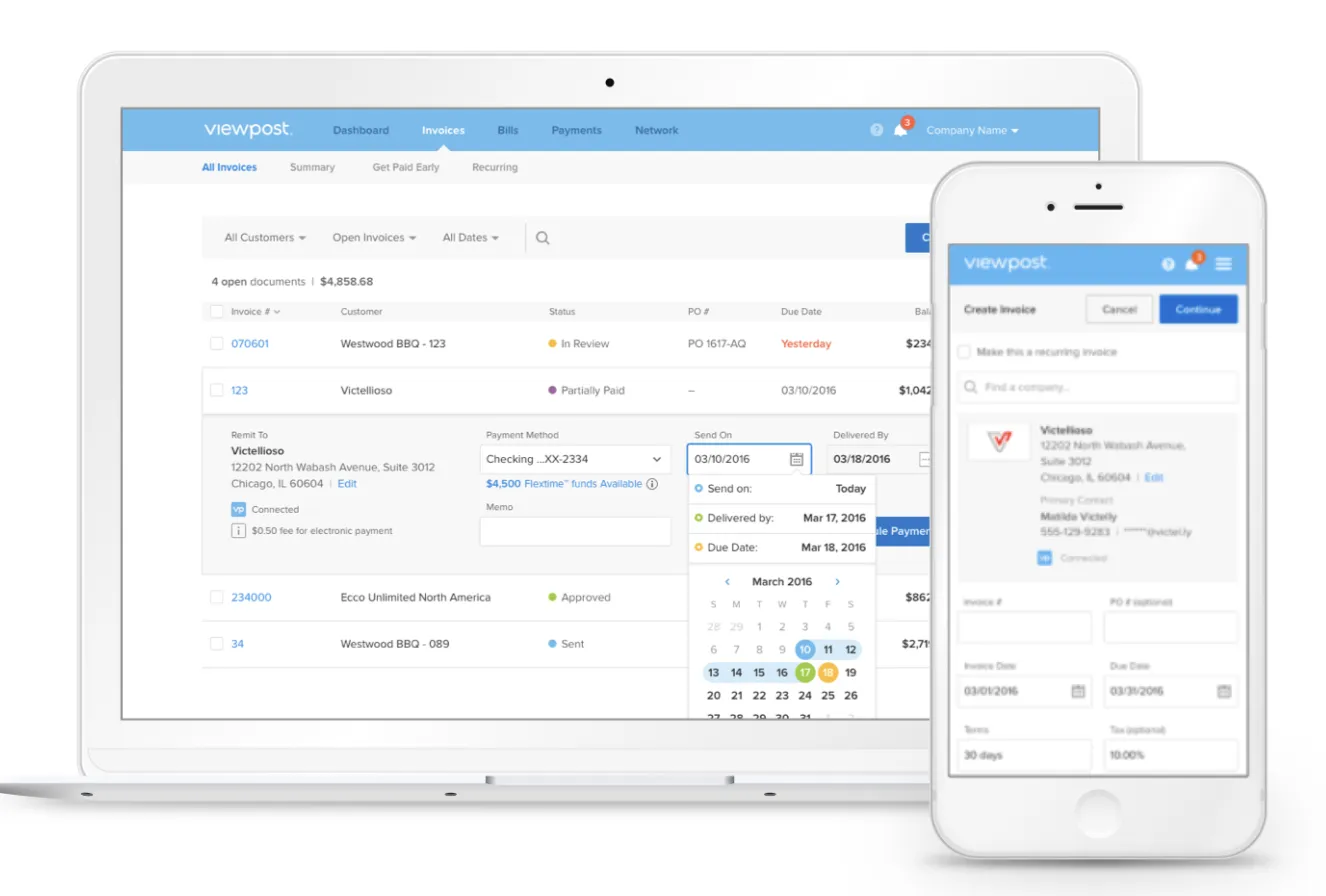

20. Viewpost

Ship and monitor skilled, custom-made invoices, and entry early fee reductions for higher management over working capital. Plus, save time with a full-featured billing and fee resolution that works whether or not you’re a freelancer or an enterprise firm.

- Pricing: $19.99 per thirty days plus transaction charges (obtainable upon request)

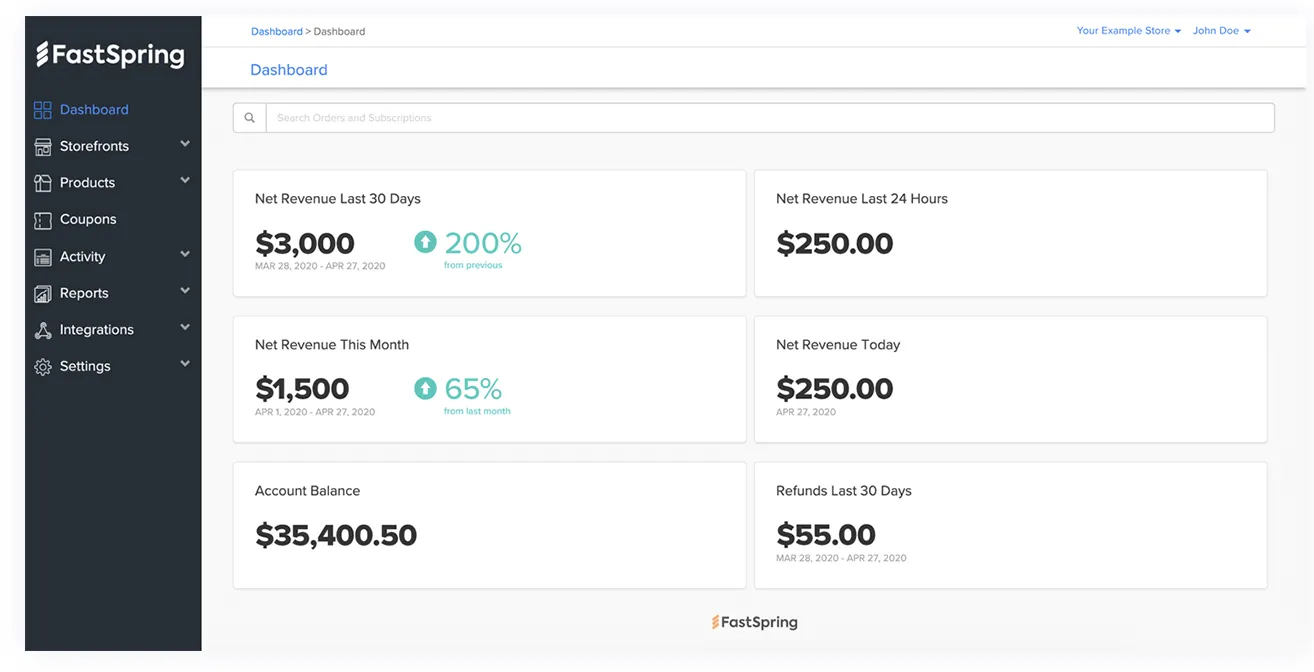

21. FastSpring

This “end-to-end” e-commerce platform makes a speciality of corporations promoting software program, content material, or apps on-line. They allow world subscriptions and funds for digital corporations (throughout internet, cellular, and in-app) and combine with the digital merchandise you have to develop your online business.

They provide omnichannel distribution enablement, a personalised ecommerce purchasing expertise, popup checkout for purchasers, subscriptions, and recurring billing. In addition they facilitate world funds with localized expertise and provide tax administration assist.

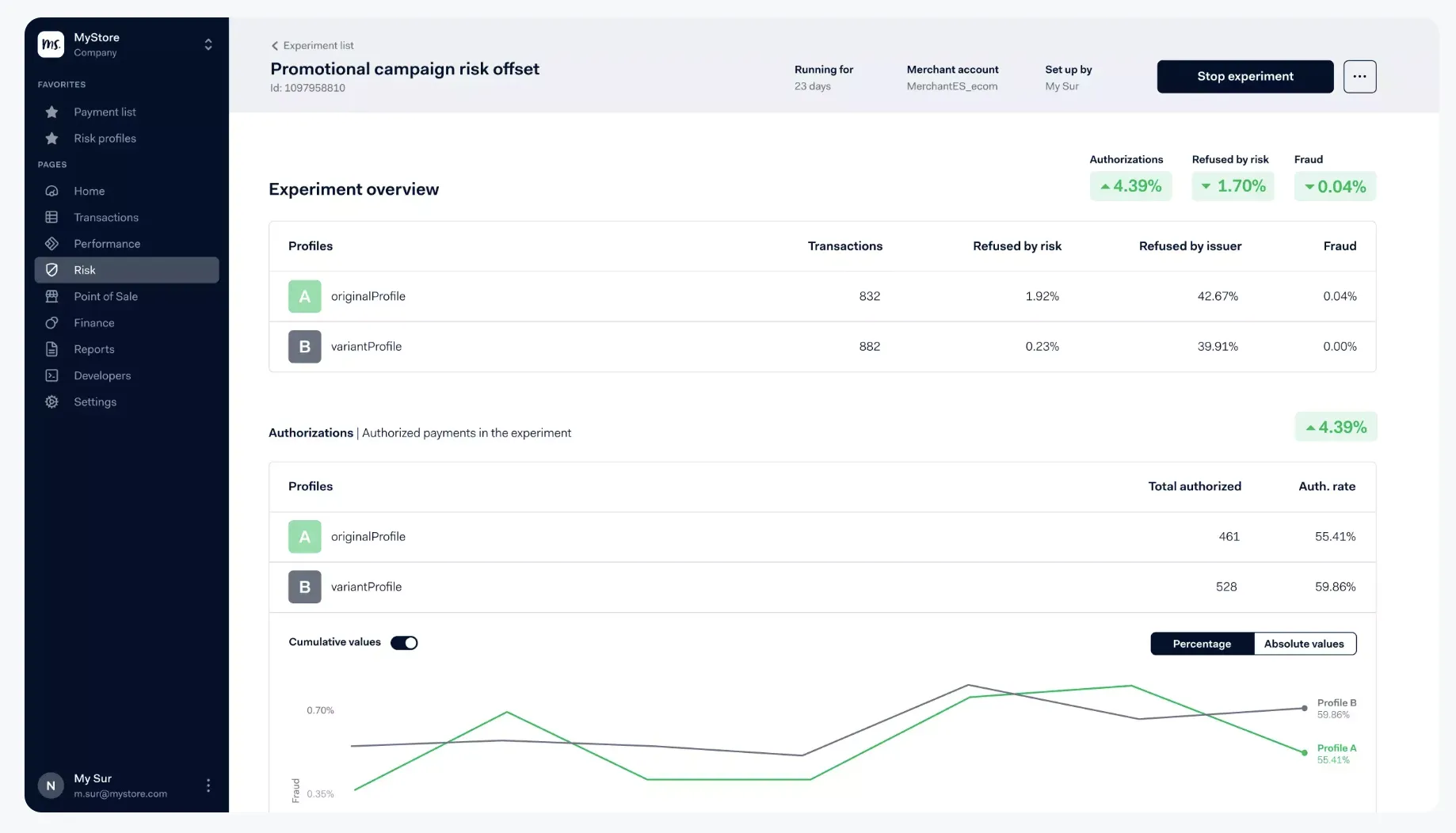

22. Adyen

Ayden is a multichannel possibility that enables your clients to make use of no matter fee methodology they see match, whether or not that be on-line, in-app, or in-store. The corporate boasts a powerful listing of shoppers, together with Uber, eBay, and Spotify — and for good purpose.

The answer is dynamic, dependable, and accessible. Backed by an inexpensive pricing construction, Ayden can work for companies of any dimension.

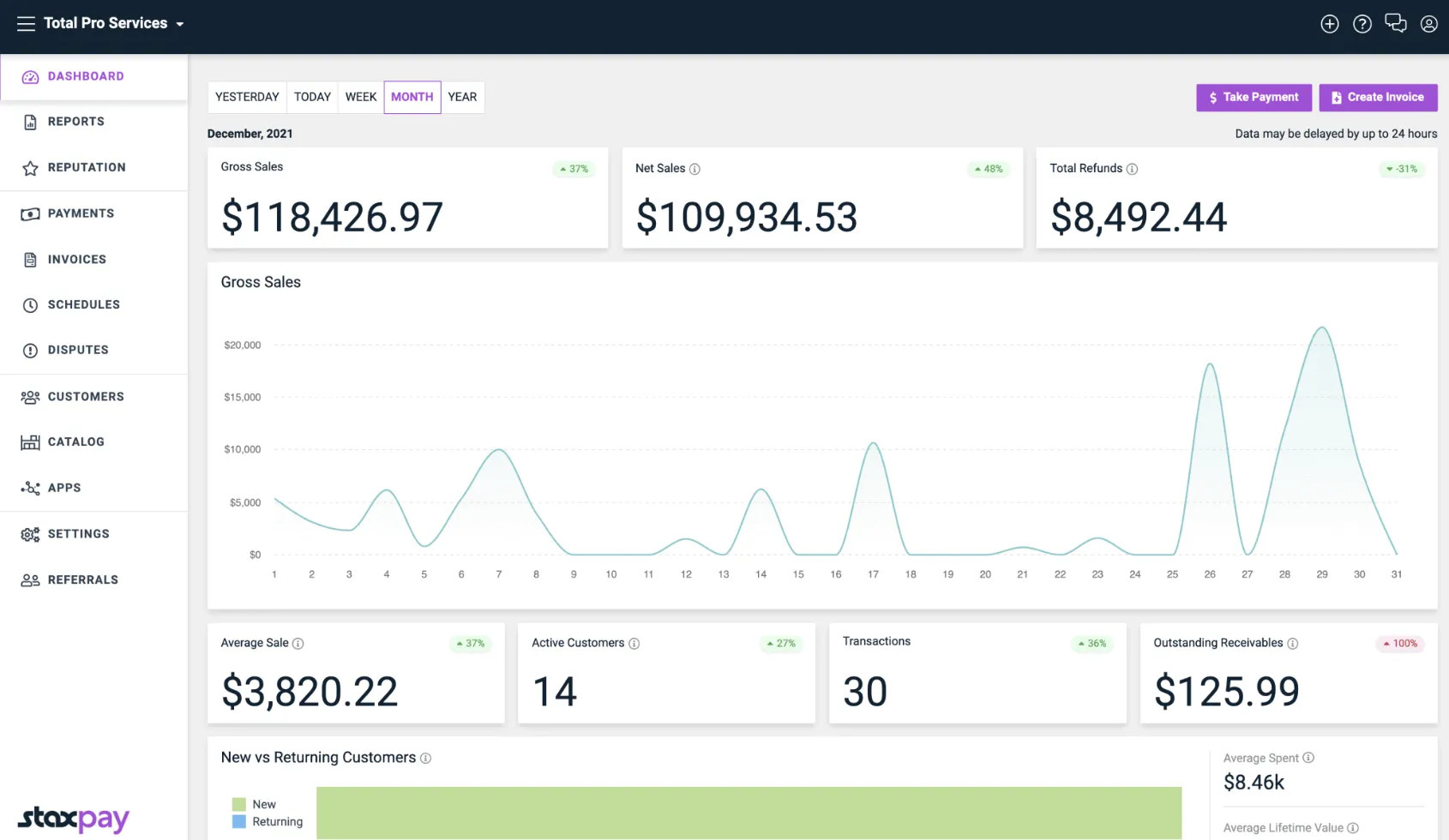

23. Stax Pay by fattmerchant

Stax Pay is included within the broader Stax finance platform. It is a versatile resolution that enables for quick, safe funds over the cellphone, on the go, or in particular person with its Stax Pay Sensible Terminal system. The platform can accommodate companies of nearly each dimension and serves varied industries — together with retail, skilled companies, discipline companies, and healthcare.

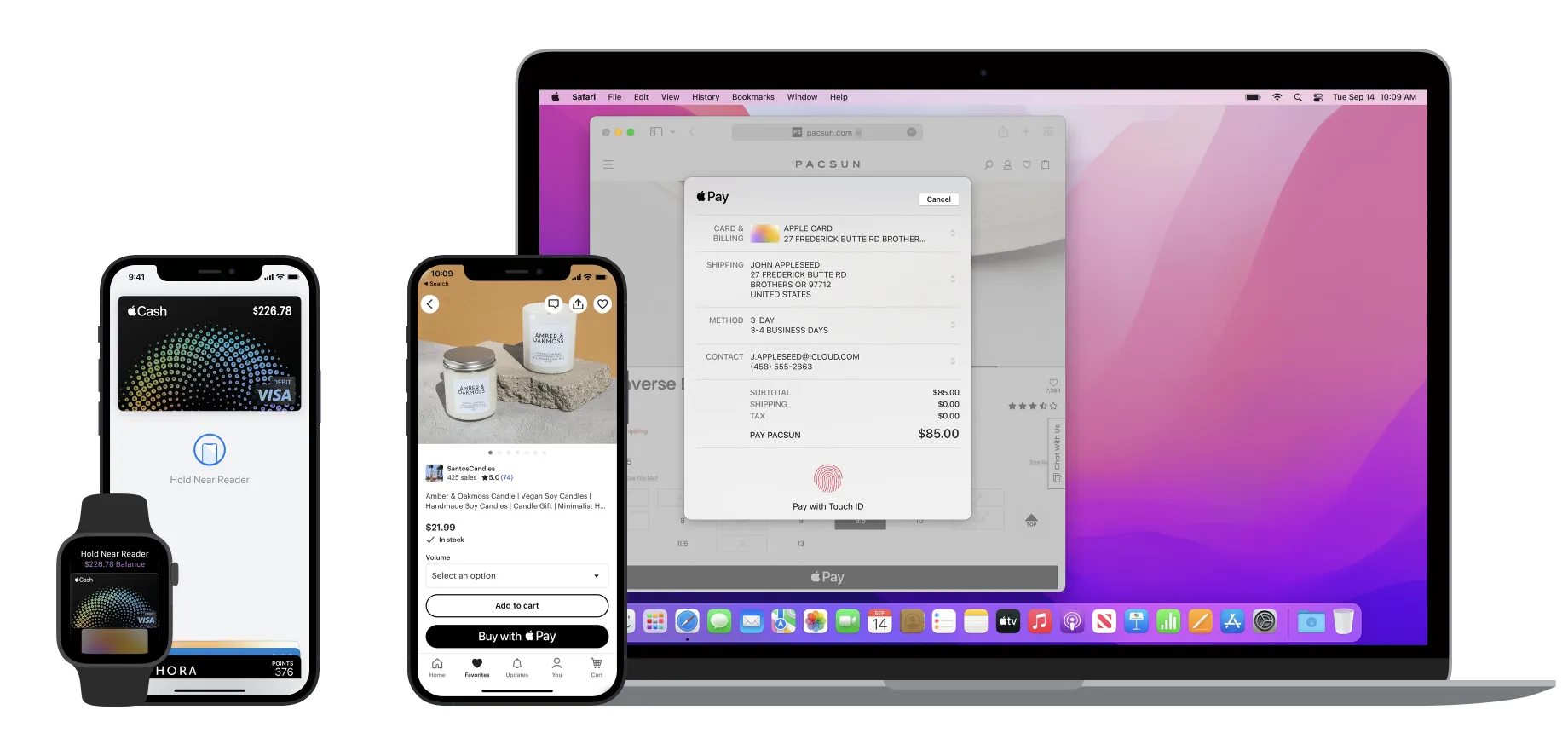

25. Apple Pay

Apple Pay is a safe and personal fee platform designed for accumulating in-person, on-line, and in-app funds. Apple Pay-enabled units, similar to an iPhone, Apple Watch, or different wearables, permit for in-person, contactless fee instantly from the consumer’s system to the enterprise with out the necessity for an exterior terminal.

Or, in case your clients have an EMV Contactless Indicator on their debit or bank card, you need to use Apple Pay to gather debit or bank card funds.

Apple Pay integrates with different apps, and you will have to arrange an exterior fee processing servicer to make use of this technique.

Getting Began

Entrepreneurship and enterprise possession aren’t straightforward. Nevertheless, these PayPal options make it simpler so that you can handle the income going out and in of your organization. Quickly, you may put the calculator down and get again to operating your online business.

Picture Supply

Picture Supply Picture Supply

Picture Supply Picture Supply

Picture Supply