The patron is tapping “out.”

Ever since inflation entered the monetary system is early 2021, there was a debate as to when the upper price of dwelling would hit client spending to the purpose of inducing a recession.

Certain, customers can depend on financial savings or credit score to make ends meet within the near-term. Nonetheless, if inflation stays elevated for a chronic interval, ultimately it turns into an excessive amount of to bear, and the patron is pressured to “faucet out” and reduce discretionary bills. That’s when a recession hits.

I point out all of this as a result of the inventory market is telling us that the recession has arrived.

The most effective technique of analyzing intra-market developments is ratio work. This consists of evaluating the efficiency of 1 asset or inventory relative to the efficiency of one other.

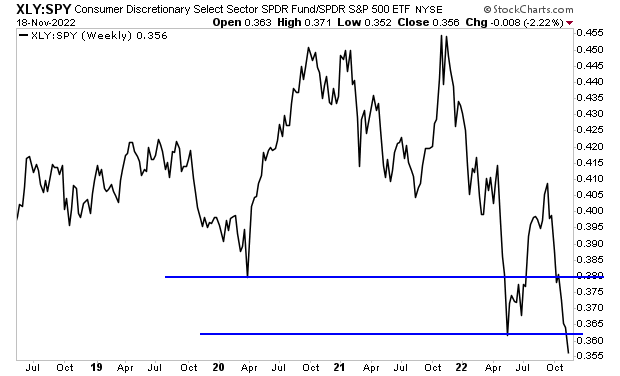

For instance, let’s have a look at the ratio between the Client Discretionary ETF (XLY) and the S&P 500 (SPY). In periods of client spending energy, this line rises. And during times of client spending weak spot this line falls.

Under is a chart of the ratio over the past 4 years. As you possibly can see, this ratio is dropping like a stone. It’s really decrease at the moment than it was on the lows of the March 2020 Crash!

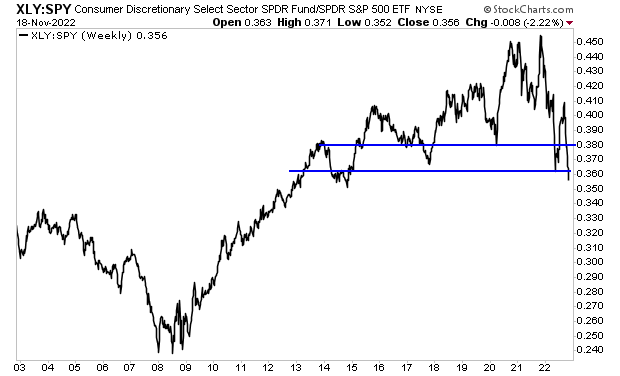

This means the patron is “tapping out” proper right here and now. The query now could be if that is only a slight downturn or the beginning of a main recession. To reply that, let’s step again and have a look at a longer-term chart.

From an economics perspective, that is essentially the most disturbing factor I’ve seen in years. It suggests the U.S. is getting into its first main recession for the reason that Nice Monetary Disaster of 2007-2009.

I believe all of us bear in mind what occurred to shares throughout that point: a rare crash during which shares misplaced over 50% of their worth.

A crash is coming. And it’s going to make 2008 appear like a joke.