Shares at the moment are in very critical bother.

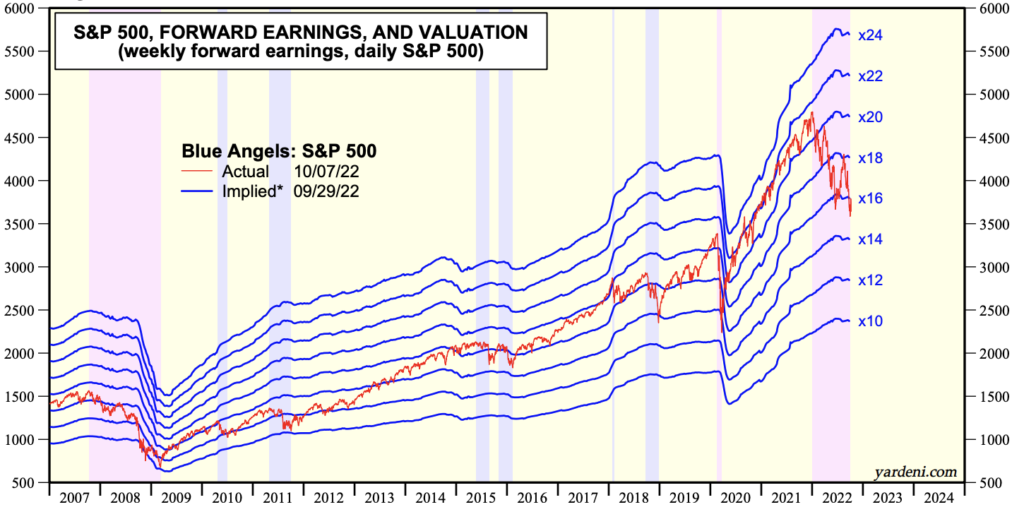

The ENTIRE collapse to this point on this bear marketplace for shares has been attributable to bond yields rising. When Treasuries have been yielding 0.25%, traders have been prepared to pay 20-22 instances ahead earnings for shares. Nonetheless, as soon as Treasury yields rose to three%+, shares have been repriced right down to 16-18 instances ahead earnings.

The beneath chart from Ed Yardeni does an important job of illustrating this.

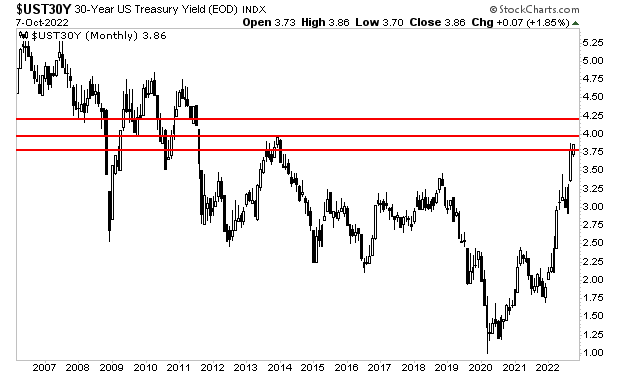

I deliver this up as a result of Treasury yields are displaying NO SIGNS of stopping.

The yield on the 30-12 months Treasury erupted larger final week, breaking above important resistance at 3.75%. The door is now open to 4% if not 4.25%.

Which means that shares are about to be repriced even decrease, probably to 14 instances ahead earnings, or ~3,400 on the S&P 500. And if Treasury yields don’t cease quickly, we’d even go to 12 instances ahead earnings which is sub-3000 on the S&P 500.

This all ties in with what I’ve been saying for months…

Inflation blew up the Every thing Bubble. And sensible traders are utilizing this to see unbelievable returns!