The world of economic establishments was once a really severe, sterile trade, one not more likely to have cross paths with any social media networks. However nowadays, few companies can afford to flee the digital revolution and never have a social media presence.

Subsequently, social media is now rewriting the banking trade playbook, permitting banks to attach with their present or potential clients, improve touchpoints, construct belief and provide worth, with out compromising on high quality and safety.

Curious to find out how the banking trade is leveraging social media to succeed in their targets? Stick with it studying and learn the way social media banking is reaching new highs every single day.

- Why ought to banks be on social media?

- Conventional banks vs on-line banks

- UK vs US banks on social media

- Social media banking greatest practices

Contemplating all of the trade rules they should adjust to and buyer knowledge privateness they completely want to guard, you’ll suppose banks wouldn’t hassle establishing their presence on social media.

However, because it seems, they discovered that the trouble is price it, and plenty of banks (significantly from the U.S. and UK) are extremely energetic on social media.

To reply the query of whether or not social media banking is smart or not, it’s sufficient to contemplate the advantages that this medium brings to the banking trade.

Producing consciousness for his or her model

Folks not flip to social media simply to choose what espresso machine to purchase, in addition they depend on it for larger choices reminiscent of selecting a financial institution for a cash mortgage.

To that finish, banks profit from being on social media as a result of it helps them construct consciousness, in addition to a picture of belief, transparency and reliability, that are essential components folks take into consideration when selecting a financial institution to deal with their funds.

Establishing a dialogue with their viewers

Historically banks would interact with their potential clients by way of ads, calls or electronic mail. However with social media of their nook, banks can now have two-way conversations with their viewers and be taught worthwhile insights about their wants and preferences.

Enhancing buyer assist

These days, individuals are keen to specific their emotions in direction of a sure model or product as quickly and clearly as potential. (Professional tip: You may observe sentiment and emotion in direction of your model utilizing Socialinsider’s new Instagram Listening software).

Remark sections have develop into the brand new message boards and buyer assist chats.

Subsequently, social media might help banks keep watch over, seize and resolve many extra buyer points than ever earlier than. For that to occur, social media and buyer assist groups must work very intently in order that no consumer suggestions slips by way of the cracks.

Educating their customers

Completely different banks have totally different takes on social media, however the frequent denominator throughout most social media accounts for banks is that they’re decided to coach their customers on use their product and navigate the monetary sector usually.

This strategy finally ends up benefiting each the tip customers and the banks.

It might come as a shock that the social media banking world is extra numerous than one might count on. Maybe an important distinction to be made is between conventional, brick-and-mortar banks that even have a web based presence and banks that function solely on-line and are additionally energetic on social media.

From my evaluation of the social media banking trade, the distinction in how banks use social media may be defined by taking a look at the kind of financial institution that’s doing the posting.

It’s not a hard-and-fast rule, however typically talking, conventional banks are typically extra conservative of their tone of voice on social media, whereas on-line banks have a bolder tone and a extra vibrant persona on social networks.

Let me present you what I imply.

Listed here are the highest 3 Instagram posts (by engagement) from the previous 3 months for Financial institution of America, one of many largest (conventional) banks within the U.S.:

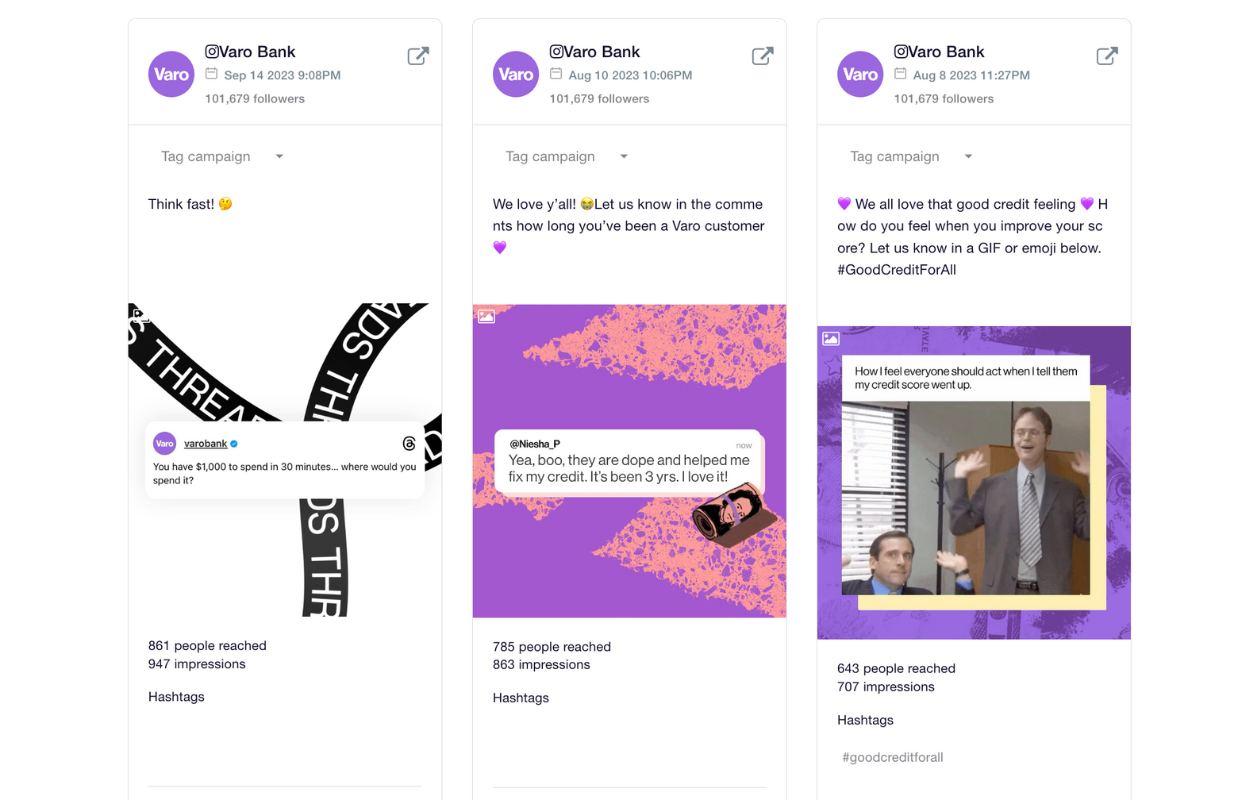

And listed below are prime 3 best-performing Instagram posts for Varo Financial institution, an up-and-coming on-line financial institution from the U.S:

these posts, it turns into apparent that the 2 banks have contrasting approaches to social media, and that they aim totally different audiences. Financial institution of America is chatting with a broader age vary, whereas Varo Financial institution is deliberately talking the language of youthful generations utilizing slang, memes and casual questions.

To dive deeper into what defines every strategy to social media banking, I took a take a look at 5 conventional banks and 5 on-line banks which are energetic on Instagram and uncovered the highest 5 matters for every class over the previous 12 months.

Based mostly on my findings, conventional banks like Citibank, Financial institution of America and the like usually tend to speak these matters:

Whereas on-line banks reminiscent of Monzo, Starling and Vero are extra taken with matters reminiscent of:

As you possibly can see, there may be some overlap within the matters we found, however on-line banks appear to be branching out into matters reminiscent of magnificence which is a extremely in style curiosity amongst youthful generations. Alternatively, conventional banks are likely to prioritize enterprise since they’re focusing on a extra mature viewers.

Trying to get an excellent broader view of the social media banking trade and do a correct comparative evaluation, I picked 5 main banks from the U.S. and 5 main banks from the UK, added their Instagram profiles into Socialinsider and set a course for the Benchmarks part.

Right here, I grouped them by geography utilizing the Manufacturers characteristic and obtained some attention-grabbing insights.

Because it seems, within the final yr, UK manufacturers lead by nearly each metric, together with engagement, variety of posts, engagement price and attain. U.S. manufacturers, nevertheless, have collectively attracted a better variety of followers on Instagram than their British counterparts.

UK banks reminiscent of Monzo and Revolut are absolute winners in terms of engagement and engagement price, in comparison with all different banks analyzed (US and UK each). Their sturdy efficiency is probably what it is lifting up the UK banks class.

It’s no shock then, that almost all of top-performing posts from the previous yr additionally belong to UK banks.

The U.S. banks I analyzed have been:

The UK banks I analyzed have been:

So how do these banks do it? How do they handle to show an trade and material that may appear chilly and interesting to some folks into one thing enjoyable, helpful and positive sufficient, worthwhile?

Effectively, there are some greatest practices for social media banking that may function a information for these simply beginning out.

- Change into a hub for instructional content material

Sadly, monetary training shouldn’t be one thing that will get a lot consideration throughout our faculty years, and but it’s one thing that we may all profit from as we develop up and begin changing into chargeable for our funds.

Apart from, sharing ideas, insights and recommendation that helps your clients is an effective way to achieve their belief in your financial institution.

Many banks which are energetic on social media are already in on this “secret”, they usually prioritize sharing instructional content material that’s helpful to their viewers. Some do it in a extra conservative manner, like Chase Financial institution:

Others, reminiscent of Monzo, make it actually enjoyable and accessible to youthful audiences, hoping that it’s going to attain extra folks and be simpler to soak up:

One content material concept that’s easy-to-implement and replicate can be infographics. As a result of they permit you folks to visualise and perceive knowledge a lot simpler than written textual content, they’re much extra partaking and due to this fact, they’re a great way to arrange instructional content material.

2. Construct belief and be human

As a monetary establishment, it may be arduous to have a human-like presence on social media, in addition to earn and hold your shoppers’ belief. However social media can facilitate a deeper connection between banks and their shoppers.

3. Use hashtags

It doesn’t matter what form of enterprise you’re representing on Instagram, hashtags stay important. They’re an effective way to group posts and goal trade niches.

To get some concepts, I added the trade hashtag – #banking – into Socialinsider’s Instagram Listening software and explored the various choices:

As you possibly can see, there are a lot of associated hashtags you need to use to focus on particular niches or contact upon in style matters, reminiscent of insurance coverage, investing, profession, training and actual property.

4. Hyperlink again to your web site or app

Attracting folks to your social networks is crucial, however the finish objective ought to be to get them to make use of your service. To try this, you want to present hyperlinks to your web site or app as continuously as you possibly can, so after they do resolve to make the leap, they’ve all they should attain you.

For Instagram, that interprets to hyperlinks in your bio (as much as 5) or hyperlinks in Tales.

5. Join buyer assist and social media groups

Since a part of your social media channels’ job is to seize person suggestions and mitigate crises earlier than they blow up, it’s essential for the assist crew and social media crew to be in shut contact always.

Consolidating this aspect of enterprise will can help you improve touchpoints and construct belief together with your shoppers.

Remaining ideas

Regardless of the various challenges banks face whereas advertising and marketing on-line, they’re proper to provide social media banking an opportunity.

By tapping into the human aspect of promoting, being responsive and staying on prime of trade developments and present affairs, banks can really thrive on social media, whereas on the similar time constructing long-lasting relationships with their shoppers.