Now that the debt ceiling debate seems to have been resolved, we may see extra risk-taking amongst traders. That is a great factor for smaller shares, like those we purchase for our portfolio. Beneath I take a more in-depth have a look at what is going on on this week within the S&P 500 (SPY) and the way this impacts our subsequent transfer. Learn on for extra….

(Please take pleasure in this up to date model of my weekly commentary initially printed June 1st within the POWR Shares Below $10 publication).

The debt ceiling deal has handed the Home and appears set to cross the Senate. That’s been marginally good for shares, with the S&P 500 (SPY) up about 3% over the past week.

There are nonetheless loads of considerations for the financial system, however it appears just like the debt ceiling gained’t be certainly one of them.

It’s not likely a shock that the US prevented a default (the results of which may have been catastrophic).

The actual shock is that it didn’t come right down to the final minute for Washington to get a deal achieved. Consideration will now shift again to the Fed and the battle towards inflation.

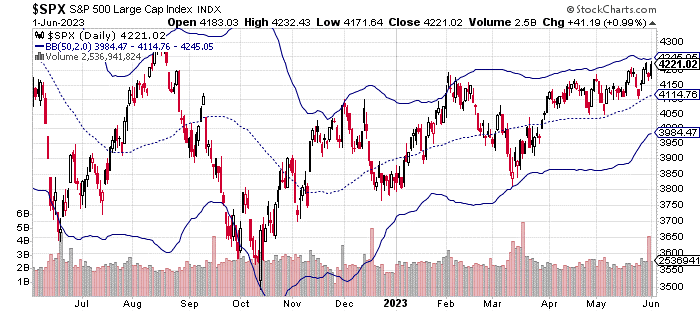

You may see within the chart above, the SPX (S&P 500 index) is close to the highest of its two commonplace deviation vary.

That doesn’t essentially indicate it’s going to tug again, however imply reversion is an actual factor with shares, so there might be some promoting strain within the close to future – albeit short-lived, probably.

With the debt ceiling points principally out of the best way, the roles report tomorrow will likely be entrance and middle for a lot of traders.

The job market stays sturdy, which is each good and dangerous. It’s good as a result of individuals have jobs (clearly). It’s dangerous as a result of it makes it extra seemingly that the Fed will proceed elevating charges to battle inflation.

The Fed doesn’t look like in a rush to lift charges at this stage, although. There’s at present an 80% probability of a charge hike pause on the June FOMC assembly (in response to the futures market).

Nonetheless, there’s over a 50% probability the Fed hikes charge on the July assembly.

The Fed is trying to realize a delicate touchdown. That’s, they wish to fight inflation (sending it decrease) with out torpedoing the financial system.

I’m unsure it’s attainable, though it has been achieved previously. We’ll have to attend and see if they will seize that magic this time round.

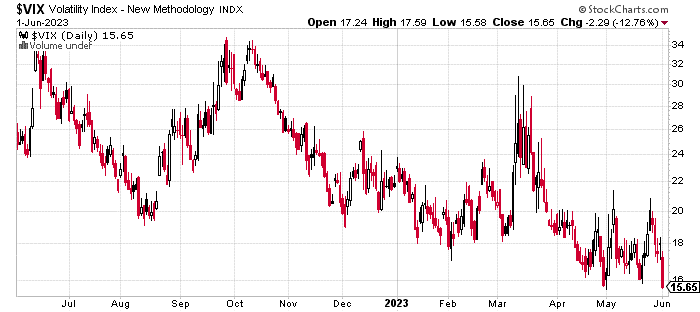

Volatility, as seen within the VIX chart beneath, wavered throughout heading into the ultimate days of the debt ceiling debate.

Nonetheless, you’ll be able to see the place the VIX is now approaching 15. Beneath 15 is usually thought-about a low volatility regime for the market.

It’s commonplace for market volatility to melt as we transfer into the summer season trip months.

Nonetheless, it’s a bit totally different this yr with at the very least one rate of interest hike anticipated over the summer season interval.

Regardless of the Fed doing an affordable job of telegraphing their strikes, additional charge hikes may introduce a measure of volatility into shares within the coming weeks.

In the end although, we could also be approaching a interval the place traders are keen to take extra dangers on shares.

Decrease volatility usually means traders will take extra possibilities on small shares and worth names. That actually implies good issues for us, which is the realm we are inclined to function in.

What To Do Subsequent?

In the event you’d wish to see extra high shares beneath $10, then you need to take a look at our free particular report:

What provides these shares the suitable stuff to turn out to be massive winners, even on this challeging inventory market?

First, as a result of they’re all low priced corporations with probably the most upside potential in at the moment’s unstable markets.

However much more essential, is that they’re all high Purchase rated shares in response to our coveted POWR Rankings system and so they excel in key areas of progress, sentiment and momentum.

Click on beneath now to see these 3 thrilling shares which may double or extra within the yr forward.

All of the Greatest!

Jay Soloff

Chief Development Strategist, StockNews

Editor, POWR Shares Below $10 Publication

SPY shares closed at $427.92 on Friday, up $6.10 (+1.45%). Yr-to-date, SPY has gained 12.32%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

Concerning the Creator: Jay Soloff

Jay is the lead Choices Portfolio Supervisor at Traders Alley. He’s the editor of Choices Flooring Dealer PRO, an funding advisory bringing you skilled choices buying and selling methods. Jay was previously an expert choices market maker on the ground of the CBOE and has been buying and selling choices for over 20 years.

The put up Shifting on From the Debt Ceiling… appeared first on StockNews.com