It has actually been a tough week for bulls within the S&P 500 (SPY). Over the previous 10 days, we have now had three huge reviews all exhibiting hotter-than-expected inflation. And whereas it regarded just like the bulls have been going to have the ability to shake off the primary two, the proof is stacking up in favor of extra charge hikes, which could make a bull victory rather more troublesome now. Here is what I imply.

(Please take pleasure in this up to date model of my weekly commentary initially printed February 24th, 2023 within the POWR Shares Underneath $10 publication).

Market Commentary

On the finish of final week, each CPI and PPI each reported rising month-over-month costs, in addition to annual value will increase that have been bigger than economists had anticipated.

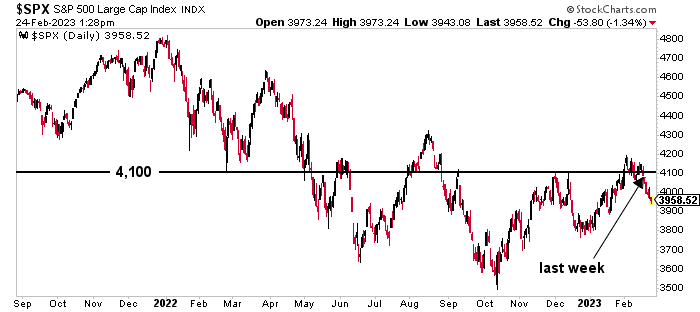

Even so, bulls saved it pretty collectively, and the S&P 500 (SPY) ended the week only a few factors under the essential 4,100 line.

Regardless of the bears racking up some huge wins final week, it nonetheless regarded like this newest spherical of “tug-o-war” was anybody’s sport…

After which the Fed minutes have been launched. And a 3rd inflation indicator (and the Fed’s favourite) – the non-public consumption expenditures (PCE) index – additionally got here in hotter than anybody was anticipating. And extra Fed officers publicly voiced their issues that inflation stays too excessive.

Look, I will be the primary to say the bulls have placed on a surprisingly sturdy present the primary weeks of the yr. However that is goes to be an enormous hurdle to clear for the rally to proceed.

However I am additionally not going to say it might’t be finished. These bulls have at all times appeared a bit bit delusional. There’s not a ton of “bullish” occasions which have occurred… folks have been simply prepared to maneuver right into a extra “danger on” atmosphere.

We have additionally now seen bearish readings from all three indicators I not too long ago spotlighted — the 4,100 degree (damaged under), the January CPI report (scorching), and the CME FedWatch Software (variety of folks anticipating a 50-bps hike in March has almost tripled from 9.2% to 27%).

They are saying the market “climbs a wall of fear.” However how excessive is just too excessive?

I am not 100% sure. Truthfully, anybody who tells you they’re is promoting you a load of, effectively, one thing.

Regardless, the bulls are going to need to placed on fairly a present with a lot proof pointing towards extra charge hikes and a better terminal charge.

As such, I would like us to take a while to arrange our portfolio for the subsequent leg decrease. I am not able to promote something at the moment, however I spent a while this morning creating commerce triggers for many of our holdings.

These will assist us preserve losses underneath management and defend the features we labored exhausting for over the previous months.

Conclusion

The perfect factor we are able to do for proper now’s be ready. Shares underneath $10 are such a robust group as a result of they provide us an essential edge over main shares which might be priced all the way down to the penny.

However they’re additionally prone to larger value swings throughout selloffs. That is why we’re preserving issues locked down tight as we navigate what occurs subsequent.

What To Do Subsequent?

If you would like to see extra prime shares underneath $10, then it’s best to try our free particular report:

What offers these shares the best stuff to grow to be huge winners, even on this brutal inventory market?

First, as a result of they’re all low priced corporations with essentially the most upside potential in at the moment’s risky markets.

However much more essential, is that they’re all prime Purchase rated shares in keeping with our coveted POWR Scores system and so they excel in key areas of development, sentiment and momentum.

Click on under now to see these 3 thrilling shares which may double or extra within the yr forward.

All of the Finest!

Meredith Margrave

Chief Development Strategist, StockNews

Editor, POWR Shares Underneath $10 E-newsletter

SPY shares closed at $396.38 on Friday, down $-4.28 (-1.07%). Yr-to-date, SPY has gained 3.65%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

Concerning the Writer: Meredith Margrave

Meredith Margrave has been a famous monetary knowledgeable and market commentator for the previous 20 years. She is at present the Editor of the POWR Development and POWR Shares Underneath $10 newsletters. Be taught extra about Meredith’s background, together with hyperlinks to her most up-to-date articles.

The publish Scorching Inflation Means a Tough Trip for Bulls Forward… appeared first on StockNews.com