Inventory markets suffered by a tough 12 months in 2022. Main indices just like the S&P 500 (SPY) and NASDAQ 100 have been down double digits throughout the board. But this easy technique confirmed a strong double-digit achieve by taking worthwhile positions in each good AND dangerous shares. One of these balanced method will doubtless proceed to outperform in what appears prefer to be a tricky second half of 2023. Learn on under to search out out extra.

2022 was one of many worst years for shares in a very long time. After a robust begin to 2023, shares are failing to interrupt out at latest highs. What occurs the remainder of the 12 months stays to be seen. The latest rise in rates of interest together with a continued earnings recession is more likely to be an overhang that can proceed to stall shares for the ultimate two quarters of 2023.

The common annual return for shares (S&P 500) over the previous 150 years is roughly 9%, together with dividends. With out dividends it drops to only over 4.5%. Inflation shaves about half off these returns.

A return again in the direction of extra historic returns could look fairly good within the coming 12 months. Inventory choice might be vital to performing properly in 2023, moderately than simply shopping for any inventory -which was seemingly the best way to simple good points up till 2022.

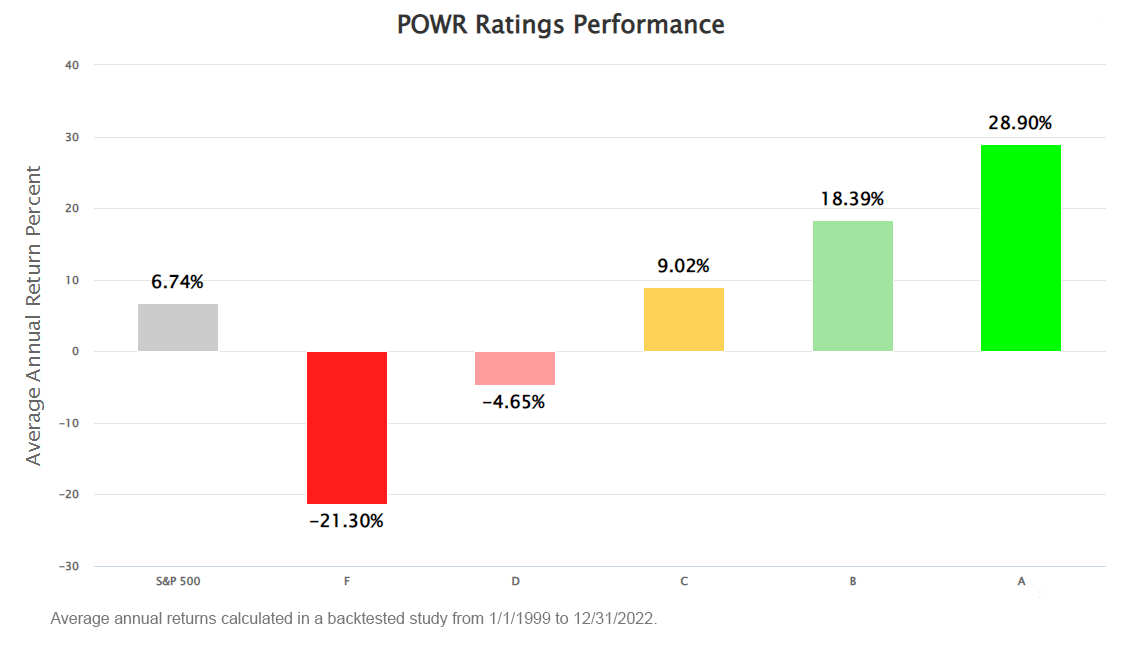

The POWR Rankings can actually present buyers and merchants with a transparent edge when deciding on shares. Over the previous 20 plus years, the A Rated sturdy buys within the POWR Rankings have outperformed the S&P 500 by over 22% yearly.

Whereas this stage of outperformance is actually eye-opening, promoting the F rated sturdy promote shares would have crushed the general market by an excellent higher diploma.

These lowest rated shares really fell over 21% per 12 months whereas the S&P 500 gained practically 7% yearly. This equates to an underperformance of roughly 28%! This implies the dangerous shares fell a bit worse than the nice shares rose compared to the S&P 500.

Many buyers and merchants should not comfy shorting shares. Limitless potential loss will increase the concern issue much more. Fortunately, the choices market offers an outlined danger answer to revenue from a pullback in shares. Places.

Proudly owning a put choice offers you the flexibility to promote a inventory at a particular value earlier than a sure time. The put purchaser pays cash upfront – referred to as the choice premium.

As an illustration, shopping for the Apple July $155 put at $4.30 offers the client the best to promote AAPL inventory at $155 till expiration on 7/21/2023 (the third Friday in July).

The worth of those bearish put choices will improve because the inventory goes down and reduce if the inventory rises. Essentially the most in danger is $430 ($4.30 premium x 100)

Shopping for put choices is an easy, however very efficient manner, to take a bearish stance on dangerous shares (utilizing Apple for example, not that could be a dangerous inventory).

To assist offset this bearish view, POWR Choices combines it with a bullish commerce that’s finished with a name buy.

Proudly owning a name choice offers you the flexibility to purchase a inventory at a particular value earlier than a sure time. The decision purchaser once more pays cash upfront – referred to as the choice premium.

As an illustration, shopping for the Apple July $175 name at $4.50 offers the client the best to purchase AAPL inventory at $175 till expiration on 7/21/2023 (the third Friday in July).

The worth of those bullish name choices will improve because the inventory goes up and reduce if the inventory drops. Essentially the most in danger is $450 ($4.50 premium x 100).

However as a substitute of simply combining places and calls on the identical inventory, POWR choices makes use of the facility of the POWR Rankings to mix places on the bottom rated (D and F) names together with bullish calls on the very best rated (A and B) shares.

Promote the worst and purchase the best-but outline the danger.

Pairing a bearish put and bullish name collectively is known as a “Pairs Commerce”. These two trades collectively mix for a way more impartial outlook.

It’s a technique we efficiently use day in and time out within the POWR Choices Portfolio to take a extra balanced “Pairs Commerce” method by combining bearish places with bullish calls. It labored very properly in 2022 and continues to work very properly to this point in 2023.

A latest instance of this POWR Pairs method utilizing the facility of the POWR rankings for bearish put performs and bullish name performs could assist shed some gentle on issues.

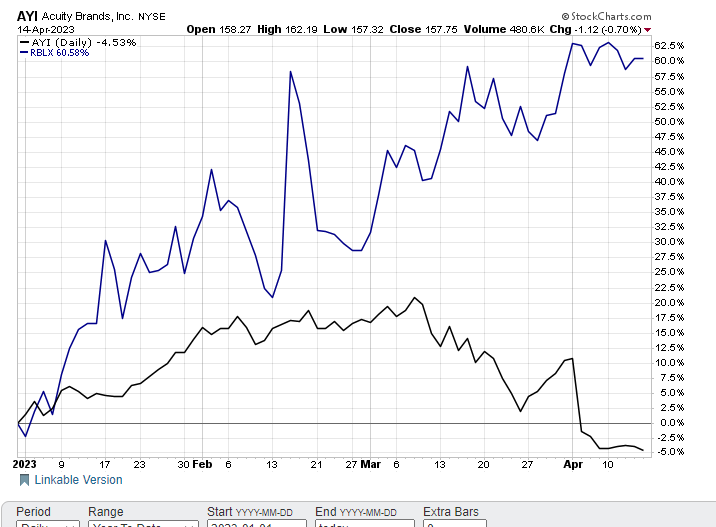

Under is a latest POWR Pairs commerce finished within the POWR Choices Portfolio on Acuity Manufacturers (AYI) and Roblox (RBLX).

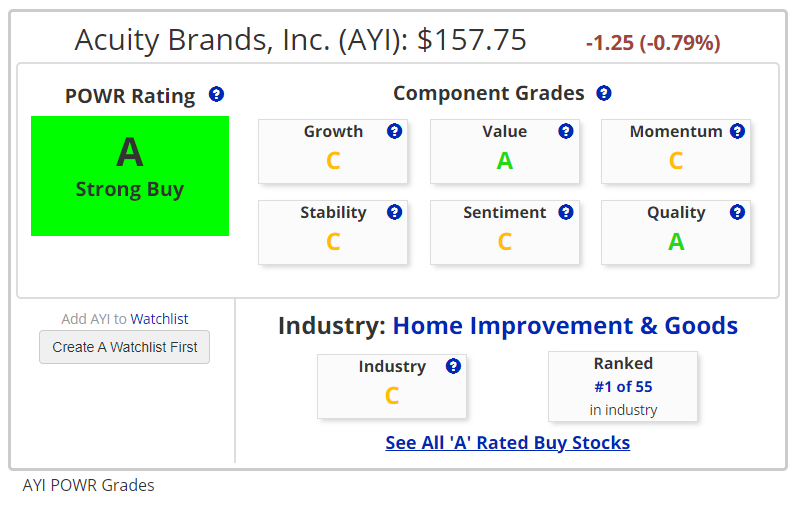

AYI was an A rated- Sturdy Purchase -stock in a C rated Trade. Primary within the trade. Sturdy inventory in a robust place.

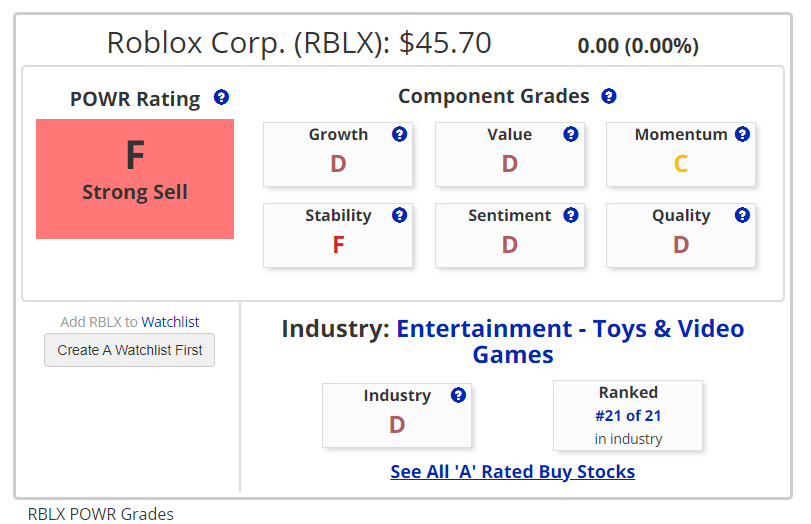

RBLX was an F rated -Sturdy Promote – inventory in a D rated trade. Ranked on the backside within the trade group as properly, so just about the worst of the worst.

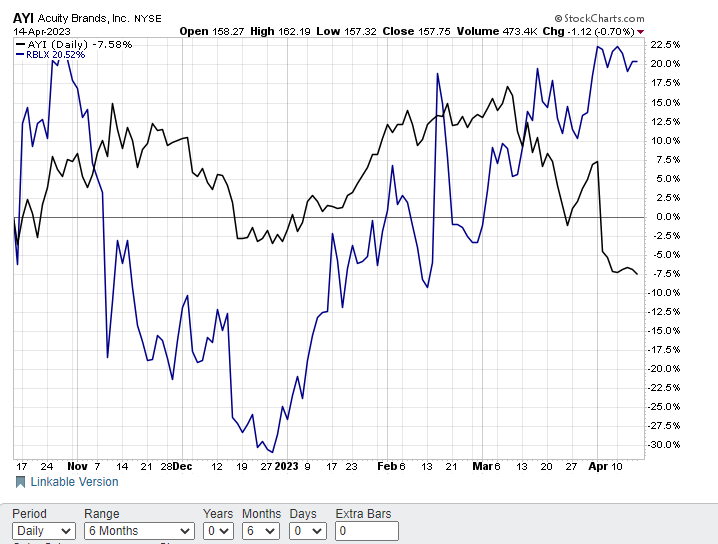

But over the previous few weeks, a lot decrease rated Roblox had been outperforming a lot larger rated Acuity by a large margin.

In truth, because the starting of the 12 months A rated AYI was decrease by virtually 5% whereas F rated RBLX screamed a lot higher-up 60%!.

This arrange ideally for a POWR Pairs commerce. Shopping for bullish calls on the big-time underperforming Sturdy Purchase AYI and bearish places on the vastly outperforming Sturdy Promote RBLX.

The expectation was for the unfold between the 2 to converge again in the direction of a extra regular comparative efficiency with AYI outperforming RBLX.

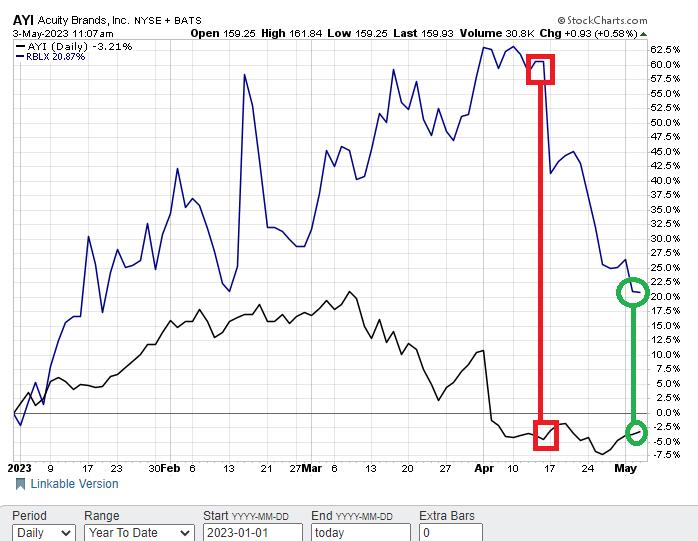

That proved to be the case. RBLX dropped sharply whereas AYI traded sideways. The unfold converged from over 60% at commerce inception (crimson) to 25% at shut out (inexperienced).

POWR Choices closed out the POWR Pairs commerce for a $210 general achieve. $40 loss on the AYI calls and a $250 achieve on the RBLX places. Commerce took 16 days from begin to end. Over a 20% achieve on the $970 invested in each the AYI calls ($500) and RBLX places ($470). Not dangerous for just a few weeks work on a impartial commerce.

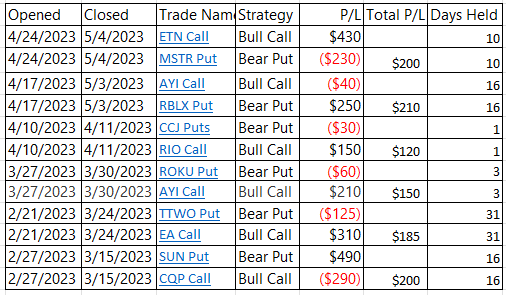

This desk under exhibits the newest six closeouts for POWR Choices. All 6 have been general profitable trades with a holding interval averaging just some weeks. All similar to the AYI/RBLX POWR Pairs commerce.

The power to say nimble and be extra impartial has served the POWR Choices Portfolio to this point. Our buying and selling confirmed strong good points since inception versus losses for shares in that very same timeframe.

Utilizing the POWR rankings to assist us choose the perfect of the perfect shares to be bullish on with name buys, together with the worst of the worst shares to be bearish on with put purchases, will doubtless proceed to show worthwhile in 2023.

What To Do Subsequent?

For those who’re searching for the perfect choices trades for in the present day’s market, it is best to undoubtedly try this key presentation The way to Commerce Choices with the POWR Rankings. Right here we present you methods to persistently discover the highest choices trades, whereas minimizing danger.

Utilizing this easy however highly effective technique I’ve delivered a market beating +55.24% return, since November 2021, whereas most buyers have been mired in heavy losses.

If that appeals to you, and also you need to be taught extra about this highly effective new choices technique, then click on under to get entry to this well timed funding presentation now:

The way to Commerce Choices with the POWR Rankings

Right here’s to good buying and selling!

Tim Biggam

Editor, POWR Choices E-newsletter

SPY shares fell $0.44 (-0.11%) in after-hours buying and selling Friday. Yr-to-date, SPY has gained 8.31%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

Concerning the Writer: Tim Biggam

Tim spent 13 years as Chief Choices Strategist at Man Securities in Chicago, 4 years as Lead Choices Strategist at ThinkorSwim and three years as a Market Maker for First Choices in Chicago. He makes common appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Community “Morning Commerce Dwell”. His overriding ardour is to make the complicated world of choices extra comprehensible and subsequently extra helpful to the on a regular basis dealer.

Tim is the editor of the POWR Choices e-newsletter. Be taught extra about Tim’s background, together with hyperlinks to his most up-to-date articles.

The put up Revenue From the Finest AND Worst Shares! appeared first on StockNews.com