You may assist your kinfolk immensely by organising an property plan now, no matter who you’re. Primarily, no matter you personal makes up your property. These belongings may very well be:

- Any property your personal

- No matter cash you’ve in a checking account

- Shares, bonds, and mutual funds invested by a taxable brokerage account

- A Roth IRA

- Your prized vinyl, stamp, coin, or artwork assortment

Having a say in how your property is distributed is important to your property planning. Though it could appear daunting, saving your family members hundreds of {dollars} will seemingly be well worth the effort now.

In brief, you and your loved ones can profit from property planning no matter your internet price.

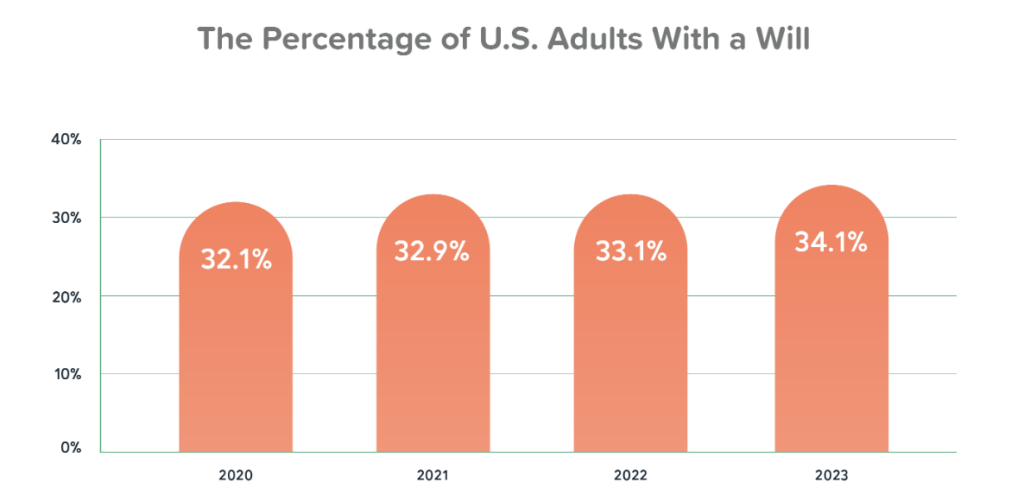

Regardless of this, 2 out of three People don’t have any kind of property planning doc, in keeping with a survey performed by Caring.com.

“Property planning is without doubt one of the essential components of a complete monetary plan, however in some way can also be essentially the most neglected element, with nearly all of adults not having any type of property planning doc,” says Patrick Hicks, Common Counsel and Head of Authorized at Belief & Will. “Having an property plan is a continuation of economic planning and important to make sure that your efforts to supply on your family members final into the longer term and act as a basis to construct multigenerational wealth and depart a legacy.”

What’s Property Planning?

In essence, property planning is deciding the way you need to distribute your belongings after you die — or turn out to be incapable of constructing monetary choices for your self. You probably have hassle placing collectively an property plan, and have the funds, seek the advice of a monetary adviser and a lawyer.

Once more, whether or not you are broke or not, an property plan is important. Though property planning could seem morbid, it has a number of benefits:

- Your needs can be legally binding when deciding who will get your belongings.

- With a view to reduce your property’s tax burden, you may prepare it in a method that minimizes taxes.

- The peace of thoughts of understanding that your monetary affairs are so as implies that your family members will not inherit an administrative nightmare.

There are a number of components to an property plan, together with:

- A will.

- Having somebody you identify to handle your funds in case you are unable to take action is known as an task of energy of lawyer.

- A complicated directive, additionally known as a dwelling will, expresses your needs for life-sustaining medical interventions in case you are terminally ailing or incapable of speaking for your self

- You may give somebody you belief the authority to make medical choices in your identify through the use of a healthcare proxy.

There are some individuals who would possibly profit from a belief as nicely.

Property Planning Guidelines

Make a list.

Your possessions may appear inadequate to justify property planning, however it’s possible you’ll be shocked at simply how a lot you even have. As such, preserving monitor of your tangible and intangible belongings is simple with a list.

Estates might comprise tangible belongings resembling:

An individual’s property might comprise the next intangible belongings:

You probably have excellent liabilities, you must also record them. These are any money owed that haven’t but been paid in full like mortgages, bank cards, or different money owed. In case you die, an executor of your property can notify collectors extra simply by preserving a written report of your excellent money owed.

Put together your property plan.

Reply these questions on how you can settle your affairs earlier than assembly with an property planning lawyer:

- How ought to your belongings be distributed to your heirs?

- You probably have minor kids, who ought to take care of them?

- What’s the price of caring for and educating your kids?

- Throughout an sickness or harm, who ought to handle your monetary affairs?

- In terms of distributing your belongings, who needs to be in cost?

Resolve what your directives can be.

Authorized directives are an essential a part of an property plan. These sometimes embrace:

A belief.

Your belongings are positioned in a belief on your profit (and that of your beneficiaries) and managed by a trustee. Your trustee can take over when you turn out to be incapacitated or ailing. Whenever you die, the belief belongings are transferred to the beneficiaries of your selection, bypassing probate. Alternatively, you may create an irrevocable belief, which can’t be modified or revoked.

Dwelling wills are also called medical care directives.

Within the occasion that you just turn out to be incapable of constructing medical choices for your self, it outlines your needs for medical care. In case you are incapable of constructing well being care choices, you too can give a trusted individual medical energy of lawyer. Advance well being care directives mix these two paperwork into one.

Energy of lawyer for monetary issues.

If you find yourself medically incapable of managing your monetary affairs, another person can. It’s your designated agent’s accountability to behave in your behalf in authorized and monetary conditions if you find yourself unable to take action. Along with paying payments and taxes, they will additionally have the ability to entry and handle your belongings.

Energy of lawyer with restricted authority.

It’s possible you’ll profit from this when you really feel uncomfortable about turning every little thing over to another person. Your named consultant’s powers are restricted by this authorized doc. Throughout the closing of a house sale or when promoting a selected inventory, you may grant the individual licensed to signal the paperwork in your behalf.

Do not give your energy of lawyer to only anybody.

Your monetary well-being – and even your life – is likely to be at their disposal. In case your major selection is unavailable, you would possibly need to assign medical and monetary illustration to completely different individuals.

Nearly all states supply standardized varieties for medical powers of lawyer that may be crammed out within the blanks. It’s not unusual for states to supply a type for monetary energy of lawyer, in addition to a dwelling will or superior directive.

Kinds typically will not price you something, however notarizing them will. There are completely different notary charges in several states, starting from free to $25.

Your beneficiaries have to be reviewed.

Though your will and different paperwork might define your needs, they might not cowl every little thing.

- Keep watch over your retirement accounts and insurance coverage insurance policies. It’s worthwhile to hold monitor of beneficiary designations on retirement plans and insurance coverage merchandise. Beneficiary designations normally take priority over wills.

- Ensure that your stuff will get to the precise individuals. The names of beneficiaries on insurance policies and accounts established a few years in the past are typically forgotten. A life insurance coverage coverage that has your ex-spouse as a beneficiary, for instance, won’t pay out to your present partner after you die.

- You should definitely fill out all beneficiary sections. Throughout probate, an account could also be distributed based mostly on the state’s guidelines for distributing belongings.

- Specify contingent beneficiaries. Having backup beneficiaries is important when you neglect to replace the first beneficiary designation and your major beneficiary dies earlier than you do.

Ensure you know the property tax legal guidelines in your state.

It’s typically potential to reduce property and inheritance taxes by property planning. Nonetheless, most individuals is not going to pay these taxes.

Solely estates exceeding a certain quantity are topic to property taxes on the federal degree. It typically applies to belongings valued over $12.06 million in 2022 or $12.92 million in 2023 and has a tax price of 18% to 40%. What in case your property exceeds the federal restrict? Your heirs might profit from a grantor-retained annuity belief, also called a GRAT, which is an irrevocable belief.

Moreover, property taxes are imposed in some states. If an property’s worth is beneath the federal authorities’s exemption quantity, then the state might levy an property tax. There are additionally inheritance taxes in some states. Because of this, those that inherit your cash might should pay taxes

Think about the worth {of professional} help.

Basically, your scenario will decide whether or not it’s essential to rent an lawyer or property tax skilled that will help you create your property plan.

- Within the case of small estates and easy needs, a web-based or packaged will-writing program might suffice. You’ll normally be guided by writing a will utilizing an interview course of about your life, funds, and different bequests, in accordance with IRS and state necessities. Your home made will may even be up to date as wanted. In comparison with working with an lawyer, on-line wills are inexpensive. With LegalZoom, you may create a easy will for $89, a complete will for $99, and an property plan bundle for $249. Nolo’s Quicken WillMaker and Belief helps you to create over 35 paperwork ranges from $89 to $199.

- Getting authorized and tax recommendation could also be worthwhile when you’ve got doubts concerning the course of. Whenever you dwell in a state with its personal property or inheritance taxes, they may also help you identify when you’re on the precise property planning monitor. A will and powers of lawyer can price as little as $1,000. However a posh property would require you to work with an lawyer. The price of hiring a lawyer can vary from $100 per hour to $400 per hour or extra.

- An property lawyer or tax skilled can help in navigating the typically difficult implications of a big and complicated property – resembling childcare issues, enterprise points, or non-familial heirs.

Keep a present property plan.

Hold your property plan up to date as soon as it has been finalized. In response to Bob Carlson, senior contributor to Forbes, paperwork needs to be reviewed each three to 5 years. Your property must be reviewed and revised when you expertise main life modifications, resembling:

- When a toddler is born, adopted, or dies

- Marriage, divorce, or separation

- Everytime you transfer to a brand new state

- A serious revenue change has occurred

- Each time the tax legislation has been considerably modified

FAQs

1. What’s property planning?

In property planning, you’re employed with skilled advisors who know your targets and issues, your belongings, and the way your loved ones works. It’d contain attorneys, accountants, monetary planners, life insurance coverage advisors, bankers, brokers, and extra.

Tax planning might or is probably not concerned with property planning, which entails transferring belongings at dying. Wills are the commonest paperwork related to this course of.

2. Do I’ve an “property”?

When somebody dies, their property is every little thing they personal earlier than they’re distributed by will, belief, or intestacy. An property can have actual property, like homes, in addition to funding properties. It additionally contains private property like financial institution accounts, shares, jewellery, and vehicles.

3. What is the level of planning?

An property plan helps you to determine who will get what out of your property, and the way a lot. As well as, it prevents taxes from ruining the property.

4. Is a will essential?

No. Wills aren’t required by legislation. Nonetheless, most individuals ought to make a plan for a way their funds and property can be divided after they die.

For starters, you may management how your belongings are distributed whenever you die by making a will. Within the occasion you move away with out a will, you will not have the ability to select what occurs to your stuff. Your will helps you to determine who will get what, or whether or not sure individuals aren’t allowed to get something. That is known as disinheriting an inheritor. In lots of instances, naming the one who will wind up your affairs makes all of the distinction in how easily issues go. Realizing they’ve picked somebody they belief to deal with their last affairs offers individuals peace of thoughts once they make a will.

Additionally, in an unlucky situation the place you move away whereas your kids are nonetheless minors, a will helps you to plan for his or her care. Plus, a will can save your heirs the difficulty of going by probate. You may as well keep away from property taxes by making a will. Your beneficiaries and heirs will not should pay property taxes on the quantities you left them.

Wills aren’t everlasting, so you may change them anytime. In case you determine to divide your property in another way later, you may make any changes you want.

5, What occurs if I haven’t got a will?

With no will, your property passes in keeping with state legislation, no matter what you need. An individual dying intestate means they die with out a authorized Will, and intestacy is what occurs to their property with out one.

Normally, the property of a married one that dies with a partner nonetheless alive goes to the partner. In case you do not plan forward, your surviving partner can use your belongings, financial savings, and retirement to assist his or her new household.

An individual’s partner and youngsters from a earlier relationship are normally exceptions. A surviving partner normally will get one-third of the property if there is not any Will, and two-thirds goes to the kids. Wills are wanted if an individual desires their belongings disposed of in another way than by statute. You may add numerous stress and expense to an already emotional and troublesome scenario whenever you die with out a will.

The excellent news? Wills do not should be difficult or costly.

The publish Retirement and Property Planning for Broke People appeared first on Due.