Fertilizer costs surged to new heights in 2022, persevering with a development that started in 2021. The toll of warfare, rising fuel prices, Chinese language export points and excessive crop costs pushed each phosphate and potash to file ranges in April.

“Agricultural costs reached file highs in Q2 2022 as grain costs shot up within the aftermath of the warfare in Ukraine — each Russia and Ukraine are key world grain producers,” FocusEconomics‘ newest commodities outlook reads.

Nonetheless, throughout the second half of 2022, demand destruction resulted in a ten to 40 p.c decline in consumption for each phosphate and potash, which pushed values decrease.

A July settlement that ended Russia’s blockade on Ukraine’s agricultural exports additionally weakened costs, whereas a rise in manufacturing out of Canada eased a few of the provide stress stemming from the warfare and Chinese language cargo curtailments.

Specialists polled by FocusEconomics anticipate that agriculture costs will “(development downwards) within the quarters forward amid softer demand, however stay above pre-pandemic ranges.” Value assist will come from components corresponding to decrease Ukrainian grain output and excessive fertilizer costs, which “may dampen crop yields in 2023.”

Demand is forecast to contract, however soil high quality hasn’t improved, which is more likely to hinder crop yields. Smaller crop yields are probably so as to add to the mounting price of meals, pushed greater in current months by inflation.

How did phosphate carry out in 2022?

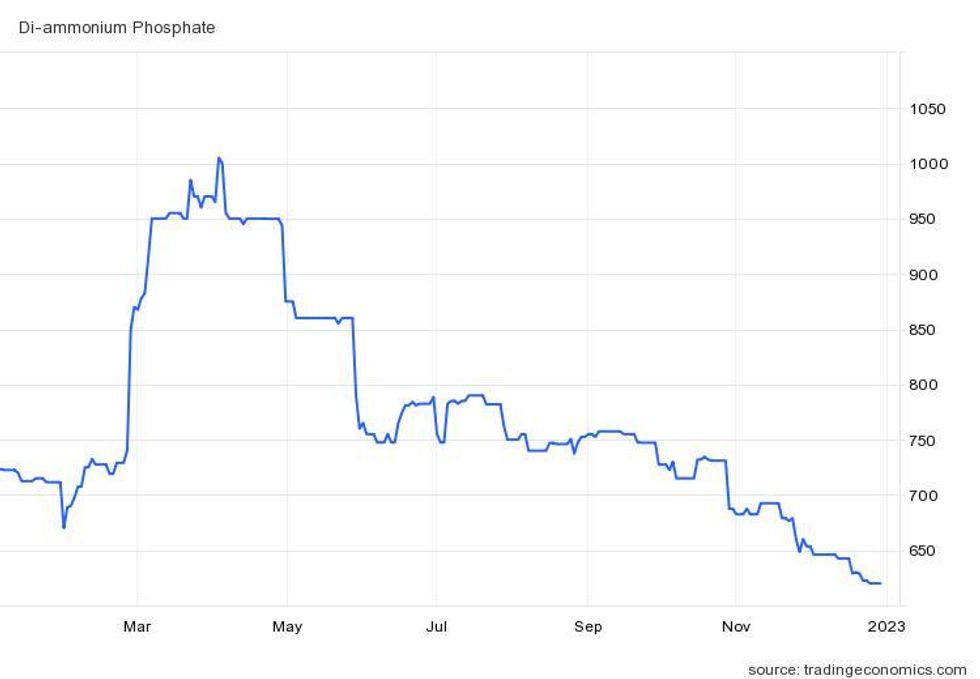

After rallying to an all-time excessive of greater than US$1,000 per metric ton (MT) in April, phosphate costs got here down considerably within the latter half of 2022, finally ending the yr decrease than they began.

The crop additive started the yr at US$713, with values constantly shifting greater by way of April, when considerations round Russian and Ukrainian grain and fertilizer exports reached a fever pitch.

The phosphate market was additional impacted when China suspended exports by way of June to make sure sufficient home provide.

“Chinese language fertilizer exports fell sharply in 2022 on government-imposed limitations. These limitations are set to stay in 2023, however as world and home costs transfer decrease, we anticipate some rest,” an outlook report from CRU Group notes.

Diammonium phosphate’s worth efficiency in 2022.

Chart by way of TradingEconomics.

In keeping with CRU, phosphate exports out of China topped 10.7 million MT in 2021, however contracted to five.4 million MT in 2022. The consultancy expects some rebound in 2023, when shipments ought to tally 6.7 million MT. Yearly, China is the prime producer of phosphate, with output of 85 million MT in 2021. Russia ranks fourth, producing 14 million MT the identical yr.

By the top of June, phosphate costs had slipped again to the US$789 stage.

The hidden prices of excessive fertilizer costs

Despite the fact that phosphate costs ended 2022 beneath their beginning worth, the true price of the record-setting rise is but to be felt.

The Worldwide Fertilizer Affiliation estimates that 85 p.c of the world’s soils are poor in nitrogen, whereas 73 p.c are poor in phosphorus (phosphates) and 55 p.c are poor in potassium (potash).

These deficiencies make fertilizers important to crop development. However to counter broad-based will increase in overhead prices, many farmers are opting to restrict the quantity of fertilizer they buy and use. That is anticipated to affect soil well being and crop yields.

“The fertilizer provide/worth disaster is in lots of respects extra regarding than direct meals inflation as a result of it may inhibit meals manufacturing in the remainder of the world that might ultimately assist take up the slack from stalled Russian and Ukrainian grain deliveries,” Maximo Torero, chief economist for the UN Meals and Agriculture Group, informed Reuters.

He defined that it will have a knock-on impact that may finally drive up the price of meals. “Excessive fertilizer costs may have farmers worldwide lowering deliberate harvests and the quantity of land they’re planting — with the chance of depressed yields within the 2022/23 crop season — including to the scarcity of imported grains and placing meals safety at even better danger,” Torero mentioned.

As the worldwide meals system slips into precarious territory, demand for wheat is predicted to hit a recent excessive in 2023.

“Current will increase in world wheat demand for meals use have been fuelled primarily by rising populations and shifts in diets and incomes,” Economist Intelligence Unit members mentioned. “Ongoing inhabitants development throughout components of Africa and Asia will underpin additional growth in 2022/23, the place we forecast that meals use will attain a file 546m tonnes.”

How did potash carry out in 2022?

Potash confronted comparable hurdles to phosphate in 2022. Probably the most prevalent was the market’s publicity to Russian disruption.

“When it comes to manufacturing capability, potash is actually essentially the most uncovered to disruption from each Russia and Belarus when in comparison with different main fertilizers,” Humphrey Knight, potash principal analyst at CRU, informed INN.

Taking the second and third respective spots on the prime potash producers record, Russia and Belarus produced a mixed 17 million MT of potash in 2022. Canada was in first place with 14 million MT.

“Previous to 2022, the 2 international locations accounted for round 40 p.c of worldwide provide. Though exports from each international locations have confronted disruption in 2022, significantly from Belarus, product has continued to stream to many downstream markets,” Knight mentioned.

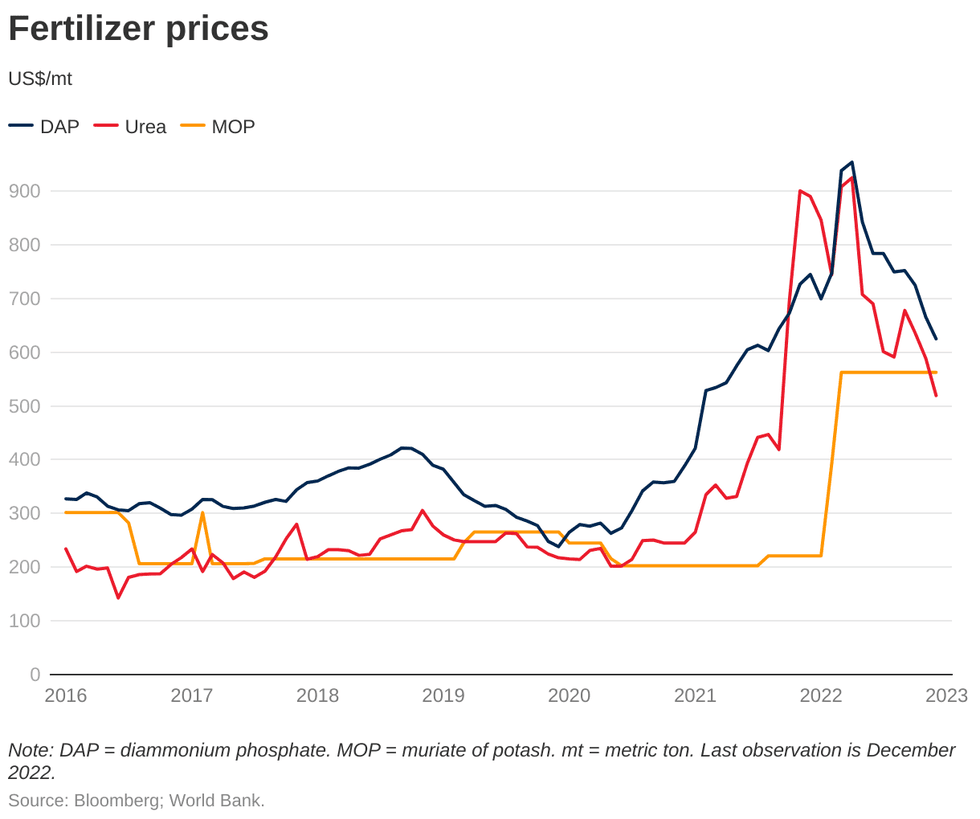

Muriate of potash (MOP) began 2022 at US$221 per MT, however the battle in Ukraine and sanctions towards Belarus drove costs to US$562 in March, the very best stage since February 2009. MOP costs remained at that stage for the remainder of the yr.

Value efficiency of diammonium phosphate, urea and MOP from 2016 to 2022.

Chart by way of Bloomberg and the World Financial institution.

Greater potash costs inflicting demand destruction

Whereas phosphate moved decrease throughout H2, potash remained elevated off of continued provide considerations. Fears that offer might be additional depleted by Russia’s invasion of Ukraine heightened the affect of 2021 sanctions concentrating on Belarusian potash exports.

“The (Russian) commerce sanctions have specified ‘carve-outs’ for the meals and fertilizer sectors to keep away from adversarial results on world meals safety,” a World Financial institution weblog publish reads. “These carve-outs have enabled Russia to proceed exporting fertilizers. Nonetheless, potash exports from Belarus have fallen by greater than 50 p.c as a result of restriction on utilizing EU territory for transit functions.”

Choosing up a few of that slack is Canada, the place the nation’s potash producers have began to ramp up output.

“Canada’s largest producers, Nutrien (TSX:NTR,NYSE:NTR) and Mosaic (NYSE:MOS), keep plans to reactivate capability the businesses had beforehand idled, no less than partly in response to the provision disruption in Russia and Belarus,” mentioned Knight.

Nonetheless, as Knight went on to clarify, 10 months of persistently excessive costs have led to potash demand destruction.

“Mosaic recorded solely a modest year-on-year enhance in potash gross sales within the first 9 months of 2022, and Nutrien noticed potash gross sales decline over the interval,” he mentioned. “Regardless of the provision disruption, demand has been weak, and the Canadian producers have consequently not been in a position to make the most of the provision hole.”

What components will transfer the agriculture market in 2023?

Wanting forward, Knight expects 2022’s worth surge to have lasting implications for farmers.

“Some spot costs hit file highs in 2022, and this has made potash affordability very unfavorable for shoppers,” he mentioned. “Consequently, many have diminished potash consumption considerably and world demand has weakened.”

As farmers diminished their use of fertilizer, many started experimenting with nutrient effectivity and enhancing merchandise. In keeping with CRU, that is one thing that might occur extra sooner or later.

“As capital markets tighten and fertilizer producers maintain flush money balances, 2023 might be the yr to ‘roll the cube’ and purchase corporations with patented new plant vitamin applied sciences,” the agency’s outlook report reads.

Following 2022’s demand destruction, Knight believes the sector may recapture misplaced shopping for if costs retract.

“The potash market actually stays uncovered to additional disruption to manufacturing into 2023, and will see provide tighten shortly if demand recovers quickly from its present lull,” he mentioned.

The principal analyst at CRU concluded, “Nonetheless, a extra gradual restoration in demand seems extra probably (in 2023), which means provide ought to stay enough.”

Do not forget to comply with us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, maintain no direct funding curiosity in any firm talked about on this article.

Editorial Disclosure: The Investing Information Community doesn’t assure the accuracy or thoroughness of the knowledge reported within the interviews it conducts. The opinions expressed in these interviews don’t mirror the opinions of the Investing Information Community and don’t represent funding recommendation. All readers are inspired to carry out their very own due diligence.

From Your Web site Articles

Associated Articles Across the Internet