Fed Chair Jerome Powell did the very best he may with the restricted choices the Fed has created for itself, and he stated nothing sudden. The Fed will proceed its course at a slower charge of rate of interest will increase however elevate curiosity to a better degree than it has thought it must all yr and better than the inventory market has believed.

All completely as anticipated right here, however inflicting the market to lose all of what little raise it received the day earlier than from the bettering inflation charge as a result of it didn’t anticipate sufficient.

Then The Fed and Powell’s presser smashed the vase of fantasy on the bottom of actuality with a hawkish assertion and projections and an much more hawkish Powell.

So, the S&P and Nasdaq stay certain inside the bear-market buying and selling vary they’ve been in all yr, and the Dow, which broke out of that vary, appears to be headed again down into it.

Whereas there have been no surprises, one of many dominant themes was the blind spot I identified a number of months in the past that I stated the Fed would get hung up on, inflicting it to over-tighten because it strikes ahead. Powell took any doubt off of that by saying a number of occasions throughout his ready speech and his Q&A time afterward that the one sign the Fed might be watching greater than any to determine when to cease elevating rates of interest is a significant transfer up in unemployment.

The misunderstanding of languishing labor

Whereas Powell continues to say the labor market is powerful, he confirmed that that labor drive (the variety of individuals ages 16 and older who’re employed or actively in search of employment) is badly damaged and received’t possible get better for a while. He acknowledged the identical numbers I gave months in the past, which is that measurement of the general labor drive is about 4,000,000 staff decrease than the place it will be if the longstanding and constant pattern for progress within the taking part labor drive had not been damaged by the Covidcrash. For the second time that I’ve heard (his Brookings discuss being the primary), Powell is now recognizing the contributing trigger I identified again in September, which is the variety of Covid-related deaths and sicknesses.

So, Powell is coming alongside in recognizing the labor market is damaged and why; but, he retains saying it’s robust as a result of there are much more jobs open than there are laborers. I preserve listening to that critical false impression all over:

AP repeated the error even when it wrote at the beginning of this week in regards to the critical ramifications of the wounded labor drive:

A diminished US workforce may lead Fed to maintain charges excessive

Nonetheless keen to rent, America’s employers are posting extra job openings than they did earlier than the pandemic struck 2½ years in the past. Drawback is, there aren’t sufficient candidates. The nation’s labor drive is smaller than when the pandemic struck.

The explanations differ — an sudden wave of retirements, a drop in authorized immigration, the lack of staff to COVID-19 deaths and sicknesses. The end result, although, is that employers are having to compete for a smaller pool of staff and to supply steadily larger pay to draw them. It’s a pattern that would gasoline wage progress and excessive inflation properly into 2023.

In a current speech, Federal Reserve Chair Jerome Powell pointed to the shortfall of staff and the ensuing rise in common pay as the first remaining driver of the worth spikes that proceed to grip the economic system….

But with value will increase nonetheless uncomfortably excessive, Powell and different Fed officers have underscored that they anticipate to preserve charges at their peak for an prolonged interval, presumably by way of subsequent yr.

So, the modern information I gave months in the past in regards to the true scenario within the labor market is lastly filtering by way of the mainstream press: a part of the reason for the labor scarcity is Covid-related deaths and sicknesses (with out stating that some of what’s known as “lengthy Covid” may be vaccine accidents). They state that this shortfall in staff goes to proceed to gasoline wage inflation, which can gasoline normal inflation properly into 2023.

Powell reiterated at the moment the next factors, which AP famous he made in current speeches earlier than this week’s FOMC assembly:

In his current speech, Powell famous that there at the moment are about 3.5 million fewer individuals who both have a job or are searching for one in contrast with pre-pandemic developments. Of the three.5 million, about 2 million include “extra” retirements — a rise in retirements way over would have been anticipated based mostly on pre-existing developments. Roughly 400,000 different working-age individuals have died of COVID-19. And authorized immigration has fallen by about 1 million.

Powell is assuming 2-million of those misplaced laborers are attributable to “extra retirements,” however the Brookings Institute says, no less than 2-million and certain 4-million are attributable to “lengthy Covid.” Powell is transferring into the Covid camp, however not all the best way there but. The significance of this realization is that useless staff clearly won’t ever come again and people with longterm sicknesses, no matter how they received them, might not ever be capable to come again both.

So, Powell admitted this shortfall goes to endure, and he additionally stated the numbers may very well be a lot larger than the three.5-4-million, which he acknowledged at the moment is the conservative quantity for the shortfall. He additionally stated there are a lot of different paths by which you’ll be able to moderately argue for a a lot larger shortfall within the taking part labor pool.

The affect of this labor disaster on GDP is important. You could have already seen the fact of what AP experiences in your individual life, and I do know I’ve seen it at many institutions in my very own small farm-town neighborhood:

Moreover fueling inflation, a smaller workforce is inflicting different penalties. Some companies, notably retailers and eating places, have needed to in the reduction of their hours of operation, shedding income and irritating clients.

I’ve gone into plenty of native eating places the place I’ve been advised or learn over the previous yr that the menu was in the reduction of attributable to labor shortages and/or that open hours or days had been in the reduction of so as to do what they may with the labor pool accessible to them. Thus, AP right here confirms what I’ve been saying about how you can not have a critical discount within the labor drive and never have a discount in manufacturing, whether or not of providers or items. AP notes that improved effectivity may make up the distinction, however states that it’s not making up the distinction and that, actually, effectivity, similar to by way of automation, has gone down.

After all a discount in manufacturing (GDP) IS a recession by definition. Usually, the one argument is over how lengthy GDP must be in decline earlier than we name it a “recession.” Nicely, that was till the argument not too long ago shifted to say declining GDP merely must be mistaken as a result of “the labor market is powerful.”

The irrationality of this argument is that the scarcity of labor that’s inflicting manufacturing to drop proves we can’t be experiencing a recession (a drop in manufacturing). That’s, on the face of it, utterly irrational, but it surely comes from entrenched considering that believes the one explanation for a shortfall in labor is an economic system that’s booming alongside so strongly that demand for labor is exceeding labor provide attributable to financial progress working forward of labor progress.

This false impression is in all places as a result of we’ve by no means seen a large drop-off like this in labor provide, so these writing about it don’t know how one can get their heads round it. They interpret it solely from the framework they’ve recognized all their lives. Thus we see AP, even on this article, which lays out the explanations for the labor shortfall, repeat the very same mistake:

How the Fed will handle a sturdy labor market, with its impact on inflation, may show perilous.

It’s mind-boggling to me that they can not see that labor is languishing at the same time as they describe the inner of causes of labor shortages. How is a labor market that’s brief, no less than, 4,000,000 staff — a lot of whom died and plenty of of whom now have longterm sicknesses — “sturdy?” Is dying sturdy? Is sickness sturdy? Is a SHORTFALL of 4-million staff “sturdy?”

They can not wrap their head round the truth that it is a sick, even dying, labor market that Powell now needs to hit on the top to knock it down additional Thus, Powell repeatedly acknowledged at the moment the identical level that AP made forward of at the moment’s assembly:

Powell and different Fed officers have stated they hope their charge hikes will gradual shopper spending and job progress. Companies would then take away a lot of their job openings, easing the demand for labor. With much less competitors for staff, wages may start to develop extra slowly.

Assume all of that by way of, and also you’ll understand the unbelievable peril concerned in considering the rationale we can’t be in a recession after two quarters of receding GDP is that “the labor market is powerful.” Powell drove this level house by making it clear the Fed needed to see unemployment rise earlier than it’s going to cease growing rates of interest and easily depart them excessive for longer.

Right here is the way you assume it by way of:

- Labor shortages are already inflicting manufacturing to fall as is clear even in small cities, similar to the place I stay (and doubtless evident the place you reside).

- Because of this, there are tens of millions of jobs that haven’t been crammed that stay overtly listed.

- Because of so many unfilled jobs, manufacturing fell from the beginning of the yr in precisely the style that might all the time prior to now have been known as a “recession.”

- As a result of they’ve so many roles they want to fill, corporations are clinging to workers as they terminate jobs underneath Fed tightening by transferring workers to different positions that stay open.

- Meaning, to get unemployment to rise, tens of millions of open jobs must be eradicated till there are only a few open positions for current labor to transition to. Then a few of terminated laborers will begin to go on unemployment, as a substitute of transferring laterally.

- Eliminating these openings won’t affect manufacturing as a result of these jobs are simply empty placeholders producing nothing at current anyway.

- Nonetheless, it’s going to take time for the Fed to clamp down on the economic system sufficient to squeeze so many further open jobs OUT to the place accessible positions realign with accessible staff, because the Fed says it needs, so as to scale back the pressures of wage inflation.

- Solely AFTER accessible work matches right down to accessible staff will additional financial squeezing remove jobs that end in a considerably rising unemployment charge.

- The Fed’s insurance policies have a lagged impact, so by the point it squeezes the economic system and, therefore, jobs down sufficient to boost unemployment considerably, the squeeze could have turn into fairly extreme.

- Decreasing jobs and employed staff additional once we know effectivity can also be falling can solely imply a higher drop in manufacturing.

- Assured decrease manufacturing equals even worse shortages.

- Worse shortages put a whole lot of upward stress on inflation, presumably making the entire inflation squeeze futile within the first place, relying on whether or not the Fed catches a break from all the opposite causes of shortages.

THAT is the nice peril right here. The Fed may make shortages a lot worse at a time once we have already got too few staff to provide the products and providers we would like or want that we may hit Nice Despair ranges, particularly given the lengthy lag impact between Fed coverage after which between job losses and stock draw downs as shortages in stock in some companies end in shortages in stock in different companies that can’t get components or elements. Diminished manufacturing, worsening shortages, may possible trigger a resurgence in inflation earlier than the Fed is even completed battling it. (And can the Fed even perceive the resurgence when it hits, or will it proceed to assume meaning it must tighten down on employment even tougher?)

Misunderstanding the current labor market by considering it’s robust is prone to show to be the worst mistake the Fed has ever made. And THAT is the situation I’m predicting for 2023. 2022 was all about shortages resulting in inflation resulting in Fed tightening, resulting in inventory and bond market crashes, all of which we noticed. 2023 turns into all in regards to the dire failure of the inflation restoration plan, leading to worse shortages and presumably a resurgent inflation downside that’s extra deeply entrenched, and an amplified recession as a result of the Fed doesn’t consider within the current recession solely attributable to its false perception in a sturdy labor market, somewhat than a sick and languishing labor market.

Three months in the past, the Fed’s policymakers estimated that the unemployment charge would rise to 4.4% subsequent yr, from 3.7% now. On Wednesday, the policymakers might forecast a better unemployment charge by the tip of 2023. In that case, that might recommend that they foresee extra layoffs and certain a recession.

They did. Powell stated the brand new regular unemployment charge, given the labor scarcity, is likely to be 4.5%, and that it’d take a better charge than that to get inflation down. Don’t ask me why that is smart as a result of it doesn’t in a time the place too few jobs are producing something. (Keep in mind, an unfilled job produces nothing.)

Terminal curiosity could also be terminal certainly

Extra vital than the employment charge Powell is searching for to drive wage-based inflation down is the terminal rate of interest he sees as essential to get there as a result of that may upset each market.

In his speech at the moment, Powell confirmed graphs of the Fed’s dot plots and acknowledged repeatedly — simply as AP reported the Fed has stated within the current previous — that the Fed will not decrease rates of interest in any respect in 2023. No pivot! Whereas the Fed will make its interest-rate selections based mostly on the information accessible to it at every assembly, Powell spelled out that he didn’t see any probability the Fed would decrease rates of interest in 2023, nor did every other Fed FOMC member.

Right here is how Fed members revised their collective dot-plot projections for rate of interest adjustments larger up and increasing additional out at at the moment’s assembly from the place they had been on the final assembly: (Every blue dot is one Fed member’s projection at this time assembly of the place the Fed’s highest base charge might be in every year forward, whereas the crimson line tracks the median degree in every column. The grey line and grey dots present what Fed members had projected at their September assembly.)

Powell admitted that ALL of of the Fed’s dot plots for terminal rates of interest had been too low all yr lengthy in order that they had been revised upward at every subsequent assembly. Then he admitted the Fed needed to revise them upward once more at this assembly to a projected terminal charge round 5.25%. Furthermore, he stated he couldn’t say with any confidence the Fed was not underestimating this time by simply as a lot as all of the earlier occasions.

In truth, it’s been longer than all yr lengthy that Fed members have needed to revise their projections upward. Right here is the place the Fed set its overnight-interest-rate projections for the yr 2023 at every Fed assembly (blue dots) in previous months. You possibly can see how, at every assembly since March, 2021, the Fed has needed to elevate its projections (skinny crimson line) larger for the very best curiosity degree it believes the Fed Funds Fee might want to attain in 2023: (Every column of dot clusters are the member’s projections for that month as to the place curiosity would peak in 2023.)

That’s a whole lot of critical underestimation for 2023’s terminal rate of interest at every assembly alongside the best way, and Powell regarded slightly embarrassed in saying at the moment all of them needed to revise upward once more at this assembly, and that he couldn’t promise they wouldn’t have to take action once more on the subsequent assembly.

Shares nonetheless have it mistaken, however they’ll get it proper if it kills them … and it’ll!

Blackrock, the Fed’s agent for the whole lot lately, warned the inventory market yesterday,

Don’t anticipate the Fed to save lots of the day – it’ll preserve rates of interest excessive even when a recession crushes shares subsequent yr

Don’t assume the Federal Reserve will bail out US inventory markets and bonds subsequent yr in the event that they get hammered by a extreme recession, a staff of BlackRock strategists has warned….

The Fed’s actions are prone to gasoline a selloff in shares in 2023, as its tightening marketing campaign plunges the US right into a recession, the strategists at BlackRock’s Funding Institute stated….

“Main central banks will hike charges once more this week: getting inflation down means they should crush demand, making recession foretold….”

The Fed, the BoE and the ECB are so centered on restoring value stability that they’re unlikely to assist monetary markets and the economic system by slashing rates of interest, even when there’s a recession….

“Markets are mistaken to anticipate them to later come to the rescue….”

BlackRock’s bearishness comes despite the fact that inventory markets have rallied in current weeks, buoyed by the thought the Fed would possibly “pivot” — or change again its course — to start easing up on tightening within the second half of 2023….

“By no means going to occur,” stated I. “No pivot!”

Powell pounded that time within the Q&A at the moment for the reason that fool market refuses to just accept it, saying he noticed no scenario during which that might occur and even be thought of.

Boivin’s staff stated that they’d keep away from each equities and stuck revenue. They consider the markets’ current overperformance relies on an assumption the Fed will return to its “outdated playbook” of low rates of interest and free financial coverage, which it used after the 2008 monetary disaster and different earlier recessions….

“Not going to occur,” stated Powell … and Blackrock … and so they each must know as they work hand-in-hand proper on the core of all of this. Not going to occur.

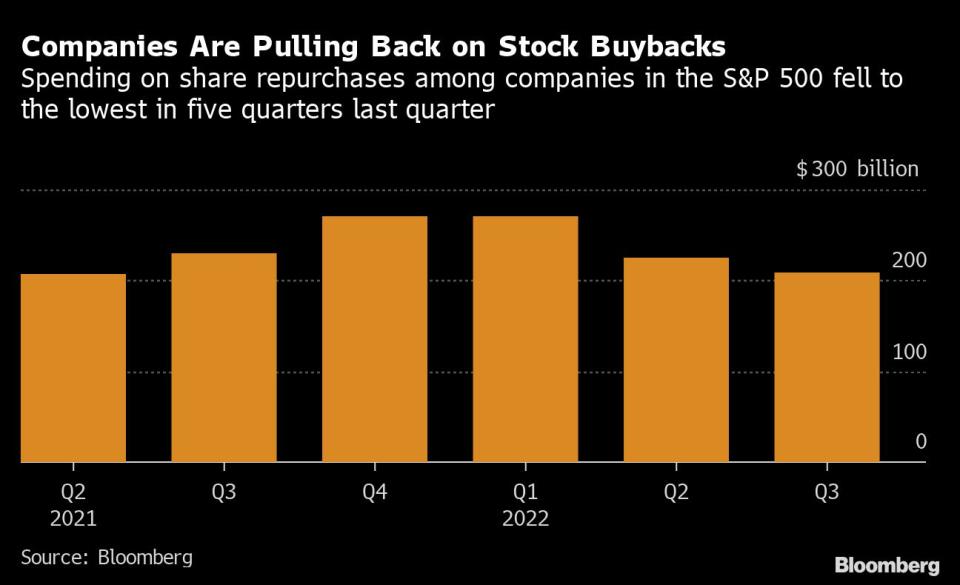

One different factor that I stated was prone to weigh on shares within the remaining quarter of 2022 was opposite to what Zero Hedge was saying. They stated buybacks would begin again up and carry the market larger, however I stated buybacks had been going to decrease as a result of company leaders don’t like to purchase again their shares in a recession. And, at the moment that was confirmed by Bloomberg:

Company America Buys Again Fewer Shares as Recession Fears Rise

US corporations are chopping share buybacks to preserve money within the face of financial uncertainty, which threatens so as to add one other weight to the fairness market’s tried rebound.

S&P 500 Index companies purchased again simply over $200 billion of their very own shares throughout the third quarter, marking the slowest quarter for repurchases for the reason that center of final yr and coming in roughly 25% under the degrees seen in late 2021 and early 2022, in response to information compiled by Bloomberg….The strikes displays mounting anxiousness that progress will stall due to the Federal Reserve’s most aggressive interest-rate hikes for the reason that Nineteen Eighties….

Already, some corporations try to determine how finest to slice up a shrinking money pie. Goldman Sachs Group Inc. Chief Govt Officer David Solomon stated this month that administration groups have to organize for “bumpy occasions forward,” and several other huge banks not too long ago joined know-how giants like Meta and Amazon.com in decreasing their payrolls….

Buybacks are a far much less disruptive price to chop than headcount.

Bloomberg by way of Yahoo!

Bloomberg introduced the next graph of their information:

I’m certain you’ll see these stair steps go down one other notch in This autumn now that Powell acknowledged at the moment the Fed has lastly gotten into “restrictive territory,” which is why it’s slowing the speed at which it raises curiosity so as to ease deeper into that restrictive territory with slightly extra warning.

And, in fact, “restrictive territory” is the place you see the breakdowns begin to happen as emerged first in crypto markets not too long ago, however the Fed is taking us deeper right into a recession Blackrock now says is a “foretold” conclusion and one that may simply turn into “extreme” as a result of there might be no Fed assist attainable when the deeper crash hits attributable to inflation.

“Foretold,” certainly. That is proper the place I stated many months in the past all of this could find yourself this yr. In truth, each step of the best way, was foretold right here; and I’m going to put that each one out tomorrow as a path of stepping stones the Fed apparently couldn’t resist and neither may the inventory market. Each step of the best way.

The total Powell Presser