The “seeming” submit Fed assembly rally for the S&P 500 is head scratcher for certain. That’s as a result of as we dig under the floor, the general market has probably not rallied…simply the same old suspects within the mega cap house. As you dissect the Fed statements there’s a nice divide in interpretation. One rational. And one borderline insane. To make sense of all of it 43 yr funding veteran, Steve Reitmeister, shares is up to date market outlook and buying and selling plan under….

There are solely 2 doable methods to interpret the Fed statements from Wednesday.

First, take the Fed at their phrase that most likely 2 extra hikes are coming and unemployment will rise due to these efforts.

Second, assume they’re bluffing and are literally accomplished with charge mountain climbing cycle.

Now let me ask you…Does chairman Powell seem like the bluffing kind? Or does he seem like an Eagle Scout that has informed the reality each time his mouth has opened since start???

Hopefully the reply is clear sufficient. The Fed just isn’t bluffing. Which explains why the CME’s FedWatch Instrument has risen to indicate 74% likelihood of a charge hike at their subsequent assembly in late July.

Extra to the purpose, the Fed has constantly said that prime inflation is an financial illness that harms long run development and employment. Thus, their purpose is to wholly eradicate it and get again to 2% annual inflation goal.

Their methodology to eradicate it’s to “decrease demand” by slowing down the financial system. It’s onerous to decrease demand if in case you have full employment and everybody’s pockets is full.

That’s the reason time after time Powell’s press convention talks in regards to the employment image being too sturdy which results in sticky wage inflation.

Including these ideas collectively it’s CLEAR that they may hold charges aloft till they’ve successfully induced unemployment to rise. That’s the reason they’re nonetheless anticipating a 1% enhance within the unemployment charge earlier than all is alleged and accomplished.

Now let me say it one other method.

They WANT unemployment to rise to place a ultimate nail within the excessive inflation coffin. That’s the reason so many commentators are saying they may hold charges aloft till “one thing breaks”.

That’s the reason you need to take them at their phrase that…

- There’s extra work to be accomplished to regulate inflation

- 2 extra charge hikes are doubtless within the forecast this yr

- Decrease charges will NOT happen in 2023

- And sure, unemployment will rise by 1%…or extra!

Right here is the true wakeup name associates.

The unemployment charge has by no means gone up by 1% and stopped there. Analysis reveals that when you rise that a lot, it usually results in a 2% or larger rise. Form of like opening Pandoras Field which drastically will increase the chances of future recession (and deeper bear market).

Do You Really feel Fortunate, Punk?

To the market bulls I repeat the purpose clean query from Soiled Harry “Do You Really feel Fortunate Punk?”

In that notorious scene Soiled Harry (Clint Eastwood) has fired a number of pictures to apprehend a felony on the run. And now he stands over him with gun pointed at his head with one of many biggest monologues of all time.

That being in all of the flurry of exercise Harry just isn’t certain whether or not he shot 5 occasions or the complete 6 within the gun. Thus, he asks the man does he really feel fortunate as as to if the gun is empty and he ought to try and flee the scene. After all, the felony was sensible to show himself in as a result of the chance of getting his head blown off was far too excessive.

Sure, the Fed has shot many charge hike bullets on the financial system. So, after they let you know they’re most likely going to shoot twice extra…and that can doubtless result in a hike in unemployment…and historical past reveals that comes hand in hand with recession…and recessions go hand in hand with decrease inventory costs…THEN it feels “straight jacket loopy” to maintain shopping for shares right now.

One other Rally That Wasn’t a Rally

On the floor it certain appears to be like like buyers interpreted the Fed assembly as a inexperienced flag for the bull market. But as we dig deeper we discover it was simply extra of the identical madness from earlier this yr. Simply all the cash going to the same old suspects within the Mega Cap house.

That is why the Bond King, Jeffrey Gundlach, stated on CNBC that that we’re seeing a mania type bubble in mega caps due to the joy over AI. However given the present valuation of the general inventory market, that bonds are the a lot better worth right now given the super rise in yields. And sure, that inventory costs ought to fall. His evaluation is totally, traditionally, objectively true.

In order we dig under the floor we discover that mid caps and small caps are literally down for the reason that Wednesday afternoon Fed announcement. Not rallying with the mega cap dominated S&P 500.

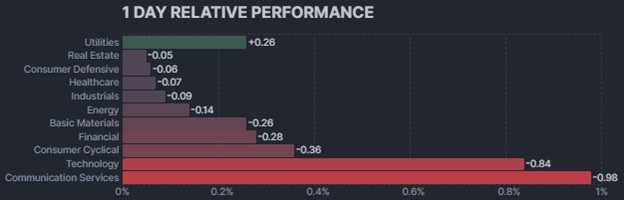

Which means there may be NO breadth…and due to this fact not a lot actual substance within the rally. With that in thoughts, now check out this chart from Friday of the highest performing sectors:

Take a look at the highest 4 sectors. These are defensive teams which suggests Threat Off market circumstances. Not the bull market that’s being too extensively promoting within the media circles.

Can shares hold rallying within the gentle of those details?

Sadly sure. That’s the very nature of manias and bubbles which brings to thoughts the famed quote from legendary economist John Maynard Keynes:

“Markets can stay irrational longer than you’ll be able to stay solvent”.

Buying and selling Plan

Given all of the above is why my buying and selling plan continues to be balanced. As in 50% invested.

That’s the easiest way to straddle the bearish elementary outlook towards bullish worth motion. (But as shared above, the worth motion just isn’t as bullish because it appears given not sufficient shares are actually collaborating within the good occasions…simply the same old suspects within the mega cap house).

This balanced posture permits us to shift extra bearish if a recession comes on the scene pushing buyers to hit the SELL BUTTON in earnest.

And sure, we are able to nonetheless shift extra bullish if the elemental image improves permitting the inventory features to broaden out to extra teams.

Heck, Powell could be the biggest poker participant on the planet and the Fed could also be accomplished elevating charges. However with that charge hike gun pointed at my head…I’m going to take him at his phrase that there are extra bullets to be fired.

What To Do Subsequent?

Uncover my balanced portfolio method for unsure occasions.

It’s completely constructed that will help you take part within the present market surroundings whereas adjusting extra bullish or bearish as crucial within the days forward.

In case you are curious in studying extra, and wish to see the hand chosen trades in my portfolio, then please click on the hyperlink under to what 43 years of investing expertise can do for you.

Steve Reitmeister’s Buying and selling Plan & High Picks >

Wishing you a world of funding success!

Steve Reitmeister…however everybody calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Complete Return

SPY shares rose $0.14 (+0.03%) in after-hours buying and selling Friday. Yr-to-date, SPY has gained 15.35%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

In regards to the Writer: Steve Reitmeister

Steve is best recognized to the StockNews viewers as “Reity”. Not solely is he the CEO of the agency, however he additionally shares his 40 years of funding expertise within the Reitmeister Complete Return portfolio. Study extra about Reity’s background, together with hyperlinks to his most up-to-date articles and inventory picks.

The submit Powell to Buyers: Do You Really feel Fortunate Punk? appeared first on StockNews.com