“US non-public sector corporations signalled a sharper fall in enterprise

exercise throughout August, in accordance with newest ‘flash’ PMI™ knowledge

from S&P International. The lower in output was the quickest

seen since Might 2020 and strong total. The speed of

contraction additionally outpaced something recorded exterior of the

preliminary pandemic outbreak because the sequence started almost 13-

years in the past.”

www.pmi.spglobal.com/Public/Residence/PressRelease/060c0e13d7fe45bfa897a470dff44fbb

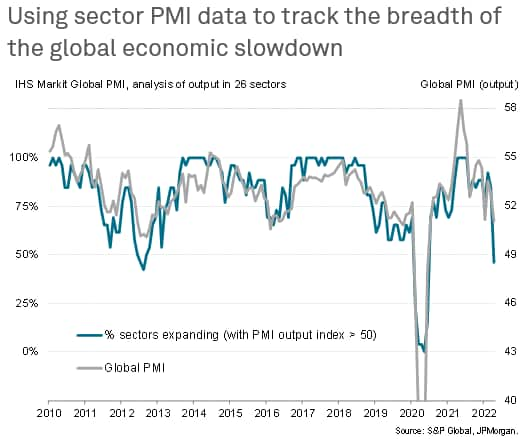

etail sector PMI knowledge compiled by S&P International, derived from data offered by panels of over 30,000 firms in 45 nations, revealed a broadening of the worldwide financial slowdown in April. Excluding the downturn seen in early 2020 through the preliminary section of the pandemic, April noticed extra sectors reporting falling output than at any time since 2012.

With the Ukraine warfare ongoing and mainland China locking down a few of its main cities to battle the Omicron variant of COVID-19, provide chain disruptions have elevated, damaging huge swathes of the worldwide manufacturing economic system, whereas value pressures have intensified, eroding spending energy.

Whereas progress exterior of China has proven some encouraging resilience, dropping solely marginal momentum in April on common, this may be linked to resurgent spending on client providers amid to loosened COVID-19 restrictions. Nonetheless, demand for client items has nearly stalled as family spending is diverted to providers, suggesting there’s a danger that the worldwide economic system is reliant on a doubtlessly short-lived rebound in client service spending to assist sustained progress within the coming months.

Costs are in the meantime rising for all items and providers, although of specific concern is a file rise in meals costs amid falling meals manufacturing, which is probably going so as to add to the worldwide value of dwelling disaster.

“The newest, from the Bureau of Labor Statistics, confirmed unit labor prices within the nonfarm enterprise sector rose 10.8% within the second quarter, following a revised 12.7% leap within the first quarter. (See chart, Labor Prices Soar, Add to Value Pressures.)

What drives up the unit labor value quantity, in addition to larger hourly compensation, is decrease worker output per hour. The leap in labor prices mirrored a 5.7% enhance in hourly compensation and a 4.6% lower in productiveness.”

Labor value per enter is rise sharply, as non-public sector output is falling at breakneck speeds. Not a superb recipe.

AC