October was fairly spooky for traders even with a late month mini bounce. But with shares nonetheless pinned underneath the 200 day transferring common for the S&P 500 it’s laborious to really feel bullish right now. 43 yr funding veteran Steve Reitmeister seems in any respect the elements at play to debate the place shares head subsequent in November and past. This features a preview of his high 11 picks for the times forward. Learn on under for extra….

Certainly the inventory market seems haunted this Halloween season as we proceed to wallow underneath the 200 day transferring common for the S&P 500 (SPY). Certain, there are some optimistic periods like we loved to kick off this week. Nevertheless, the general the temper is quite unfavourable.

That is all taking place whereas lately hovering bond charges have leveled off. So why is the temper nonetheless so dower? And can that hold the Santa Claus rally away this yr?

We are going to “unmask” these points on this Halloween version of the Reitmeister Complete Return.

Market Commentary

Bond Charges Up > Inventory Costs Down

This has been the equation that defined many of the downfall for shares over the previous couple months. The extra benign model of that story was that charges have been normalizing to extra conventional historic ranges versus the extremely low manipulated ranges now we have loved the previous 2 many years.

The extra sinister model of that charge rising story was that maybe traders have been shedding confidence in main world governments to pay again that UNSEEMLY debt burdens. That is what some name the Debt Supercycle which might be a painful debt disaster (image the Greek debt drawback and make it 50X worse).

Learn extra about these 2 concepts in my latest commentary: Bear Market Warning from the Bond Market?

10 yr Treasury charges did briefly contact 5% again on 10/18. That has appeared to be a spot of resistance with charges settling underneath that mark ever since.

So why have shares not been extra strong with this bond charge reprieve?

First, the priority is that like every long run rally there are runs greater adopted by pauses/pullbacks/corrections after which the subsequent run greater. Which means that simply because charges ran out of steam round 5% right now does not imply they will not run greater down the street. Thus, traders are possible in wait and see mode to understand what occurs subsequent.

Additionally, this rising of charges has many traders predicting an important softening of the financial system from a reasonably overheated +4.9% tempo in Q3. That’s the reason the important thing financial reviews this week may have market transferring impression. I’m referring to ISM Manufacturing on 11/1 adopted by Authorities Employment and ISM Providers on 11/3.

Actually, you possibly can throw the 11/1 Fed assembly into the combo as an vital occasion to look at. However proper now, traders are useless sure they are going to sit on their fingers as soon as once more.

The important thing, as per common, might be Powell’s feedback that may give us a way of their future charge plans. Additionally of curiosity might be if there are any feedback about greater charges, outdoors of their efforts, is doing among the laborious work to additional soften the financial system within the quest to lastly tame excessive inflation.

Again to the financial reviews for a second. Sure, ISM Manufacturing leads the parade on Wednesday. Nevertheless, on Tuesday we received served up the perfect main indicator for that report within the Chicago PMI that stayed very low at 44 (underneath 50 = contraction).

This possible factors to a subdued ISM Manufacturing report to leap begin November. The hot button is how smooth? If it simply is available in a notch underneath 50 then some traders could have a good time that as an indication the financial system is moderating from the too scorching tempo set in Q3…and this may be good for moderating inflation and permitting the Fed to decrease charges sooner.

Nevertheless, if now we have a studying enormously decrease than the earlier 49…then it might increase fears of a recession forming…and that almost all actually wouldn’t be good for shares.

Let’s additionally think about what is going on this earnings season as we’re on the mid level. Proper now it appears fairly much like different latest quarters. Which means firms have been beating low expectations which reveals up with the rise of earnings development for the present quarter.

Earlier than you have a good time, solid your eyes on the three columns to the fitting the place earnings estimates are getting minimize for the long run. And general, no actual earnings development anticipated til Q2.

For the reason that expectations for future earnings development is a foremost catalyst for inventory value appreciation…then you possibly can admire why the market has been in correction mode. And that’s the reason the maker of this earnings chart, Nick Raich of Earnings Scout, is recommending that folk keep underweight shares right now till we see earnings revisions flip optimistic.

Worth Motion & Buying and selling Plan

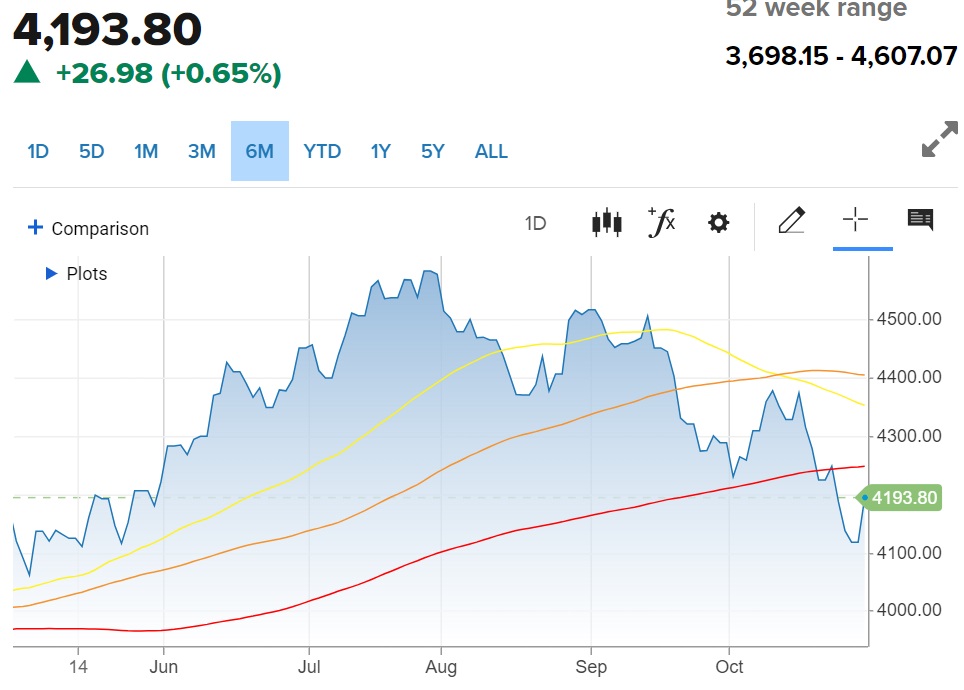

Transferring Averages: 50 Day (yellow), 100 Day (orange), 200 Day (purple)

No option to see the above and be ok with the market being under all 3 key development traces. Particularly unhealthy when the issues break under the 200 day transferring common (4,242) which passed off per week in the past.

Truthfully, I do not sense much more draw back on the best way given the present info in hand. Fairly, I simply see us consolidating underneath the 200 transferring common for some time as traders await extra info on what lies forward.

Sadly, I additionally do not see a lot motive to interrupt again greater till traders are extra satisfied that the development of charges has ended and thus odds of future recession stays low.

Given this explains our latest adjustments to be extra cautious within the Reitmeister Complete Return portfolio. Extra about that under.

What To Do Subsequent?

Uncover my present portfolio of 5 shares packed to the brim with the outperforming advantages present in our POWR Rankings mannequin.

Plus I’ve added 6 ETFs which might be all in sectors properly positioned to outpace the market within the weeks and months forward. (And sure have some inverse ETFs within the combine which might be rising because the market falls…even some gold blended in given the rise in worldwide tensions).

That is all based mostly on my 43 years of investing expertise seeing bull markets…bear markets…and every little thing between.

In case you are curious to study extra, and wish to see these 11 hand chosen trades, and all of the market commentary and trades to come back….then please click on the hyperlink under to get began now.

Steve Reitmeister’s Buying and selling Plan & High Picks >

Wishing you a world of funding success!

Steve Reitmeister…however everybody calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Complete Return

SPY shares fell $0.85 (-0.20%) in after-hours buying and selling Tuesday. Yr-to-date, SPY has gained 10.57%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

In regards to the Creator: Steve Reitmeister

Steve is healthier identified to the StockNews viewers as “Reity”. Not solely is he the CEO of the agency, however he additionally shares his 40 years of funding expertise within the Reitmeister Complete Return portfolio. Be taught extra about Reity’s background, together with hyperlinks to his most up-to-date articles and inventory picks.

The submit November Inventory Market Outlook appeared first on StockNews.com