This week we’re going to speak about money circulation statements. I discover money circulation statements to be probably the most complicated and sophisticated of the three key monetary statements. Subsequently I’m going to do my finest to maintain it easy.

The Distinction Between Money Move and PNL

Ultimately, money circulation statements are to designed to offer perception into the “money” shifting out and in of the enterprise. At first look it’s straightforward to assume we already know this. We’ve seen the P&L assertion. We all know how a lot the corporate made. The issue with that’s, the P&L assertion solely addresses what’s “owed” or “earned” not essentially the money transaction. It’s doable for a extremely worthwhile firm to be tight on money. An instance of it is a cell phone supplier. Cellular carriers have very excessive capital prices to construct on the market networks. Capital prices don’t present up on the P&L Statements.

They’re depreciated as an expense time beyond regulation. Subsequently a billion greenback money out lay received’t be seen as a billion greenback expense merchandise on the P&L. The provider might be exhibiting a revenue, however be money circulation adverse. The opposite aspect of that coin might be service firm that prices for a 12 months of it’s companies up entrance. The service firm would get a lump sum of money in let’s say January, however can solely acknowledged the income month-to-month. Subsequently they might be money circulation optimistic within the month they obtained the money, however might be shedding cash.

How you can Calculate Money Move

Accounting for money circulation isn’t easy. Calculating money circulation is simpler so we’ll begin their. To calculate money circulation, merely examine money originally of the 12 months (or time interval you need to measure) from the top of the 12 months and you’ve got money circulation. For instance, in case you start the 12 months with 10 million {dollars} in money and ended the 12 months with 6 million {dollars} in money, you might be money circulation adverse by 4 million {dollars}. In case your money stability on the finish of the 12 months is 12 million {dollars}, your money circulation is optimistic by 2 million {dollars}.

As I stated, accounting for money circulation will get just a little extra bushy however I’ll do my finest to spell it out.

Items of Money Move Statements

The very first thing to note is money can come from three key areas, working actions, investing actions and financing actions.

Working actions is money spent or generated by way of the operations of the enterprise, this consists of money from items and companies bought, funds to suppliers, loans bought, curiosity on loans and many others.

Investing actions consists of, money obtained from or spent on the sale of property, loans made or obtained, or money spent and obtained from mergers and acquisitions.

Financing actions embrace, money from traders reminiscent of VCs and shareholders in addition to outflows of money within the type of dividends.

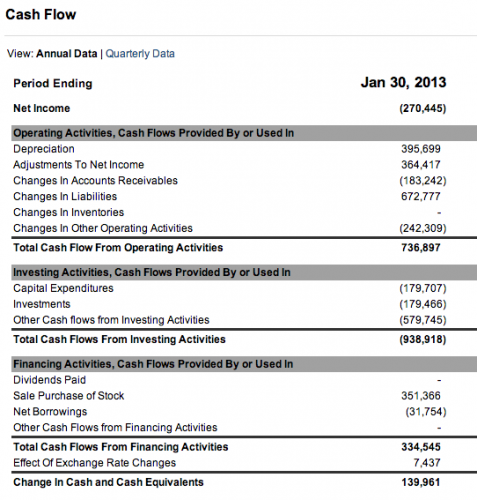

To remain in line with the Stability Sheet and P&L posts we’ll take a look at Salesforce’s money circulation assertion.

Working Actions

Discover the working class, Salesforce is producing a pleasant chunk of money from operations, over 700 million {dollars}. That’s 30% of whole income and working revenue.

Investing Actions

Now lets take a look at the investing class. Salesforce has used virtually a billion {dollars} of money in investing. On this class they’re money circulation adverse. A 179 million of the money was in capital bills. I’m going to imagine that is primarily for {hardware}, servers, community infrastructure and many others. Capital bills are thought of investments within the firm and that’s why they present up within the investments class of the money circulation assertion.

Past capital expenditures, Salesforce used money in outdoors investments to the tune of greater than 750 million. I don’t understand how Salesforce is dividing “investments” from “different money flows from funding actions” however we do know that Salesforce has been on an acquisition spree over the previous few years and it may have one thing to do with M&A and debt.

Financing Actions

Lastly, we are able to take a look at the financing actions a part of the money circulation assertion. Right here we see Salesforce has generated over 335 million in money from financing actions, largely from it’s inventory.

On the finish of 2013, Salesforce is money circulation optimistic to the tune of just below 140 million {dollars}.

Why does money circulation matter?

If you happen to bear in mind within the Stability Sheet publish, I say money is king. Money is what retains a enterprise going. If you happen to run out of money, sport over, until you will get somebody to finance you. However, that’s by no means a superb signal. Subsequently, figuring out if an organization is producing money, and the place it’s coming from OR the place it’s going OUT is essential.

WITCE (What’s the Buyer Expertise) Money Move Assertion Questions

- Is the shopper money circulation optimistic or adverse?

- How does what you promote have an effect on money circulation?

- Does what you promote doubtlessly enhance money circulation; accounts receivables, inventories and many others?

- How does the shoppers money circulation influence your deal technique?

- Does it matter in case you prospects or clients are money circulation optimistic or adverse?

- Do you account for a firms money circulation well being in your prospecting and gross sales course of?

- Can you discover alternatives to promote your services or products by reviewing a prospects or clients money circulation assertion?

We’ve now lined the three most crucial monetary statements. The secret is to take a look at them in tandem. By all of them on the identical time may give you some actual perception into who you might be promoting to, their monetary well being and most significantly potential information to enhance your deal technique or create new alternatives.

I hope you bought one thing out of those three posts and located them informative. Undecided what’s up for subsequent WITCE Wednesday, however I’m liking this sequence to date, so I’m going to maintain going for awhile.

If there’s a matter you’d like me to cowl, let me know.