This text was developed by Tech & Durables business specialists Ines Haaga and Sohjin Baek of the GfK International Strategic Insights Workforce.

Set towards a backdrop of rising costs, shrinking markets, and altering client habits, it sounds a contradiction to recommend {that a} premiumization technique affords progress potential in as we speak’s difficult atmosphere. Nonetheless, we at GfK we have now recognized that the present rise within the attraction of higher-priced tech and sturdy merchandise amongst premium patrons will persist all through 2022.

In earlier articles, we coated how manufacturers can embrace premium and how premiumization can save client tech and durables. On this weblog, we study the drivers and the merchandise already benefitting from the pattern. We profile excessive spec premium patrons, and share learn how to understand the chance they current in your corporation. So learn on to find if your corporation may maximize the facility of premium.

What’s driving the shift to premium?

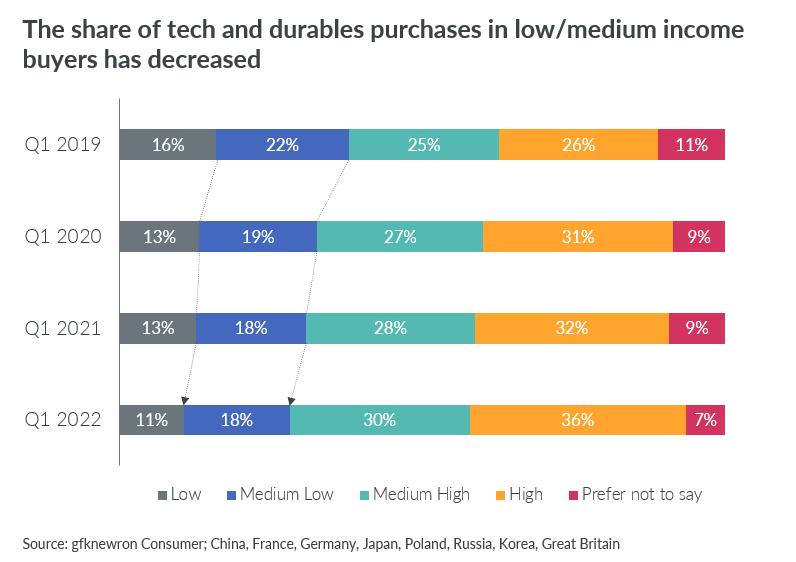

Firstly, family budgets are more and more restricted, and the share of purchases has modified. Between Q1 2019 and Q1 2022, the share of low and medium-income patrons in Tech and Durables declined from 38% in Q1 2019 to 29% in Q1 2022. Over the identical interval, high-income patrons grew their share from 26% to 36%.

In order these with extra restricted budgets delay and even keep away from shopping for, better-off premium patrons obtain a much bigger share of gross sales. These with decrease incomes might also be impacted by the discount within the variety of entry-level objects on the market, as pushed by provide chain shortages, producers have focused on producing larger priced-items providing higher margins.

As well as, client preferences are driving the potential of premium. Our 2021 Client Life examine has proven that greater than one-third (37%) of customers agree ‘you will need to indulge myself regularly’. This can be one other motivation of premium patrons for upgrading to higher-priced, feature-rich premium merchandise.

Meet the ‘Excessive Spec Premium’ purchaser

Function wealthy and well-known manufacturers are essential standards in serving to Excessive Spec Premium patrons make buy selections. Primarily based on gfknewron Client evaluation, customers will be categorized into seven viewers teams, with Excessive Spec Premium patrons representing 15% of all customers in Europe. This group values well-known status manufacturers in addition to product options. Virtually all (95%) agree with the assertion “I desire a feature-rich machine from a model I do know nicely. If which means paying extra, then so be it!”

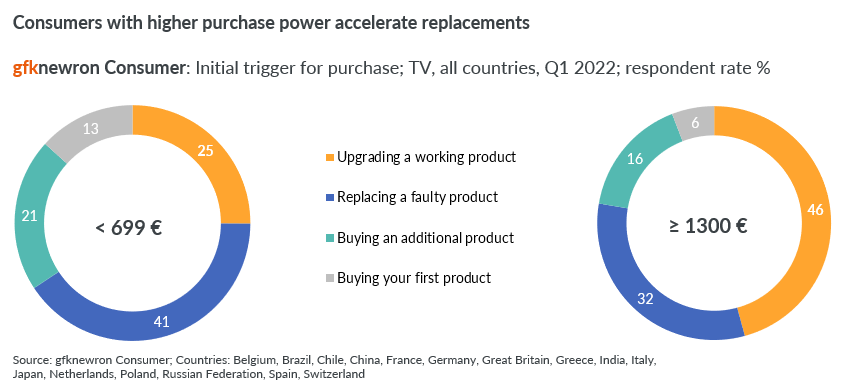

For these premium patrons, pricing is much less prone to be an essential consideration issue. There are quite a few components that attraction to Excessive Spec Premium patrons, together with whether or not it’s sustainable or good, maybe it helps make life less complicated, or affords an upgraded, enhanced expertise. Upgrades are an essential driver, and in reality evaluation of TV gross sales between Q1 2019 and Q1 2022 reveals that ‘upgrading a working product’ is on a progress trajectory as a purpose to purchase (up from 29% to 34% by Q1 2022), whereas ‘changing a defective product’ has remained flat through the time interval.

The premium worth alternative: Driving income and margin

Gross sales on the higher-end have been rising since April 2018. The newest evaluation reveals that the 5% of unit gross sales on the high finish worth level accounted for 26% of income from Might 2021 to April 2022, making them each environment friendly and efficient. So higher-priced merchandise provide a greater revenue margin too. The place assets are restricted, it’s logical to concentrate on the dearer, higher-return objects. This pattern is occurring in key classes together with flat TVs, smartphones, cell PCs, displays, washing machines, and vacuum cleaners. Right here gross sales are rising in double-digits, whereas on the lower cost level, gross sales have plateaued or are in decline.

Evaluation of customers who purchased a flat-screen TV reveals that these purchasing within the low- to mid-level worth level of €699 or much less are buying particularly to switch an merchandise. Compared, these – premium patrons – spending €1300 or extra are changing a working product. This implies that these customers are shopping for to indulge their want for higher options, or to indulge themselves, or a mix of each. Evaluation of customers shopping for higher-priced vacuum cleaners signifies an additional hyperlink, this time between excessive ranges of client confidence and spending.

So, whereas some customers are feeling the squeeze of rising costs and are reducing their expenditures within the TCG class, this isn’t the case for all. There may be nonetheless a big proportion of consumers who’re attracted by feature-rich merchandise from well-known status manufacturers, and who can afford to purchase them to fulfill their want for self-indulgence. This implies there’s a real alternative to maximise the potential of premium in the event you perceive what’s going to attraction to Excessive Spec premium patrons.