In 2018 myself and my good good friend and colleague Kyle Crystal of Lakeshore Technical Evaluation wrote a sequence of White Papers on the historical past, development and use in technical evaluation of Andrews Pitchfork that was printed within the Society of Technical Analysts of their quarterly publication. Over the following a number of weeks I might be publishing these within the Markets Compass Substack Weblog.

It’s the authors’ intent in penning this preliminary weblog put up is to attract a timeline that serves to explain the evolution of Median Line Evaluation and briefly contact on those that have contributed to the event of what we all know at this time as Andrews Pitchfork. In additional blogposts I’ll dig deeper into development and evaluation of Andrews Pitchfork. The historical past of Andrews Pitchfork could depart impatient merchants bored and chomping on the bit for the Development and Evaluation sections however researching and understanding the event over lots of of years left the authors with a deeper understanding of why this time and value software is invaluable.

Though the technical methodology often called Median Line Evaluation as we all know it at this time is rightly attributed to Dr. Alan Andrews, it must be recognized that it discovered its genesis lots of of years earlier than his time. That stated, it was he who introduced it ahead to the examine of shares, bonds, currencies and commodities and his intensive evaluation and research are the idea of what’s now known as Andrews Pitchfork. It has been elaborated on since his passing by a number of of his college students who studied straight with him and by plenty of discovered and proficient technicians who’ve, refined, and studied it in live performance with different indicators. It has been stated his disciples who had been grain merchants had been chargeable for attaching the moniker Andrews Pitchfork to the method. It’s my intention on this “Half One” to inform a short historical past of the event of what we consider is an underutilized technical software that belongs in each analyst’s toolbox.

No that’s not an image of Roger Daltry. Sir Issac Newton was unquestionably one of the sensible scientists to have ever lived. He was born prematurely on Christmas Day 1642 (Julian Calendar) in Woolsthorpe close to the village of Colsterworth, seven miles south of Grantham in Lincolnshire County, England. He was named after his father who had died 3 months earlier than he was born and was so tiny nobody anticipated him to dwell. His mom remarried and solid him apart when he was three to be raised by his grandfather. When his stepfather died, he returned to his mom’s aspect when he was 10 years of age together with her stepson and two step daughters shifting again to his household’s house in Woolsthorpe.

When he was twelve his mom despatched him away once more however this time it was to attend King’s Faculty in Grantham. He boarded within the house of an apothecary in a small attic room. It was throughout this era that he developed into what Richard Westfall in his e-book on Newton known as “A Sober, Silent, Pondering Lad”. He developed an curiosity in science and keenness for chemistry residing above that apothecary store.

After a tough begin at King’s Faculty he started to excel academically which led to Newton discovering himself at Trinity Faculty in Cambridge in 1661. It was his time at Cambridge that he developed an extended listing of scientific understanding. What follows are two of the numerous discoveries that had been part of the genesis of what grew to become Median Line Evaluation.

Most of those that had been chargeable for the Scientific Revolution studied Hermeticism. These three wisdoms of the entire universe, alchemy, astrology, and theurgy performed an important position within the development of physics, astronomy, arithmetic and pure sciences. There are three main Airtight texts or doctrines (there are 47 scared texts in whole which might be recognized of) which were attributed to Hermes Trismegistus, a syncretic mixture of the Greek god Hermes and the Egyptian god Thoth. Of the three main teachings we flip our consideration to The Emerald Pill which can have been one of many earliest alchemical works that survives and was translated quite a few occasions by many various authors from many cultures. Our focus is on a later translation of the textual content by Sir Issac Newton. In his translation, the second verse states, “That which is beneath is like that which is above, that which is above is like but which is beneath”.

For sure, Newton performed an essential half within the Scientific Revolution, a lot in order that “Newtonian” got here for use to explain the our bodies of data that owed their existence to his theories. In 1669 Newton started work on what is taken into account one of many best scientific books ever written, Philophiae Natrualis Principia Mathematica which was lastly printed in 1687. The tile of the e-book was shortened to Principia, or Ideas in English. The e-book contained Newton’s well-known three legal guidelines of movement together with quite a few different scientific theories. It’s one in all three legal guidelines of movement that had been derived by Newton from Johann Kepler’s Legal guidelines of Planetary Movement and his research of The Emerald Pill that was the dawning of the Newton’s Third Regulation, which brings the historical past of median line evaluation ahead. The Third Regulation states that “for each motion, there’s an equal however reverse response”.

Roger Babson was born in Gloucester, Massachusetts on July 6, 1875. His father was Nathaniel Babson, a dry-goods service provider within the metropolis; and his mom was Nellie Sterns whose mom owned a millinery retailer. His was a typical childhood of that interval, though he relates, he was an unruly little one that suffered whippings by the hand of his trainer as did most youngsters who “acted up” throughout college. The primary statistics that Babson compiled even at that early age, had been the file of thrashings that numerous girls and boys obtained in the course of the college yr. His rating was forty-seven. This was a doubtful begin, however a begin nonetheless to a famend profession as a statistician, bond dealer, businessman, economist, and author that spanned many years and left a legacy and place of notoriety within the historical past of economic markets. In his detailed e-book titled “Actions and Reactions An Autobiography of Roger W Babson” there are a quite a few shared experiences of his youth, his faculty life and enterprise profession. We won’t reiterate all of them, however we’ll share those who we really feel had an impression on his later enterprise years. It was his founding of Babson’s Statistical Group and his long-standing relationship with a professor of engineering, George F. Swain, whom he studied underneath on the Massachusetts Institute of Know-how the place Babson obtained his coaching as an engineer from 1895-1898 and the place the 2 males’s friendship was cast. It’s their philosophical connection that pursuits us and their improvement of the traditional or median line.

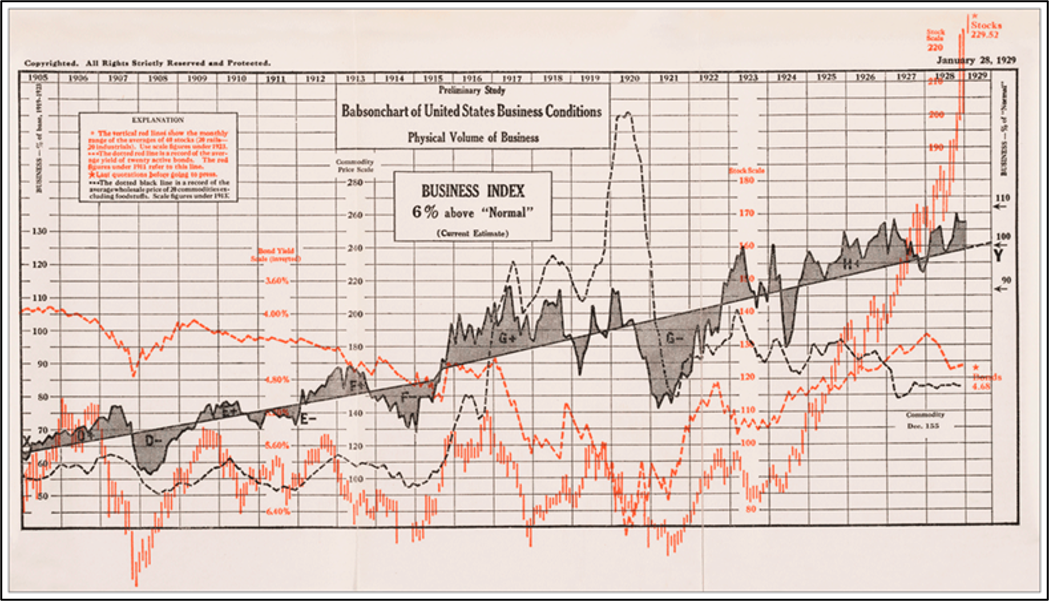

Babson was in New York promoting his bond statistical analytical analysis on the day of the 1907 inventory market crash and was bowled over by the big losses collected by supposed discovered and skilled market professionals. On the time, he had been finding out Benner’s Prophecies of Future Ups and Downs in Costs and How Cash is Made In Safety Funding, believing that there have to be have been a solution to forecast financial and market adjustments in a extra proactive and fewer reactive method. With these two books and his personal amassed statistical knowledge in hand he sought out his former professor and good friend George Swain. Each concluded that there was the idea in these two books and Babson’s collected knowledge that, when utilized correctly, may forge a brand new methodology of forecasting. It was Professor Swain who launched and drew a “regular line” by means of the historic knowledge within the Babson’s Composite Chart of pig iron, corn and, hogs that might normalize the unstable “zig-zagging” index Babson had been growing. (chart beneath). He additionally urged that Newton’s Third Regulation of Motion and Response could apply to this and different financial indicators, because it does to physics, chemistry, and astronomy. Thus, was the origin of the well-known Babsoncharts that had been built-in into Babson’s Statistical Group’s publications and later analytically led to his well-known well timed prediction of the 1929 crash that was printed in New York Journal.

It was Babson’s additional devotion to the work of Sir Issac Newton that later induced him to create of the Gravity Analysis Basis on the suggestion of Thomas Edison. This suggestion was simply accepted as was revealed in a later essay he wrote known as Gravity- Our Enemy Quantity One, he indicted his need to beat gravity stemming from the childhood drowning of his youthful sister: (“She was unable to battle gravity, which got here up and seized her like a dragon and purchased her to the underside”). It was at one in all Babson’s seminars years later that he carried out that illustrated how Newton’s Third Regulation might be utilized to the inventory market when he met Alan Andrews. They grew to become hardened associates and Babson taught Andrews his motion and response methods. Out of respect of Babson’s research that he shared with Andrews, he later named his median line course the Motion-Response Course in acknowledgement of his mentor’s teachings.

Though Alan Andrew’s date of delivery stays unknown, we do know he handed on in 1985. Little is thought of his private life, spouse or youngsters. His father owned a dealer/vendor the place he traded for shoppers and his personal account and is claimed to have made a big sum of money within the Nice Despair. Alan’s father despatched him to engineering college at Massachusetts Institute of Know-how after which on to Harvard. The story goes that after he graduated, his father challenged him to make a million {dollars} in a single yr whereas working at his father’s brokerage agency. He didn’t accomplish his father’s job in a single yr, however in two years had made a million {dollars} buying and selling commodities. Andrews later grew to become a lecturer in civil engineering on the College of Miami in Florida. After he retired, he returned to his roots and determined to not solely handle his personal investments however to show others. He started publishing a weekly advisory publication that he offered by subscription that targeted on his buying and selling strategies and included suggestions for the approaching week. He additionally created the FFES (Basis for Financial Stabilization) Case Examine Course making use of rules of mathematical chance to the manufacturing of earnings from prognostication. It detailed numerous median line strategies and different methods that together with fan traces which he known as Horn’s of Lots. He offered the course for the tidy sum of $1,500 in the course of the 1960’s and 1970’s. He additionally held seminars and one-on-ones that had been attended by New York and Chicago pit merchants. Andrews additionally typically integrated his scholar’s observations and research into his work, cautious to call strategies such at Schiff Adjusted Median Line (named after Jerome Schiff a New York dealer who introduced it to his consideration) and Hapogian Traces named after one other one in all his college students Dr. Hapogian.

It has not been the authors’ intention to instruct readers within the Historical past of the Growth of Median Line Evaluation on the development of Median Traces or to delve into different guidelines or analytical idiosyncrasies of the completely different methods or functions of Andrews Pitchfork. These might be mentioned within the weblog posts that observe over the following few weeks.