If the Fed succeeding is a “Black Swan,” carry it on.

What if the “Black Swan” of 2023 is the Federal Reserve succeeds? Two stipulations right here:

1. “Black Swan” is in quotes as a result of the frequent utilization has widened to incorporate occasions that don’t match Nassim Taleb’s authentic standards / definition of black swan; the time period now consists of occasions thought of unlikely or which might be off the radar screens of each the media and the alt-media.

2. The definition of “Fed success” isn’t so simple as the media and the alt-media current it.

Within the standard telling, the Fed made a coverage mistake in preserving rates of interest and quantitative easing (QE) in place for too lengthy, and now it’s made a coverage mistake in reversing these insurance policies. Huh? So ZIRP/QE was a coverage mistake, OK, we get that. However reversing these coverage errors can also be a coverage mistake? Then what isn’t a coverage mistake? Doing nothing? However wait, isn’t “doing nothing” sustaining ZIRP/QE or ZIRP/QE Lite?

This narrative is senseless.

The opposite standard narrative has the Fed’s coverage mistake as tightening monetary circumstances, a.okay.a. reversing ZIRP/QE, an excessive amount of too rapidly, as this may trigger a recession. OK, we get the avoidance of recession is taken into account “a great factor,” however aren’t recessions a vital cleaning of extreme debt and hypothesis, i.e. a vital a part of the enterprise cycle with out with unhealthy debt, zombies and malinvestments construct as much as ranges that threaten the soundness of your entire system?

Sure, recessions are a vital a part of the enterprise cycle. So avoiding recessions is systemically disastrous. So in line with this narrative, the Fed ought to “do no matter it takes” to keep away from recession, despite the fact that a long-overdue recession is desperately wanted to cleanse the deadwood, unhealthy debt, zombie enterprises and speculative excesses from the system.

So this narrative can also be nonsense.

A popular narrative of the alt-media is that debt ranges are too excessive and the Fed jacking up charges will crush the financial system so badly it’ll usher in Melancholy and TEOTWOWKI (the top of the world as we all know it). OK, we get that debt service (curiosity funds) rising will stress households, enterprises and governments, however once more, isn’t the self-discipline of capital truly costing one thing an essential suggestions in a wholesome financial system?

The right reply is sure. With out the self-discipline imposed by capital truly costing one thing significant, then you find yourself with the orgy of borrowing, malinvestment, corruption and speculative extra that’s presently undermining the long-term stability and vitality of our financial system.

So this narrative can also be nonsense. Fearing the price of capital may crush extreme borrowing, malinvestment, corruption and hypothesis is to cheer on the collapse of an financial system hollowed out by the near-zero price of capital.

If greater charges disintegrate zombies (entities dwelling off lowering debt service by refinancing debt at decrease charges), that’s a great factor, not a nasty factor. If marginal debtors who had been going to default anyway can not borrow extra, that’s additionally a great factor. If malinvestments that solely made sense with zero-cost capital are not funded, that’s a great factor, not a nasty factor.

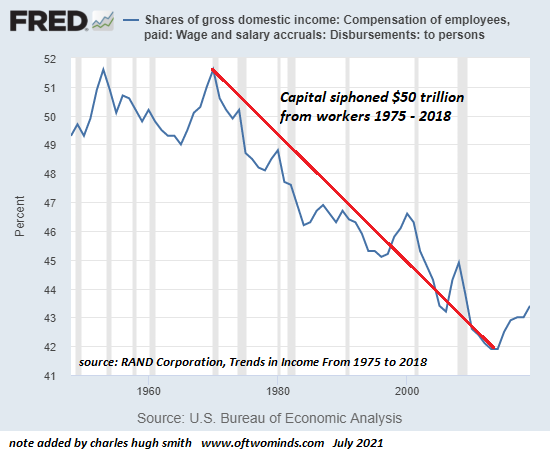

One other narrative has the Fed tightening monetary circumstances with the intention of destroying the labor market because the means to scale back inflation. OK, we get that greater wages are enhance the prices of employers, however what concerning the previous 45 years of wage suppression (See chart beneath) throughout which capital siphoned $45 trillion off of labor?

What if inflation is being pushed by greater than wages snapping again from 45 years of suppression imposed by financialization and globalization? What if what’s driving inflation isn’t wages however the reversal of the gross distortions created by hyper-financialization and hyper-globalization?

Put one other means: possibly the Fed isn’t as blind to the sources of wages rising (demographics, and so on.) as many suppose. Possibly the Fed sees a powerful labor market and rising wages for what they’re, good issues, not unhealthy issues.

Summing up: the hysteria a couple of recession is totally misplaced. Recessions–of a sure form, we should stipulate– are a vital a part of a wholesome enterprise cycle, and as soon as that is understood, then we ought to be cheering for a recession of the type that imposes desperately wanted self-discipline on an financial system being crippled by the excesses triggered by zero-cost capital and extreme debt / leverage / hypothesis.

One other well-liked narrative has the US greenback going to zero sooner reasonably than later because it’s changed by multipolar currencies and preparations. OK. we get some great benefits of a multipolar world and competing currencies / cost schemes–competitors is an effective factor when it’s clear and everybody has to observe the identical guidelines–however aren’t we lacking one thing essential about currencies right here?

There’s a humorous factor known as curiosity. If you purchase a bond issued by a sovereign state treasury, that bond pays the proprietor curiosity denominated (as a normal rule) within the sovereign state’s forex.

As a normal rule, greater curiosity is healthier than near-zero curiosity. The upper the rate of interest, the extra moolah the bond proprietor earns.

The potential spoiler is threat: if the sovereign state defaults on that stunning high-interest-rate bond, then a lot or the entire capital invested within the bond is misplaced. That’s a nasty factor. If the sovereign state’s forex drops in buying energy (i.e. it buys progressively much less oil, grain, semiconductors, and so on. per unit of forex), that’s additionally a nasty factor as a result of a ten% drop in buying energy vis a vis different currencies and commodities not solely offsets the 5% curiosity, it reduces the worth (as measured by buying energy) of the capital.

So greater curiosity is barely of curiosity (heh) if the chance of default and forex devaluation is low. This brings up one other well-liked narrative: a forex dropping worth vis a vis different currencies is an effective factor as a result of it (supposedly) makes our exported items and providers extra enticing as a result of they’re now cheaper.

Wait a minute. So lowering the buying energy of everybody’s cash by devaluing the nation’s forex is an effective factor as a result of a handful of exporters may profit? However because the worth of the forex is dropping, how a lot will they really acquire when measured in buying energy? And what concerning the 95% of the individuals and financial system who turn out to be poorer as their forex loses buying energy?

This narrative can also be nonsense. A stronger forex is an effective factor for the overwhelming majority of the citizenry and the financial system as a result of it magically will increase the buying energy of everybody’s cash. A devalued forex is a disaster, not a great factor. A forex that’s gaining buying energy is an effective factor.

If we put this all collectively, we see how the Fed may effectively succeed, with success outlined thusly:

1. the labor market doesn’t collapse and wages proceed rising.

2. A much-needed cleaning of distorting excesses attributable to zero-cost capital has already taken place over the previous 12 months.

3. The upper yields on US Treasury bonds and private-sector debt has strengthened the US greenback, rising the buying energy of everybody utilizing / holding {dollars}, i.e. 100% of the American populace, and everybody who owns dollar-denominated belongings globally.

Measuring “recession” by the inventory market, housing or GDP is deceptive. Belongings inflated to bubble heights by zero-cost credit score have to be deflated by pushing the price of capital excessive sufficient to impose much-needed self-discipline. Hypothesis / malinvestment pushed by hyper-financialization and hyper-globalization are harmful to the long-term stability and well being of the financial system and nation and these have to be deflated together with the asset bubbles.

If we measure “recession” by the success of reimposing some much-needed self-discipline through tighter monetary circumstances and better charges of curiosity, we get a a lot totally different definition of success. Sarcastically, the inventory market will truly do a lot better as soon as the excesses of zero-cost capital have been wrung out of the system.

By elevating charges aggressively, the Fed has wrung a lot of this extra out of the system, with out many even noticing. By telegraphing the top of The Fed Put, zero-cost capital and extreme stimulus, the Fed has put the world on discover {that a} weaker greenback and an financial system primarily based on speculative malinvestment is not “the protected wager.”

That’s the definition of success if we care to revive stability and vigor.

It’s exhausting to not discover the emotional need of many observers for the Fed to fail. Many object (for good causes) that the Fed even exists. (I’m sympathetic to this view.) Others hope the system collapses in a heap as a result of it so richly deserves it, or as a result of it ought to collapse for one motive or one other.

We are able to perceive the emotional satisfaction to be derived from the omnipotent Fed failing, but when we put aside the numerous delights of schadenfreude and concentrate on the long-term stability and vitality of our financial system, society and nation, we should always cheer aggressively greater charges that are stored excessive, come what might, as the required price of reimposing desperately wanted self-discipline through greater charges and tightening monetary circumstances, and a equally wanted protection of the nation’s forex.

If the Fed succeeding is a “Black Swan,” carry it on.

Hat tip to Santiago Capital for this tweet: Ever cease to suppose that the Black Swan everyone knows is on the market…is the Fed pulling this off?