The S&P 500 (SPY) managed to interrupt via the vital 4,000 stage, which is nice information for inventory merchants. Seems to be like we’d have the ability to climb that wall of fear in any case! How did we handle to show issues round after “the worst week” to date in 2023? Learn on to search out out.

(Please get pleasure from this up to date model of my weekly commentary initially revealed March third, 2023 within the POWR Shares Below $10 publication).

Market Commentary

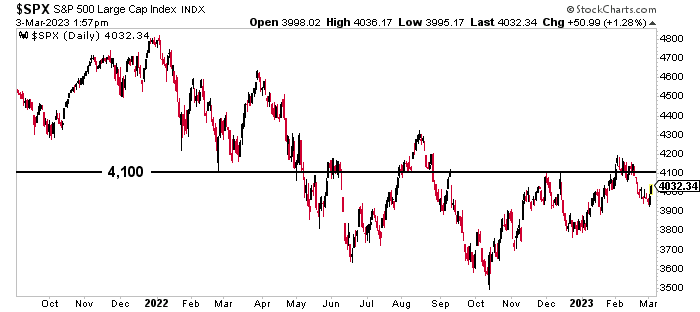

he previous two days have seen a couple of constructive catalysts that kicked issues right into a constructive path and pushed shares again above 4,000 (though we nonetheless have a methods to go earlier than we retest the vital 4,100 stage).

First off, the 10-year Treasury yield additionally dropped under 4%, which was a constructive signal for the market.

The PMI information for February additionally had merchants’ consideration. PMI improved to 50.6, beating analysts’ consensus of fifty.5. ISM Non-Manufacturing PMI went down from 55.2 to 55.1, however nonetheless managed to exceed expectations.

In line with Andrew Hunter, Deputy Chief U.S. Economist at Capital Economics, the figures counsel that the financial system is rising, however not as quick as some folks had been considering.

Most market segments, particularly Client Cyclical and Actual Property shares, had a great day, apart from Client Defensive shares, which did not see a lot upward motion.

This means merchants are nonetheless in “threat on” mode, which implies they’re keen to spend money on extra risky belongings proper now. That is nice for our shares underneath $10.

If the S&P 500 (SPY) stays the place it’s, we’ll have a constructive week, which is an enormous win after final week, which was one of many worst to date this yr.

The Federal Reserve additionally made headlines this week, because it launched its semiannual Financial Coverage Report back to Congress. The report lays out the Fed’s plan to proceed rising rates of interest to get inflation again to 2%.

Atlanta Federal Reserve President Raphael Bostic wrote an essay calling for the central financial institution to lift its coverage price by 50 foundation factors to a spread of 5%-5.25% after which maintain it there till properly into 2024.

He additionally mentioned he is maintaining a tally of the information and can alter his coverage trajectory if mandatory.

The Fed elevated the benchmark price by 1 / 4 of a proportion level in February, and can launch new projections after the March 21-22 assembly.

Similar to we noticed final yr, the market will doubtless make some massive strikes based mostly on what the Fed officers say between every now and then.

Conclusion

Whereas this week noticed some wins for the bulls, much more must occur for the S&P 500 to overhaul the vital 4,100 stage once more.

However our portfolio carried out properly final yr regardless of the volatility, and I count on we’ll see the identical this yr, particularly contemplating we’ve got some constructive catalysts coming for a handful of our holdings.

What To Do Subsequent?

If you would like to see extra high shares underneath $10, then it is best to try our free particular report:

What provides these shares the appropriate stuff to grow to be massive winners, even on this brutal inventory market?

First, as a result of they’re all low priced firms with probably the most upside potential in right this moment’s risky markets.

However much more vital, is that they’re all high Purchase rated shares in accordance with our coveted POWR Scores system and so they excel in key areas of progress, sentiment and momentum.

Click on under now to see these 3 thrilling shares which might double or extra within the yr forward.

All of the Finest!

Meredith Margrave

Chief Development Strategist, StockNews

Editor, POWR Shares Below $10 E-newsletter

SPY shares . Yr-to-date, SPY has gained 5.69%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

In regards to the Writer: Meredith Margrave

Meredith Margrave has been a famous monetary knowledgeable and market commentator for the previous twenty years. She is at present the Editor of the POWR Development and POWR Shares Below $10 newsletters. Study extra about Meredith’s background, together with hyperlinks to her most up-to-date articles.

The publish Is the Inventory Market Lastly Bouncing Again? appeared first on StockNews.com