The inventory market is affected by many issues just like the Fed and the financial system. Nevertheless, there may be not sufficient discuss how the motion of bond charges makes shares roughly enticing. Like how the S&P 500 (SPY) is having a horrible September as bond charges explode larger. Study extra about this dynamic relationship and what it means for inventory costs within the days forward.

Traders have lengthy appreciated the connection that when charges go up…shares go down.

That was a major catalyst behind the 2022 bear market. But traders have been inspired in 2023 that inflation was coming underneath management…and thus charges would head decrease sooner or later. This had shares again on the rise for almost all of the yr.

Then on 9/20 the Fed mentioned “NOT SO FAST!” which had charges spiking once more…and traders fleeing shares.

Did that story take a flip for the higher on Thursday?

Let’s assessment on this week’s commentary.

Market Commentary

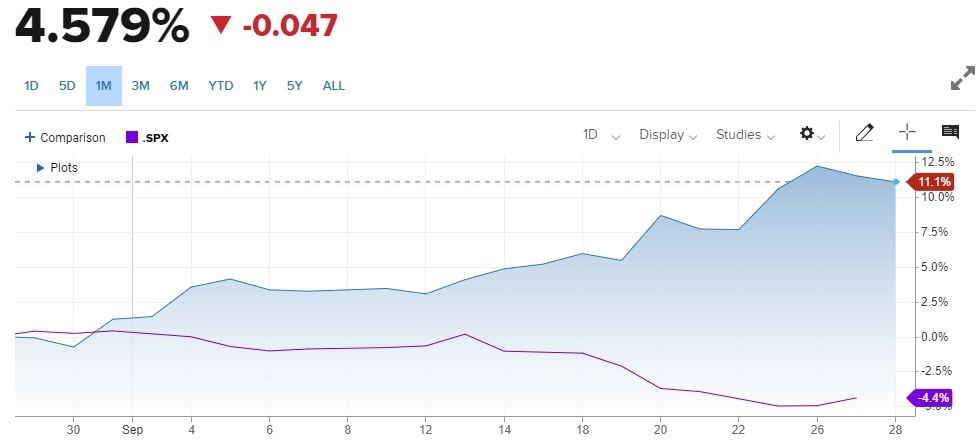

One of the best place to start out our dialog is with this 1 month chart exhibiting the rise of the ten 12 months Treasury price vs. the decline of the S&P 500 (SPY):

The inverse relationship is kind of obvious. As charges accelerated larger later within the month…the inventory decline accelerated as effectively.

The explanations behind the upper charges was defined intimately in my commentary after the 9/20 Fed announcement. Right here is the core part for our dialogue as we speak:

“…Nutshell of the Wednesday Fed announcement.

The financial system is doing higher than we anticipated…so it’s going to take a bit longer to deliver down inflation to focus on degree…the excellent news is that we actually imagine we are able to do it with out making a recession.

So why did shares go down on this seemingly optimistic outlook?

As a result of the dot plot of price expectations by Fed officers now has the top of 2024 price nonetheless means up at 5.1%. That was revised larger from the earlier estimate of 4.6%.

Sure, this most definitely matches in with the Fed narrative of “larger charges for longer”, however for much longer and better than traders beforehand anticipated.”

Now let’s slim in on what occurred with 10 yr Treasury charges on Thursday:

This sooner or later chart exhibits how charges continued to spike early within the session Thursday up in the direction of a excessive of 4.688%. But dramatically reversed course ending the session down at 4.577%. That additionally helped shares take pleasure in one in every of their finest periods shortly. (The bond dump prolonged into Friday which will increase the chances we have now seen peak charges).

Please keep in mind that charges have been down round 3.8% only a couple months in the past. It is a dramatic transfer that will have lastly run its course. If that’s the case, then it helps enhance the chances that we have now made a backside with shares transferring larger from right here.

The most important shock I see with the current rise in bond charges is how the probability of a price hike on the November 1st Fed assembly has dropped from 62% only a month in the past to solely 19% as of as we speak. Additional the concept of a elevate occurring by the December 13th assembly has declined to 36%.

This data simply doesn’t jive with Fed statements in September which appeared to point sturdy probability of not less than yet one more hike. Nor does it jive with hovering bond charges. Once more, maybe one other clue that the rally in bond charges is overextended and able to retreat which is nice for shares.

Pulling again to the large image it is extremely onerous to have a bear market and not using a recession forming. And proper now the chances of which are pretty low.

That’s the reason I imagine that this dump is discovering a backside round present ranges. And maybe no additional than the 200 day transferring common closing in on 4,200. That’s the draw back chance.

Whereas the upside potential this yr has us retesting the highs of 4,600 seen in late July. After which subsequent yr possible cracking above 5,000.

Thus, I like to recommend staying absolutely invested on this market. The important thing to success is selecting the very best investments. And that’s what we are going to cowl within the subsequent part…

What To Do Subsequent?

Uncover my model new “2024 Inventory Market Outlook” overlaying:

- Bear Case vs. Bull Case

- Buying and selling Plan to Outperform

- Prime 11 Picks for the 12 months Forward

- And A lot Extra!

Acquire entry to this very important presentation now by clicking under:

2024 Inventory Market Outlook >

Wishing you a world of funding success!

Steve Reitmeister…however everybody calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Whole Return

SPY shares have been buying and selling at $430.78 per share on Friday morning, up $2.26 (+0.53%). 12 months-to-date, SPY has gained 13.89%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

In regards to the Creator: Steve Reitmeister

Steve is healthier identified to the StockNews viewers as “Reity”. Not solely is he the CEO of the agency, however he additionally shares his 40 years of funding expertise within the Reitmeister Whole Return portfolio. Study extra about Reity’s background, together with hyperlinks to his most up-to-date articles and inventory picks.

The submit Inventory Market vs. Bond Charge Relationship Revealed appeared first on StockNews.com