This text/submit comprises references to services or products from a number of of our advertisers or companions. We might obtain compensation if you click on on hyperlinks to these services or products

You are studying Investor Junkie’s weekly e-newsletter that will get you caught up on the week’s monetary information in lower than 5 minutes.

Final week’s market abstract (July Eleventh-July fifteenth, 2022):

- S&P 500: -0.46%

- Dow: +0.03%

- Nasdaq: -0.63%

- Bitcoin: +1.49%

One other month has passed by and inflation has hit one more 40-year excessive. However in contrast to in earlier months, this time there’s really a robust signal that the tide is about to show.

Netflix is partnering with Microsoft to serve advertisements on its cheaper ad-supported tier that is set to come back out subsequent 12 months. That is an enormous snag for Microsoft, however might there could also be extra to the deal than meets the attention?

Crypto lenders are falling like flies and the FDA obtained its first software for an over-the-counter contraception capsule. Get the complete scoop on all these tales under and see which of this week’s incomes experiences we’re most desperate to see.

Clint, Editor-in-Chief

What Everybody’s Been Buzzing About

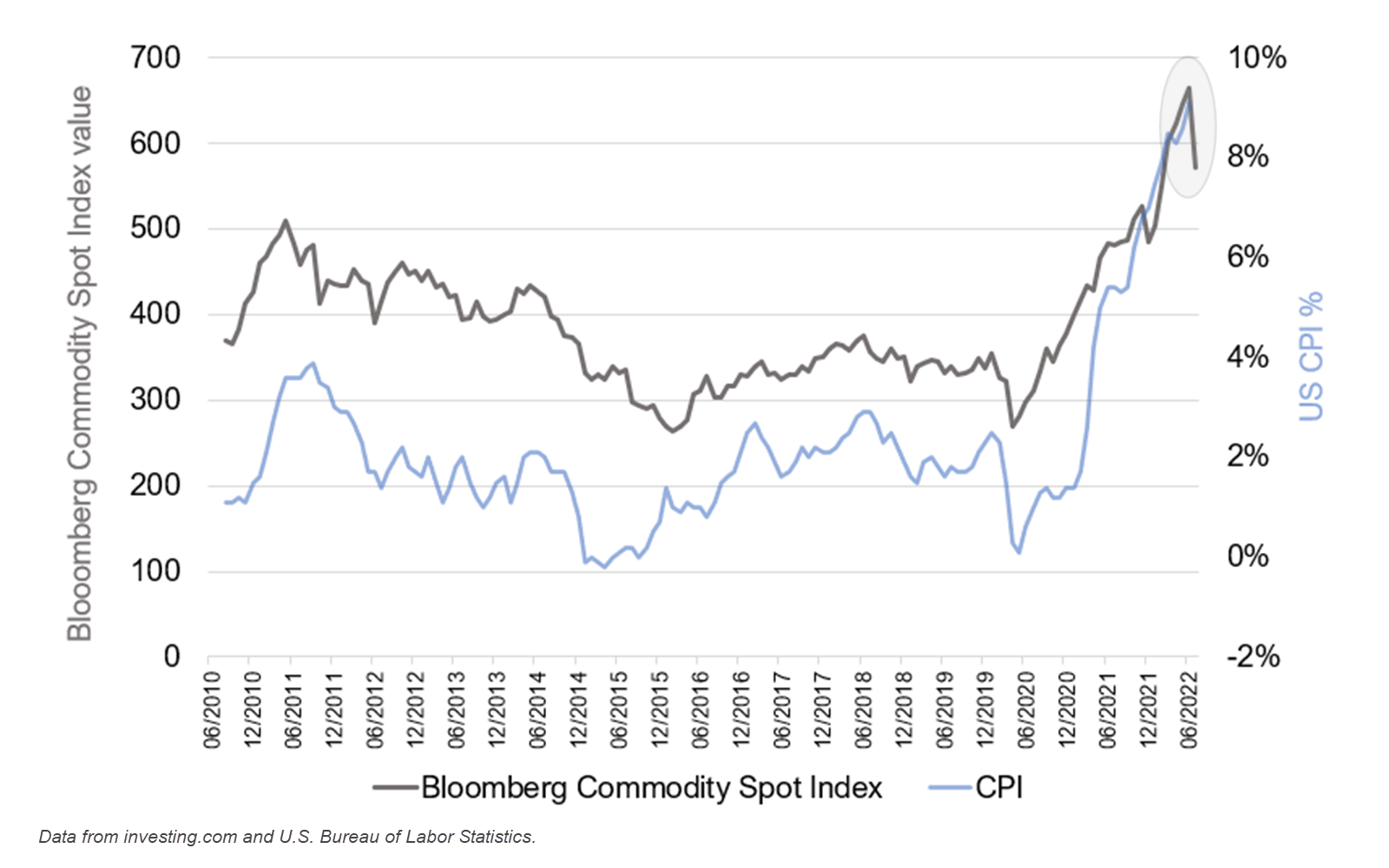

Inflation remains to be horrible – however some see gentle on the finish of the tunnel. The most recent Shopper Value Index (CPI) confirmed that inflation rose 9.1% in June. That is the best fee we have seen because the inflation disaster of the Eighties. However many analysts are inspired to see that the Bloomberg Commodity Spot Index (BCOMSP) has been declining sharply since June.

- As commodities go… So tends to go inflation. The BCOMSP tracks the futures costs of client items like meals and vitality. And because the chart under reveals, this index has traditionally been among the finest main indicators of the how the inflation fee will transfer subsequent. So if that development holds true, there is a good likelihood that a few month from now we’ll lastly have some optimistic inflation information to debate.

Picture credit score: Finimize

Microsoft’s advert enterprise will get an enormous enhance from Netflix. Microsoft introduced final Wednesday that it’ll function the worldwide promoting expertise and gross sales accomplice for Netflix’s upcoming ad-supported tier. This can be a massive win for Microsoft and immediately makes it a significant participant within the advert tech tempo. Some say that Microsoft’s current acquisition of Xandr from AT&T performed an necessary position in serving to it to seal the deal.

- Let’s be cynical. Reportedly, Google and Comcast have been the opposite two finalists to serve the advertisements. However each of these firms have their personal streaming platforms that instantly compete with Netflix. I believe that had extra to do with Microsoft successful the deal than any kind of technical benefits it could possess. One analyst has speculated that Netflix is cozying as much as Microsoft as a result of it is hoping to be acquired down the street, however I am not personally shopping for that idea.

Head-to-head comparability: >>> Apple vs. Microsoft: Key Variations For Traders to Take into account

Voyager and Celsius each filed for chapter. Each firms have been massive names within the crypto lending area. That is a distinct segment that exploded over the previous two years as people and establishments flocked to those platforms to borrow towards their crypto property. However I do not assume it is a coincidence that these are the primary two firms to file for Chapter 11 this 12 months, whereas Binance.US and FTX (which each focus way more on buying and selling than lending) have been seeking to develop in 2022.

- The larger they’re, the more durable they fall. Simply final November, Celsius was valued at $3.5 billion throughout a $750 million funding spherical. And Voyager Digital’s inventory (VYGF) worth reached its peak of over $27 per share in March 2021. Now, each firms are bancrupt and VYGF is buying and selling for round $0.27 as of writing. Their tales are poignant examples of the high-risk, high-reward stakes that include being a crypto lender.

Redfin inventory falls after it says failing offers are at a 2-year excessive. Redfin (RDFN) stumbled almost 10% after the corporate introduced that housing contracts are falling by on the highest fee in 2 years. This comes only a month after the corporate laid off 8% of its workforce in expectation of a cooling market. Shares of RDFN are actually down almost 85% from this identical time final 12 months.

- Sorry, not sorry. Potential homebuyers are unlikely to really feel sympathy for Redfin’s current misfortunes. In only one 12 months, their price to buy a house has risen by ~50%. So it is no shock that purchaser’s regret is inflicting lots of them to tug out of offers earlier than they attain the closing desk – particularly since we’re lastly beginning to see contracts embrace contingencies as soon as once more.

Keep optimistic >>> 3 Advantages of Shopping for a Residence When Curiosity Charges Are Excessive

FDA obtained its first software for a “mini” contraception capsule. Paris-based HRA Pharma has requested the FDA to approve its over-the-counter contraception capsule. Also known as “mini capsules,” these oral contraceptives solely embrace progestin (whereas “mixture capsules” embrace estrogen as effectively). Mini capsules can be found around the globe, however have but to obtain U.S. approval. Cadence Well being is hoping to submit an FDA software for its personal mini capsule within the subsequent 12 months.

- All eyes are on the reproductive healthcare area. Because the overturning of Roe vs. Wade, contraception entry has obtained extra consideration. The provision of a non-prescriptive contraception capsule might considerably scale back the variety of unintended pregnancies that happen within the U.S. annually. Along with pharmaceutical firms like HRA Pharma, many anticipate girls to extra broadly rely on FemTech firms (assume interval trackers, fertility apps, and girls’s telemedicine providers) within the Put up-Roe world.

What To Maintain Your Eye on This Week

Earnings experiences from massive banks. A number of of the most important U.S. banking firms are reporting quarterly earnings this week, together with JPMorgan, Morgan Stanley, Wells Fargo, Citigroup, and PNC. Wall Road will probably be particularly being attentive to the amount of money these banks are reserving as this might point out their degree of concern concerning an impending recession.

Hunker down >>> How one can Put together for a Recession in 2022, 2023, and Past

American Airways and United Airways Earnings are reporting earnings too. That is two of the highest three airways within the U.S. The third airline, Delta, reported earnings final week. It posted income that have been post-pandemic highs, but nonetheless $350+ million under expectations as a consequence of skyrocketing prices.

Employees Favorites

Listed here are three tales from across the net that our group discovered attention-grabbing:

Having fun with this text and wish it to be delivered proper to your inbox? Join under!