How we profited from the ability of the POWR scores with a robust pairs commerce philosophy on VAL and HP.

Alfred Winslow Jones is extensively credited with creating the primary hedge fund, or extra precisely “hedged fund”, within the late Nineteen Forties.He supposedly acquired the concept whereas researching a markets article for Fortune journal.

The concept was fairly basic-create a hedge, or pairs commerce, by shorting shares he thought would drop in worth whereas shopping for shares he thought would head greater. It’s referred to as a pairs commerce since each the bullish and bearish commerce are accomplished simultaneously-or paired collectively.

For instance, shopping for Ford (F) and shorting Basic Motors (GM) could be a traditional pairs commerce should you anticipated Ford to outperform GM.

This primarily dampens down total market threat. Even higher if the quick and the lengthy inventory have been in the identical trade to vastly scale back sector threat.

This can be a core technique we’ve employed from inception within the POWR Choices Portfolio, however with a number of extra advantageous options.

- We use choices, not inventory, to take the offsetting quick and lengthy positions. Shopping for bearish places on the “unhealthy” shares and bullish calls on the “good” shares. This can be a a lot cheaper method to create a hedged commerce. It additionally has outlined threat.

- The portfolio depends on the POWR scores to assist determine the very best rated shares to purchase with bullish name purchases and the bottom rated shares to quick with bearish put purchases. Since inception, the Sturdy Purchase (A Rated) and Purchase Rated (B Rated) POWR Shares have outperformed the S&P 500 by over 3x. The F Rated Sturdy Promote and D Rated Promote POWR Inventory have fallen by practically 4X the S&P 500.

- Look to uncover conditions the place the decrease rated shares have briefly outperformed the upper rated shares to supply extra edge from the anticipated imply reversion.

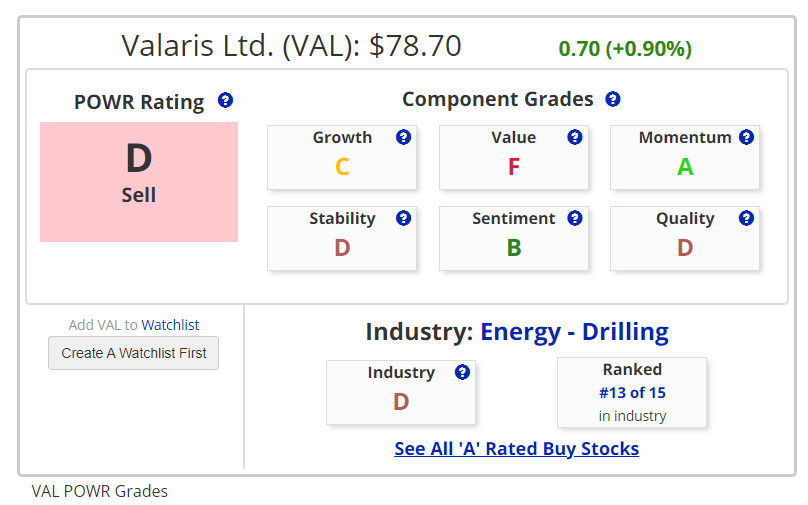

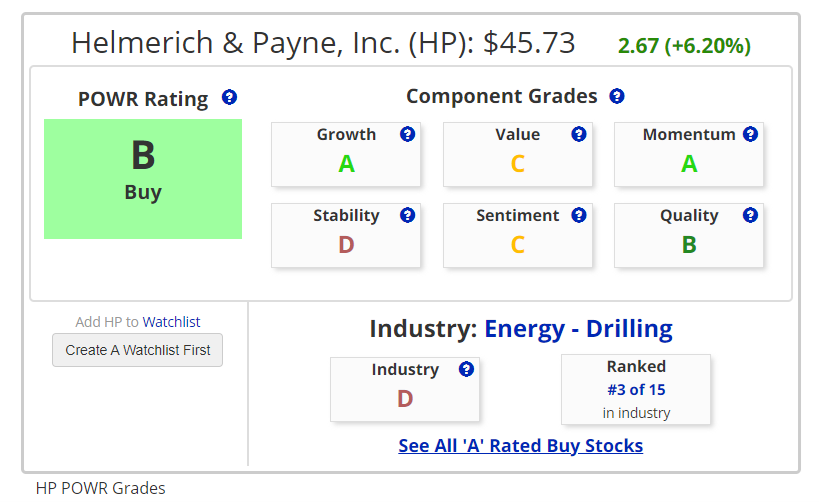

Let’s take a stroll by means of a pairs commerce lately accomplished within the POWR Choices Portfolio to assist shed some gentle on the method. It was a mix of a put buy on the decrease D rated Valaris (VAL) and a name buy on the upper B rated Helmerich & Payne (HP). Each shares have been within the Vitality-Drilling Business.

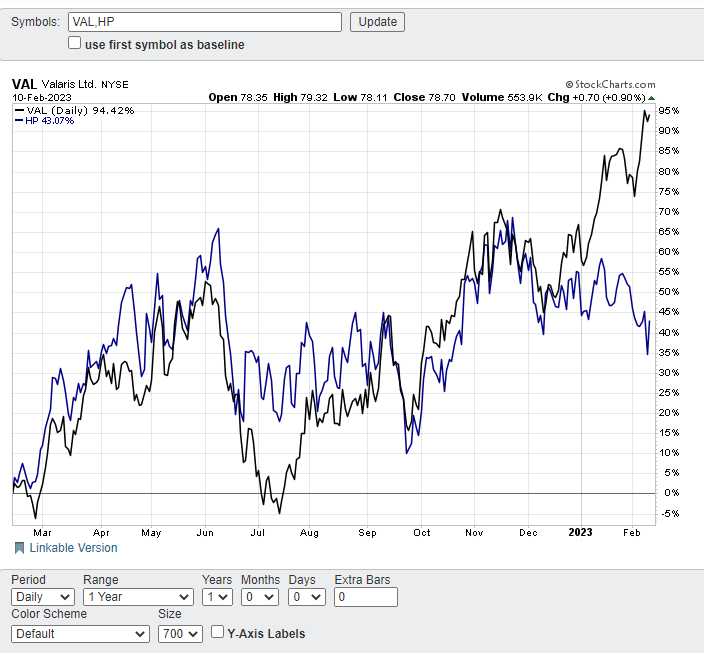

The comparative chart beneath from February 10 reveals how decrease rated Valaris (VAL) had dramatically outperformed greater rated Helmerich & Payne (HP) by over 50% prior to now 12 months, with most of this outperformance starting in early December. Earlier than that point, you possibly can see that the 2 shares have been extra extremely correlated-or moved extra in tandem collectively.

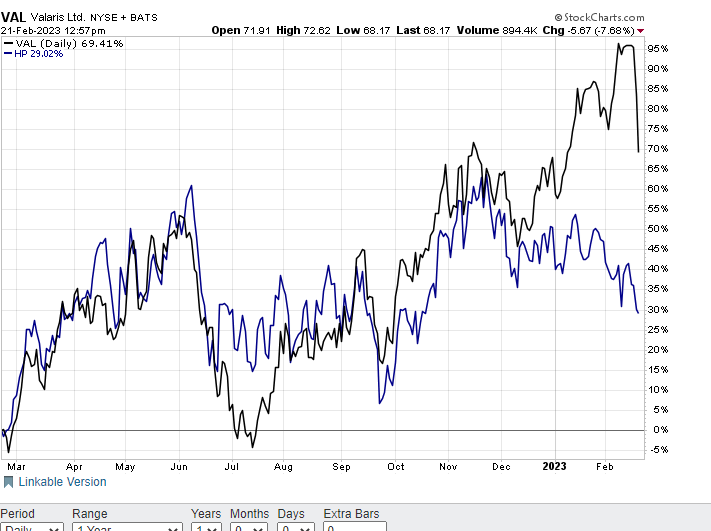

On February 21 the comparative efficiency differential converged by roughly 10%. Each shares fell, however VAL dropped at a far quicker tempo than HP.

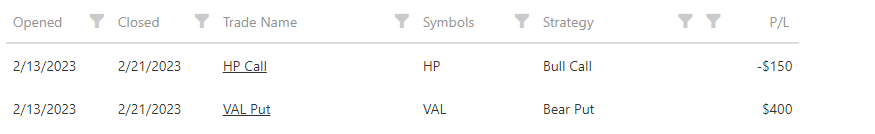

Initially, on 2/13, the POWR Choices Portfolio purchased the HP Calls at $5.50 and the VAL places at $5.00 for a mixed outlay of $1050.

One week later, the convergence generated a revenue. POWR Choices bought the HP calls at $3.50 and the VAL places at $9.50 for a complete mixed credit score of $1300, or a web acquire of $250 .

General acquire, as proven, was $250 whole web revenue on $1050 invested. This equates to a web return of 23.8% in every week. Not a foul short-term return for a low threat commerce.

All achieved by taking an outlined threat bullish name place on the upper rated,however underperforming, Helmerich and a bearish put place on the decrease rated, however outperforming, Valaris.

The particulars are proven beneath:

2023 could also be shaping up as a 12 months the place shares go nowhere. That is very true given the red-hot begin to the 12 months following such a dismal 2022.

Buyers and merchants alike could also be nicely served placing the POWR Choices pairs commerce philosophy to work as a part of their buying and selling toolbox. Decrease threat with nonetheless sizeable potential returns is a viable technique in any market, particularly the one we discover ourselves in presently.

POWR Choices

What To Do Subsequent?

In case you’re in search of the perfect choices trades for at this time’s market, it’s best to take a look at our newest presentation Tips on how to Commerce Choices with the POWR Scores. Right here we present you tips on how to constantly discover the highest choices trades, whereas minimizing threat.

If that appeals to you, and also you need to be taught extra about this highly effective new choices technique, then click on beneath to get entry to this well timed funding presentation now:

Tips on how to Commerce Choices with the POWR Scores

All of the Finest!

Tim Biggam

Editor, POWR Choices Publication

VAL shares closed at $65.30 on Friday, up $0.36 (+0.55%). Yr-to-date, VAL has declined -3.43%, versus a 3.65% rise within the benchmark S&P 500 index throughout the identical interval.

In regards to the Creator: Tim Biggam

Tim spent 13 years as Chief Choices Strategist at Man Securities in Chicago, 4 years as Lead Choices Strategist at ThinkorSwim and three years as a Market Maker for First Choices in Chicago. He makes common appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Community “Morning Commerce Reside”. His overriding ardour is to make the advanced world of choices extra comprehensible and subsequently extra helpful to the on a regular basis dealer. Tim is the editor of the POWR Choices publication. Study extra about Tim’s background, together with hyperlinks to his most up-to-date articles.

The submit How To Pare Down The Danger And Pump Up The Earnings With A Pairs Commerce Strategy appeared first on StockNews.com