This text is a paid partnership with Vigorous. All opinions are our personal, however we advocate Vigorous as an HSA supplier.

Well being Financial savings Accounts, or HSAs, have gotten a well-liked selection for each employers and workers. With open enrollment season upon us, let’s discuss somewhat about how the HSA works, and the way you even have a large choice in the case of who manages your HSA.

The idea of an HSA could be scary at first – particularly if you happen to’re used to an HMO or PPO plan. Nevertheless it’s essential to keep in mind that the HSA isn’t insurance coverage – it’s a further characteristic to your regular medical health insurance that some plans provide.

When you’ve got the flexibility to pick an HSA well being care plan – whether or not by means of your employer or by means of the open market, we predict it’s the best choice.

Right here’s what it’s good to learn about HSAs, and how one can change suppliers out of your office plan if you happen to want higher choices. That approach, you possibly can swap to Vigorous (which is likely one of the finest HSA suppliers) even if you happen to’re employed.

What’s An HSA?

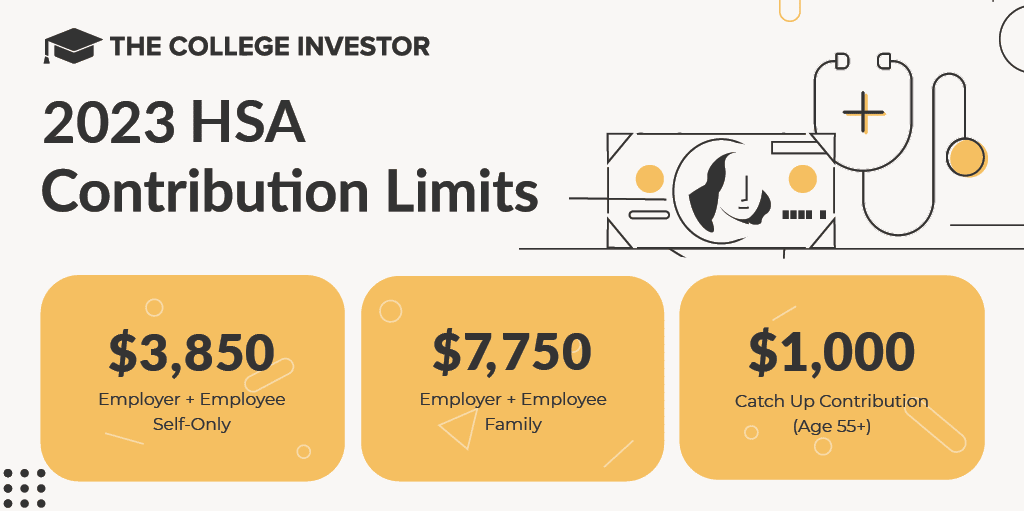

An HSA is a well being financial savings account. This account can be utilized to economize or make investments cash for use for well being care or different bills. You’ll be able to contribute as much as the 2023 annual HSA contribution limits of $3,850 for people or $7,750 for households.

It’s accessible to people who go for a qualifying excessive deductible medical health insurance plan. This plan might be supplied by an employer or it may be bought on a market.

The foundations for a qualifying well being care plan are:

- In 2023, your medical health insurance will need to have an annual minimal deductible of $1,500 for people and $3,000 for households.

- In 2023, the annual out-of-pocket most can’t be greater than $7,500 for people and $15,000 for households. This definition solely applies to the in-network providers.

- The medical health insurance plan have to be in order that the person/household pays the primary value of healthcare as much as the deductible earlier than any form of insurance coverage kicks in (preventative care excluded from this definition). This consists of pharmaceuticals as properly. The deductible and most out-of-pocket bills are listed yearly for inflation.

- Household protection is decided by having an insurance coverage coverage that covers you and at the least one different particular person.

You could find the full HSA well being plan necessities right here.

So, it’s essential to notice that the HSA is an account, and you continue to have medical health insurance. Lots of people overlook this and by some means assume an HSA is costlier.

However the advantages of an HSA are wonderful, and it makes it completely price it if you happen to’re eligible.

Is An HSA Value It?

HSAs are superior saving and investing autos as a result of they obtain a triple tax benefit (however truly there are 5 main benefits).

Right here’s what you get with an HSA:

- Contributions are pre-tax, so it lowers your taxable revenue

- Progress is tax free throughout the account (similar to an IRA)

- Withdrawals are tax free for qualifying medical bills

- You should utilize your HSA for Medicare premiums tax-free

- You’ll be able to withdraw your cash in retirement penalty free, similar to a conventional IRA

That’s why we prefer to name the HSA the Secret IRA – it’s like an IRA, however higher!

The large issue that makes an HSA price it’s the truth that you possibly can make investments throughout the HSA. However that is additionally the largest detriment many HSA plans face. Too many don’t help you make investments, or in the event that they do, they cost charges or have excessive minimums.

However don’t fret – in contrast to a 401k, you possibly can change your HSA supplier anytime! Should you’re not self-employed, you possibly can nonetheless transfer your HSA to a greater supplier if you happen to select.

How To Change Your HSA From Your Office Supplier (Even If You’re Not Self Employed)

Should you’re not glad along with your office HSA supplier, or are opening an HSA for a plan to procure on {the marketplace}, it’s important that you simply select an amazing HSA supplier.

Reminder: You’ll be able to change your HSA supplier even whereas nonetheless working at your organization! Not like a 401k, you possibly can change your HSA supplier anytime!

What makes an amazing HSA supplier?

- No charges to keep up an account

- Low charges to take a position

- Potential to put money into low value mutual funds

- Quick access to your funds

Because of this we like Vigorous. They provide a very free well being financial savings account – no hidden charges. They provide as much as 3 free debit playing cards to entry your funds simply (who wants greater than three anyway), and so they provide the flexibility to take a position.

Investing is additionally free at Vigorous, and you’ll make investments 100% of your HSA (in contrast to different suppliers and most company HSA accounts), and also you make investments at Charles Schwab. They provide among the finest low value index funds available on the market.

You will not discover a higher deal than free!

However what when you have an employer HSA? It’s nonetheless potential to switch your funds over to Vigorous – even whilst you’re nonetheless employed. You simply must do a trustee-to-trustee switch and transfer the funds over (which is free at Vigorous).

You are able to do this as usually as you want, however most individuals will do it just a few instances per 12 months. This lets you have a win-win state of affairs.

Should you’re prepared for an amazing HSA, take a look at Vigorous right here.

Our Ideas On How To Greatest Use Your HSA

Now that you’ve your HSA at Vigorous (or are within the technique of transferring it over), it’s important that you simply use your HSA to your most profit.

First, if you happen to get any sort of employer match to your HSA, take benefit. Many employers provide wellness matches to an HSA, just like 401k matches. Besides these matches usually rely on you performing some sort of wellness exercise, like an internet survey or getting your bodily.

Second, make investments your HSA! That is the place the HSA energy actually lies. Investing your cash for the long run will allow you to develop this nest egg tax free.

Lastly, don’t contact it! It could be tempting to reimburse your self for each expense. However if you happen to can afford to pay out of pocket, merely save your receipts and let your cash develop. You’ll be able to reimburse your self any time, or deal with the HSA like an IRA in retirement.

Hold correct data, however attempt to let the cash develop tax free.

Ultimate Ideas

The HSA is our favourite financial savings and investing account, and sadly not sufficient individuals benefit from it.

Nonetheless, with instruments like Vigorous, it’s simpler than ever to take management of your HSA and make investments it to your future. Even when you have an HSA along with your employer, you continue to can benefit from Vigorous to take a position.

269255

The submit How To Change Your HSA Supplier appeared first on The School Investor.