Considered one of my greatest fears for renters has come true. Rents are surging as a consequence of rising residence costs, rising family formation, and never sufficient stock. The principle query now could be: How lengthy will hire will increase final?

We shouldn’t really feel dangerous for individuals who’ve been towards homeownership for years. Yow will discover loads of them commenting in my posts:

All these towards actual property have rationally saved and invested the distinction within the inventory market and different lessons. And given most asset lessons have achieved phenomenally nicely over time, renters who invested have additionally achieved very nicely.

Nevertheless, for these of you who needed to purchase actual property however couldn’t or wish to purchase actual property however can’t, this submit is written largely for you. This submit ought to make it easier to higher work out your future residing scenario.

How A lot Are Rents Up Yr Over Yr?

In keeping with knowledge from Zillow, 2021 hire was up 11.5% from a 12 months earlier, or nearly $200. In different phrases, the median hire worth in America in August 2020 was round $1,530. At the moment it’s round $1,739.

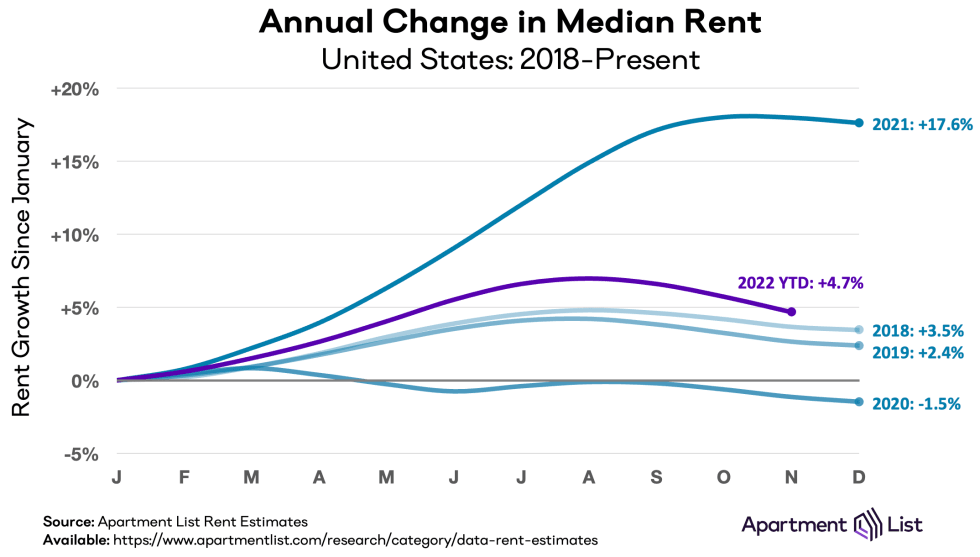

In keeping with ApartmentList, the nationwide median hire elevated by a record-setting 17.6 % over the course of 2021. 2021 was the best hire progress 12 months in many years.

In 2022, hire continued to creep larger by about 4.8% in keeping with ApartmentList and in keeping with my 2022 housing market forecast. In different phrases, hire will increase lastly slowed down in 2022 because the bear market took maintain.

Right here’s one other chart from CoreLogic. It exhibits a nationwide single-family hire index for varied worth factors can also be up dramatically 12 months over 12 months in 2021 as nicely. It exhibits the Excessive Tier section (black line) improve probably the most.

Rents Will Lastly Sluggish Or Go Down In 2023

I believe residence costs in 2023 will lastly decline by about 8%. Because of this, so will rents due to a Fed-induced international recession. Because of aggressive fee hikes by the Federal Reserve in 2022 and a ~20% decline within the S&P 500, rents ought to inevitably start to fall.

In 2023, I count on nationwide rents to decline by 5% in 2023.

Listed here are some indicators of decrease inflation to come back:

- Gasoline costs down 37% from June peak

- Used automotive costs down 19% from peak

- International freight charges down 81% from 2021 peak

- Fertilizer costs down 45% from March peak

- Rents down in Sep, Oct, & Nov of 2022

- Residence Costs down over 10% from June peak

New Tenant Repeat Lease Index

Researchers on the BLS and Cleveland Fed launched a knowledge collection on December 19, 2022 known as the New Tenant Repeat Lease Index. As you possibly can see from the yellow line under, the New Tenant Repeat Lease Index has rolled over exhausting.

The Shopper Worth Index tracks housing inflation by a big panel of housing items which might be surveyed each six months. However as a result of rental turnover is gradual and CPI tracks contract rents for all items, CPI knowledge lags present market circumstances considerably.

How Lengthy Will Lease Will increase Final?

Rents can not improve quicker than wage progress indefinitely. In some unspecified time in the future, hire will increase must gradual.

Subsequently, it’s my perception that hire will increase will start to reasonable by 1H2023 as residence worth progress slows, sufficient folks lastly transfer out of their mother and father’ properties or shed roommates, and housing building bottlenecks lower.

The New Tenant Repeat Lease Index makes an attempt to seize hire progress or declines in real-time. Subsequently, it’s extremely probably CPI knowledge for 2023 will proceed to move south since hire is a big element of the Shopper Worth Index.

Moderating Lease Worth Progress Versus Destructive Lease Worth Progress

Be certain to distinguish between moderating hire worth progress and detrimental hire worth progress. As an alternative of driving 85 mph on the freeway, a automotive would possibly decelerate to 65 mph. The automotive continues to be shifting ahead, however simply not at as speedy of a tempo.

If median hire worth progress is 4.8% YoY for the whole 2022, I believe median hire worth progress will gradual to about simply 2-3% by the top of 2022.

Earlier than the Fed began aggressively mountain climbing charges, I anticipated nationwide median hire worth progress to revert to the imply by rising 2% – 3%. Nevertheless, the Fed appears decided to trigger one other recession in 2023. Because of this, I count on rents to say no by 5% in 2023.

2023 ought to transform a greater time to be a renter as hire costs fade. Nevertheless, there must be an excellent alternative to purchase property in mid-2023. That is very true if returns for equities and bonds dramatically decline over the following 10 years as nicely.

Publish pandemic, the intrinsic worth of a house has completely elevated. We’re all spending extra time at residence, and due to this fact, all of us respect our properties extra.

There isn’t any going again to the best way issues have been. The most probably state of affairs is a hybrid mannequin the place employees earn a living from home part-time and work within the workplace part-time.

Subsequently, I’m an investor in single-family and multifamily properties to benefit from this long-term pattern. In 20 years, I’m fairly certain our kids will marvel at how low cost rents have been immediately.

Recommendation For Renters Wanting To Management Residing Bills

As a landlord since 2005, producing optimistic returns was essential so I might escape work earlier. At the moment, producing optimistic returns is essential so I can higher care for my household of 4. Actual property revenue accounts for about 50% of our present passive revenue portfolio.

On the similar time, as a private finance author since 2009, I even have a purpose of serving to as many individuals obtain monetary freedom as potential. This purpose is why I’ve inspired readers to purchase actual property as younger as they probably can for thus lengthy. Inflation is just too highly effective of a drive to fight.

Whether or not you imagine me or not is neither right here nor there. In case you are a renter, what issues is what you do and the way you consider the present scenario going ahead. Subsequently, right here is a few recommendation for renters as a landlord and as an ex-renter myself.

1) Eradicate misinformation, perceive the newest market circumstances

Though seeing rents and residential costs improve will be irritating, there’s a optimistic for renters. Most landlords are incapable of accelerating rents as quick because the market. The explanations are as a consequence of kindness, ineptitude, legal guidelines, and laziness.

Subsequently, even when the nationwide median hire or native market hire elevated by 11% from a 12 months earlier, your hire has most probably not elevated by the identical magnitude.

In a rising market, the distinction between present market hire and the hire you might be paying is your “revenue” and a landlord’s “loss.” Your revenue is what you save by not having to pay market hire. A landlord’s loss is the chance value of not incomes market rents. The longer you hire a spot, often the bigger your revenue grows and vice versa for the owner.

Perceive Rental Circumstances

If a renter doesn’t perceive the newest rental market circumstances, s/he would possibly get erroneously upset at not getting their manner.

For instance, one tenant just lately requested for a hire lower when neighborhood rents are up between 10% – 15% ($400 – $615). Since 2H2020, there’s been an enormous flood of folks migrating to the western facet of San Francisco as a consequence of higher worth, more room, higher air, extra parks, and fewer density. I knew demand was up as a result of I rented out a home in September 2020 and skilled extra demand than ever earlier than.

After I declined my tenant’s request and simply stored the hire unchanged, he was sad. But when he understood the newest market circumstances, he would have felt extra at peace.

Asking for a hire lower when the rental market is up 15% is like asking for a increase throughout a bear market. It might occur for those who’ve developed an incredible relationship along with your landlord. However what’s extra prone to occur is your supervisor including you to the RIF record for being so disconnected from actuality.

Don’t make the second greatest monetary mistake if you wish to obtain monetary freedom.

2) Know that your landlord has rising bills too

For many who have by no means owned property earlier than, it’s comprehensible to not know all the prices related to proudly owning actual property. Landlords usually have the next prices: insurance coverage, upkeep, mortgage, property taxes, particular assessments, property administration.

In different phrases, the elevated hire by no means 100% goes to the owner’s backside line. For instance, even when I’ve no mortgage, I nonetheless pay about $23,000 a 12 months in property taxes for one rental property. This property tax goes up 2% a 12 months, often without end.

The extra a renter understands a landlord’s prices, the extra a renter received’t really feel as dangerous about paying larger rents. The identical goes for voting on laws to boost extra money for some trigger. If the cash raised is coming from paying extra property taxes, then rents will inevitability improve. Subsequently, voters of such laws must be advantageous with paying larger rents.

If you happen to’re fortunate to not have any hire improve in a rising-rent setting, your landlord’s cashflow is declining. Subsequently, as a renter, you would possibly achieve consolation figuring out your landlord is making much less.

3) Preserve issues harmonious and don’t get private

When you have an excellent landlord who’s attentive, takes care of points, and communicates with you in knowledgeable method, cherish the connection. A landlord who finds good tenants will definitely do the identical.

On the finish of the day, a harmonious relationship is healthier than a contentious one, particularly if you realize your landlord and see him/her from time to time. In case your landlord is a faceless company, then it’s simpler to be extra aggressive or combative. However even nonetheless, it’s often price preserving issues cool with the property supervisor.

If you happen to get too private, you run the chance of offending both occasion. If you happen to offend the owner by citing some private difficulty, he would possibly resolve to boost the hire to the authorized most. Worse, he would possibly provide you with discover, which might be dangerous for those who don’t wish to transfer out.

On the similar time, if a landlord offends a renter, the renter would possibly injury the place, delay paying hire, or not pay in any respect. Subsequently, relating to the lease settlement and negotiating future phrases, preserve issues strictly enterprise. Please don’t carry private points and judgement calls right into a negotiation.

Many landlords have a love-hate relationship with actual property. The older and wealthier a landlord will get, the much less they wish to cope with tenant and upkeep points. Because of this, the extra a tenant will be self-sufficient, the much less probably the hire will improve.

4) Apply Stealth Wealth

Earlier than I had children, one of many the explanation why I loved driving a Honda Match was as a result of my tenants wouldn’t decide me once I came visiting to deal with a problem. Driving a less expensive automotive than my tenants not solely felt good, it helped diminish envy.

Strategically, to attenuate the possibilities of a hire improve, it’s additionally finest for renters to apply Stealth Wealth. If the owner sees you rolling in a brand new automotive, fancy watch, $10,000 residence theater system, or no matter luxurious merchandise, he might logically suppose you possibly can afford to pay extra hire.

When doubtful, it’s higher to be extra low key with every thing you do.

5) A renter actually does have to save lots of and make investments the distinction

Anti-homeownership advocates all the time argue that renting is healthier as a result of it’s cheaper, much less problem, and you may make investments the distinction in higher performing belongings. Sure, these are nice causes for renting within the quick time period or medium time period.

Nevertheless, similar to the way you wouldn’t quick the S&P 500 over the long run, you wouldn’t quick the true property market by renting long run both. As an alternative, it’s higher to spend money on the S&P 500 and a minimum of personal your main residence to get impartial actual property.

If you happen to hire, you should really save and make investments the distinction. If you happen to don’t, you’ll probably fall financially behind your friends who do personal. The principle purpose is householders have a pressured financial savings account each time they pay their amortizing mortgage. The opposite purpose is that actual property tends to inflate with inflation over time.

If a house owner owns a $500,000 home that appreciates by 8% one 12 months, a renter with a $80,000 revenue wants a 50% pay increase simply to remain even. Or, a renter with a $100,000 inventory portfolio must see a 40% return to remain even. Each are unlikely.

The common web price for a house owner is 40X or so higher than the common web price of a renter. There are all types of causes for this large discrepancy. However one purpose is the dearth of self-discipline in saving and investing the distinction over the long run.

6) At all times be in search of shopping for alternatives

One of many nice advantages of renting is attempting out a neighborhood in a lower-cost manner earlier than shopping for. After a couple of 12 months, you need to have an excellent concept if you wish to dwell within the neighborhood long-term. And for those who don’t, you need to spend time a minimum of as soon as a month exploring new neighborhoods.

Fortunately, it’s simpler than ever to discover new properties on-line. You may even observe hire will increase along with property costs. I like to recommend organising e-mail alerts with properties that meet your filters. It’s similar to signing up for my e-mail record that robotically e-mails you at any time when I publish a brand new submit. This fashion, you’ll by no means miss a factor.

If you happen to can afford to purchase a house utilizing my 30/30/3 rule, I might purchase. Simply ensure to depart in your house for a minimum of 5 years to trip out the cycles.

There are nice shopping for alternatives that pop up on a regular basis. You would possibly discover a stale-fish itemizing that was priced too excessive. You would possibly stumble throughout an excellent itemizing throughout the center of a snow storm when no person is trying. A pair is perhaps getting a divorce and simply needs a fast sale.

Gems are ready to be snagged day-after-day. You simply should spend time trying.

Rents Are An Financial Sign

Lastly, one other great way to have a look at rising rents is to view them as a optimistic sign for a wholesome native economic system. Rising rents often imply optimistic demographic adjustments, rising wages, and extra job alternatives. Conversely, declining rents normal means a weakening economic system.

In case your hire is rising by 5% – 10%, however you may get an equal or higher increase, you’re successful! If rents are flat or declining, it’s going to probably be tougher to get that increase and promotion. Which scenario would you fairly be in? If I used to be working, I’d a lot fairly be within the former.

If rents are rising shortly, it is perhaps a optimistic sign to spend money on native firms. After interviewing many potential tenants who labored at Google and discovering out their mind-boggling salaries, I made a decision to spend money on Google inventory 10 years in the past.

There’s all the time a silver lining to each suboptimal scenario. Even sitting in horrendous visitors on a regular basis might be a optimistic sign so that you can make investments extra.

Renting is completely advantageous throughout the quick or medium time period. Even in a rising-rent setting, renters can prosper by shopping for Treasury bonds and different mounted revenue investments. Nevertheless, over the long term, I encourage everybody to personal their main residence, spend money on actual property, and spend money on shares and different danger belongings.

Your web price and your descendants will thanks.

Actual Property Suggestion

To spend money on rising rents, check out Fundrise, one of many largest actual property crowdfunding platforms immediately. Fundrise main invests in residential rental properties throughout the nation. You may spend money on a Fundrise eREIT for as little as $10. Fundrise manages over $3.2 billion in belongings beneath administration for over 310,000 traders.

There’s no want to attend till you’ve gotten a down fee to spend money on property. Neither is there a must be a landlord anymore to benefit from the residential actual property increase.

Learn The Greatest Private Finance E book At the moment

If you wish to learn the very best ebook on attaining monetary freedom sooner, try Purchase This, Not That: Tips on how to Spend Your Means To Wealth And Freedom. BTNT is jam-packed with all my insights after spending 30 years working in, learning, and writing about private finance.

Constructing wealth is just part of the equation. Constantly making optimum choices on a few of life’s greatest dilemmas is the opposite. My ebook helps you decrease remorse and dwell a extra purposeful life.

It’ll be the very best private finance ebook you’ll ever learn. You should purchase a replica of my WSJ bestseller on Amazon immediately. The richest folks on the earth are all the time studying and all the time studying new issues.

For extra nuanced private finance content material, be part of 55,000+ others and join the free Monetary Samurai publication and posts by way of e-mail.

Monetary Samurai is without doubt one of the largest independently-owned private finance websites that began in 2009. How Lengthy Will Lease Will increase Final is a Monetary Samurai unique submit.