Studying Time: 7 minutes

Within the fashionable banking panorama, Buyer Engagement has grow to be a crucial think about driving buyer loyalty and enhancing your prospects’ lifetime worth (LTV).

With the rise of digital applied sciences, banks like yours can now leverage Buyer Engagement platforms to supply customized experiences and improve buyer satisfaction.

These platforms can even assist you to cut back prices and enhance your backside line by streamlining operations and automating routine duties.

Nevertheless, with cybersecurity threats on the rise, making certain that your Buyer Engagement platforms are safe and adjust to trade laws is crucial.

Listed below are totally different situations you almost certainly end up in day-after-day and the way a Buyer Engagement Platform might help you get unstuck:

Digital Onboarding and KYC (Know Your Buyer)

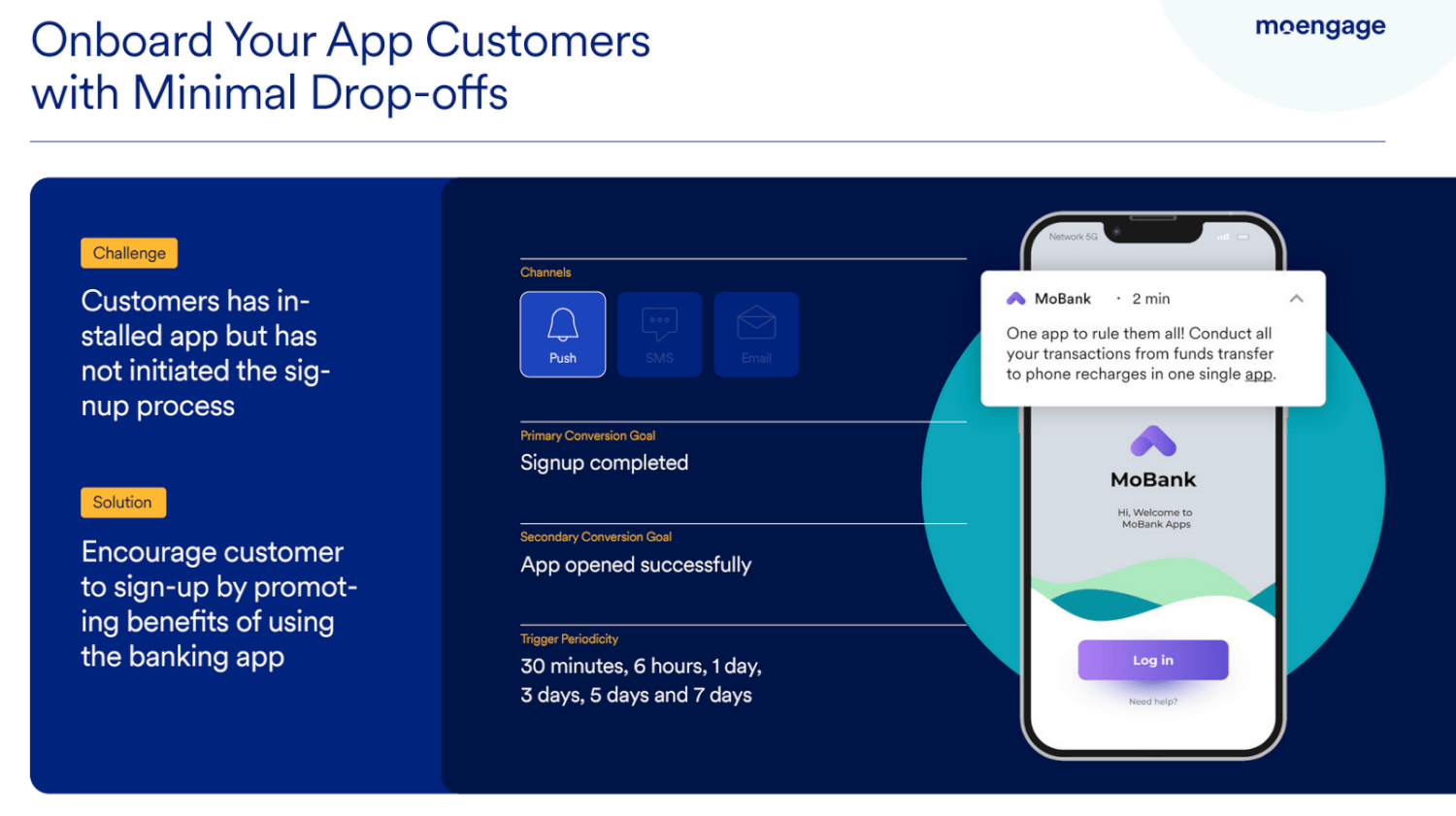

Banking prospects choose a seamless digital onboarding expertise after they join a brand new financial institution. They want to set up your cell app or enroll in your web site and full their KYC to start transacting digitally.

Your major objective in the course of the onboarding stage needs to be to assist new prospects overcome digital inertia, full their KYC course of, and get used to your platform.

Purpose:

The first objective of onboarding needs to be to extend the variety of new prospects signing up in your cell app or banking web site.

A secondary objective is also lowering the time a buyer takes to create an account and end their KYC course of. The lesser this window, the quicker your prospects can begin transacting digitally and see the worth of your digital platform.

Metrics to measure success:

The important thing success metric is the proportion of the full variety of prospects who accomplished their KYC course of amongst those that signed up in a given month or week.

The secondary success metric is usually a % drop within the time taken to finish the KYC course of after a buyer has signed up in your platform.

Technique to enhance onboarding for brand new prospects:

- Educate new prospects concerning the comfort of digital banking and the advantages of finishing their KYC course of

- Create a segmented e mail and SMS movement focusing on prospects – urging them to put in the app/ create an account on the web site and a movement to finish KYC

How Can a Buyer Engagement Platform Assist With Onboarding a New Banking Buyer?

1. Construct Buyer Journeys

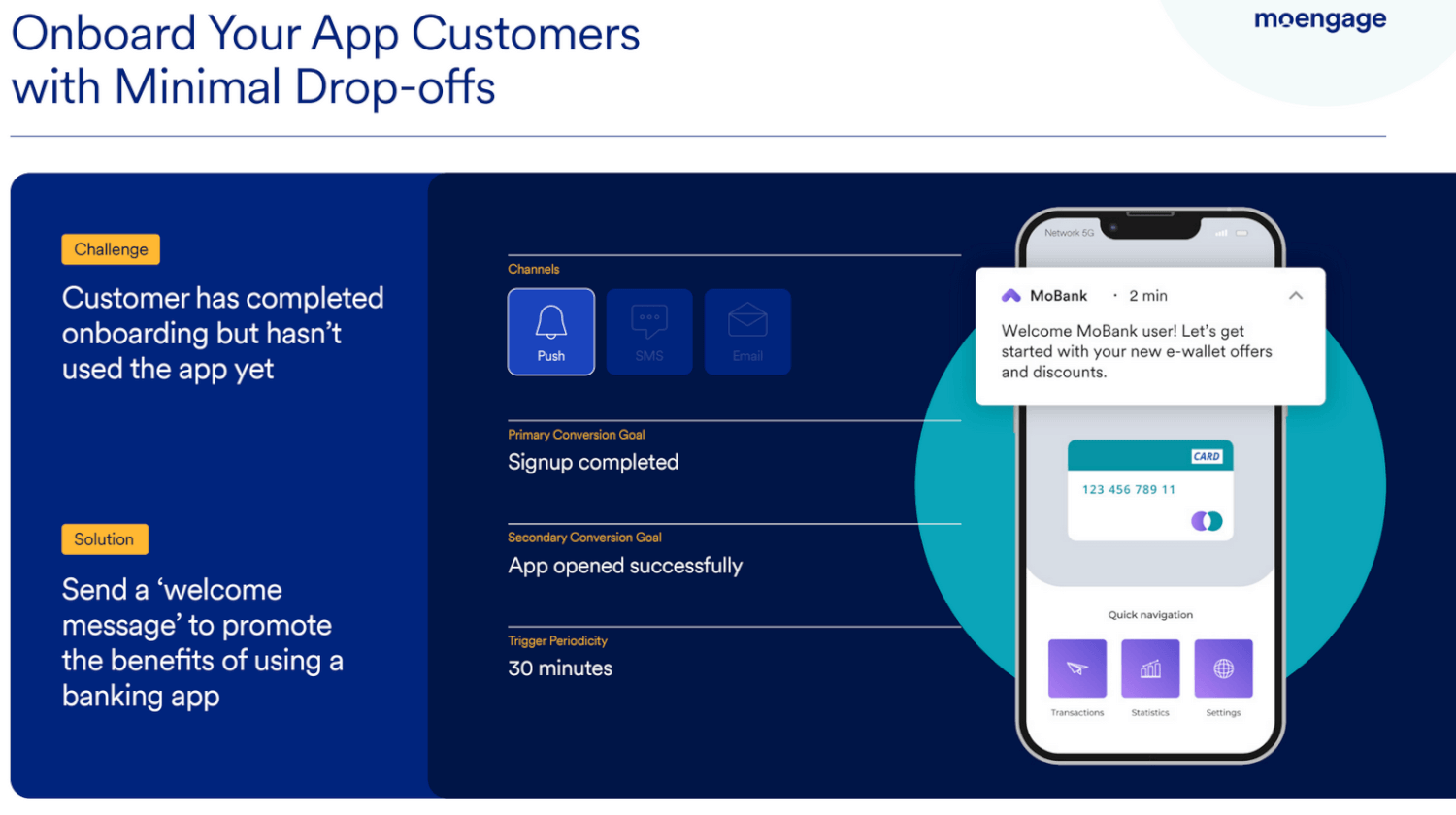

Banks can use a Buyer Engagement Platform to orchestrate the best journey of a brand new buyer on their cell app or web site.

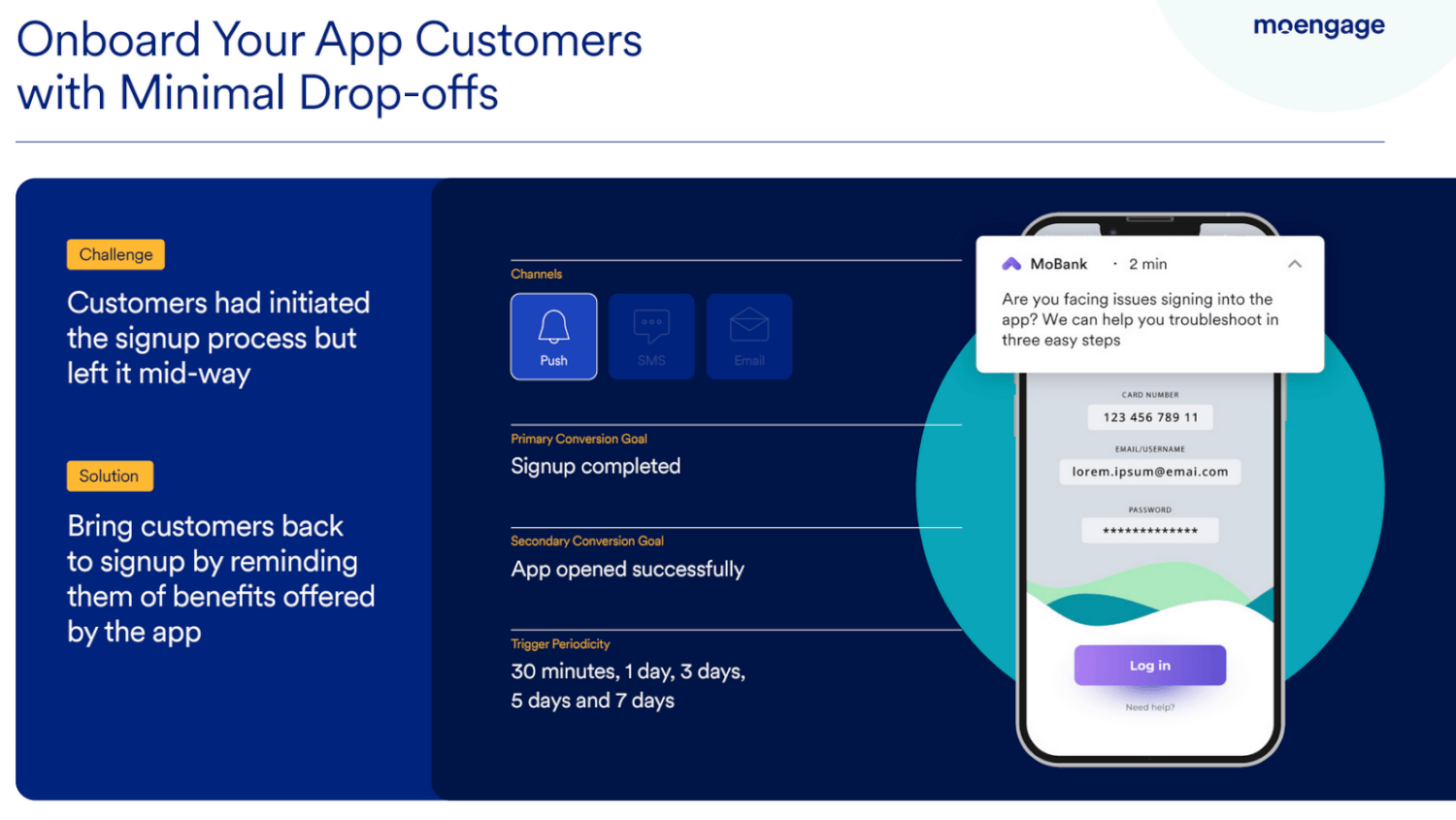

With automation, prospects will comply with a path that leads them to rapidly end their KYC course of after they enroll, to allow them to begin transacting. This includes creating two journeys inside one:

- Journey 1 to assist them kickstart their KYC course of, and

- Journey 2 to assist them full it by sending well timed reminders and reminding them of incomplete steps.

2. Use AI to select the perfect Buyer Journey

By leveraging a Buyer Engagement Platform’s AI, banks can see a lift of their onboarding success metrics.

AI will robotically decide the perfect sequence of messages that new prospects have to obtain and the perfect channels they should obtain these messages on.

Banks can use a Buyer Engagement Platform to create two or extra potential paths new prospects can take after which let AI and ML algorithms observe the efficiency of every path and choose the journey with the utmost objective conversions.

Learn all about MoEngage’s Clever Path Optimizer and why you want it.

Learn all about MoEngage’s Clever Path Optimizer and why you want it.

Be taught from the leaders: Symbo Insurance coverageSymbo is an insurtech firm aiming to grow to be the world’s largest embedded insurance coverage distribution platform. With MoEngage Flows, Symbo constructed a seamless, automated, and action-based onboarding journey. Due to MoEngage, the staff was abel to cater to prospects in 4 totally different levels:

|

Product Cross-sells and Upsells

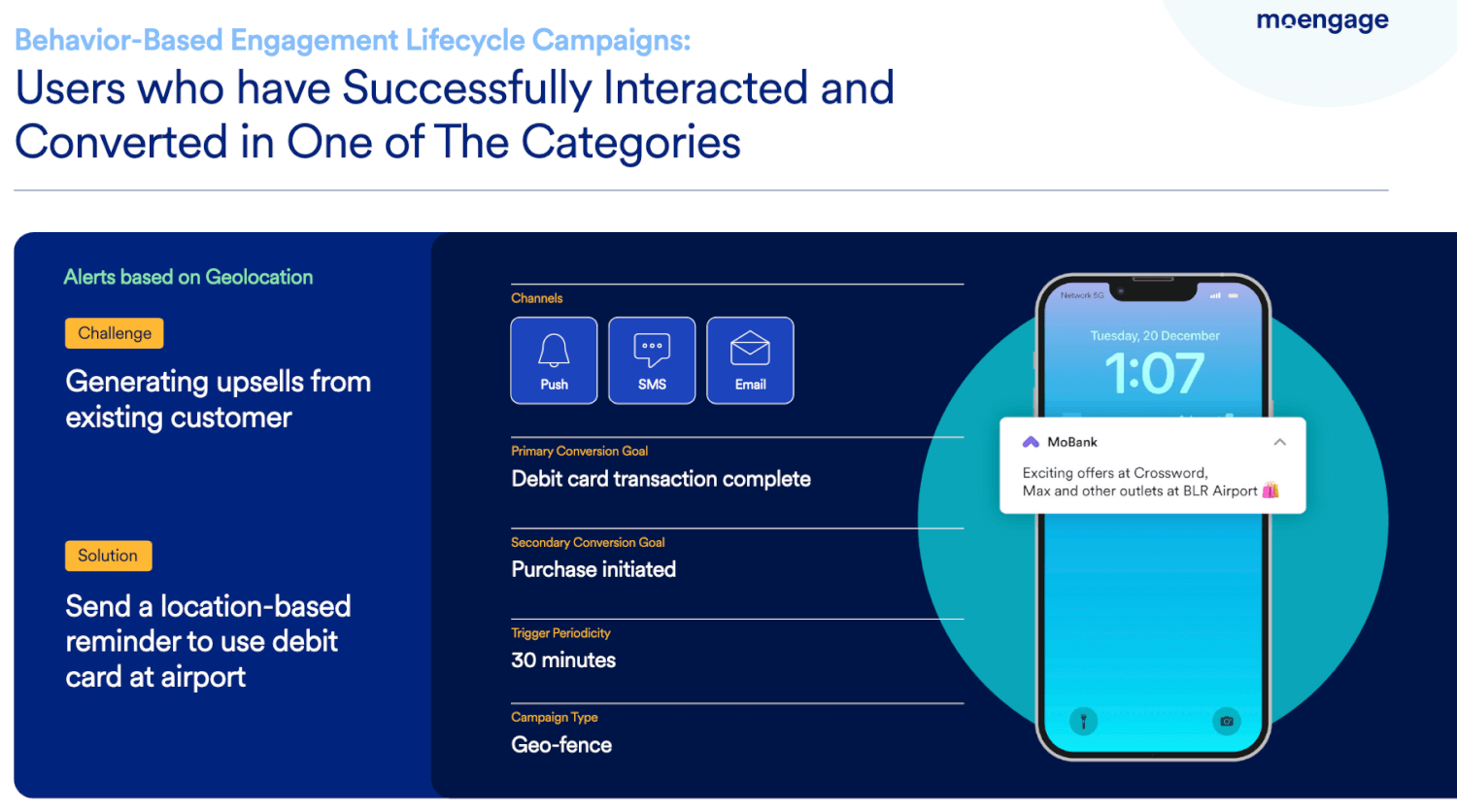

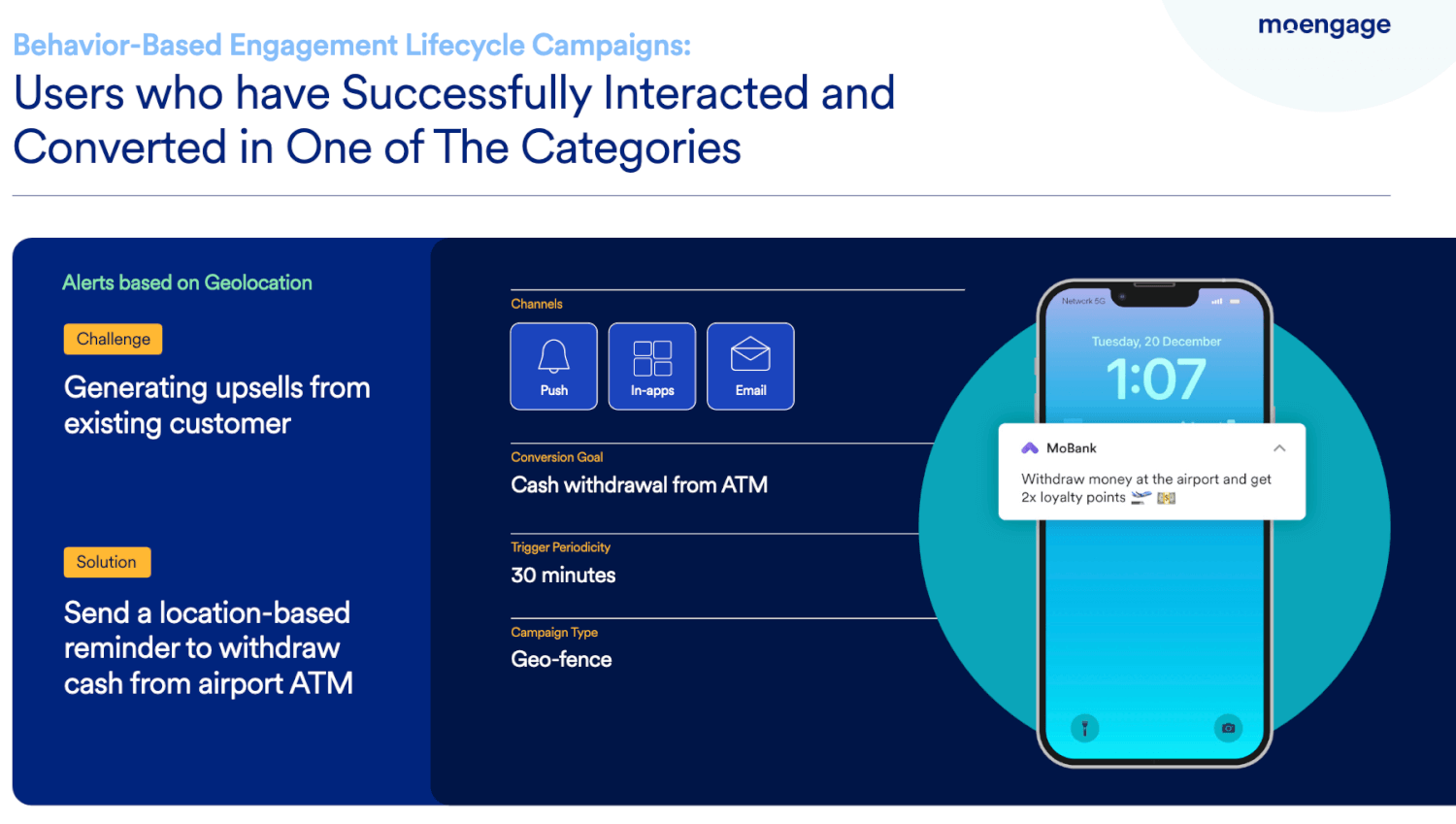

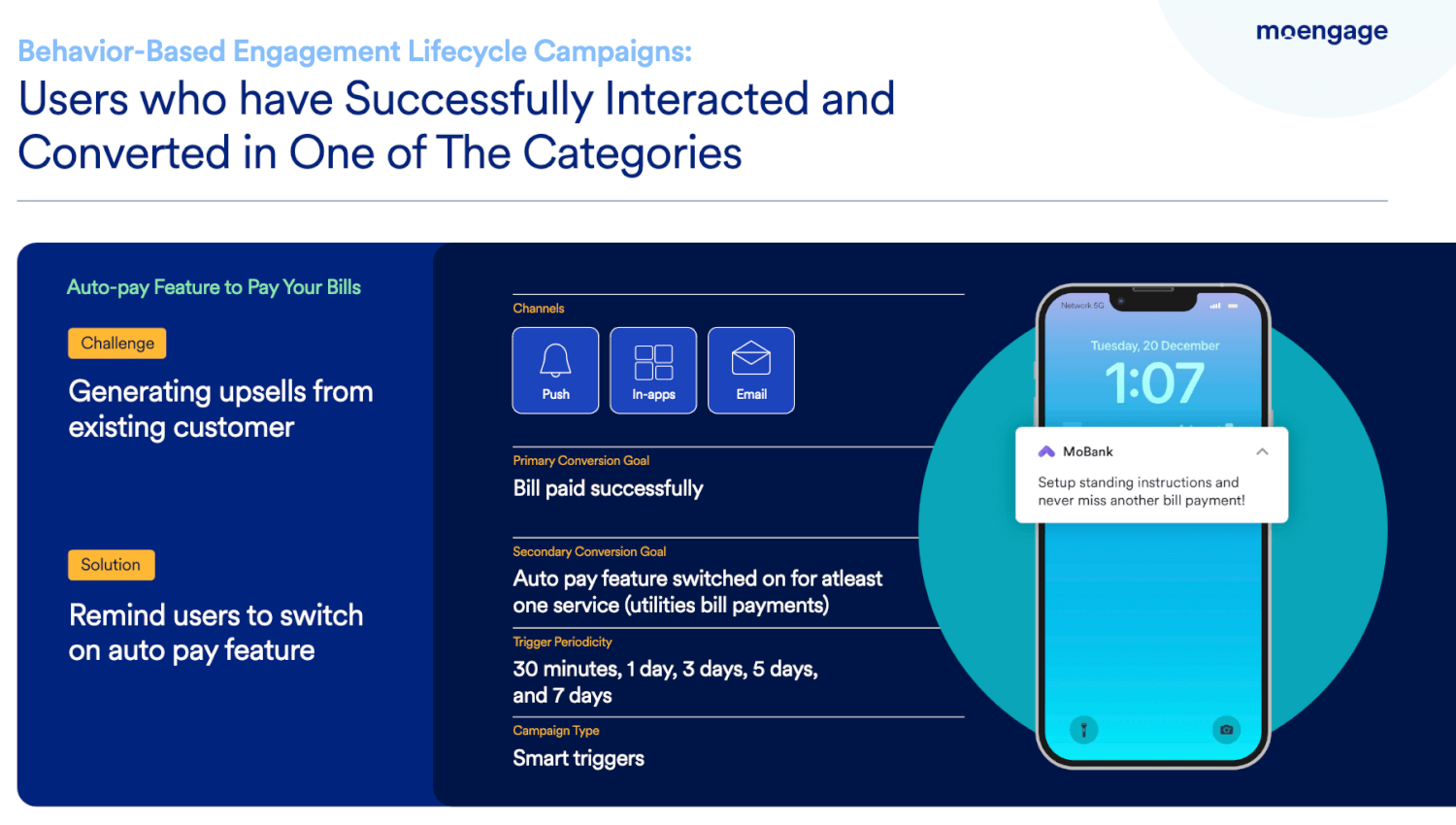

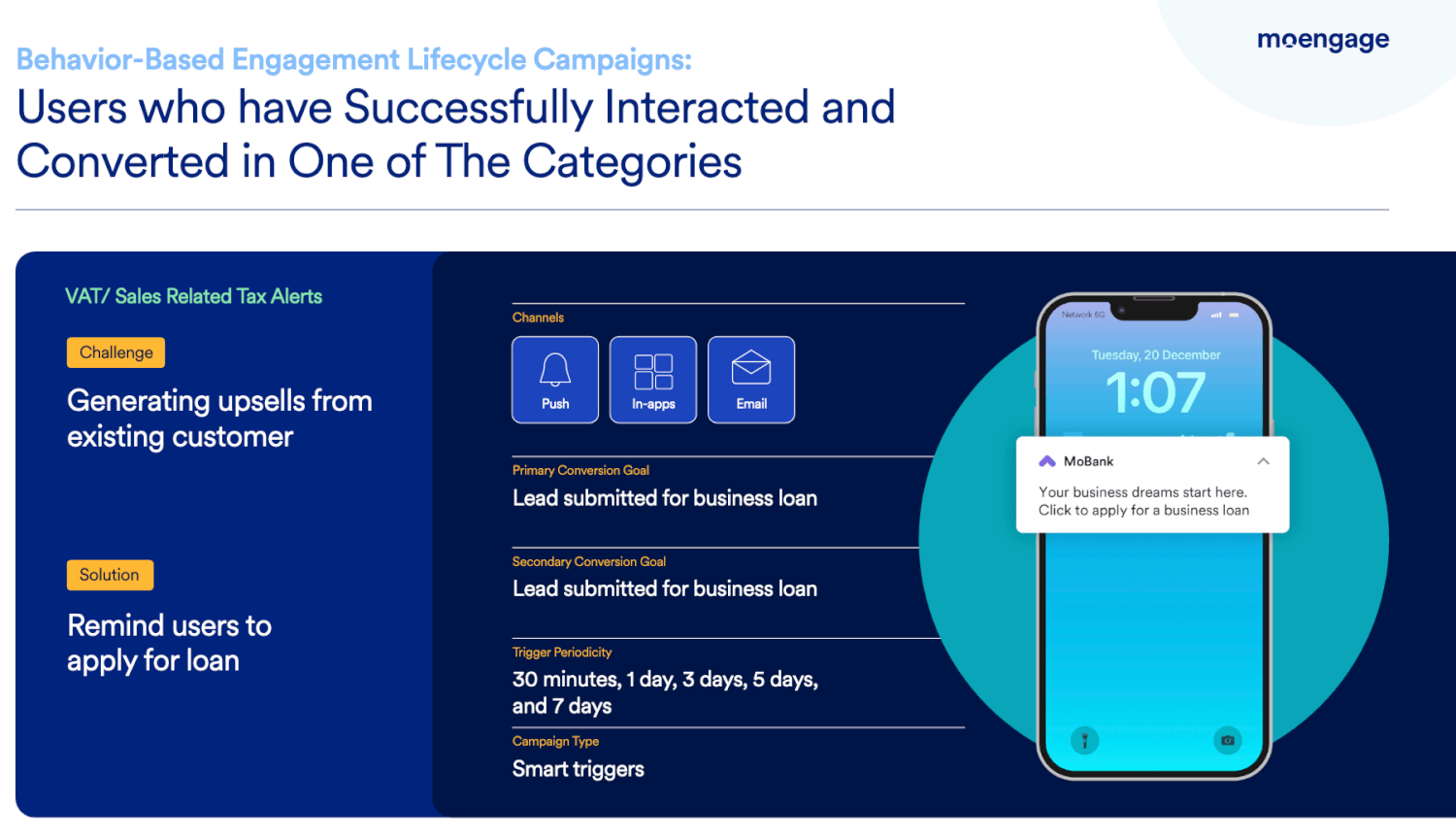

As soon as your prospects have been onboarded and are comfy transacting digitally, you can begin launching campaigns to cross-sell and upsell related monetary merchandise primarily based on their account steadiness, borrowing historical past, credit score historical past, and extra.

You may as well encourage your prospects to make use of their bank cards extra usually by displaying them related presents which can be relevant to their card.

Purpose:

The first objective of cross-sells and upsells needs to be to get your prospects to buy further services out of your financial institution.

A secondary objective could possibly be to encourage your prospects to extend the utilization of their assigned bank cards.

Metrics to measure success:

A key metric to measure the success of your cross-sell and upsell campaigns needs to be the variety of requests or purposes for added services. These requests might both be by means of your financial institution’s web site or your financial institution’s cell utility.

A secondary metric could possibly be the rise within the quantity transacted by every buyer through the issued bank card.

Technique to drive extra cross-sells and upsells:

- Create buyer segments primarily based on standards just like the vary of checking account steadiness, and promote totally different related monetary merchandise to every phase.

- Educate prospects on the a number of financial savings, borrowings, credit score, buying and selling, and funding services your financial institution has to supply.

- Construct buyer cohorts primarily based on their present issued bank card and share customized presents which can be relevant to their card.

How Can a Buyer Engagement Platform Assist Drive Extra Cross-sells and Upsells for Your Financial institution?

Construct omnichannel campaigns customized to every buyer phase. Utilizing a Buyer Engagement Platform, you’ll be able to create or import segments whereas complying with PII safety tips and compliances.

You possibly can then create a number of campaigns throughout a number of touchpoints comparable to E-mail, Push Notifications, Web site Banners, SMS, WhatsApp, Google Advertisements, Fb, and extra.

The important thing to omnichannel messaging is to maintain the expertise seamless as your prospects change between channels. Should you’ve recognized a specific monetary product to upsell to a cohort, make sure that all messages on all channels promote the identical product.

Examine MoEngage’s omnichannel capabilities right here.

Examine MoEngage’s omnichannel capabilities right here.

Be taught from the leaders: NaviNavi, one in all India’s largest lending platforms, wished to extend the conversions of upsell campaigns to potential prospects. Navi’s advertising and marketing staff determined to achieve out to present prospects taken with loans and insurance coverage through WhatsApp. This new-age advertising and marketing channel was made potential due to MoEngage’s WhatsApp integration. After utilizing MoEngage and WhatsApp, Navi witnessed a 1.5X enhance within the variety of insurance coverage upsells, a 75% larger conversion fee for his or her upsell campaigns, and a 4X progress within the variety of reachable prospects.

|

Well timed Alerts and Reminders

There are a number of analysis papers like this and this that present a robust relationship between the issue of restoration, overdue loans, and the profitability of banks.

A optimistic correlation between fee defaults and profitability means you should spend money on constructing campaigns that continually remind your prospects for funds and dues.

Partaking prospects on the proper dates of the month will assist guarantee they don’t miss recurring funds like payments, EMIs, and loans.

Purpose:

The first objective for well timed alerts and reminders have to be to make sure that prospects don’t default on their funds, i.e., miss recurring funds comparable to payments, EMIs, or loans.

A secondary objective could possibly be to make sure the utmost reachability of your transactional alerts so your prospects don’t miss out on vital messages.

Metrics to measure success:

A key metric to measure the success of those campaigns is fee accomplished.

To measure reachability, you’ll be able to calculate the proportion of the full prospects you despatched out a particular marketing campaign for and the impressions (for Push Notifications, SMS, In-app Messages, and Web site Banners) or opens (for Emails and WhatsApp).

Technique to ship well timed alerts and reminders:

- Create a dynamic phase of consumers that robotically grow to be part of the phase when the due date for his or her funds is lower than 10 days.

- Notify these buyer segments concerning the upcoming due date for his or her pending funds.

- Create a recurring marketing campaign on E-mail, SMS, WhatsApp, In-app Messages, or Web site Banners.

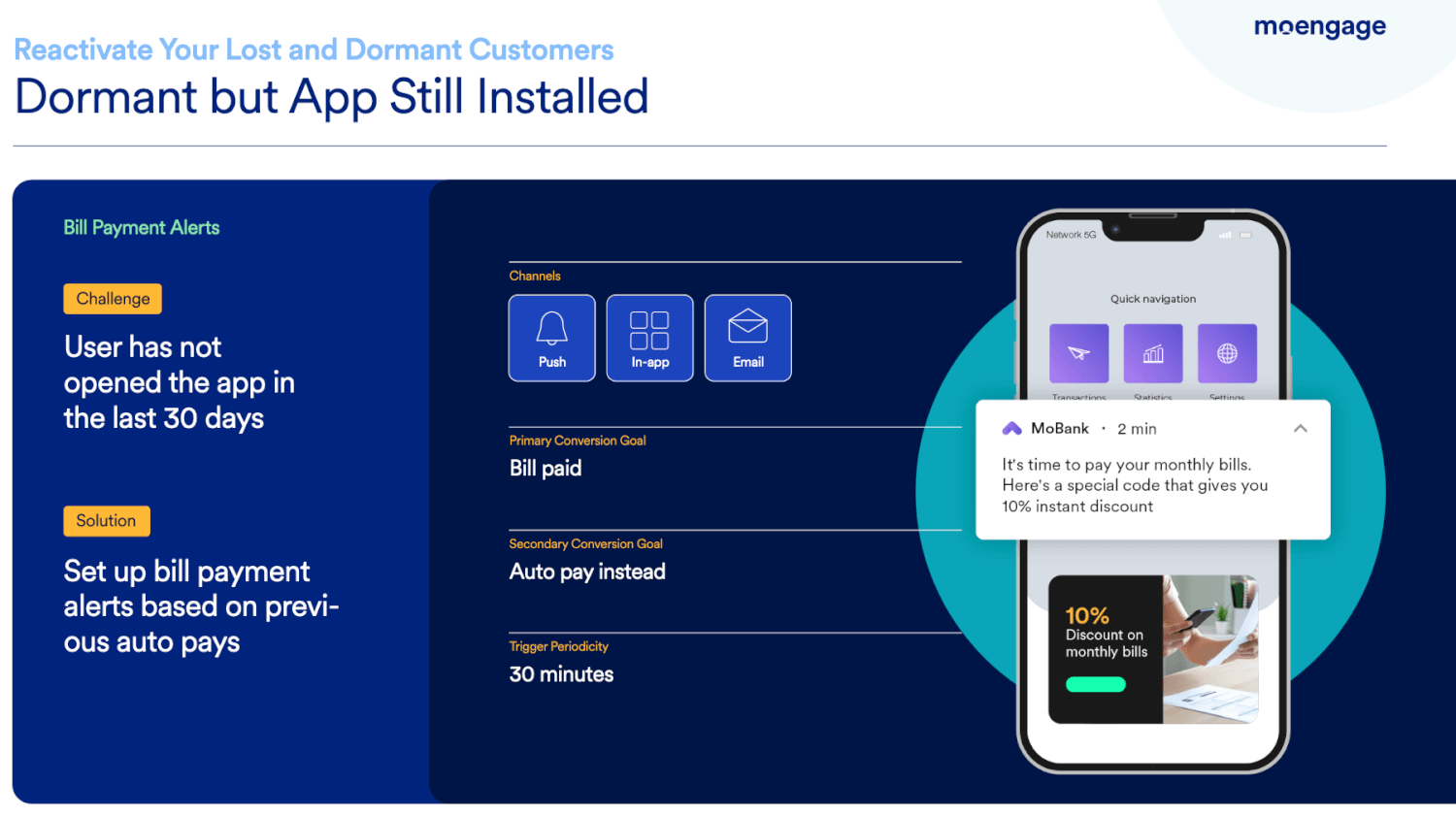

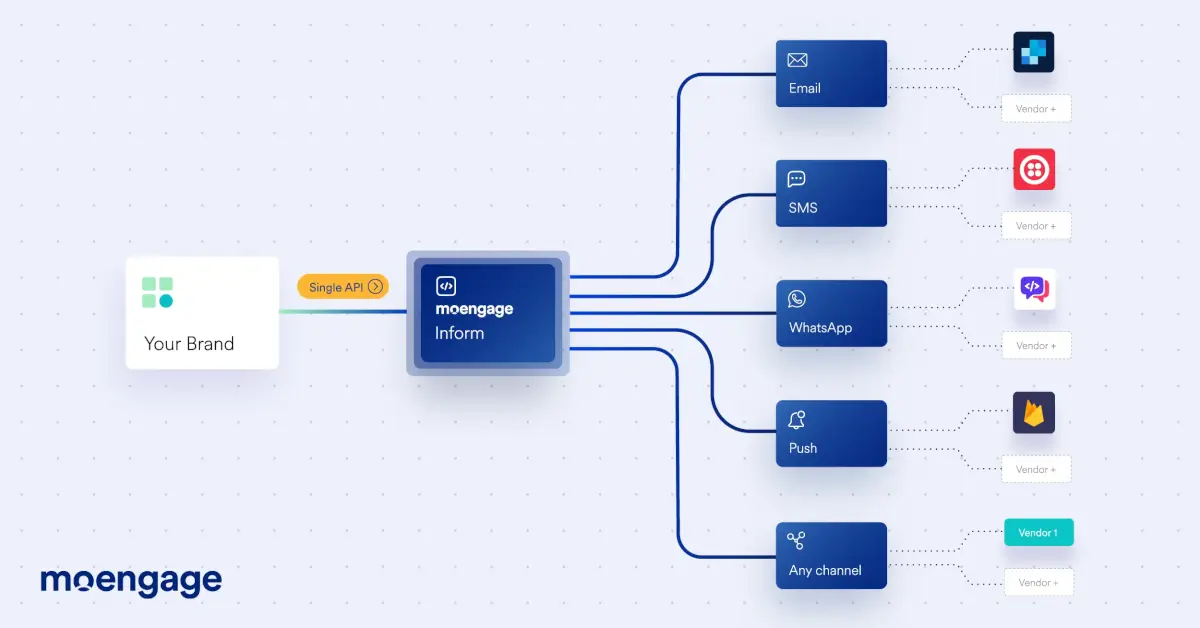

How Can a Buyer Engagement Platform Assist You Ship Well timed Alerts and Reminders to Your Banking Clients?

Use a plug-and-play API to scale and keep your transactional messaging infrastructure. Trendy Buyer Engagement Platforms like MoEngage have APIs that can be utilized to ship crucial transactional messages like alerts and reminders to totally different buyer segments.

As a substitute of constructing and sustaining your individual transactional messaging infrastructure, you’ll be able to leverage these plug-and-play APIs to automate template creation, add new messaging channels, and extra!

Examine MoEngage Inform, a transactional messaging API, right here.

Examine MoEngage Inform, a transactional messaging API, right here.

Be taught from the leaders: Zeta

That is what Anand Madanapalle Sridhar, the Affiliate Director of Product Administration at Zeta, a next-gen banking tech firm in India, needed to say about MoEngage Inform:

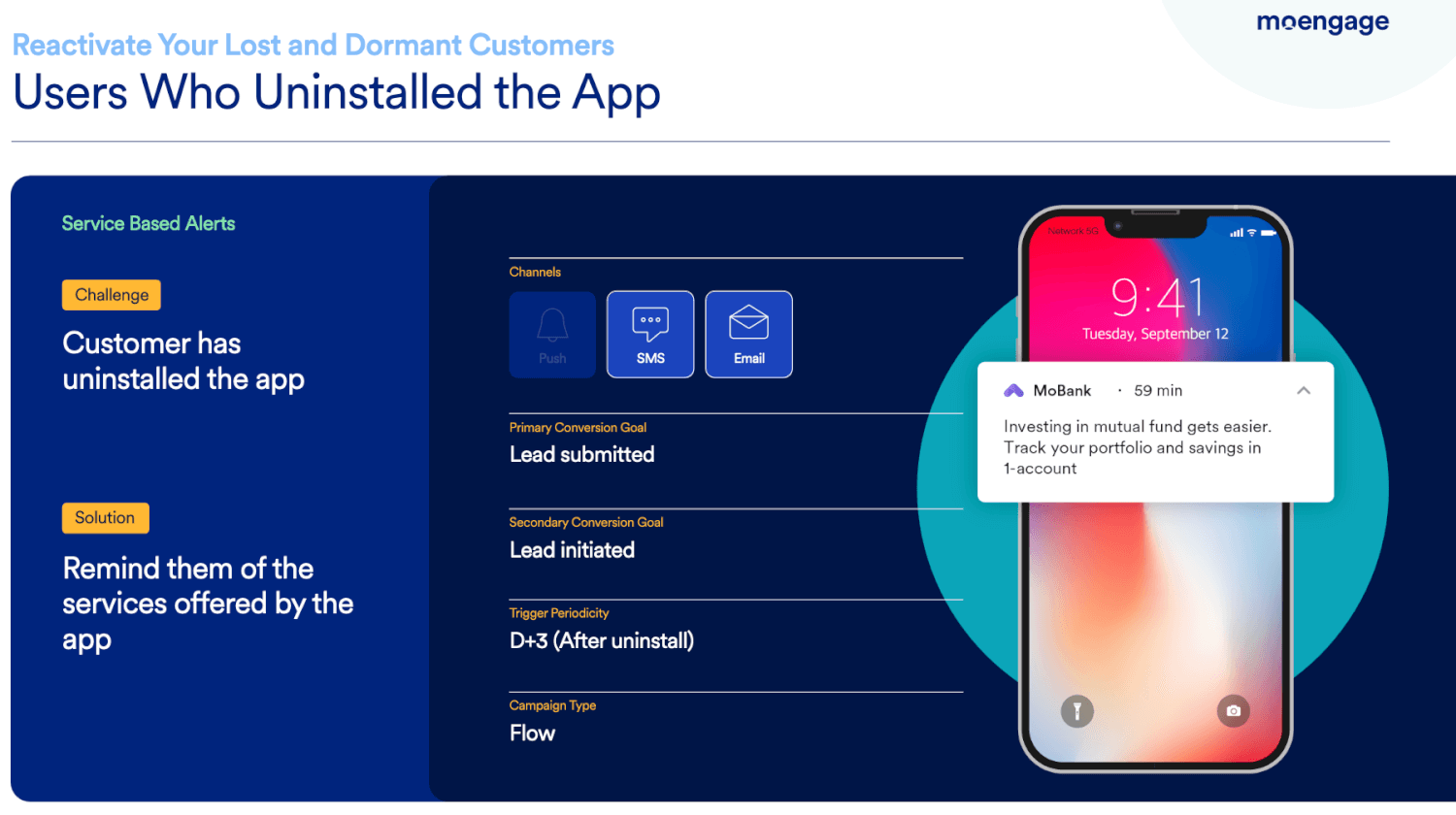

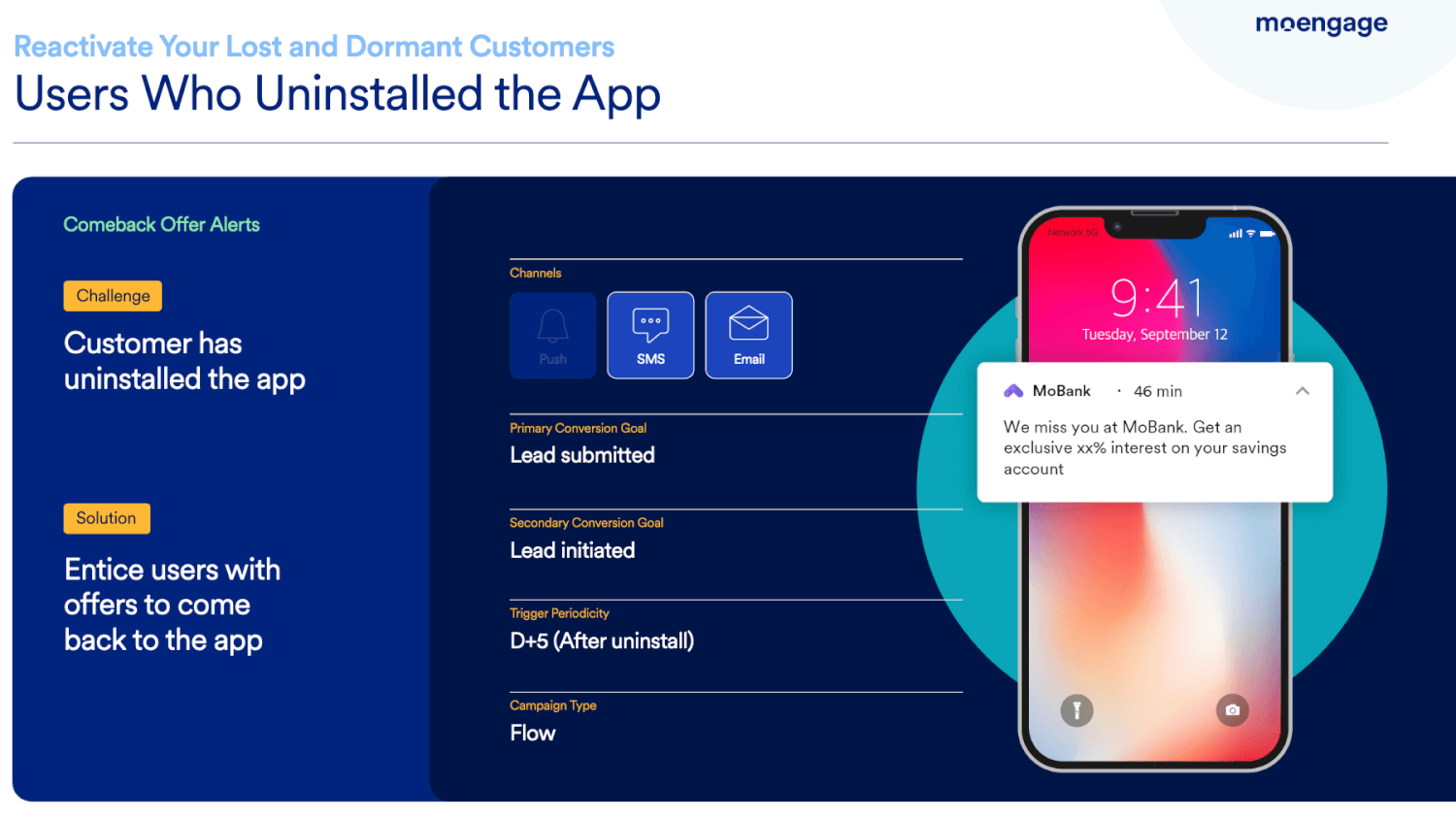

Reactivation

Trendy prospects usually are likely to overlook what apps they’ve put in on their telephones or overlook what duties they will accomplish through banking web sites.

The tip end result? They both uninstall your cell app or cease visiting your web site altogether.

These dormant prospects should be reminded concerning the totally different worth propositions of your banking platform to reignite their curiosity.

Purpose:

The first objective of reactivation needs to be the variety of prospects who reinstall your cell app or login to their account in your web site after an extended interval of inactivity.

Metrics to measure success:

A key metric to measure the success of your reactivation campaigns is the variety of cell app reinstalls or the variety of occasions your web site was visited.

In instances the place your buyer has not uninstalled your cell app however has not been energetic for a very long time, you’ll be able to measure the cell app opened as a hit metric.

Technique to drive reactivation for banking manufacturers:

- Construct RFM segments and create buyer journeys that have interaction every dormant buyer and persuade them to come back again and use your digital platform.

- Remind dormant prospects concerning the totally different worth propositions of your cell app or web site by sending related messages on a number of channels.

How Can a Buyer Engagement Platform Assist You Reactive Your Banking Clients?

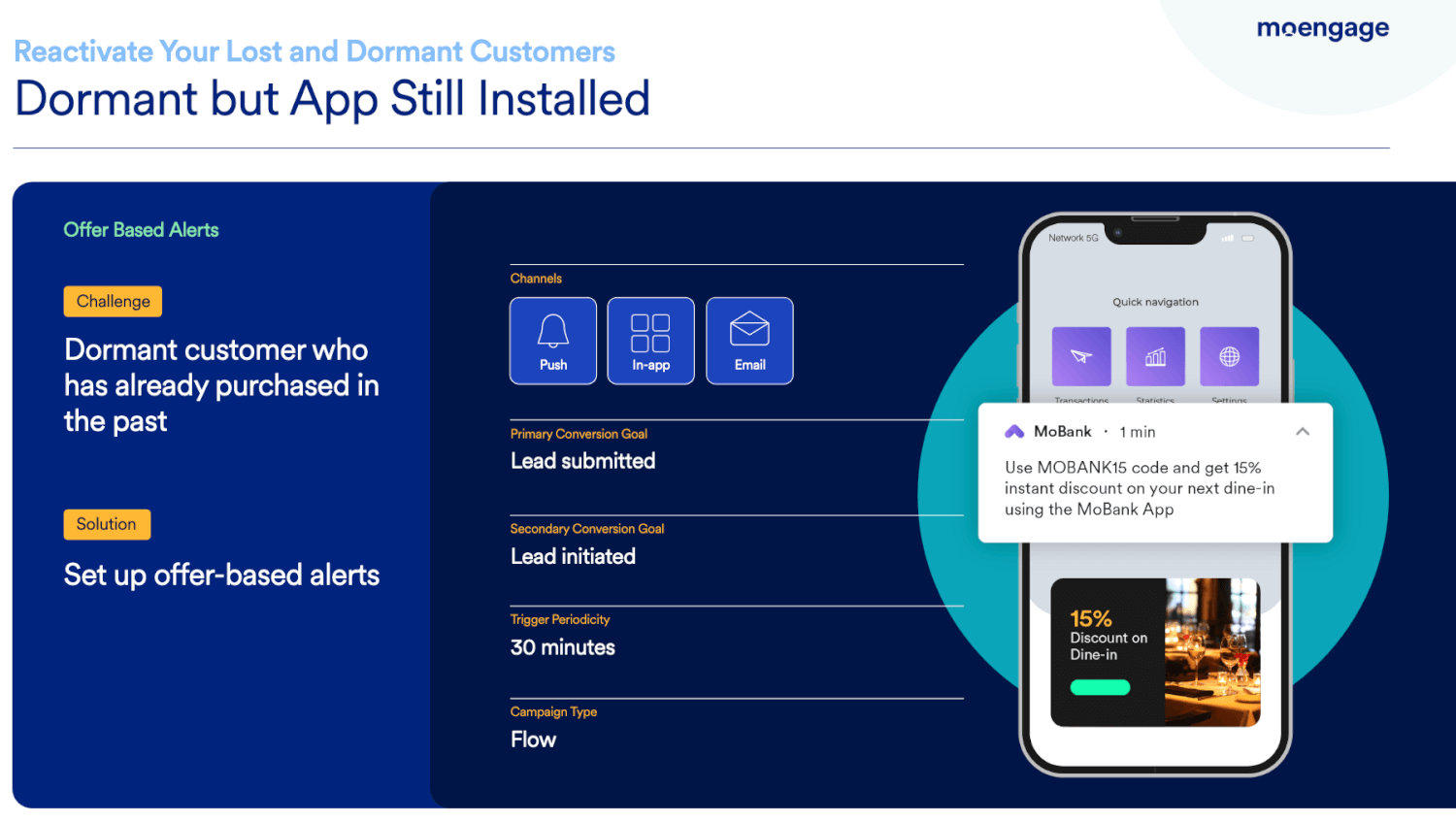

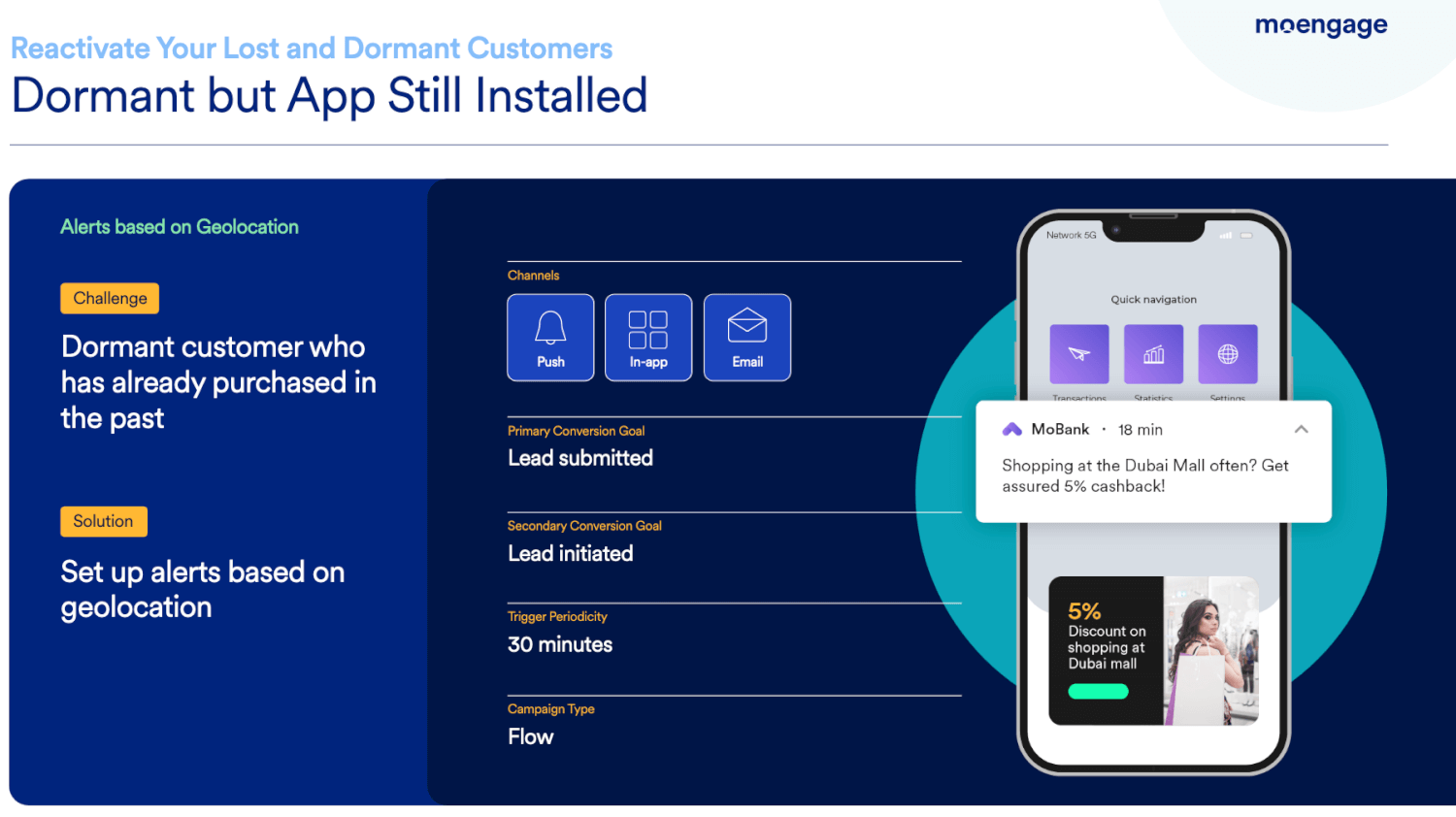

Establish churned or inactive prospects and re-engage them with related content material. Utilizing a Buyer Engagement Platform like MoEngage, you’ll be able to create buyer segments primarily based on their recency, frequency, and financial (RFM) scores.

To establish inactive prospects, take a look at segments with the bottom recency rating.

As soon as recognized, construct customized workflows for these segments and embrace a number of channels like E-mail, SMS, Google Advertisements, or WhatsApp.

You may as well study the person preferences of consumers in these segments primarily based on their earlier shopping habits and buying historical past.

These insights will assist you to curate the right messages in your reactivation campaigns.

Conclusion

Buyer Engagement Platforms (CEPs) present a superb alternative for banks like yours to enhance buyer expertise, enhance buyer loyalty, and cut back prices whereas sustaining a safe atmosphere in your prospects’ information.

By leveraging CEPs, you’ll be able to provide customized experiences that align with buyer preferences, streamline operations, and automate routine duties, all whereas making certain the security and safety of your prospects.

Buyer Engagement Platforms will assist you to enhance LTV and CX if used for:

- Digital Onboarding and KYC (Know Your Buyer)

- Product Cross-sells and Upsells

- Well timed Alerts and Reminders

- Reactivation

Learn extra about MoEngage’s Insights-led Buyer Engagement Platform right here.

The put up How Banks Can Use Buyer Engagement Platforms to Enhance LTV and CX Whereas Decreasing Prices in a Safe Surroundings appeared first on MoEngage.