Easy methods to energy up the POWR Pairs Trades to decrease threat and improve return in a wide array, no change market atmosphere.

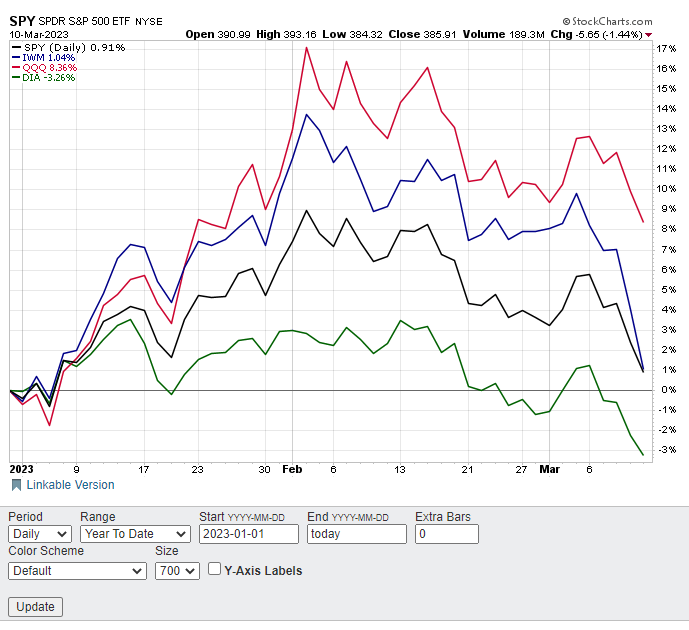

After a rip-roaring begin to 2023, shares have come crashing again to just about unchanged on the 12 months.

The NASDAQ 100 (QQQ) nonetheless is up properly to date in 2023 at a little bit over 8%, however that’s greater than a 50% drop from the highs in early February. The S&P 500 (SPY) and Russell 2000 (IWM) have fallen additional and are clinging to slight beneficial properties for the 12 months. The Dow Jones Industrials (DIA) are actually firmly in adverse territory in 2023.

The roles have been reversed in 2022 with the DIA being by far one of the best performer (down just below 14%) of the 4 indices whereas QQQ (down over 25%) was the worst.

Any such big selection, no change market atmosphere makes shopping for shares harder and places a particular premium on inventory selecting. Utilizing the POWR Rankings to uncover one of the best shares to purchase and the worst shares to promote will likely be an excellent determined edge in 2023.

That’s precisely the method we now have used with nice success in POWR Choices. A POWR Pairs Commerce to coin the time period.

We begin by taking a look at bullish calls on the best rated shares and bearish places on the bottom rated shares. This eliminates a lot of the general market publicity and distills the relative efficiency right down to the facility of the POWR scores. Increased rated shares outperform decrease rated shares to a big diploma as proven within the chart under.

Then we establish conditions the place the decrease rated inventory has out-performed the upper inventory in an enormous means and is able to revenue from the anticipated convergence of the 2 again to a extra traditionally conventional relationship. Up to now, we invariably used this pairs philosophy with two shares in the identical trade to additional dampen threat.

We additionally all the time take into account implied volatility (IV) in each buying and selling choice. POWR Choices buys comparatively low cost choices to additional put the general odds in our favor.

In our newest POWR Pairs Commerce, nevertheless, we determined to forego the identical trade requirement and simply have a look at shopping for good shares doing awful and shorting unhealthy shares doing too good.

It ended up being a really viable further method to our pairs buying and selling philosophy. A fast walk-through our newest POWR Pairs Commerce will assist shed some mild.

Whereas not a “conventional” pairs commerce, for the reason that two shares are in numerous industries, it nonetheless is a POWR Rankings efficiency pairs commerce.

Shopping for bearish places on the a lot lower-rated however significantly better performing Alcoa (AA) and shopping for bullish calls on the a lot higher-rated however a lot decrease performing Bristol-Myers Squibb (BMY).

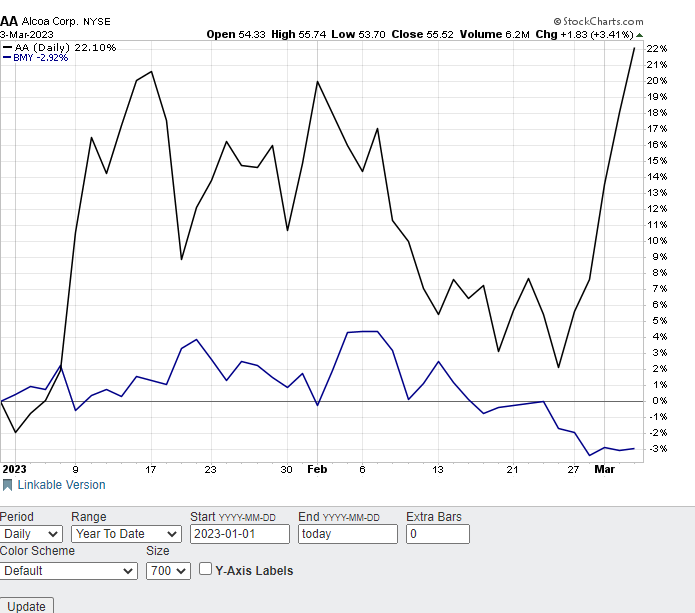

D rated -Promote- Alcoa (AA) is buying and selling at yearly highs for 2023, up 22%.

A rated -Robust Purchase-Bristol Myers (BMY) is simply off the yearly lows, down about 3% year-to-date.

The chart under exhibits the comparative efficiency to date in 2023. Observe how AA did drop sharply in February whereas BMY hugged the flatline. For the reason that finish of February, nevertheless, AA has exploded greater as soon as once more whereas BMY has drifted decrease. Efficiency differential received to 25%.

Search for AA to be a relative underperformer to BMY over the approaching weeks as the worth efficiency between the 2 shares converges because it has prior to now.

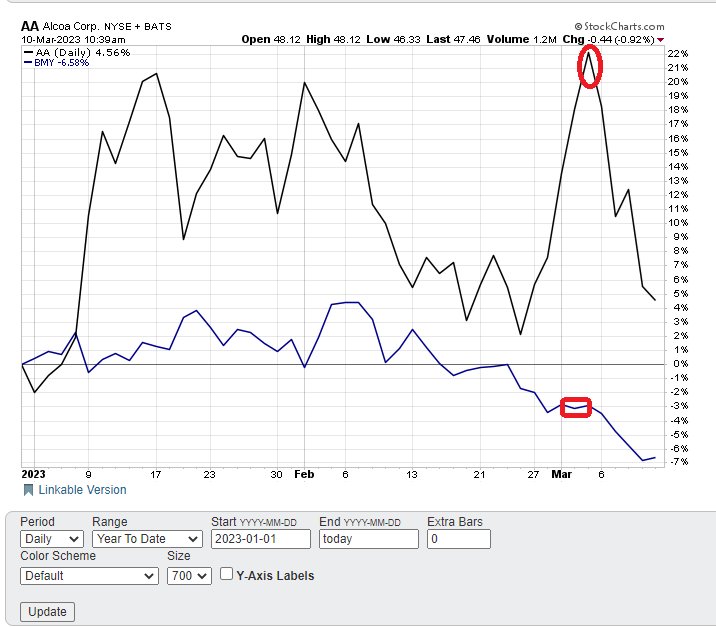

On March 3, The POWR Choices portfolio purchased the AA June $50 places for $3.90 ($390 per choice) and on the similar time purchased the BMY June $67.50 requires $4.20 ($4.20) per choice. Whole mixed outlay was $810.

Quick ahead to Friday March 10. You may see how AA has dropped over 17% for the reason that pairs commerce was initiated (highlighted in pink). BMY has fallen as nicely, however solely a little bit over 3.5%.

This led to closing out the pairs commerce for the reason that unfold had converged dramatically. The unique efficiency differential of over 25% on March 3 shrank, or converged, by greater than half to only over 11% on March 10.

Simply as importantly, implied volatility rose in that timeframe. This gave a carry to each our lengthy places on AA and lengthy calls on BMY. The AA places went from a 53.81 IV to a 56.30 IV. The BMY Calls rose from a 21.14 IV to a 22.28 IV.

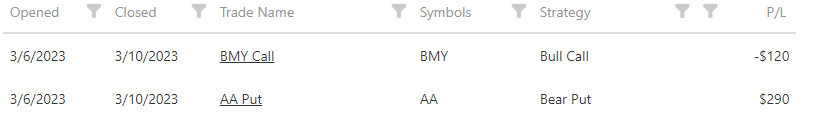

Exited the bullish BMY requires a lack of $120. Bought out of the bearish AA places for a achieve of $290. Web general achieve was $170 ($290 -$120). Precise commerce information seen under.

Web share achieve on the commerce was simply over 20% ($170 web achieve/ $810 preliminary mixed outlay). The holding interval was only a week. In on Monday, out on Friday.

Traders and merchants trying to generate related low-risk however stable short-term returns could need to think about using the POWR Pairs Commerce method to considerably scale back the draw back however nonetheless go away loads of upside open for grabbing beneficial properties.

What To Do Subsequent?

Whereas the ideas behind choices buying and selling are easier than most individuals understand, making use of these ideas to constantly make successful choices trades is not any simple activity.

The answer is to let me do the exhausting be just right for you, by beginning a 30 day to my POWR Choices publication.

I’ve been uncovering one of the best choices trades for over 30 years and with the quantitative muscle of the POWR Rankings as my start line I’ve achieved an 82% win charge over my final 17 closed trades!

Throughout your trial you’ll get full entry to the present portfolio, weekly market commentary and each commerce alert by textual content & e-mail.

I’ll be including the subsequent 2 thrilling choices trades (1 name and 1 put) when the market opens this Monday morning, so begin your trial right this moment so that you don’t miss out.

There’s no obligation past the 30 day trial, so there’s completely no threat in getting began right this moment.

About POWR Choices & 30 Day Trial >>

Right here’s to good buying and selling!

Tim Biggam

Editor, POWR Choices E-newsletter

shares closed at $385.91 on Friday, down $-5.65 (-1.44%). 12 months-to-date, has gained 0.91%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

Concerning the Writer: Tim Biggam

Tim spent 13 years as Chief Choices Strategist at Man Securities in Chicago, 4 years as Lead Choices Strategist at ThinkorSwim and three years as a Market Maker for First Choices in Chicago. He makes common appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Community “Morning Commerce Reside”. His overriding ardour is to make the advanced world of choices extra comprehensible and due to this fact extra helpful to the on a regular basis dealer.

Tim is the editor of the POWR Choices publication. Be taught extra about Tim’s background, together with hyperlinks to his most up-to-date articles.

The submit Higher To Be Bullish Or Bearish? Being Each Is The Greatest Strategy appeared first on StockNews.com