Pull quotes have been supplied by Investing Information Community shoppers Aclara Assets and E-Tech Assets. This text shouldn’t be paid-for content material.

Uncommon earths are key components, a lot of that are vital for the power transition targets set by governments world wide, with demand for the group of vital metals anticipated to be sturdy in coming many years.

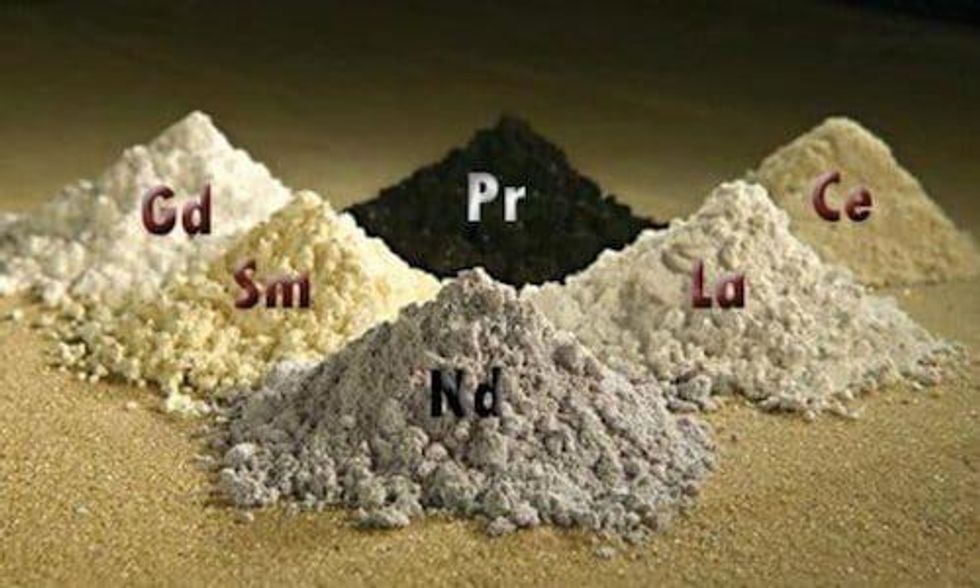

Used within the high-strength magnets present in a lot of the most recent tech, from smartphones to wind generators to electrical automobiles (EVs), uncommon earths will probably be an vital focus for the useful resource sector effectively into the subsequent decade as extra nations within the west work to create provide chains much less depending on China.

As 2023 begins, what’s the uncommon earths forecast for the 12 months forward? The Investing Information Community (INN) reached out to analysts within the house to search out out.

How did uncommon earths carry out in 2022?

In 2021, the dynamics for uncommon earths components (REE) provide and demand have been unsure because the world was simply starting to reopen after the COVID-19 pandemic, however most analysts remained optimistic concerning the sector shifting ahead.

Talking with INN about the principle developments within the REE house, Ryan Castilloux of Adamas Intelligence stated there have been three essential elements that impacted the market in 2022.

“The Russia-Ukraine struggle exacerbated inflation in Europe and North America and fostered a shopper confidence disaster that slowed demand progress for brand new electronics, shopper home equipment, cordless energy instruments and different makes use of of uncommon earth magnets,” he stated.

The skilled added that, on the similar time, strict lockdowns and pandemic management measures in China final 12 months contributed to a serious shopper confidence disaster within the Asia Pacific area. This hindered manufacturing of EVs, cell phones and every part in between.

“Including insult to damage, the standard automotive business continued to be dogged by microchip and different element shortages, slowing international vehicle manufacturing but once more and demand for uncommon earth magnets used broadly in micromotors, sensors and audio system all through,” Castilloux stated.

For Nils Backeberg of Challenge Blue, 2022 didn’t throw any main disruption within the anticipated progress for uncommon earths.

“Whereas sure purposes can have had a decrease performing 12 months in step with the weak financial sentiment, uncommon earth magnet markets remained aligned with electrical car and energy-saving know-how progress,” he stated.

One shock in 2022 was the market tightness in H1 for neodymium, the principle gentle uncommon earth used within the creation of everlasting magnets. This was accelerated by Chinese language above-market demand funding in neodymium-iron-boron (NdFeB) magnet capability.

“Exterior of China, geopolitical curiosity has seen some tasks transfer into building as a race to fulfill restricted ex-China demand via sustainable, de-risked, non-Chinese language provide takes heart stage for vital supplies,” Backeberg stated. “Nonetheless, China’s uncommon earth business gave the world a mild reminder of its main place by considerably ramping up its mining and refining quotas for the 12 months.”

In 2021, China produced essentially the most uncommon earth metals at 168,000 metric tons (MT). The second largest producer was the US with solely 43,000 MT.

When it comes to costs, heavy uncommon earth costs noticed the best surprising upside, as provide from Myanmar was restricted for a lot of the 12 months, in response to Challenge Blue information.

In the meantime, the continued shopper confidence disaster born out of 2022 and continued automotive business bottlenecks led magnet uncommon earth (neodymium, dysprosium, terbium and praseodymium) costs to be decrease than Adamas Intelligence anticipated on the finish of 2021.

“Wanting ahead, we consider the present market malaise will ease within the coming 6 to 18 months, steering costs again in step with our current projections via the medium- to long-term,” Castilloux stated.

What’s the uncommon earths provide and demand forecast for 2023?

As the brand new 12 months begins, there are key provide and demand dynamics to concentrate to that might influence uncommon earths.

With a number of exceptions, Castilloux expects to see elevated demand for practically all REEs subsequent 12 months, though magnet uncommon earth demand will see the best surge on the again of rising EV gross sales, wind energy installations and extra.

“Furthermore, ought to low fuel costs persist in Europe and the tip of lockdowns in China encourage renewed shopper confidence in these areas within the near-term, we might see a latent demand pop in 2023 (as we noticed in 2021) as pent up demand from the 12 months prior materializes,” he stated.

Challenge Blue’s Backeberg agrees, saying many of the uncommon earths will proceed to see demand progress — even cerium and lanthanum, used predominantly in gasoline refining and emissions discount catalysts.

“In 2023, we might even see a comparatively boosted demand associated to financial restoration after a weak 2022, true for all areas,” he added.

Commenting on provide of REE, Backeberg stated the most important danger within the uncommon earth provide chain stays heavy uncommon earths mining in Myanmar. The nation supplies 60 % of China’s medium-to-heavy uncommon earths feedstock.

“The border to China has a historical past of closing usually,” he stated. “Environmental, social and governance considerations from the western world are nonetheless targeted on battery supplies however might see a rising give attention to EV motor supplies sourced from Myanmar.”

Challenge Blue doesn’t see any tight provide or deficits in 2023, barring any unexpected provide disruptions.

In the meantime, for Adamas Intelligence, lanthanum and cerium will proceed to be oversupplied in 2023 on the international stage.

“Nonetheless, within the US we count on demand will proceed to outstrip provide as MP Supplies ramps up refined oxide and chemical manufacturing,” Castilloux stated. “Conversely, the magnet uncommon earths will proceed to face a good supply-demand stability in 2023 with potential for deficits ought to shopper confidence bounce again in main markets, fueling a latent demand pop.”

How will the uncommon earths provide chain change in 2023?

A pattern that was accelerated by the COVID-19 pandemic has been the awakening of governments world wide to their provide chain vulnerabilities and their excessive dependence on nations equivalent to China.

As the brand new 12 months begins, the subsequent alternative for miners will probably be taking a look at unbiased ex-China provide chains to feed European and US magnet demand, Backeberg stated.

“These markets are nonetheless of their infancy and alternatives restricted, however geopolitical curiosity will seemingly see some progress begin to be established,” he stated. “It nonetheless opens the inquiries to surplus non-magnet uncommon earth provide generated in these ex-China provide chains.”

For the Challenge Blue skilled, the non-Chinese language worth chain will function at a premium to China, with nations taking a look at environmental-social-governance-linked metrics to help worth premiums required to develop ex-China provide.

“The EU and the US will seemingly proceed to see EV-related investments in 2023, which can have a bearing on the alternatives for a uncommon earth magnet provide chain, whereas China stays many years forward and continues to put money into bettering its personal base,” he stated.

Commenting on how nations can compete with China, Castilloux stated that with higher prioritization of sustainability, transparency, governance and environmental attributes of provide chains, China’s value management is turning into simpler to problem.

“That stated, within the case of magnet uncommon earths and sure battery supplies, international demand is rising far quicker than China alone can fulfill anyhow, thus areas are usually not but in heavy competitors per se,” he stated.

For Castilloux, it’s encouraging to see governments taking motion to help, stimulate and put money into provide chain growth.

“Whereas there’s dangers in doing so, like making the incorrect investments or cooking up a political scorching potato, the chance of inactivity for Canada, the US, Europe and different resource- and/or demand-endowed nations is way higher,” he stated. “The shift to electromobility and renewables really does current a as soon as in a era alternative for these areas.”

For the REE market particularly, geopolitical curiosity can also be slowly waking as much as the truth that mining uncommon earths and not using a refinery doesn’t set up provide chain independence.

“There are already some processing tasks underway with political backing, however there are nonetheless extra steps within the worth chain required to get to EV motors,” Backeberg stated.

For Castilloux, what’s wanted proper now’s extra funding and authorities push to handle the shortage of capability within the US and Europe to transform magnet uncommon earth oxides into the metals and alloys wanted for magnet manufacturing.

“That’s the key hole threatening the up-and-coming magnet provide chains in these areas in the intervening time,” he stated.

What elements will transfer the uncommon earths market in 2023?

Regardless of the elevated macro setting uncertainty, Castilloux stays optimistic concerning the REE market in 2023.

“We see potential for the present market woes to ease quicker than some could also be anticipating, steering magnet uncommon earth costs again inline with our current projections by mid-year,” he stated.

For the skilled, the so-called magnet uncommon earths have the most important upside going into 2023.

“Demand for these components is rising quicker than all others. The availability-demand stability for these components is already very tight and their respective costs are already traditionally excessive because the market is poised to get better,” Castilloux added. “Different REEs utilized in magnets as components, equivalent to gadolinium and holmium (Gd and Ho), are additionally effectively positioned as standard magnet uncommon earth costs and shortage enhance.”

Equally, for Backeberg, dysprosium and terbium are the most effective positioned components as 2023 kicks off.

“The market progress stays targeted on magnet supplies, particularly for rotary magnets utilizing HREEs, which, with the availability danger for heavy uncommon earths, supplies the most important upside,” he stated. “The forecast progress for uncommon earth magnets is anticipated to proceed at tempo with restricted substitution applied sciences in place for EV drivetrains.”

Long run, Challenge Blue believes that vital forecast demand upside based mostly on the present know-how panorama will should be met by technological developments — with a number of already in growth.

“The present quota stage (in China) ought to see neodymium healthily provided in 2023; nevertheless, additional ramp-ups in magnet manufacturing forward of demand might see extra upside volatility,” Backeberg stated.

However, heavy uncommon earth costs stay linked to the unstable provide chain from Myanmar. Challenge Blue predicts that HREEs’ supply-demand stability will begin to drive the general market dynamics of uncommon earths, which can restrict the upside in neodymium costs over the medium time period.

Don’t neglect to comply with us @INN_Resource for real-time updates!

Securities Disclosure: I, Priscila Barrera, maintain no direct funding curiosity in any firm talked about on this article.

Editorial Disclosure: The Investing Information Community doesn’t assure the accuracy or thoroughness of the data reported within the interviews it conducts. The opinions expressed in these interviews don’t mirror the opinions of the Investing Information Community and don’t represent funding recommendation. All readers are inspired to carry out their very own due diligence.

From Your Web site Articles

Associated Articles Across the Internet