International uncertainty as soon as once more dominated the lead market in 2022, with costs staying risky all year long.

However even with frequent ups and downs, the metallic nearly broke the US$2,500 per metric ton (MT) stage early within the 12 months.

As 2023 kicks off, the Investing Information Community is trying again on the primary tendencies within the lead area in 2022 and what’s forward for costs, provide and demand within the new 12 months. Learn on to study what specialists see coming.

How did lead carry out in 2022?

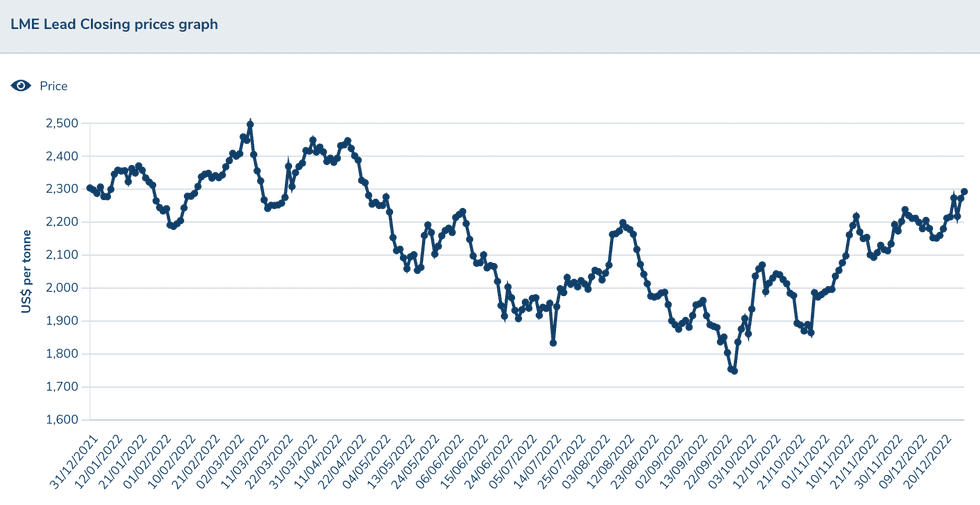

Lead costs carried out in a uneven trend for many of 2022 after seeing excessive ranges and instability in 2021. The base metallic kicked off 2022 buying and selling at US$2,337, climbing by means of the primary quarter to start Q2 at US$2,450.

Lead’s value efficiency in 2022.

Chart by way of the London Steel Alternate.

Regardless of the outbreak of the Russia-Ukraine struggle, which introduced uncertainty to the world markets on account of strict financial sanctions on Russia, lead costs fell on account of weaker consumption development.

“The drop got here amid reviews of an elevated provide of major lead, which was considerably tempered by tighter provide from secondary sources — smelters of scrap lead will face an elevated value following the latest imposition of a VAT in China,” analysts at FocusEconomics mentioned again in April.

Through the second quarter, lead costs fell sharply beneath the US$2,000 threshold and continued their decline within the third quarter to succeed in their lowest stage of the 12 months in September, when the metallic was altering fingers for US$1,737.50.

“Lead costs possible benefited during the last month from the easing of the worldwide semiconductor scarcity, which seems to have boosted automobile provide,” FocusEconomics analysts defined on the time. “That mentioned, the broader demand backdrop was nonetheless downbeat on account of rising rates of interest around the globe and stop-start Covid-19 restrictions in China.”

Elevated volatility continued to take a maintain of the lead market within the final quarter, however costs climbed to finish the 12 months at US$2,336.50 — nearly impartial in comparison with their 2022 start line.

“The worldwide lead market was sturdy on the finish of 2022, with a refined deficit in that 12 months drawing down a lot of the shares builtup in 2020 to 2021 and a shortfall within the focus market reversing any slight extra in 2021 following 2020’s massive deficit,” Wooden Mackenzie analysts mentioned in a latest report.

What components will transfer the lead market in 2023?

As the brand new 12 months begins, buyers within the lead market ought to keep watch over provide and demand dynamics, in addition to different catalysts that might influence the sector shifting ahead.

After rising by 4.6 % in 2021, international demand for refined lead metallic is forecast to extend by 1.4 % to 12.6 million MT in 2023, in keeping with the Worldwide Lead and Zinc Research Group (ILZSG). “Measures carried out by the Chinese language authorities to comprise a resurgence in COVID-19 circumstances negatively impacted lead demand within the automotive sector,” the business group mentioned. “Nonetheless, this was partially balanced by an increase within the exports of lead acid batteries.”

For Wooden Mackenzie’s analysts, the extent to which COVID-19 impacts the lead market in 2023 will possible stem from how nicely China can modify to the ending of its zero-COVID coverage.

“This can be a key uncertainty in relation to steer consumption and wider financial development,” they mentioned. “Nonetheless, the load of the substitute battery market and lead recycling implies that the influence on lead’s supply-demand steadiness will possible be restricted.”

Though the Russia-Ukraine struggle has had solely a modest bearing on the lead market, greater energy prices ensuing from sanctions on Russia are one thing to observe in 2023. “Elevated prices have made some smelters weak, whereas they’ve additionally boosted curiosity in vitality storage methods, which might make use of lead batteries,” Wooden Mackenzie analysts mentioned.

One other issue to observe is the lithium market, as exercise there’ll decide the velocity at which the world switches from lead-acid batteries to lithium-ion batteries.

“With the uptake of lithium-ion batteries as a part of the vitality transition nonetheless in its infancy, latent demand for lithium-ion batteries will typically be operating forward of lithium uncooked materials provides,” as per the agency. “Lithium chemical costs elevated severalfold in 2022 and this has resulted in lead-acid batteries getting used when lithium-ion batteries had been most popular.”

Trying over to provide, world lead mine provide is forecast to stay roughly unchanged in 2022 at 4.56 million MT, the ILZSG says. In 2023, output is anticipated to rise by 2.7 % to 4.68 million MT.

For its half, Wooden Mackenzie expects international mine manufacturing in 2023 to be 12 % lower than it was 10 years in the past. It is going to possible be no less than 5 % lower than it was in 2019, however the agency forecasts that it’s going to greater than get better all that it misplaced in 2022.

“Abra is essentially the most vital new mine when it comes to scale of lead manufacturing, but in addition as a result of it won’t additionally produce zinc,” analysts on the agency identified. One other to observe is Ozernoye in Russia. “A threat for lead mine provide in 2023 is that zinc costs weaken to extent that some mines change into uneconomic and curtail output.”

The ILZSG expects world refined lead provide to fall by 0.3 % to 12.34 million MT in 2022, with a 1.8 % rise to 12.56 million MT anticipated in 2023. “(We count on) that international demand for refined lead metallic will exceed provide by 83,000 tonnes in 2022. In 2023, a smaller deficit of 42,000 tonnes is predicted,” the group mentioned.

Panelists lately polled by FocusEconomics see costs averaging US$2,014 in This autumn 2023 and US$1,934 in This autumn 2024.

“Potential provide disruptions and the provision of bodily shares are key components to observe when it comes to provide,” they mentioned. “In the meantime, the velocity of China’s restoration from the present surge in Covid-19 circumstances, the tempo of world financial coverage tightening and the scope of Chinese language infrastructure spending are key components to observe on the demand aspect.”

Don’t neglect to observe us @INN_Resource for real-time information updates!

Securities Disclosure: I, Priscila Barrera, maintain no direct funding curiosity in any firm talked about on this article.

From Your Web site Articles

Associated Articles Across the Net