Aluminum costs trended up for a lot of the first quarter of 2022 because the Russia-Ukraine struggle elevated market volatility.

Excessive power prices additionally impacted the metallic, which noticed costs decline within the second half of the yr.

With 2023 now in full swing, traders on this industrial metallic are questioning concerning the aluminum outlook for subsequent yr. Right here the Investing Information Community (INN) appears to be like again on the primary developments within the sector and what’s forward for aluminum.

How did aluminum carry out in 2022?

On the finish of 2021, market watchers have been anticipating a deficit within the aluminum sector, with the next atmosphere for costs.

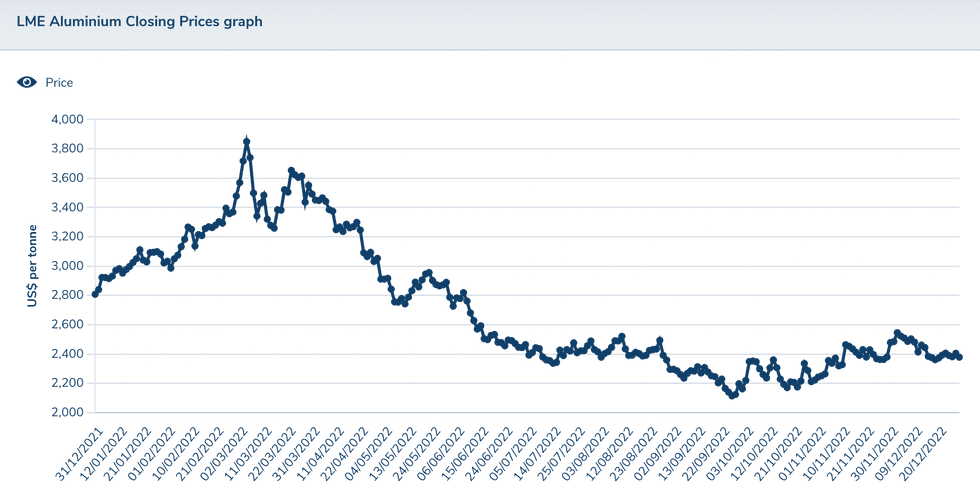

However after growing steadily within the first few months of the yr, aluminum was unable to carry onto its beneficial properties. The London Metallic Trade aluminum value plummeted from a excessive of US$4,000 per metric ton (MT) in March to a low of US$2,079 in September.

“It’s been a turbulent yr for the aluminum market,” Ami Shikvar of Wooden Mackenzie instructed INN. “The influence of the Russia-Ukraine battle, energy shortages in Europe and China and fears of a recession have dominated value path.”

Aluminum’s value efficiency in 2022.

Chart by way of the London Metallic Trade.

Excessive power costs have led to quite a few manufacturing cuts in China and Europe for the reason that begin of the struggle — Europe’s power disaster paired with hydropower shortages in China have impacted almost 4.5 million MT per yr capability, as per Wooden Mackenzie.

“Provide was falling, however as fears of a recession gripped the market, the London Metallic Trade aluminum value fell as demand was falling quicker than provide,” Shikvar defined. “The closure of the Nikolaev alumina refinery in Ukraine and the Australian alumina export ban additionally pushed the London Metallic Trade aluminum value greater.”

Wooden Mackenzie was anticipating costs for aluminum to common US$2,900 in 2022 in opposition to a backdrop of smelting cuts in Europe in late 2021 and a rebound in demand for the metallic.

“The Russia-Ukraine battle meant that costs have been susceptible to volatility and largely headline pushed in March,” Shikvar stated.

What elements will transfer the aluminum market in 2023?

As the brand new yr begins, there are a couple of elements traders within the aluminum trade ought to contemplate.

Wooden Mackenzie anticipates a muted international restoration as improved Chinese language demand as a result of rest of strict COVID-19 restrictions offsets the still-weak demand development seen elsewhere.

“Nonetheless, Q1 2023 will doubtless stay weak as a result of lackluster property market in China,” Shikvar stated.

When it comes to provide, for Shikvar there could also be gentle on the finish of the tunnel even supposing aluminum output in Europe is at its lowest degree since 1988. “European energy costs have softened, and a few smelters could contemplate restarting capability if energy costs fall additional,” she stated. “Nonetheless, marginally low power costs in spring gained’t final for lengthy.”

The chance of disruption in Europe stays, with almost 400,000 MT of capability weak to closures if energy costs spike once more, in line with Wooden Mackenzie knowledge.

“Conversely, there are too many variables that might alter our provide estimates for China,” Shikvar stated. “Over time, the Nationwide Improvement and Reform Fee and the provincial authorities have mandated smelting and refining cuts to cope with oversupply, weak Shanghai Futures Trade costs, air pollution and power shortages. This will likely effectively proceed in 2023 as some provinces grapple with intermittent power shortages.”

Wanting forward, aluminum provide is poised to develop marginally as greenfield tasks, expansions and restarts add to produce.

“Greater power prices and potential hydropower shortages within the dry season may suppress provide,” Shikvar stated. “However, a deteriorating financial atmosphere may push the market right into a surplus.”

Making aluminum requires round 40 instances extra power than copper, making it essentially the most energy-intensive base metallic to supply.

“Regardless of the latest weak spot in power costs, we don’t count on capability to return again on-line within the brief time period with Europe heading into the winter months and the struggle with Russia raging on,” Ewa Manthey of ING stated in a November 2022 notice. “Additional smelter closures and curtailments in manufacturing are extremely doubtless given the uncertainty over power costs by means of subsequent yr.”

With seen inventories at traditionally low ranges, provide dangers in China and Europe and the potential for decrease energy availability and excessive power prices, 2023 may very well be one other attention-grabbing yr for aluminum.

“An unsure macroeconomic outlook will additional add to the aluminum market danger,” Shikvar stated. “As such, we’re forecasting costs to common round US$2,350 in 2023.”

ING believes that within the brief time period the market will concentrate on bigger macroeconomic and demand-side issues. The agency sees costs trending down additional this yr, hitting US$2,150 within the first quarter.

“We imagine a restoration in value ought to begin in 2Q 2023, though any restoration is prone to be gradual,” Manthey stated.

Panelists lately polled by FocusEconomics see aluminum costs remaining round present ranges by means of This autumn 2023. They count on costs to common US$2,395 in This autumn 2023 and US$2,332 in This autumn 2024.

“Demand will doubtless be decided by the speed at which China’s economic system rebounds, particularly the highly-indebted however aluminum-hungry development sector,” FocusEconomics states in its newest report.

“On provide, decrease common power costs than in 2022 ought to restrict additional closures of smelters, whereas the London Metallic Trade’s November determination to not ban Russian metals has additional alleviated provide fears.”

For traders concerned about aluminum, it will likely be necessary to look at for any indicators of a rebound in demand, which may push premiums greater, in line with Shikvar. “Additionally, any additional alumina cuts may enhance aluminum costs,” she stated.

Don’t neglect to observe us @INN_Resource for real-time information updates!

Securities Disclosure: I, Priscila Barrera, maintain no direct funding curiosity in any firm talked about on this article.

Editorial Disclosure: The Investing Information Community doesn’t assure the accuracy or thoroughness of the knowledge reported within the interviews it conducts. The opinions expressed in these interviews don’t replicate the opinions of the Investing Information Community and don’t represent funding recommendation. All readers are inspired to carry out their very own due diligence.

From Your Website Articles

Associated Articles Across the Net