What’s your organization value? It is an necessary query for any entrepreneur, enterprise proprietor, or potential investor.

What’s extra, figuring out worth your enterprise turns into more and more necessary because it grows, particularly if you wish to elevate capital, promote a portion of the enterprise, or borrow cash.

Right here, we’ll check out various factors to contemplate when valuing your enterprise, widespread equations you need to use, and high-quality instruments that can assist you to crunch the numbers.

Desk of Contents

How you can Worth a Enterprise

Public vs. Non-public Valuations

Enterprise Valuation Strategies

Enterprise Valuation Calculators

What’s a enterprise valuation?

Because the identify suggests, a enterprise valuation determines the worth of a enterprise or firm. Through the course of, all areas of a enterprise are fastidiously analyzed, together with its monetary efficiency, belongings and liabilities, market place, and future progress potential.

Finally, the objective is to reach at a good and goal estimate which may be helpful in making enterprise choices and negotiating.

How you can Worth a Enterprise

- Firm Dimension

- Profitability

- Market Traction and Development Price

- Sustainable Aggressive Benefit

- Future Development Potential

1. Firm Dimension

Firm dimension is a generally used issue when valuing an organization. Sometimes, the bigger the enterprise, the upper the valuation shall be. It’s because smaller firms have little market energy and are extra negatively impacted by the lack of key leaders. As well as, bigger companies possible have a well-developed services or products and, consequently, extra accessible capital.

2. Profitability

Is your organization incomes a revenue?

If that’s the case, this a great signal, as companies with larger revenue margins shall be valued larger than these with low margins or revenue loss. The first technique for valuing your enterprise primarily based on profitability is thru understanding your gross sales and income information.

Valuing a Firm Primarily based On Gross sales and Income

Valuing a enterprise primarily based on gross sales and income makes use of your totals earlier than subtracting working bills and multiplying that quantity by an business a number of. Your business a number of is a median of what companies usually promote for in your business so, in case your a number of is 2, firms often promote for 2x their annual gross sales and income.

3. Market Traction and Development Price

When valuing an organization primarily based on market traction and progress charge, your enterprise is in comparison with your opponents. Buyers need to know the way giant your business market share is, how a lot of it you management, and the way shortly you’ll be able to seize a share of the market. The faster you attain the market, the upper your enterprise’ valuation shall be.

4. Sustainable Aggressive Benefit

What units your product, service, or resolution aside from opponents?

With this methodology, the best way you present worth to clients must differentiate you from the competitors. If this aggressive benefit is simply too tough to keep up over time, this might negatively influence your enterprise’ valuation.

A sustainable aggressive benefit helps your enterprise construct and preserve an edge over opponents or copycats sooner or later, pricing you larger than your opponents as a result of you have got one thing distinctive to supply.

5. Future Development Potential

Is your market or business anticipated to develop? Or is there a possibility to increase the enterprise’ product line sooner or later? Elements like these will enhance the valuation of your enterprise. If traders know your enterprise will develop sooner or later, the corporate valuation shall be larger.

The monetary business is constructed on attempting to precisely outline present progress potential and future valuation. All of the traits listed above must be thought of, however the important thing to understanding future worth is figuring out which components weigh extra closely than others.

Relying in your kind of enterprise, there are totally different metrics used to worth private and non-private firms.

Public Versus Non-public Valuation

.png?width=2000&height=900&name=How%20to%20Value%20a%20Business%20Public%20vs%20Private%20valuation%20(1).png)

Public Firm Valuation

For public firms, valuation is known as market capitalization (which we’ll focus on beneath) — the place the worth of the corporate equals the full variety of excellent shares multiplied by the value of the shares.

Public firms may also commerce on ebook worth, which is the full quantity of belongings minus liabilities in your firm stability sheet. The worth is predicated on the asset’s authentic price much less any depreciation, amortization, or impairment prices made towards the asset.

Non-public Firm Valuation

Non-public firms are sometimes more durable to worth as a result of there’s much less public data, a restricted monitor file of efficiency, and monetary outcomes are both unavailable or won’t be audited for accuracy.

Let’s check out the valuations of firms in three phases of entrepreneurial progress.

1. Ideation Stage

Startups within the ideation stage are firms with an thought, a marketing strategy, or an idea of acquire clients, however they’re within the early phases of implementing a course of. With none monetary outcomes, the valuation is predicated on both the monitor file of the founders or the extent of innovation that potential traders see within the thought.

A startup and not using a monetary monitor file is valued at an quantity that may be negotiated. Most startups I’ve reviewed created by a first-time entrepreneur begin with a valuation between $1.5 and $6 million.

All the worth is predicated on the expectation of future progress. It is not at all times within the entrepreneur’s finest curiosity to maximise its worth at this stage if the objective is to have a number of funding rounds. The valuation of early-stage firms may be difficult as a result of these components.

2. Proof of Idea

Subsequent is the proof of idea stage. That is when an organization has a handful of workers and precise working outcomes. At this stage, the speed of sustainable progress turns into essentially the most essential think about valuation. Execution of the enterprise course of is confirmed, and comparisons are simpler due to obtainable monetary data.

Firms that attain this stage are both valued primarily based on their income progress charge or the remainder of the business. Extra components are evaluating peer efficiency and the way nicely the enterprise is executing compared to its plan. Relying on the corporate and the business, the corporate will commerce as a a number of of income or EBITDA (earnings earlier than curiosity, taxed, depreciation, and amortization).

3. Proof of Enterprise Mannequin

The third stage of startup valuation is the proof of the enterprise mannequin. That is when an organization has confirmed its idea and begins scaling as a result of it has a sustainable enterprise mannequin.

At this level, the corporate has a number of years of precise monetary outcomes, a number of merchandise transport, statistics on how nicely the merchandise are promoting, and product retention numbers.

Relying in your firm, there are a number of equations to make use of to worth your enterprise.

Firm Valuation Strategies

Let’s check out a few of the formulation for enterprise valuation.

Market Capitalization Formulation

Market Worth Capitalization is a measure of an organization’s worth primarily based on inventory worth and shares excellent. Right here is the system you’d use primarily based on your enterprise’ particular numbers:

Multiplier Methodology Formulation

You’d use this methodology in the event you’re hoping to worth your enterprise primarily based on particular figures like income and gross sales. Right here is the system:

.png?width=2345&name=Blue_Opt01%20(2).png)

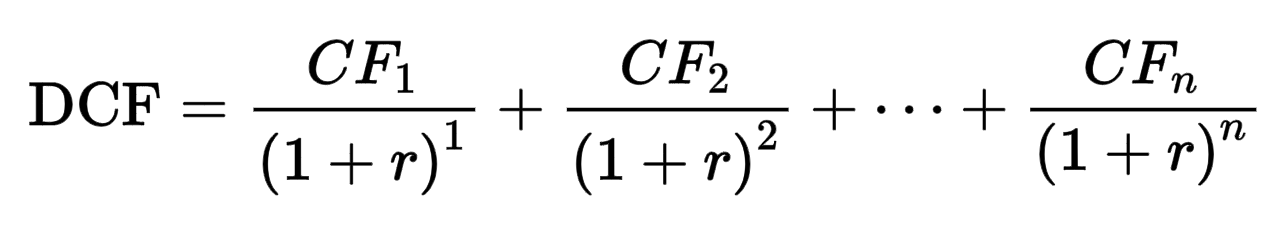

Discounted Money Circulate Methodology

Discounted Money Circulate (DCF) is a valuation approach primarily based on future progress potential. This technique predicts how a lot return can come from an funding in your organization. It’s the most complex mathematical system on this checklist, as there are lots of variables required. Right here is the system:

Listed here are what the variables imply:

- CF = Money stream throughout a given 12 months (can embrace as a few years as you’d like, merely comply with the identical construction).

- r = low cost charge, generally known as weighted common price of capital (WACC). That is the speed {that a} enterprise expects to pay for its belongings.

This methodology, together with others on this checklist, requires correct math calculations. To make sure you’re heading in the right direction, it might be useful to make use of a calculator device. Beneath we’ll suggest some high-quality choices.

Enterprise Valuation Calculators

Beneath are enterprise valuation calculators you need to use to estimate your firms worth.

1. CalcXML

This calculator appears at your enterprise’ present earnings and anticipated future earnings to find out a valuation. Different enterprise parts the calculator considers are the degrees of threat concerned (e.g., enterprise, monetary, and business threat) and the way marketable the corporate is.

2. EquityNet

EquityNet’s enterprise valuation calculator appears at varied components to create an estimate of your enterprise’s worth. These components embrace:

- Odds of the enterprise’ survival

- Business the enterprise operates in

- Belongings and liabilities

- Predicted future income

- Estimated revenue or loss

3. ExitAdviser

ExitAdviser’s calculator makes use of the discounted money stream (DCF) methodology to find out a enterprise’s worth. To find out the valuation, “it takes the anticipated future money flows and ‘reductions’ them again to the current day.”

Firm Valuation Instance

It could be useful to have an instance of firm valuation, so we’ll go over one utilizing the market capitalization system displayed beneath:

Shares Excellent x Present Inventory Worth = Market Capitalization

For this equation, I have to know my enterprise’s present inventory worth and the variety of excellent shares. Listed here are some pattern numbers:

Shares Excellent: $250,000

Present Inventory Worth: $11

Here’s what my system would appear like once I plug within the numbers:

250,000 x 11

Primarily based on my calculations, my firm’s market worth is 2,750,000.

Again to You

Whether or not you’re trying to borrow cash, promote a portion of your organization, or just perceive your market worth, understanding how a lot your enterprise is value is necessary for your enterprise’ progress.

.png#keepProtocol)