Because the fourth largestgoldproducer in Africa, Mali is dwelling to over 350 artisanal gold-mining websites alongside a number of company mining initiatives. Greater than 2 million individuals within the nation depend upon gold mining, with the valuable metallic accounting for 80 % of Mali’s exports in 2021 and 10 % of the nation’s GDP.

Gold mining in Mali has allowed the nation to ascertain itself on the worldwide stage, exporting a number of billion ounces of gold every year. But this alone shouldn’t be what makes Mali such a promising funding goal. It is the truth that the overwhelming majority of Mali is unexplored — and there may be each indication that the nation is dwelling to mineral riches simply ready to be found.

Even Southern Mali, dwelling to many of the nation’s mining operations, is basically underexplored. The 2019 discovery of a billion greenback gold belt within the area might jumpstart a sequence of worldwide acquisitions and exploration initiatives. Already a hotbed of mining growth, Mali now has the potential to develop into one of many world’s premier mining jurisdictions.

Probably the most vital greenstone belt on the continent

Most of Mali’s mineral wealth — together with that of its instant friends, Ghana and Burkina Faso — traces again to the Birimian greenstone belt. Shaped from the collision of tectonic plates within the West African Craton billions of years in the past and named for Ghana’s Birim River, this greenstone belt is the best-known on the continent. Almost all of the gold inside its geologic constructions happens in Birimian deposits — gold-bearing rocks composed of interbedded metasediments and metavolcanics.

The Birimian greenstones are confirmed to host extremely wealthy gold deposits via a number of episodes of gold emplacement. Many of those deposits happen in corridors 10 to fifteen kilometers huge, characterised by intensive shear zones. Gold mineralization in these belts is often hydrothermal, fashioned by structural weaknesses that supplied makeshift plumbing programs for gold-bearing fluids to stream into and settle.

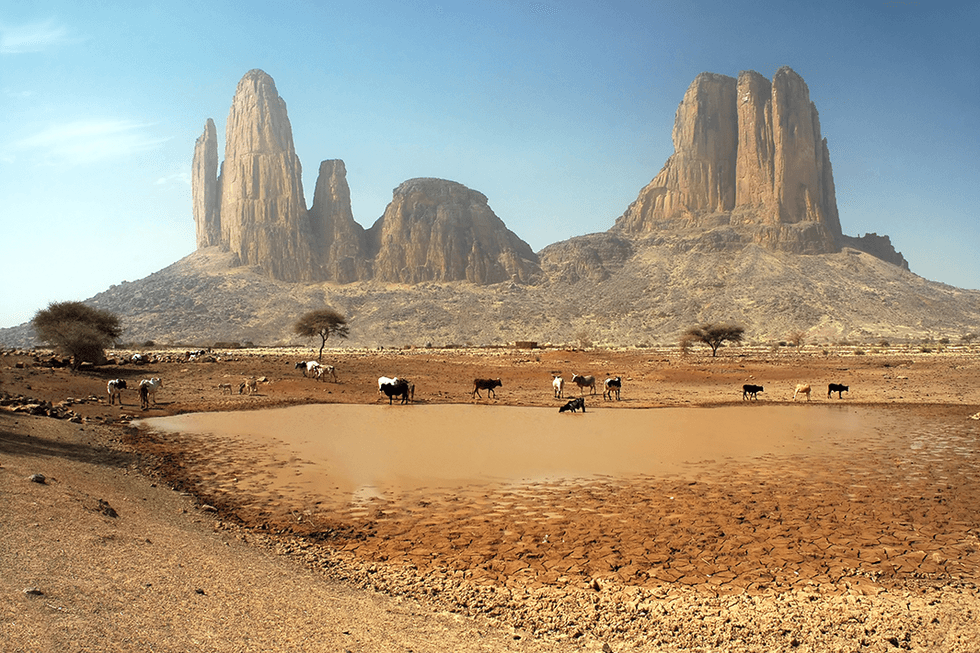

One other good thing about the Birimian belt is its age. The vast majority of gold-bearing deposits in West Africa happen in savannah-like areas flattened by weathering and erosion. Since many of those areas additionally exist in shut proximity to the Sahara desert, they’re additionally fairly arid, making them extremely favorable for mining operations.

It is estimated that a lot of the Birimian greenstone belt stays unexplored.

A prolific rising mining camp

Thought-about a steady jurisdiction by the worldwide mining neighborhood, Southern Mali has lengthy been a prolific goal for gold discovery. Lots of its richest deposits happen in shut proximity to pre-existing infrastructure, while the significance of mining to Mali’s financial system creates a extremely favorable social and regulatory local weather. That is maybe greatest exemplified by the Niaouleni-Kobada-Sanankoro Hall.

Extending from Southern Mali into Guinea and the Siguiri Basin, the hall has lengthy been dwelling to a number of regional and artisanal mining initiatives. Now, firms, equivalent to Sylla Gold (TSXV:SYG,OTCQB:SYGCF) have begun staking their claims each right here and all through Southern Mali. A sequence of promising exploration initiatives over the previous a number of years stands to not solely strengthen Mali’s financial system, but additionally draw extra mining firms from all all over the world to this rising jurisdiction.

“New gold discoveries in Mali have elevated the nation’s gold reserves to 881.7 tons on the finish of October — roughly 15 years of output at present manufacturing ranges,” a Ministry of Mines official defined lately. “The rise in reserves is the results of exploration.”

The main gamers in Mali’s gold-mining sector

Even previous to this present flurry of mining exercise, Mali was dwelling to a number of titans of the business.

Barrick Gold (NYSE:GOLD,TSX:ABX) operates the Loulo Gounkoto advanced, comprising two distinct permits alongside the border between Mali and Senegal. The corporate maintains 80 % possession of each mines, with the remaining 20 % held by Mali’s authorities. Between them, Loulo and Gounkoto host gold reserves of 6.7 million confirmed and provable ounces.

Initially collectively owned by Anglogold Ashanti (NYSE:AU,ASX:AGG) and IAMGOLD (TSX:IMG,NYSE:IAG), the Sadiola gold mine was acquired by Allied Gold in 2020, which now owns an 80 % stake. As with Loulo Gounkoto, the remaining 20 % is held by the State of Mali. A subsidiary of Allied Assets, Allied Gold owns a number of belongings all through Africa, together with the Agbaou mine, which it acquired in 2021 for C$80 million.

Canadian mining company B2Gold (TSX:BTO,NYSEAMERICAN:BTG) operates the Fekola mine, positioned close to Barrick’s Loulo Gounkoto advanced. The mine produced 567,795 ounces in 2021 and at a mean money working value of US$765 per ounce. The low-cost mine is anticipated to realize related manufacturing by the tip of this yr.

Algom Assets, a subsidiary of BCM Worldwide, owns and operates the Tabakoto and Segala gold initiatives. Acquired from Endeavour Mining (TSX:EDV,LSE:EDV) in 2018, the initiatives are located roughly 360 kilometers west of Bamako. Collectively, the initiatives include 8.9 million tonnes of confirmed and provable gold reserves.

Though it bought Sadiola to Allied Gold, IAMGOLD has been a serious participant in Africa’s mining sector, and it lately entered into an settlement to promote its Boto Gold undertaking, which comprises an estimated 1.4 million ounces of the valuable metallic, to Managem (CSE:MNG). IAMGOLD has additionally been engaged in a extremely promising greenfield exploration undertaking, Diakha-Siribaya. That property can be included within the US$282 million deal.

Mali’s most promising latest discoveries

Though Mali has lately hosted many firms engaged in exploration and discovery initiatives, three are significantly noteworthy.

Located roughly 126 kilometers southwest of Mali’s capital metropolis, Bamako, the advanced-stage Kobada undertaking combines a low development value and value profile with wealthy gold deposits comprising 1.43 million ounces of inferred assets. Owned by Toubani Assets (ASX:TRE,TSXV:TRE), the mine will leverage a contractor-driven mining plan mixed with gravity and carbon-in-leach processing. When the mine begins manufacturing, it would have an anticipated output of 100,000 ounces for the primary 10 years, and a complete mine lifetime of 16 years.

Cora Gold (LSE:CORA) owns the Sanankoro gold undertaking alongside the Yanfolila Gold Belt. Comprising 5 contiguous permits spanning 342 sq. kilometers, the undertaking hosts an estimated 24.9 million tonnes of gold at 1.15 grams per tonne (g/t). The corporate lately confirmed continued assist for the undertaking from its chief investor, Lionhead Capital Advisors Proprietary.

Sylla Gold is arguably probably the most attention-grabbing of the three. For one, the corporate’s management has a confirmed observe file in African gold exploration and discovery. They’ve all been concerned in a number of profitable discoveries throughout the identical geologic surroundings as their present undertaking, Niaouleni.

These embody Jilbey Gold’s Bissa Hill undertaking in Burkina Faso, Merrex Gold’s Siribaya and Diaahka deposits (quickly to be owned by Managem) and Roscan Gold’s Kandiolé undertaking.

Sylla Gold’s 17,200 hectare Niaouleni undertaking is its most promising discovery prospect but. On its preliminary drill program, 48 of 57 reverse circulation holes hit high-grade gold mineralization. Preliminary outcomes ranged from 6.39 g/t to 2.13 g/t, all roughly six kilometers south of the Kobada deposit.

Sylla Gold has additionally recognized vital massive geochemical anomalies alongside the Kobada and Gosso shears, each of which fall throughout the firm’s license. Though it has but to check these anomalies, testing by previous operators throughout the area present a substantial amount of promise. Some areas throughout the firm’s Niaouleni West allow, for example, ran as excessive as 4.3 g/t in soils.

These areas haven’t but been drilled, however it’s however clear that the hall through which Sylla Gold operates hosts vital gold endowment, the true extent of which is able to solely develop into evident via additional exploration.

Takeaway

Southern Mali is an extremely promising area for exploration and discovery. If latest exercise throughout the space is any indication, it could very quickly develop into a hotbed of mining funding. Anybody with an curiosity in including gold to their funding portfolio is suggested to maintain a detailed eye on Mali, in addition to the businesses working inside.

This INNSpired article is sponsored by Sylla Gold (TSXV:SYG). This INNSpired article gives info which was sourced by the Investing Information Community (INN) and permitted by Sylla Gold in order to assist buyers be taught extra concerning the firm. Sylla Gold is a consumer of INN. The corporate’s marketing campaign charges pay for INN to create and replace this INNSpired article.

This INNSpired article was written in keeping with INN editorial requirements to teach buyers.

INN doesn’t present funding recommendation and the data on this profile shouldn’t be thought-about a advice to purchase or promote any safety. INN doesn’t endorse or advocate the enterprise, merchandise, companies or securities of any firm profiled.

The knowledge contained right here is for info functions solely and isn’t to be construed as a proposal or solicitation for the sale or buy of securities. Readers ought to conduct their very own analysis for all info publicly accessible regarding the firm. Prior to creating any funding determination, it’s endorsed that readers seek the advice of immediately with Sylla Gold and search recommendation from a professional funding advisor.