.elementor-column .elementor-spacer-inner{top:var(–spacer-size)}.e-con{–container-widget-width:100%}.e-con-inner>.elementor-widget-spacer,.e-con>.elementor-widget-spacer{width:var(–container-widget-width,var(–spacer-size));–align-self:var(–container-widget-align-self,preliminary);–flex-shrink:0}.e-con-inner>.elementor-widget-spacer>.elementor-widget-container,.e-con>.elementor-widget-spacer>.elementor-widget-container{top:100%;width:100%}.e-con-inner>.elementor-widget-spacer>.elementor-widget-container>.elementor-spacer,.e-con>.elementor-widget-spacer>.elementor-widget-container>.elementor-spacer{top:100%}.e-con-inner>.elementor-widget-spacer>.elementor-widget-container>.elementor-spacer>.elementor-spacer-inner,.e-con>.elementor-widget-spacer>.elementor-widget-container>.elementor-spacer>.elementor-spacer-inner{top:var(–container-widget-height,var(–spacer-size))}.e-con-inner>.elementor-widget-spacer.elementor-widget-empty,.e-con>.elementor-widget-spacer.elementor-widget-empty{place:relative;min-height:22px;min-width:22px}.e-con-inner>.elementor-widget-spacer.elementor-widget-empty .elementor-widget-empty-icon,.e-con>.elementor-widget-spacer.elementor-widget-empty .elementor-widget-empty-icon{place:absolute;prime:0;backside:0;left:0;proper:0;margin:auto;padding:0;width:22px;top:22px}

.elementor-heading-title{padding:0;margin:0;line-height:1}.elementor-widget-heading .elementor-heading-title[class*=elementor-size-]>a{colour:inherit;font-size:inherit;line-height:inherit}.elementor-widget-heading .elementor-heading-title.elementor-size-small{font-size:15px}.elementor-widget-heading .elementor-heading-title.elementor-size-medium{font-size:19px}.elementor-widget-heading .elementor-heading-title.elementor-size-large{font-size:29px}.elementor-widget-heading .elementor-heading-title.elementor-size-xl{font-size:39px}.elementor-widget-heading .elementor-heading-title.elementor-size-xxl{font-size:59px}

Find out how to Dissolve an LLC in Washington

.elementor-widget-image{text-align:middle}.elementor-widget-image a{show:inline-block}.elementor-widget-image a img[src$=”.svg”]{width:48px}.elementor-widget-image img{vertical-align:center;show:inline-block}

.elementor-widget-text-editor.elementor-drop-cap-view-stacked .elementor-drop-cap{background-color:#69727d;colour:#fff}.elementor-widget-text-editor.elementor-drop-cap-view-framed .elementor-drop-cap{colour:#69727d;border:3px strong;background-color:clear}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap{margin-top:8px}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap-letter{width:1em;top:1em}.elementor-widget-text-editor .elementor-drop-cap{float:left;text-align:middle;line-height:1;font-size:50px}.elementor-widget-text-editor .elementor-drop-cap-letter{show:inline-block}

Deciding to name it quits on an organization you labored onerous to construct is a giant choice. However in case you do decide that dissolving your LLC is the perfect path ahead, it’s important to comply with the precise course of and do it accurately.

Dissolving an LLC in Washington requires a number of particular steps that have to be fastidiously accomplished. On this information on learn how to dissolve an LLC in Washington, we’ll go over the fundamentals of LLC dissolution and the step-by-step course of you may comply with to make sure your organization is formally dissolved within the eyes of the regulation.

Fundamentals of LLC Dissolution

Dissolving an LLC means that you’re formally ending the corporate’s existence within the eyes of the state. Because of this you and the corporate will now not be required to fulfill obligations equivalent to reporting necessities and submitting company taxes.

Kinds of LLC Dissolution

In Washington, there are three various kinds of LLC dissolution. Here’s a breakdown of those three varieties and the circumstances that apply to every one:

Administrative Dissolution

Administrative dissolution is a kind of LLC dissolution that’s ordered and initiated by the state. This occurs when LLCs in Washington fail to adjust to state necessities. Nonetheless, administrative dissolution can typically be overturned if the corporate rectifies the difficulty(s) that led to the dissolution.

Judicial Dissolution

This sort of dissolution happens when an organization is ordered by the courtroom to be dissolved, sometimes because of causes equivalent to unlawful actions, fraud, or conditions the place it’s now not potential for the enterprise to proceed its operations.

Voluntary Dissolution

The most typical kind of LLC dissolution is voluntary dissolution, and this happens when the members of an LLC voluntarily resolve to dissolve the corporate. This sort of dissolution requires LLC members to finish a selected course of, and it’s the kind that we are going to deal with for the rest of this information.

Dissolving Your LLC in Washington

For those who and the opposite members of your Washington LLC resolve to voluntarily dissolve the corporate, it’s important to comply with the precise steps. Right here is the step-by-step course of you may comply with to dissolve your organization and keep away from any problems:

Step 1: Vote to Dissolve the LLC

Earlier than an LLC may be dissolved, its members should vote to approve the dissolution. For single-member LLCs, this choice lies with only one individual. However for multi-member LLCs, a proper vote will probably be required.

Single vs multi member LLC dissolution

Homeowners of a single-member LLC can resolve all on their very own whether or not they need to dissolve the corporate. For multi-member LLCs, the process for voting on dissolution is usually outlined within the firm’s working settlement. This contains particulars equivalent to how the vote is to be held and the bulk that’s required to proceed with dissolving the corporate.

Dissolution guidelines in your LLC working settlement

Most LLC working agreements will embrace particular particulars on how the dissolution course of is to be carried out. This contains specifics on voting for dissolution, nevertheless it additionally contains issues like how the corporate is to distribute its remaining property, cancel contracts, and notify collectors. Earlier than you progress ahead with dissolving the corporate, be sure you fastidiously evaluate its working settlement and comply with the entire necessities it outlines.

Step 2: Wind Up All Enterprise Affairs and Deal with Any Different Enterprise Issues

When you and the remainder of the LLC’s members have made the choice to dissolve the corporate, the subsequent step is to wind up any remaining enterprise affairs. This contains issues like:

-

Notifying your registered agent, suppliers, prospects, and some other stakeholders -

Canceling your whole enterprise licenses or permits -

Dealing with any worker issues, equivalent to ultimate paychecks and unemployment insurance coverage -

Closing enterprise financial institution accounts and ensuring that you’ve got met all monetary obligations

Step 3: Notify collectors and claimants about your LLC’s dissolution, settle present money owed, and distribute remaining property

If your organization owes any excellent money owed, these must be paid in full earlier than the LLC may be legally dissolved. Notify all collectors and claimants of your intention to dissolve the corporate, and pay any money owed which are nonetheless owed to them.

As soon as all excellent money owed are paid, you will want to distribute any firm property that stay. As we beforehand mentioned, your organization’s working settlement ought to element how property are to be distributed amongst members.

Step 4: Notify Tax Companies and settle remaining taxes

The ultimate matter that have to be seen to earlier than you may legally dissolve your Washington LLC is to file ultimate state and federal tax returns. If the LLC owes any taxes, these should even be paid earlier than it may be dissolved.

Whereas Washington doesn’t have a state earnings tax, your LLC should owe different kinds of state taxes, equivalent to enterprise and occupation (B&O) tax, gross sales tax, or use tax. Affirm that each one state taxes have been paid by checking with the Washington State Division of Income.

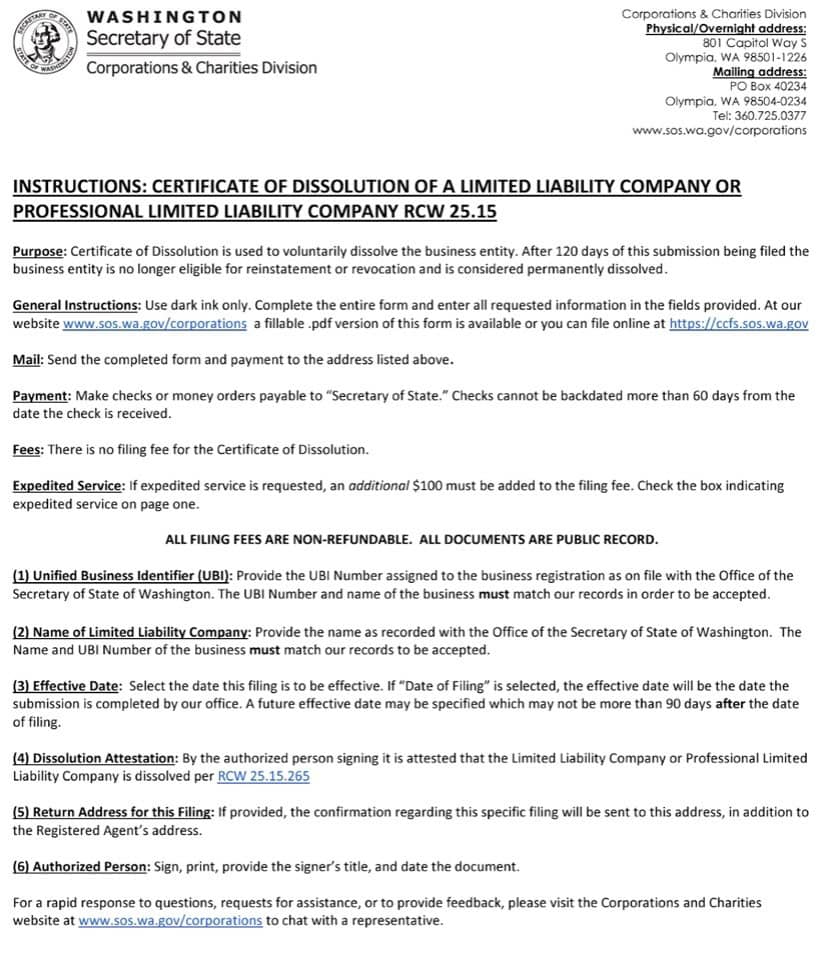

Step 5: File certificates of dissolution (termination kind) with the Secretary of State

Upon getting accomplished all the mandatory steps to dissolve your LLC, you may formally dissolve it by submitting a Certificates of Dissolution with the Washington Secretary of State. This manner is accessible on the Secretary of State’s web site, and it seems like this:

Rigorously evaluate the Certificates of Dissolution kind and fill in all required data to make sure there aren’t any errors that might delay the method. You’ll be able to file the Certificates of Dissolution both on-line or by mail.

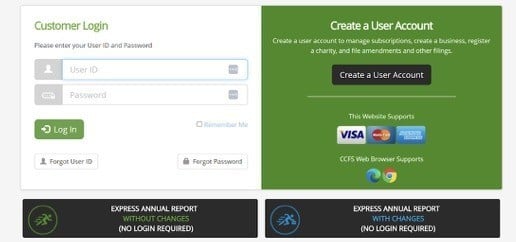

To file on-line:

-

Go to the Washington Secretary of State’s web site and entry the Firms and Charities Submitting System (CCFS).

-

Log in or create an account, then choose “Dissolve or Withdraw” from the menu.

-

Seek for your LLC by its identify or UBI quantity.

-

As soon as you discover your LLC, choose the choice to file the “Certificates of Dissolution” and full the shape.

-

You will have to pay a submitting charge of $20 when submitting the shape on-line.

- Full the Certificates of Dissolution kind, which is accessible as a PDF on the Washington Secretary of State’s web site.

- Embody a examine or cash order for the $20 submitting charge.

- Mail the finished kind and cost to:

Washington Secretary of State

Firms and Charities Division

801 Capitol Method S

PO Field 40234

Olympia, WA 98504-0234

You’ll obtain a affirmation as soon as your submitting has been processed. Remember that mailed filings could take longer to course of in comparison with on-line submissions.

Conclusion

For those who and the remainder of your LLC’s members have determined that it’s greatest to now not proceed working the corporate, legally dissolving it’s a vital ultimate step. By following the steps coated on this information, you may dissolve your Washington LLC in order that it ceases to exist so far as the state is worried, releasing you as much as put the corporate behind you and transfer on to your subsequent enterprise.

Remember that each enterprise end result is a studying alternative. Dissolving your LLC could mark the tip of 1 period, however it may additionally mark the start of one thing new and extra profitable!

FAQs

There’s a variety of the reason why enterprise house owners select to dissolve an organization. Regardless of the purpose could also be, although, it’s important to formally dissolve your LLC by following the suitable course of. This can remove any ongoing authorized obligations that the corporate has.

The one value related to dissolving an LLC in Washington (not together with paying off present money owed and tax obligations) is the submitting charge of $20 that you can be required to pay whenever you file a Certificates of Dissolution with the Washington Secretary of State.

Sure, as soon as you have accomplished all prior steps (equivalent to holding a dissolution vote and submitting a ultimate tax return), the remainder of the method may be accomplished solely on-line by visiting the Washington Secretary of State’s web site and accessing the Firms and Charities Submitting System (CCFS).

How lengthy it takes to dissolve an LLC in Washington is determined by whether or not you’re submitting by mail or on-line. On-line filings sometimes take 2-3 enterprise days to be processed, whereas mailed filings sometimes take 7-10 enterprise days. Washington additionally affords an expedited submitting possibility for a further charge, With expedited service, on-line filings are often processed inside 24 hours, whereas mailed filings are processed inside 1-2 enterprise days after they’re acquired.

For those who fail to formally dissolve your Washington LLC, you’ll nonetheless be required to fulfill obligations equivalent to submitting annual experiences, submitting taxes, and different compliance obligations. That is true even when you don’t proceed working the corporate.

In case your Washington LLC can be registered to conduct enterprise in different states, you’ll have to dissolve the corporate in every a type of states individually. Remember to understand that totally different states could have their very own distinctive necessities and charges when dissolving an LLC.

This portion of our web site is for informational functions solely. Tailor Manufacturers will not be a regulation agency, and not one of the data on this web site constitutes or is meant to convey authorized recommendation. All statements, opinions, suggestions, and conclusions are solely the expression of the writer and offered on an as-is foundation. Accordingly, Tailor Manufacturers will not be answerable for the knowledge and/or its accuracy or completeness.

The publish Find out how to Dissolve an LLC in Washington appeared first on Tailor Manufacturers.