In case your gross sales group is struggling to strike a steadiness between firm necessities and the compensation wants of staff, it is doubtless time to reevaluate your compensation plan and fee construction.

As a salesman, it is invaluable to know what forms of fee plans can be found and what wage and fee charges you must search for from an employer.

Fortunately, I’ve compiled some sources so that you can work out one of the best gross sales fee construction on your gross sales group or your self. Able to study extra?

Maintain studying or click on one of many hyperlinks beneath to leap to the part you’re on the lookout for:

What’s a gross sales fee?

Gross sales fee is a key facet of gross sales compensation. It is the amount of cash a salesman earns primarily based on the variety of gross sales they’ve made. That is further cash that usually enhances a typical wage.

Why is gross sales fee vital?

Gross sales fee is customary in lots of gross sales roles. It is used to encourage, drive gross sales, and reward gross sales groups for robust efficiency.

Commissions may affect gross sales group methods. For instance, if sure merchandise supply a better fee, a salesman may select to deal with these merchandise solely.

Gross sales Fee Construction

A gross sales fee construction outlines how a lot a corporation pays its salespeople for every particular person sale. When planning a fee construction, gross sales leaders ought to take into account elements like how a lot of their price range they’ll allocate for fee, how a lot they’ll pay for various ranges of gross sales output, staff’ base salaries, and any potential bonuses or incentives they’re prepared to incorporate.

Learn how to Put a Gross sales Fee Construction in Place

1. Evaluate annual gross sales targets.

Gross sales targets are the benchmarks on your division, in order that they’re one of the best place to start out as you create a fee plan. These targets present the gross sales group the place the enterprise desires to go and the way they will help get it there.

In addition they offer you a transparent image of how a lot income your group generates, gaps within the pipeline, and areas the place your group can do higher. As you make key choices about fee, you should utilize these targets as a basis.

For instance, say your annual gross sales targets embrace boosting gross sales of a brand new service by 15% and retaining 30% of your present clients. You could need to arrange a residual fee plan on your group members who work with present clients or an absolute fee plan to drive new service gross sales.

2. Consider every gross sales function for fee.

Every salesperson is exclusive. The longer they’re together with your firm, the extra personalised their function will change into. Many organizations even have a various vary of merchandise, channels, and places, and that may additionally affect gross sales positions.

To draft your fee plan, check out every function. Dig into the best way your group sources leads and closes gross sales. Then, check out current efficiency suggestions. This will help you focus your plan on areas the place a fee plan will be most influential.

3. Evaluate price range and income targets.

Your gross sales price range drives most of your methods, and that ought to embrace your fee plan. Earlier than you promise your group compensation that you could’t ship, spend a while with the price range. Then, have a look at how one can measurably affect income targets with a raise out of your gross sales reps.

4. Examine KPIs for every gross sales place.

Gross sales targets are one other group motivator. In addition they assist your gross sales reps measure their efficiency. In case your reps solely see their metrics throughout month-to-month conferences, you may need to get them extra engaged with their numbers.

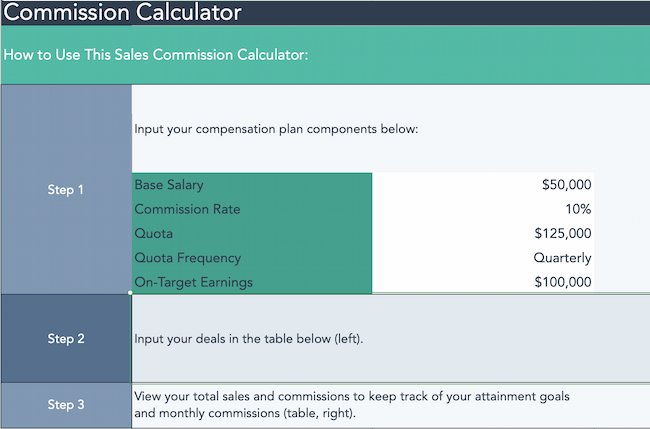

This software can simplify the method of calculating important KPIs like deal dimension and win fee, in addition to fee charges:

Featured software: Gross sales metrics calculator

As you create your fee plan, have a look at the numbers for every group member and function. And do not simply have a look at particular person efficiency, have a look at overlaps in territory, schedule, product selections, and extra. This overview will help you see patterns in your present gross sales efficiency. Then, you should utilize this information to reward your group in the best means.

5. Develop an preliminary fee plan.

As soon as you’ve got gathered your analysis and drafted your preliminary concepts, it is time to put collectively your plan.

A gross sales fee plan has to steadiness worker and stakeholder wants and expectations, strategic targets, and extra. You desire a plan that is versatile as a result of gross sales targets are sometimes a transferring goal. However your plan additionally must be easy and simple to know.

So, do not anticipate your first draft to be excellent, and provides your self sufficient time to step away and take into consideration every resolution earlier than you decide to it.

6. Evaluate your gross sales fee proposal with stakeholders.

If your enterprise does not have already got a fee construction in place, it may be a giant monetary and cultural shift. Your plan may have extra worth to your enterprise if it has the complete help of key stakeholders. Ideally, the complete firm will see the worth of this method.

So, spend a while on the presentation of your plan. You will have to current your plan in a means that is clear to a variety of individuals with totally different loyalties and opinions. You could need to add information, quotes, and pictures to help your concepts. This will help different stakeholders see the place you are coming from and supply extra constructive insights.

It is also vital to remain open to ideas. There is a good probability you will hear suggestions chances are you’ll not like or anticipate, and also you may have to revisit your plan many occasions earlier than it is able to launch.

7. Determine on timing.

There are two essential components of timing for gross sales commissions.

First, the preliminary fee launch. Do you want it to align together with your firm’s fiscal 12 months or are you able to begin straight away? Are there any main firm benchmarks or holidays approaching? These elements and extra can affect once you determine to share your gross sales fee plan.

Subsequent is when your gross sales group will begin to see commissions of their paychecks. For some companies, the fee interval matches the pay interval. However others award reps for the prior interval or create a customized schedule primarily based on particulars within the fee settlement.

You could need to work together with your finance group to set a schedule that is simple for everybody to know and stick to.

8. Begin providing gross sales commissions to your group.

Some firms and relationships are extra informal than others. So, it may be tempting to start out sharing gross sales fee particulars one-on-one as soon as your plan is prepared.

However in accordance with 2022 SHRM analysis, solely 61% of staff really feel that their compensation is truthful for his or her function. This makes transparency in compensation extra vital than ever.

So, fastidiously plan the way you need to share your fee plan. You could possibly tweak your preliminary stakeholder presentation, as a result of information, quotes, and pictures might be vital to your viewers. Current the factors of the plan clearly and embrace each related element. Both means, it is vital to:

- Anticipate questions

- Be constant

- Take into consideration the main points earlier than you begin having conversations

That is an thrilling step on your group, and the extra ready you might be, the extra helpful your fee plan will be.

Gross sales Fee Ideas

In his e-book, “The Excessive-Velocity Gross sales Group“, gross sales strategist Marc Wayshak discusses how vital compensation and fee are to your gross sales infrastructure. He presents three suggestions to bear in mind when making a fee construction: Do not cap salaries, do it proper the primary time, and maintain it easy.

Let’s evaluation his suggestions and some extra necessities beneath.

1. Do not cap salaries.

Wage caps are the very best salaries an worker could make of their function at your organization. Capping salaries decreases the incomes potential of your salespeople. Gross sales administration needs to be supportive of their group and wish people to make as a lot as doable in return for his or her laborious work.

2. Do it proper the primary time.

In gross sales compensation, there is not room for do-overs. Every time you introduce a brand new compensation plan, it strikes your gross sales group’s targets and targets. This diminishes your reps’ morale and motivation.

3. Maintain it easy.

Make your compensation and fee plan clear. The less complicated your plan is, the better it is going to be to comply with. Not solely will this make the fee construction simpler to implement, however it is going to additionally guarantee there are no loopholes within the plan. A salesman ought to be capable of fill within the blanks: If I do X, then I’ll make $Y.

4. Give attention to the suitable merchandise.

If you happen to’re making a product-based gross sales fee plan, select your merchandise fastidiously. Whereas it may be helpful for gross sales reps to deal with the merchandise they like greatest, commission-based gross sales may affect:

- Provide chains

- Revenue margins

- Gross sales turnover

5. Join commissions to enterprise targets.

Gross sales targets have a direct affect on enterprise technique. There are lots of individuals concerned in these processes. This could create a state of affairs the place totally different groups have divergent priorities. Utilizing monetary targets as a place to begin for gross sales fee construction will help your group deal with the suitable priorities.

6. Maintain staff in thoughts when adjusting quotas and territories.

Gross sales quotas let gross sales reps know what they’re accountable for. Territories assist simplify advanced markets. These invaluable approaches may imply that every gross sales rep has distinctive challenges that affect their means to shut. An efficient gross sales fee plan will take these variations under consideration.

7. Use information when making choices.

Gross sales metrics and different information will help you guarantee that your fee plan is according to historic efficiency. If you wish to do it proper the primary time, information is important to the planning course of.

Information may observe how your fee plan is motivating your group over time. This allows you to shift methods as wanted to maximise progress.

Gross sales Fee Charges

Gross sales fee charges are the proportion of revenue or different compensation that gross sales reps get for assembly targets. Objectives may embrace making a sale, assembly a quota, or succeeding as a group.

What’s a good fee fee for gross sales?

The idea of a ‘truthful fee fee for gross sales’ is fluid and tends to fluctuate by business and function. A gross sales fee fee can replicate elements like the worth of services or products offered, worker involvement within the gross sales course of, or the scale of an worker’s gross sales territory.

There’s no precise science to pinning that determine down, however referencing common fee charges on your business generally is a stable place to begin.

Gross sales Fee Constructions with Examples

- Base Wage Plus Fee

- Straight Fee Plan

- Relative Fee Plan

- Absolute Fee Plan

- Straight-Line Fee Plan

- Tiered Fee Plan

- Territory Quantity Fee Plan

- Recoverable Draw In opposition to Fee Plan

- Non-Recoverable Draw In opposition to Fee Plan

- Residual Fee

So, what fee construction do you have to select? Effectively, there are a number of to choose from. Widespread buildings embrace:

1. Base Wage Plus Fee

The bottom wage plus fee plan could be probably the most standard fee construction. With this plan, salespeople get a base wage with fee. The usual wage to fee ratio is 60:40, with 60% mounted and 40% variable.

When to Use It

This construction is right for firms the place gross sales rep retention is essential to the success of the gross sales group. The corporate is actively investing within the success of a given rep whereas encouraging their efficiency.

Gross sales Fee Charges Instance: Base Wage Plus Fee

With a base wage plus fee plan, a salesman working for a high-end retail outlet could be working for $25 per hour plus a further 5% of any gross sales they make.

Professional Tip:

This mix of safety and rewards typically offers gross sales reps motivation to develop of their roles.

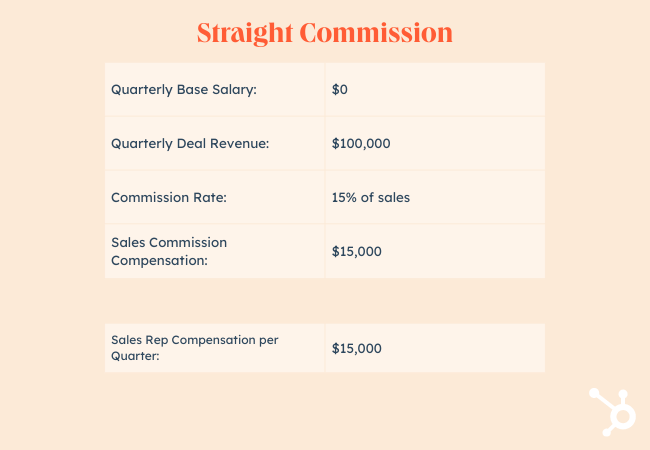

2. Straight Fee Plan

With this plan, gross sales reps’ revenue comes instantly from the gross sales they earn — there isn’t any base wage.

When to Use It

This construction is normally leveraged by startups or different companies which may lack dependable entry to capital. In a variety of methods, it quantities to a pay-as-you-go plan. This typically fits companies that do not have the sources to supply aggressive base salaries.

Gross sales Fee Charges Instance: Straight Fee

With a straight fee plan, a gross sales rep at a B2B SaaS startup may make a 12% fee for each sale they make. In the event that they land a deal value $10,000, they’d make $1,200 on the sale — however they would not obtain any base compensation past that.

Professional Tip:

Excessive-performing gross sales reps sometimes thrive in environments set by this plan, however the construction does not lend itself to stability.

3. Relative Fee Plan

With a relative fee plan, a rep’s fee is instantly proportional to how a lot of a set quota they hit. That compensation comes on high of a base wage, so it offers reps extra of a security web than a straight fee plan.

When to Use It

This plan is basically the safer reply to a straight fee plan. It is nonetheless instantly tied to efficiency, but it surely does not alienate reps that could be working into bother — resulting in much less turnover.

Gross sales Fee Charges Instance: Relative Fee

If a salesman was being paid in accordance with a relative fee plan, they could have a quarterly quota of $90,000 and a quarterly fee of $10,000. In the event that they meet 85% of the quota, they will obtain 85% of the fee — or $8,500.

Professional Tip:

This fee construction is nice for extra advanced organizations. It presents a chance to reward each rep, even when their pipelines look wildly totally different.

For instance, some territories will pull in additional gross sales than others. You may regulate the quota by territory, and align the fee with that territory. This fashion your fee construction rewards reps for placing in equal effort.

This construction may flex with altering enterprise targets whereas remaining comparatively steady for gross sales staff.

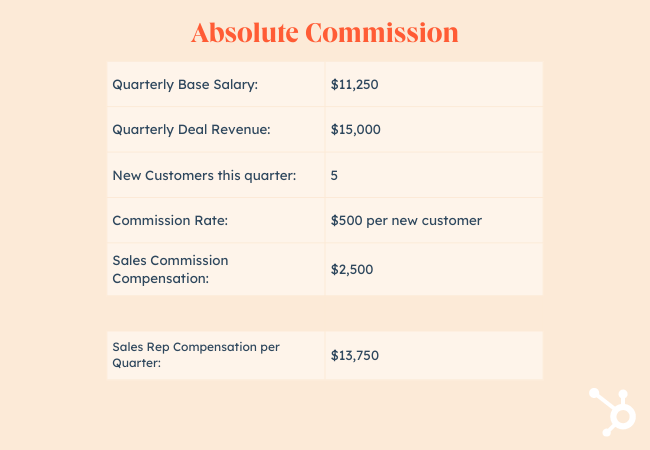

4. Absolute Fee Plan

An absolute fee plan pays reps for hitting set targets and performing particular actions, like buying new clients.

Just like the relative fee plan, an absolute fee construction will help incentivize underperformers. That stated, the emphasis is much less on income and extra on exercise.

When to Use It

This technique is most frequently employed to assist direct gross sales reps’ focus. If a enterprise wants to enhance its numbers for a particular exercise, it would use an absolute fee plan that revolves round it.

Gross sales Fee Charges Instance: Absolute Fee

A salesman working with an absolute fee plan may obtain a flat $500 fee for each new buyer they purchase — no matter deal dimension.

Professional Tip:

This construction is simple for gross sales reps to know and ship on. The extra intuitive your fee plan is, the extra doubtless it’s to encourage your group to carry out.

5. Straight-Line Fee Plan

A straight-line fee plan rewards salespeople primarily based on how a lot or little they promote. Because the title implies, it is rooted in a straight correlation — a pattern that sometimes holds true even after reps meet their quota. It is one of many higher methods companies can encourage underperformers to fulfill quota. On the identical time, it does not sluggish overperformers down.

When to Use It

A straight-line fee plan works greatest for organizations that need to incentivize reps to succeed in their full potential.

Gross sales Fee Charges Instance: Straight-Line Fee Plan

Like a gross sales rep working inside a relative fee plan, a salesman working inside a straight-line fee plan would obtain compensation proportional to how a lot of their quota they hit.

The distinction is that fee earnings would maintain coming even after they meet their quota. So, if a rep has a quarterly fee of $10,000 and exceeds quota by 10%, they’d obtain $11,000 in fee.

Professional Tip:

To profit from this plan, companies have to have the sources essential for an uncapped fee construction.

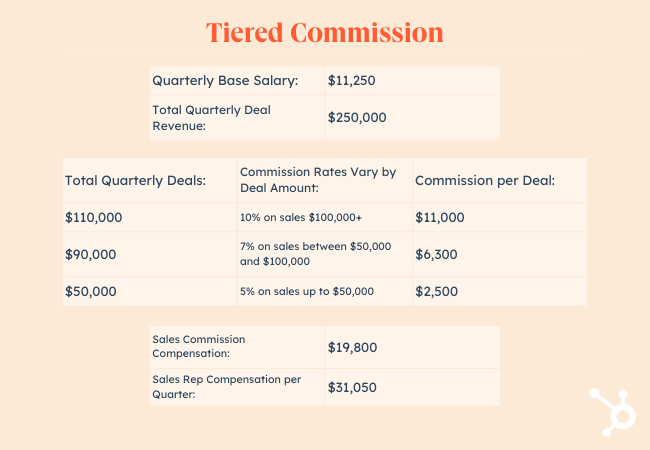

6. Tiered Fee Plan

A tiered construction encourages reps to place in additional effort by offering greater commissions as they hit substantial gross sales milestones. Right here, reps might be paid growing commissions as they meet their quota, exceed their quota, and proceed to shut extra offers than they’re anticipated to.

When to Use It

A tiered fee plan is right for organizations with salespeople who constantly attain (however don’t exceed) their targets. It additionally presents a little bit extra management on fee charges than the straight-line fee plan.

Gross sales Fee Charges Instance: Tiered Fee

With a tiered fee plan, a rep may obtain:

- 5% fee on all gross sales as much as $50,000

- 7% on gross sales between $50,000 and $100,000

- 10% on gross sales $100,000 and above

Professional Tip:

Tiered fee buildings want cautious alignment between totally different components of the enterprise. For instance, say a particular product or sort of shopper brings in higher-value offers. On this state of affairs, different groups should be prepared to fulfill potential elevated demand in these areas.

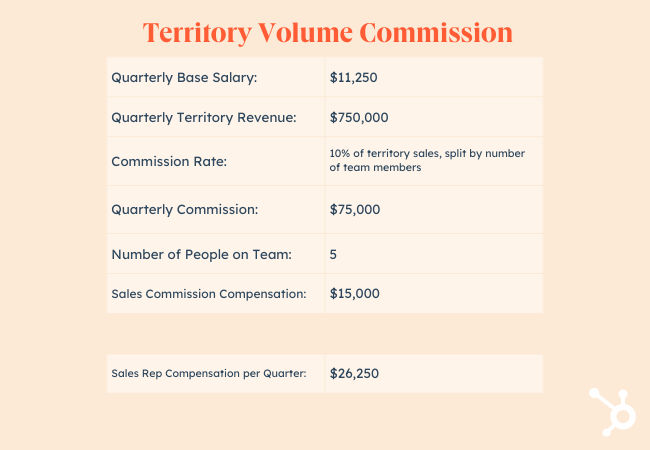

7. Territory Quantity Fee Plan

With this fee construction, salespeople work with purchasers in clearly outlined areas. Then the group working in every particular territory will get paid on a territory-wide, team-oriented foundation versus one revolving round particular person gross sales.

When to Use It

A territory quantity fee plan fits companies which have presences in a number of territories. It is excellent for team-based organizations who’re desirous to fortify particular service areas.

Gross sales Fee Charges Instance: Territory Quantity Fee

If a group of 5 manages to generate $750,000 in gross sales inside their territory at 10% fee, they’d cut up it and obtain $15,000 every.

Professional Tip:

This gross sales fee plan depends on teamwork and shared duty for relationship upkeep. In case your group has an extended buy cycle with many touchpoints to shut a transaction this technique might be a great match.

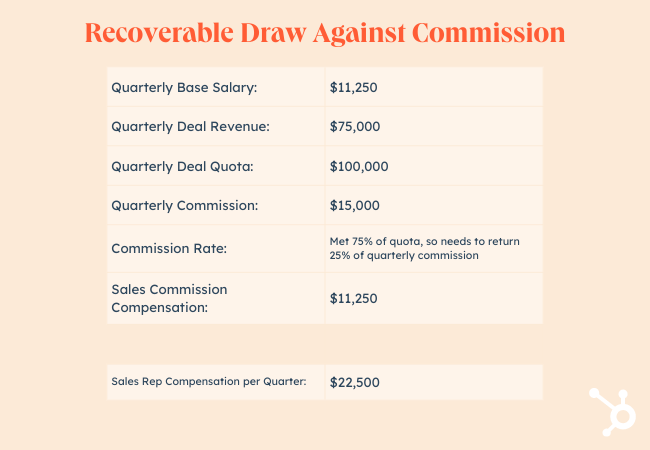

8. Recoverable Draw In opposition to Fee Plan

With a recoverable draw in opposition to fee plan, a gross sales rep receives their fee prematurely. It normally comes out in the beginning of a pay or gross sales interval within the type of a predetermined lump sum. On the finish of that gross sales interval, that lump sum or “draw” comes out of that rep’s complete earned commissions.

When to Use It

A recoverable draw in opposition to fee plan is usually used to get reps off the bottom in some capability. It typically compensates newly employed, ramping reps as they onboard. It is also a good selection for a rep getting acclimated to a brand new territory.

Gross sales Fee Charges Instance: Recoverable Draw In opposition to Fee

With this fee plan, a gross sales rep may obtain a draw of $5,000 in the beginning of a given month. In the event that they solely attain 90% of their quota, they’d pay $500 of that $5,000 again to their employer.

Professional Tip:

This technique ensures some revenue to gross sales reps as they ramp up in a brand new territory or function. On the identical time, the recoverable facet of this fee will be complicated.

For instance, some employers may need to recuperate this draw straight away or cap these funds. Others will wait a set time frame to gather. It is vital to make choices on restoration timing early on to take care of robust worker relationships.

9. Non-Recoverable Draw In opposition to Fee Plan

A non-recoverable draw is kind of a totally assured fee stipend. Like its recoverable counterpart, it begins with a agency giving its reps a predetermined lump sum. However with a non-recoverable plan, reps aren’t anticipated to pay any of that cash again.

When to Use It

This plan is not notably sustainable or motivating. It is sometimes used as a short-term measure throughout occasions of firm, business, or broader financial uncertainty to make sure that gross sales reps have a steady supply of revenue.

Gross sales Fee Charges Instance: Non-Recoverable Draw In opposition to Fee

With a non-recoverable draw in opposition to fee plan, a gross sales rep’s employer would give the rep $5,000, assuming they will hit quota. If they do not, the employer cannot recoup that draw.

Professional Tip:

This technique will help a enterprise keep long-term helpful relationships with staff throughout traumatic occasions.

10. Residual Fee

A residual fee construction relies on the long-term worth of particular person accounts. With this construction, salespeople who shut offers proceed to obtain fee from these accounts on an ongoing foundation — as long as they proceed to generate income. This explicit construction can have greater stakes than most.

On one hand, salespeople can construct a breadth of stable, productive revenue streams over time. On the opposite, dropping an account — for causes which may don’t have anything to do with the salesperson who landed it — can imply a large fee hit that could be laborious to recuperate.

When to Use It

This construction is greatest for companies that construct long-term relationships with purchasers, like advert businesses or consulting companies.

Gross sales Fee Charges Instance: Residual Fee

A gross sales rep who works inside a residual fee plan may herald a big account. If that account pays a recurring cost of $5,000 monthly, a rep making 7% fee would earn $350 monthly in residuals from that shopper.

Professional Tip:

This technique is beneficial for each shopper and worker retention. It additionally incentivizes constant follow-up, upselling, and cross-selling with present clients.

This final information to gross sales compensation gives much more element on gross sales fee buildings and compensation plans. And it’ll assist you discover which construction will work greatest on your firm and gross sales group.

Common Gross sales Fee Charges by Trade

Averages for wage and fee enable gross sales leaders to see how their gross sales fee plan compares to the remainder of their business. It additionally lets salespeople see how their gross sales compensation plan stacks up.

The wages beneath are from the BLS Occupational Employment Statistics (OES) survey. These wages replicate the median common pay for every business. The fee fee will rely upon the corporate and the fee construction they select.

1. Wholesale and Manufacturing Gross sales Representatives

Median pay: $62,890

These sorts of gross sales representatives promote items for wholesalers or producers to companies, authorities businesses, and different organizations. Their job safety and livelihood are sometimes nearly solely intertwined with the amount of merchandise they’ll promote. Their fee construction tends to replicate that. These reps are sometimes paid with absolute or base wage plus fee plans.

2. Insurance coverage Gross sales Brokers

Median pay: $49,840

Insurance coverage gross sales brokers contact potential clients to promote totally different sorts of insurance coverage. Brokers spend time instantly interfacing with purchasers, finishing paperwork, and making ready displays. In addition they fulfill different customer-facing and administrative duties. Fee for this model of gross sales is mostly paid on a base wage plus fee foundation. Fee percentages are inclined to fluctuate by the kind of insurance coverage brokers are promoting.

3. Promoting Gross sales Brokers

Median pay: $52,340

Promoting gross sales brokers promote promoting area to companies and people. They typically work throughout quite a lot of industries and media, together with promoting businesses, radio, tv, and Web publishing. Promoting gross sales brokers typically have strict quotas and obtain a fee for assembly or exceeding them.

4. Actual Property Brokers and Gross sales Brokers

Median pay: $48,770

Actual property brokers and gross sales brokers assist purchasers purchase, promote, and hire properties. Each state requires actual property gross sales professionals to be licensed. That would imply finishing programs or passing a state-specific examination. They’re typically self-employed, so many have the pliability to outline their very own fee construction.

5. Securities, Commodities, and Monetary Companies Gross sales Brokers

Median pay: $93,260

Securities, commodities, and monetary companies brokers purchase and promote securities or commodities in funding and buying and selling companies. They’ll additionally present monetary companies to companies and people. Some advise clients about shares, bonds, mutual funds, commodities, and market circumstances. These salespeople typically cost flat-rate commissions both per share or per commerce.

6. Gross sales Representatives, Companies, SAAS, Enterprise Help, All Different

Median pay: $71,110

This class of gross sales encompasses salespeople in positions and industries in all kinds of service-based companies, together with enterprise help, technical consulting, electronics, telecommunications, laptop techniques and electronics, and software program as a service. It excludes promoting, insurance coverage, journey, and different classes. Given the big selection of industries and corporations encompassed on this class, it may be laborious to determine its commonest fee construction.

7. Door-to-Door Gross sales Staff, Information and Avenue Distributors, and Associated Staff

Median pay: $34,970

A number of totally different sorts of salespeople fall below this class, together with professionals in telecommunications, residential constructing development, and subscription programming. Just like the earlier one, the big selection of industries and corporations encompassed on this class makes it laborious to pin down a typical fee construction.

8. Retail Salespersons

Median pay: $31,920

Retail gross sales refers to reps that promote merchandise (comparable to clothes, furnishings, or home equipment) in a retail brick-and-mortar surroundings. These environments embrace the whole lot from basic merchandise shops to sellers specializing in particular wares comparable to sporting items or musical devices.

Since success is usually depending on foot site visitors moderately than gross sales exercise, retail salespersons are sometimes compensated by a base wage solely. Nonetheless, retail environments with high-ticket gadgets typically pay flat fee charges.

9. Gross sales and Associated Staff, All Different

Median pay: $38,840

This class of gross sales encompasses salespeople in positions and industries that don’t fall into any of the industries above. This could embrace roles at vehicle dealerships, in non-depository credit score intermediation, and with meals and beverage retailers. The vary of roles that fall into this class is broad, so the number of the fee buildings used tends to be as nicely.

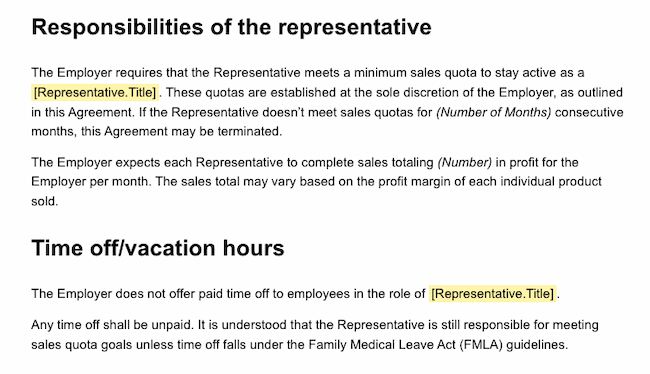

Earlier than agreeing to simply accept a gross sales job at an organization, you must have a transparent define and understanding of its fee construction and compensation plan. The gross sales fee settlement ought to inform you the whole lot you have to know concerning the fee and wage you are going to make.

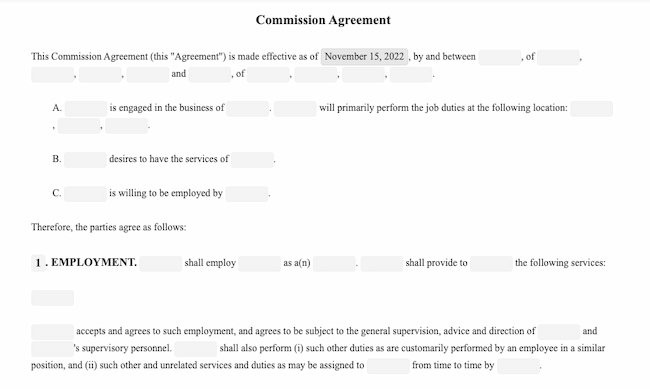

What’s a gross sales fee settlement?

A gross sales fee settlement is a doc that features the phrases of a salesman’s employment. This doc:

- Outlines their fee construction

- Particulars the character of the employee-employer relationship

- Establishes a timeframe for employment

- Specifies the worker’s fee share

A gross sales fee settlement is ready by an employer and agreed upon by a brand new worker — and each events will need to have a radical understanding of what is in it.

As we have touched on, a gross sales fee plan can tackle a variety of varieties — so new hires have to know precisely how they will be compensated for his or her efforts. Past that, employers have to ascertain and doc clear phrases of employment to guard themselves from authorized recourse if an worker has a difficulty with the fee construction they’re working inside.

Briefly, it permits each the salesperson and their employer to agree on compensation, fee, and job duties. Listed here are the important thing components to incorporate in a gross sales fee settlement.

1. Authorization

This part offers the okay for the salesperson to promote services or products on behalf of their employer. The employer typically limits the promoting by limiting the areas or territories by which the choices are offered and prohibiting the rebranding and reselling of their merchandise.

2. Documentation

The salesperson should agree to make use of documentation and instruments which are permitted by the corporate to maintain observe of their gross sales actions. Which may embrace sources like CRM databases, software program, or varieties.

3. Non-Compete Clause

A non-compete clause requires the salesperson to chorus from representing or promoting on behalf of a competitor for a time frame after leaving their employer.

4. Non-Disclosure Clause

The non-disclosure clause ensures that the worker agrees to chorus from sharing confidential data or mental property.

5. Fee Construction

That is the place you share the main points of the fee construction. After studying this part, the worker and employer ought to have a transparent understanding of:

- The compensation construction (comparable to fee, efficiency incentives, bonuses)

- When a fee is earned

- When commissions are paid

- Penalties of cancellations, refunds, or default of funds from clients

6. Settlement

Each the salesperson and their employer comply with the main points of the gross sales fee settlement by signing and relationship the doc.

For added suggestions and perception, seek the advice of your authorized group or hunt down the recommendation of a lawyer that will help you fastidiously craft your gross sales fee settlement.

Gross sales Fee Settlement Templates

If you happen to want some assist creating a gross sales fee settlement or strategic marketing strategy, these templates are a good way to get began.

1. Gross sales Fee Settlement Template from PandaDoc

Edit and customise this gross sales fee settlement template to suit your wants. This template will be signed by your recipients, and you can observe the doc’s opens and views.

2. Gross sales Fee Settlement Template from FormSwift

This gross sales fee settlement template builder will assist you define the working relationship between worker and employer. It contains basic data (like deal with and cellphone quantity), fee construction, documentation, and non-compete and non-disclosure clauses.

3. Gross sales Fee Settlement Template from RocketLawyer

With this fill-in-the-blank gross sales fee settlement, you are capable of shortly plug within the particulars on your doc. And it features a progress bar to point out you the way way more of the settlement must be accomplished.

Thoughtfully Plan Your Fee Construction for Lengthy-Time period Success

With a well-planned gross sales fee construction, you will entice high staff and retain them. And clearly outlined compensation plans will make it simpler for workers to know expectations and earn their fee. This places your enterprise in a terrific place for future progress.

Editor’s observe: This submit was initially printed in January 2020 and has been up to date for comprehensiveness.