When the Chase Sapphire Reserve® Card debuted in 2016, everybody talked about its excessive reward price, profitable six-figure welcome bonus, and superb advantages. In reality, there was a lot curiosity within the card that the corporate was depleted of metallic bank cards once they couldn’t sustain with demand.

For years, the Chase Sapphire Reserve® — regardless of its a lot greater annual price — was thought-about the less expensive cost card over the Chase Sapphire Most well-liked® Card resulting from Reserve’s beneficiant level system and perks, which outweighed its $550 annual price.

However with a latest refresh of the Chase Sapphire Most well-liked® card, accompanied by an annual price hike for the Sapphire Reserve® card (it jumped from $450 to $550 in 2020), the $95-annual-fee Chase Sapphire Most well-liked® card has now turn into the best choice for a lot of customers in search of a standout journey rewards bank card.

However which one is best for you? Let’s have a look at every card’s particulars and make it easier to reply that query.

Learn extra: Greatest Chase bank cards

Overview

Each the Chase Sapphire Most well-liked® Card and its premium cousin, the Chase Sapphire Reserve®, are among the most well-recognized journey rewards bank cards with customers. They each earn beneficial bonus factors on journey and eating and supply numerous perks for Peloton and DoorDash.

We’re all the time requested for bank card options by our readers, and these two are virtually all the time talked about.

Whereas the playing cards have a number of similarities when it comes to incomes charges, redemption choices, and the identical capability to switch your factors at a 1:1 ratio to 14 journey loyalty packages, the Chase Sapphire Most well-liked® prices a a lot decrease annual price and contains lots of the identical advantages because the Chase Sapphire Reserve®.

Signal-up bonus

Every card has a welcome bonus — however one is vastly superior.

Chase Sapphire Most well-liked®

Chase simply introduced the launch of an elevated sign-up bonus of 60,000 bonus factors after you spend $4,000 on purchases within the first 3 months from account opening. That is $750 while you redeem via Chase Final Rewards®. Since Chase Final Rewards® factors maintain a regular 1:1 worth, with one level equal to at least one cent, however you may get a lot better worth out of your factors by transferring to one in all Chase’s journey switch companions.

Chase Sapphire Reserve®

A far cry from its inaugural sign-up supply again in 2016, new Chase Sapphire Reserve® cardholders can earn 60,000 bonus factors after you spend $4,000 on purchases within the first 3 months from account opening. That is $900 towards journey while you redeem via Chase Final Rewards®.

Sapphire Reserve® cardholders obtain an elevated 50% redemption worth (1.5 cents per level) for journey booked via Chase Final Rewards®.

Verdict

Though each Sapphire Playing cards have the identical intro bonus, The Chase Sapphire Reserve® Card is the winner right here as a result of factors may be redeemed for a better quantity via Chase Final Reward. The Chase Sapphire Reserve® Card takes spherical 1.

Rewards

Rewards is the place the playing cards differ considerably.

Chase Sapphire Reserve® gives customers with greater rewards in eating out, automobile leases, and lodge stays, whereas the Chase Sapphire Most well-liked® shines for on-line grocery purchases, streaming providers, and eating in or out.

Chase Sapphire Most well-liked®

Chase Sapphire Most well-liked® cardholders get pleasure from bonus factors within the following classes:

- 5x factors per greenback spent on journey reservations via Chase Final Rewards®.

- 3x factors per greenback spent on choose streaming providers.

- 3x factors per greenback spent on eating, which incorporates eligible takeout and supply providers.

- 3x factors per greenback spent on on-line grocery purchases (excludes Goal, Walmart, and wholesale golf equipment).

- 2x factors per greenback spent on journey not bought via Chase Final Rewards®.

- 1x level per greenback spent on all different purchases.

Factors are value 1.25 cents while you use Chase Final Rewards® to redeem them.

Chase Sapphire Reserve®

For the Chase Sapphire Reserve®, the reward factors are fairly completely different. That is the place this card might come out forward, relying on the place you spend your cash. The Sapphire Reserve® provides:

- 10x factors per greenback spent on Chase Eating Purchases booked via Chase Final Rewards® (limitations apply).

- 10x factors per greenback spent on automobile leases and lodge stays when booked via Chase Final Rewards® (after spending $300 on journey yearly).

- 5x factors per greenback spent on flights when booked via Chase Final Rewards®.

- 3x factors per greenback spent on eating and journey not booked via Chase Final Rewards®.

- 1x level per greenback spent on all different purchases.

When redeeming rewards via Chase Final Rewards®, factors are equal to 1.5 cents.

Verdict

It relies on the place you spend your cash. For those who’re a frequent traveler, get pleasure from eating out, and plan to earn and redeem your factors by reserving journey via the Chase Final Rewards® portal, then the Sapphire Reserve® could also be a wonderful match.

Nevertheless, if you would like a broad quantity of spending classes the place you may earn bonus factors, and these classes align along with your on a regular basis spending habits, you might wish to go for the Chase Sapphire Most well-liked®.

The end result? Tie.

The higher possibility will rely in your spending patterns on every card’s bonus classes.

Journey advantages/insurance coverage

Right here is an space the place the Chase Sapphire Reserve® outweighs the Chase Sapphire Most well-liked® Card.

The Chase Sapphire Most well-liked® Card gives fundamental journey protection, insurance coverage for journey delays or cancellations, automobile leases, and baggage delays. It’s value noting that the Chase Sapphire Most well-liked® delivers major auto rental protection insurance coverage while you use your card to pay on your rental automobile. Which means you do not need to file a declare along with your insurance coverage firm first for those who’re in a fender bender or if the rental automobile is stolen. That’s a powerful perk for a card with an annual price of solely $95.

Alternatively, Chase Sapphire Reserve® contains emergency medical and dental protection with airport lounge perks. It treats cardholders as VIPs on this space.

Chase Sapphire Most well-liked® Card

Chase Sapphire Most well-liked® cardholders will get pleasure from:

- Buy safety while you use your card.

- Prolonged guarantee safety.

- Reimbursement for misplaced baggage necessities.

- Insurance coverage for luggage delay.

- Journey cancellation or interruption insurance coverage.

- Waiver for vehicle collisions.

- Emergency and journey help providers.

Chase Sapphire Reserve®

Chase Sapphire Reserve® goes above and past right here, with many extra perks than the Chase Sapphire Most well-liked® card for insurance coverage protection and journey extras. Cardholders can count on:

- Entry to Reserved by Sapphire eating places.

- Advantages for the Luxurious Lodge & Resort AssortmentSM, comparable to early check-in, late check-out, and complimentary upgrades.

- Precedence Go™ Choose lounge membership (worth is $429).

- Credit score for NEXUS, World Entry, and TSA PreCheck® charges.

- Emergency dental and medical insurance coverage.

- Automotive rental insurance coverage.

- Journey cancellation/interruption insurance coverage.

- Emergency transportation and evacuation.

- Misplaced baggage reimbursement.

- Journey delay insurance coverage.

- Buy and prolonged guarantee safety.

- Auto rental harm waiver for collisions.

One other distinction in insurance coverage is that Chase Sapphire Most well-liked® prices a price per name for roadside help. The Sapphire Reserve® card permits 4 free service calls, as much as $50 every.

Each playing cards additionally supply as much as $50,000 in annual buy safety. Nevertheless, the Sapphire Reserve® provides $50,000 yearly (as much as $10,000 per declare), whereas the Chase Sapphire Most well-liked® gives $50,000 per account (as much as $500 per declare).

Verdict

The Sapphire Reserve® wins hands-down within the classes of insurance coverage and journey perks. Simply do not forget that all these bells and whistles include that $550 annual price.

Further advantages

These advantages are further perks that include every card. Whereas each playing cards are fairly comparable of their advantages, the Chase Sapphire Reserve® comes out barely forward on this space.

Chase Sapphire Most well-liked® Card

Cardholders obtain a $50 assertion credit score yearly on lodge lodging booked via the Chase Final Rewards® portal. Upon your one-year (account) anniversary, you’ll additionally earn bonus factors equal to 10% of your whole purchases made the earlier yr.

You can too switch your factors at a 1:1 ratio with as much as 14 journey companions, together with fashionable names like Southwest, JetBlue, United, Hyatt, and Marriott.

Chase Sapphire Reserve®

A beneficiant good thing about the Sapphire Reserve®, which helps to offset at the very least a portion of its lofty annual price, is a $300-per-year journey credit score. This card’s annual $300 journey credit score may be utilized to a variety of prices, from flights, lodges, rental automobiles, and even parking and tolls — making it extremely simple to make use of. This basically makes the Sapphire Reserve® a $250 annual price card ($550 annual price – $300 journey credit score), which can make it easier to justify the extra premium card possibility.

Sapphire Reserve® cardholders additionally achieve entry to over 1,300+ airport lounges worldwide through Precedence Go™ Choose. Customers are additionally reimbursed $100 each 4 years once they use their card to pay for a TSA PreCheck®, World Entry, or NEXUS utility price.

Verdict

As soon as once more, the Sapphire Reserve® wins — however provided that you’re a frequent traveler who will use the $300 journey credit score and lounge entry to justify the upper annual price. In any other case, if you would like a well-rounded journey rewards card and your point of interest is to amass a pleasant chunk of factors, the Chase Sapphire Most well-liked® is your finest wager.

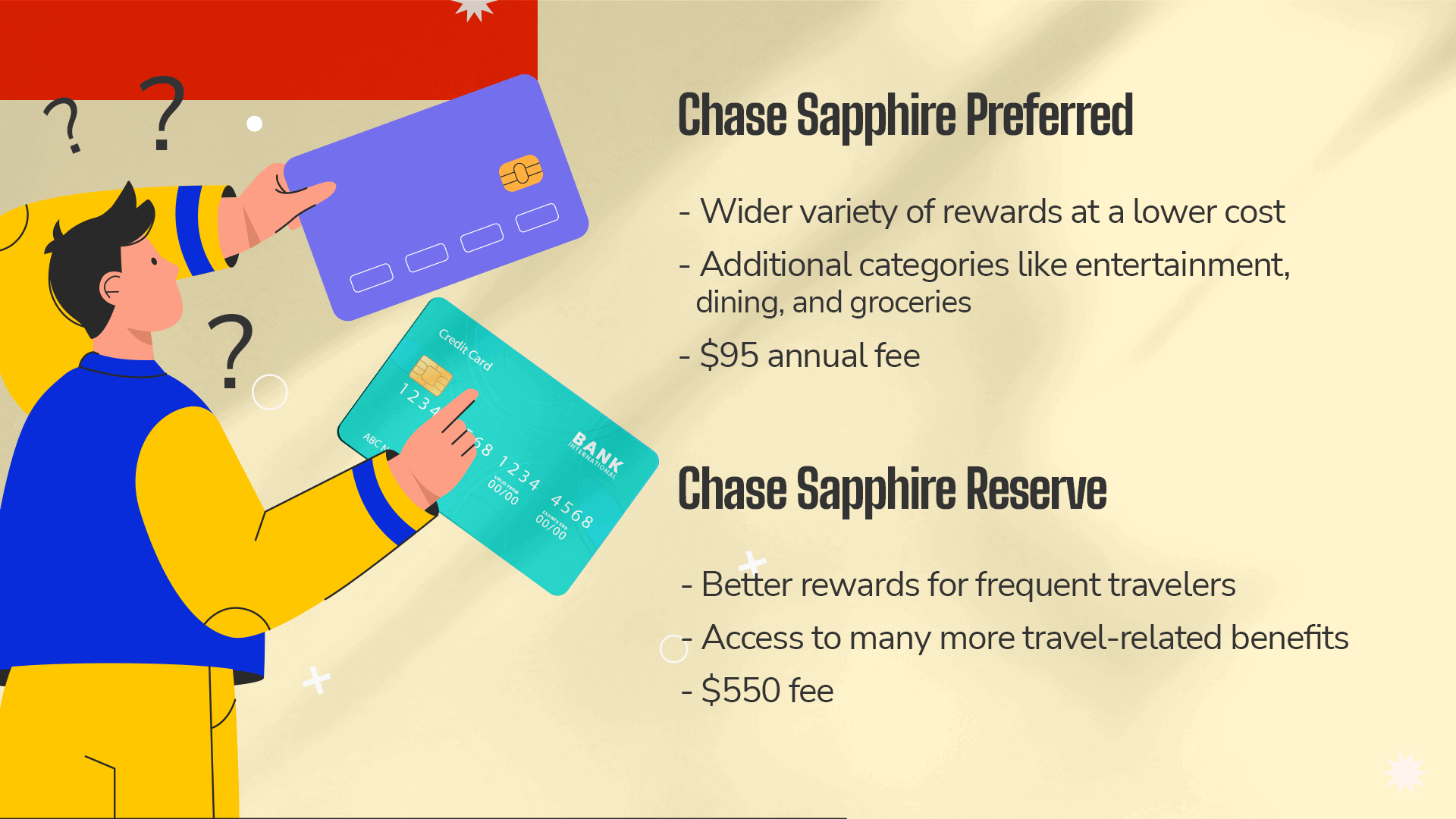

Why select Chase Sapphire Most well-liked®?

Most individuals favor the Chase Sapphire Most well-liked® bank card as a result of it rewards you higher for every greenback you spend at a decrease value. Regardless that the Chase Sapphire Reserve® has an unbelievable 10x incomes potential in some classes, the Chase Sapphire Most well-liked® card is fashionable due to its wider number of on a regular basis spending classes.

This may be the very best reward card for eating out for individuals who get pleasure from leisure or date nights. Largely everybody makes use of a streaming service to observe exhibits and films, and on-line grocery purchases have gotten extra commonplace. So, if you’re doing these items anyway, you might as nicely get rewarded on your spending and contemplate the Chase Sapphire Most well-liked®.

With this card, you may add as much as six further customers at no further value.

Moreover, the cardboard has a pleasant anniversary bonus that the Chase Sapphire Reserve® doesn’t supply: a ten% bonus on whole purchases in the course of the earlier yr. That’s 1,000 bonus factors for those who spend $10,000 on the cardboard.

As compared, Chase Sapphire Reserve® prices customers $75 yearly per approved person. Whereas this isn’t uncommon for a luxurious card, the associated fee shortly provides up if it’s essential to share the account with others.

The annual price is considerably decrease for the Chase Sapphire Most well-liked® card, so for those who aren’t positive whether or not you’ll use all the advantages supplied (or are positive you gained’t), it doesn’t make sense to pay the hefty annual price for the Sapphire Reserve® card.

That is when the Chase Sapphire Most well-liked® card turns into the higher possibility. With 1:1 factors switch with companions and a less expensive annual price (by a whopping $455), this feature could also be extra enticing to some customers.

Learn our full Chase Sapphire Most well-liked® card evaluate for extra info.

Why select Chase Sapphire Reserve®?

Frequent vacationers will profit from the Chase Sapphire Reserve® bank card. Each reward playing cards permit you to switch reward factors to 14 airline and lodge companions at a 1:1 ratio. Nevertheless, for those who e-book journey via Chase Final Rewards®, you’ll obtain a superior 1.5 cents per level redemption with the Sapphire Reserve® in comparison with 1.25 cents per level with the Chase Sapphire Most well-liked®.

The Sapphire Reserve® additionally comes with an easy-to-use $300 annual assertion credit score that can be utilized for a lot of journey bills — together with issues not so clearly categorized as “journey,” like ferries, campground charges, timeshares, and extra. This $300 credit score compensates for a big a part of the annual price and is simply pretty much as good as money for a lot of for its ease of use, bringing the annual price right down to a extra affordable $250. For those who redeem your factors via the Final Rewards® portal on the price of 1.5 cents per level and use the opposite accompanying perks, you may simply get sufficient worth to outweigh the annual price.

Sapphire Reserve® can also be the one card between the 2 that has Precedence Go™ Choose. This permits customers to entry over 1,300+ airport lounges globally, with complimentary drinks and snacks.

The Sapphire Reserve® not solely provides a Precedence Go™ Choose lounge membership with entry to airport lounges globally, but it surely additionally reimburses you as much as $100 for TSA PreCheck®, World Entry, and NEXUS utility charges each 4 years so that you could transfer extra shortly via customs and safety in your subsequent journey.

Learn our full Chase Sapphire Reserve® card evaluate for extra info.

How do you establish which card is best for you?

Off the bat, I’d be remiss if I didn’t point out that each Chase Sapphire playing cards are topic to Chase’s 5/24 rule. What’s this rule you ask?

Nicely, right here it’s: when you’ve got opened 5 or extra new playing cards within the final 24 months, Chase will virtually actually deny you for both card. For those who’re not sure for those who’ve utilized for 5 or extra playing cards, from any bank card issuer, within the final 24 months, go to Credit score Karma and have a look at what number of bank card accounts you’ve opened over the earlier two years.

When deciding which card would profit you probably the most, it’s essential to contemplate your spending habits and decide your commonest on a regular basis purchases. For those who spend cash in classes like rental automobiles, airplane tickets, and lodge stays, then the Chase Sapphire Reserve® card could also be definitely worth the funding.

Nevertheless, there are extra widespread spending classes on the Chase Sapphire Most well-liked® card that the Sapphire Reserve® doesn’t possess. As a reminder, the Chase Sapphire Most well-liked® earns three factors per greenback on groceries bought on-line (doesn’t embrace wholesale golf equipment, Goal, or Walmart), eating out and takeout, plus sure streaming providers. If that is the place most of your spending goes, the Chase Sapphire Most well-liked® is tough to go up.

If you examine annual charges to credit facet by facet:

Chase Sapphire Most well-liked®:

$95 annual price – $50 reimbursement for lodge bookings = $45 per yr yearly

Chase Sapphire Reserve®:

$550 annual price – $300 reimbursement for journey purchases = $250 yearly

Whereas everybody might want the flowery luxurious card, not everybody can use it to its full potential. That’s why it’s essential to research your spending habits and life-style wants. For those who’re satisfied that the Chase Sapphire Most well-liked® is the proper match for you, now could also be the very best time to think about making use of.

Options to the Chase Sapphire Most well-liked® and Sapphire Reserve® playing cards

Whereas the Chase Sapphire Most well-liked® and Reserve® playing cards every come extremely advisable, neither might fit your private state of affairs.

Listed here are some alternate options to think about, together with the reason why you may wish to select one in all them as an alternative.

Chase Freedom Limitless®

Not taken with paying an annual price? Then the annual price for the Sapphire Reserve® is probably going a dealbreaker for you. For those who’re not an enormous spender, you might be unable to reap the benefits of sufficient rewards and perks to make such a price value it.

For those who’re in search of a card with no annual price, then the Chase Freedom Limitless® card is a good different.

This card provides limitless 1.5% money again on all purchases. It additionally comes with an introductory supply that allows you to earn an extra 1.5% on all purchases (as much as $20,000 spent within the first yr). That’s as much as $300 money again!

After your first yr or $20,000 spent, you’ll earn 5% money again on journey booked via Chase Final Rewards® — plus 3% on eating and drugstore purchases and 1.5% on all different purchases.

The Chase Freedom Limitless® card additionally comes with a 0% Intro APR on Purchases for 15 months and 0% Intro APR on Steadiness Transfers for 15 months. After the 15-month introductory interval, your APR will vary between 20.24% – 28.99% Variable, relying in your creditworthiness.

To qualify, you’ll want credit score rating — particularly, 700 or greater. This can be a bit decrease than the superb credit score rating of 750 or greater that’s required for each the Chase Sapphire Most well-liked® and Chase Sapphire Reserve® playing cards.

Capital One Platinum Secured Mastercard®

Don’t have good or wonderful credit score? Then a secured card, just like the Capital One Platinum Secured Credit score Card, is perhaps the choice that you simply want.

Even when your credit score rating is poor (beneath 600), you may get authorized for the Capital One Platinum Secured Credit score Card.

This card comes with a $0 annual price, which is uncommon for secured playing cards.

The Capital One Platinum Secured Credit score Card doesn’t include all the bells and whistles that the Chase Sapphire Most well-liked® and Chase Sapphire Reserve® playing cards supply. Nevertheless it’s a good way for college kids — or anybody with poor or no credit score — to start out constructing their credit score historical past.

Simply through the use of this card, you may be routinely thought-about for a better credit score line in as little as six months, with no further deposit wanted.

The APR on this card is a bit greater, at 29.99% (Variable). Nevertheless, the entire level of this card is so that you can construct your credit score rating by paying off your stability in full every month.

Your Capital One Platinum Secured Credit score Card contains normal advantages, like Concierge Service in addition to a $0 Fraud Legal responsibility that ensures you gained’t should pay something in case your card is stolen.

You additionally get entry to the Capital One cell banking app and Capital One digital pockets so that you could monitor your spending always. Lastly, you get Grasp RoadAssist® Roadside Service all through the US and an Prolonged Guarantee on eligible purchases.

For Capital One merchandise listed on this web page, among the above advantages are offered by Visa® or Mastercard® and will differ by product. See the respective Information to Advantages for particulars, as phrases and exclusions apply.

Citi Customized Money℠ Card

If a yr (or extra) at 0% APR is crucial to you, then the Citi Customized Money℠ Card is another that’s laborious to beat.

This card has no annual price and an introductory price of and stability transfers. After the introductory interval, you’ll be charged , relying in your creditworthiness.

Along with the prolonged 0% APR interval, the Citi Customized Money℠ Card encompasses a versatile reward program. You’ll earn 5% money again on as much as $500 every billing cycle in your prime spending class out of the next:

- Choose streaming providers

- Drugstores

- Health golf equipment

- Fuel stations

- Grocery shops

- Residence enchancment shops

- Dwell leisure

- Eating places

- Choose journey and transit bills

You’ll additionally earn 1% again on all different purchases or any quantity that exceeds $500 per thirty days in your prime spending class.

You can too earn $200 money again after you spend $1,500 on purchases within the first 6 months of account opening.

Citi ThankYou® factors may be redeemed at a price of 1 cent every on gadgets like reward playing cards, money again, and journey (rental automobiles, lodges, and airfare) via the Citi ThankYou® portal.

The Platinum Card® from American Categorical

The Platinum Card® comes with a hefty annual price of $695 — even greater than the Chase Sapphire Reserve® card’s price. However for those who spend a big quantity on journey, procuring, and leisure every year, you then’ll get greater than your cash’s value in advantages.

Advantages embrace:

- A $200 lodge credit score per yr

- A $200 airline price credit score per yr

- $200 in Uber Money per yr ($15 per thirty days to make use of on eligible orders with Uber Eats and rides with Uber, plus a $20 bonus in December)

- 5X Membership Rewards® factors on eligible pay as you go journey

- A $240 digital leisure credit score. As much as $20 in assertion credit every month while you use your card on eligible purchases, like Audible, Disney+, Hulu, SiriusXM, or the New York Occasions.

Plus, too many different perks and advantages to listing right here!

Abstract

The Chase Sapphire Most well-liked® and Chase Sapphire Reserve® playing cards each supply superb rewards and advantages.

The Chase Sapphire Most well-liked® encompasses a decrease annual price and a greater variety of on a regular basis spending classes. It’s an important card for incomes rewards on issues like groceries, eating out, and streaming providers.

The Chase Sapphire Reserve® is finest for frequent vacationers. Whereas its annual price is $455 greater than that of the Chase Sapphire Most well-liked® card, a lot of that may be simply offset with its $300 annual assertion credit score on many eligible journey bills. By redeeming their factors via the Final Rewards® portal at a price of 1.5 cents per level, greater spenders ought to be capable of get sufficient worth to offset the cardboard’s excessive annual price.