The S&P 500 (SPY) has soared by way of the primary half of the 12 months. Much more spectacular are the tech shares within the Nasaq having a stellar first act on the 12 months. However that’s then…and that is now. That’s the reason funding veteran, Steve Reitmesiter, shares his newest views in the marketplace together with 2nd half of 2023 inventory market outlook, buying and selling plan and prime picks. Get the remainder of the story under.

Monday was the standard sleepy vacation session. Low buying and selling quantity and modest worth strikes which implies not a lot fascinating exercise price discussing after the sturdy June rally to place an exclamation level on the primary half of the 12 months.

What issues now’s what occurs subsequent. And that depends upon the Fed charge choices and what which means for the well being of the economic system. Specifically, if employment stays resilient or if it is going to lastly crack resulting in recession and renewal of the bear market.

All that and extra will likely be on the coronary heart of at present’s Reitmeister Whole Return commentary.

Market Commentary

Probably the most full means for me to share my inventory market outlook and buying and selling plan for the twond half of the 12 months is by watching the presentation I simply gave for the MoneyShow that covers the next subjects:

- Assessment of…How Did We Get Right here?

- Bear Case

- Bull Case

- And the Winner Is??? (Spoiler: Bear case extra doubtless)

- Buying and selling Plan with Particular Trades Like…

Assuming you watched the video, let me add some further colour commentary.

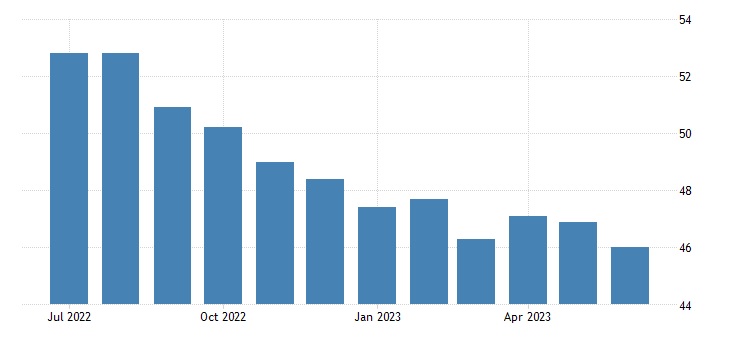

ISM Manufacturing received the July financial knowledge off with a thud on Monday. The general studying weakened from 46.9 to 46.0.

Please keep in mind once more that under 50 = contraction. And in addition keep in mind that manufacturing is taken into account the main indicator for what occurs to the general economic system. As you’ll be able to see under the development retains reducing decrease and decrease.

Subsequent think about this quote from Timothy Fiore, Char of the ISM, as to what he’s seeing on this month’s manufacturing report:

““Demand stays weak, manufacturing is slowing as a result of lack of labor, and suppliers have capability. There are indicators of extra employment discount actions within the close to time period“.

That final half is what calls for repeating. That being indicators that employment is lastly exhibiting indicators of weakening which has been the lynchpin for the recession dialog.

Q1 and Q2 of 2022 the US economic system truly contracted which is often the recipe for a recession. Nevertheless, employment stayed sturdy and with out that ache, then no recession was recorded. Because of this we have to see unemployment go as much as imagine {that a} recession is afoot and that may reawaken the bear market from its slumber.

This assertion from head of ISM, coinciding with a drop of their employment index from 51.4 to 48.1, might certainly be an indication that employment is able to tip unfavourable with greater jobless claims, decrease job provides, and better unemployment charge within the months forward lastly signaling recession.

No…simply this ISM studying alone just isn’t sufficient for bears to wave a victory flag. Simply an fascinating notice of warning buyers ought to think about earlier than overly committing to this rally which seems far too forward of itself given the regarding state of the economic system right now. Plus given historical past as our information the economic system is prone to solely worsen the longer the Fed retains elevating charges to stamp out progress and inflation. (12 of the 15 final charge hike cycles led to recession).

Talking of the Fed, the chances of a 25 level charge hike on July twenty sixth is now as much as 87% from simply 53% only a month in the past. This has additional inverted the yield curve and thus additional elevated the chances of a recession forming within the coming 12 months as much as 71%.

Extra financial stories are on the best way that buyers will wish to hold a detailed eye on together with:

7/6 ISM Companies: Will it observe ISM Manufacturing into unfavourable territory? Nicely, final time it dropped from 51.9 to 50.3…barely in enlargement territory. Additionally of curiosity would be the employment element which tipped unfavourable final month. That mixed with weak spot in ISM Mfg employment element might inform us one thing concerning the subsequent set of jobs stories.

7/6 ADP Employment & JOLTs: Traders will search for clues in these 2 employment stories to foretell what exhibits up Friday within the extra extensively adopted…

7/7 Authorities Employment State of affairs Report: Traders are nonetheless anticipating 250,000 job provides exhibiting the power of the roles market. That appears a bit elevated and maybe arrange for disappointment. Additional, buyers will hold a detailed eye on modifications in Common Hourly Earnings. This type of sticky wage inflation has been bothering the Fed and retaining them on the speed hike struggle path. So this wage element may have a great deal to do with future rake hike choices.

7/12 CPI & 7/13 PPI: These month-to-month inflation stories will even have market transferring affect because it definitely will issue into the subsequent factor…

7/26 Fed charge hike resolution: To be sincere, the pause final month made no sense if you end up saying extra work to do and sure 2 extra charge will increase. At this stage it’s a forgone conclusion {that a} charge hike will are available in late July. Thus, the important thing to market response will likely be statements by Powell to see if the committee nonetheless sees 1 or extra charge hikes and once they is likely to be prepared for a pivot to larger lodging.

As shared in my 2nd Half of 2023 Inventory Market Outlook I nonetheless imagine the info level to recession and return of the bear market the most probably end result.

Sure, I perceive the value motion is clearly saying one thing else. However that’s simply the pendulum of concern and greed for you…it at all times swings too laborious in a single course earlier than swinging again to the opposite.

The important thing for investing right now is to take care of a balanced investing posture…like 50% invested within the inventory market.

If certainly I’m proper that Fed is working extra time to create a recession…then when these indicators change into extra evident to buyers shares will tumble and we are able to get extra defensive in our portfolio (promoting Danger On shares + upping the ante on inverse ETFs to revenue on the best way down).

If the Fed amazingly generates a comfortable touchdown, then I will likely be glad to heed these alerts by getting extra aggressively lengthy the inventory market.

However let’s keep in mind the Fed themselves are predicting a recession will kind earlier than they begin reducing charges. When you think about the historic optimistic bias of Fed statements, then extra buyers ought to respect why being bullish now appears a bit untimely.

What To Do Subsequent?

Uncover my full market outlook and buying and selling plan for the remainder of 2023. It’s all out there in my newest presentation:

2nd Half of 2023 Inventory Market Outlook >

Simply in case you might be curious, let me pull again the curtain slightly wider on the principle contents:

- Assessment of…How Did We Get Right here?

- Bear Case

- Bull Case

- And the Winner Is??? (Spoiler: Bear case extra doubtless)

- Buying and selling Plan with Particular Trades Like…

- Prime 10 Small Cap Shares

- 4 Inverse ETFs

- And A lot Extra!

If these concepts attraction to you, then please click on under to entry this very important presentation now:

2nd Half of 2023 Inventory Market Outlook >

Wishing you a world of funding success!

Steve Reitmeister…however everybody calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Whole Return

SPY shares had been buying and selling at $443.79 per share on Monday afternoon, up $0.51 (+0.12%). Yr-to-date, SPY has gained 16.92%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

In regards to the Writer: Steve Reitmeister

Steve is best recognized to the StockNews viewers as “Reity”. Not solely is he the CEO of the agency, however he additionally shares his 40 years of funding expertise within the Reitmeister Whole Return portfolio. Be taught extra about Reity’s background, together with hyperlinks to his most up-to-date articles and inventory picks.

The submit Are Inventory Fireworks OVER After July 4th? appeared first on StockNews.com