Put this phrase in your vocabulary for the second half of the 12 months as a result of you’ll be listening to it all over the place: “a gentle recession.”

That is the place the puck goes. All of Wall Road’s chief strategists and chief economists are going to be pivoting to this case in the event that they haven’t already. The “tender touchdown” concept goes to fade away. Now will probably be a tender, silky, attractive delicate recession. It’s about to turn into consensus.

There isn’t a purpose to dwell in concern of this, ought to it truly occur. Now we have already been dwelling with recessionary situations within the inventory marketplace for 7 or 8 months now.

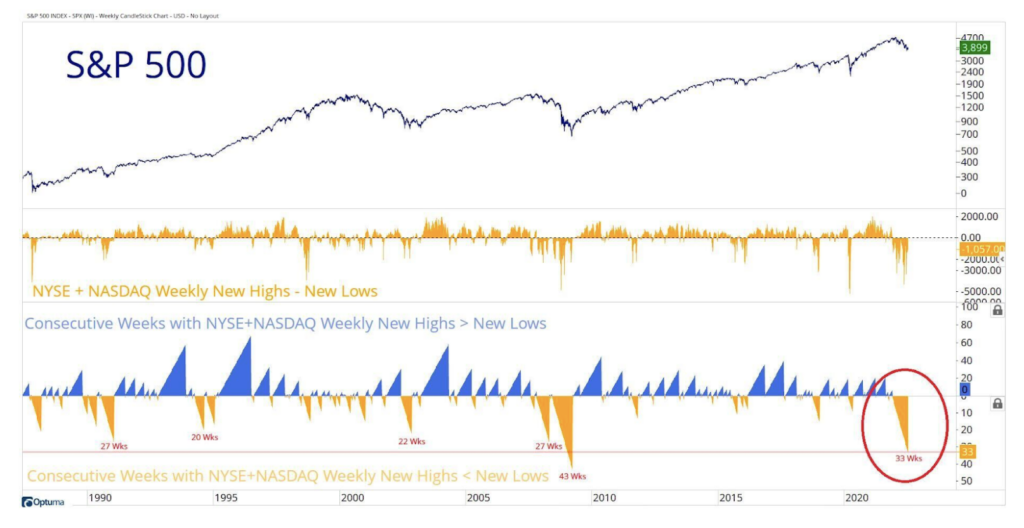

Final night time on What Are Your Ideas we used the beneath chart from JC:

That’s 33 consecutive weeks of extra shares making new lows than making new highs. As you may see, that is traditionally as unhealthy because it will get with the lone exception of the Nice Monetary Disaster in 2008-2009. Once more, this isn’t the longer term, that is the current. Now we have already been dwelling by means of it.

This morning’s June CPI report got here in at 9.1%, one other contemporary 40-year excessive and above Wall Road’s consensus expectations. Core CPI (which removes the at all times risky meals and power elements) additionally got here in hotter than anticipated. PCE – Private Consumption and Expenditures, an alternate inflation measure mentioned to be extra intently watched by the Federal Reserve – may are available in milder however that is solely as a result of it has a decrease weighting to housing and hire costs. The housing element for inflation is now the largest upside contributor.

The excellent news is that falling gasoline costs during the last month will assist the scenario on the bottom. As well as, journey costs have been cooling off, each airline fares and accommodations are off the highs. However that’s about it.

What this report means is that one other 75 foundation level transfer is a lock for July’s FOMC assembly. That will put the in a single day Fed Funds fee at 2.25%. One other massive hike is sort of assured for September. This morning the Financial institution of Canada introduced a 100 foundation level rate of interest hike. The market was anticipating 50 foundation factors. Central bankers around the globe are completed taking part in video games, excluding the ECB and BoJ. They’re checkmated for numerous causes and won’t act till everybody else has.

And this week we’re going to start out listening to from Company America, which can solely enhance the case for “a gentle recession” as CEOs and CFOs journey over one another to ratchet down 2nd half expectations. That is what ought to occur. It units up future upside surprises ought to the recession truly show to be delicate.

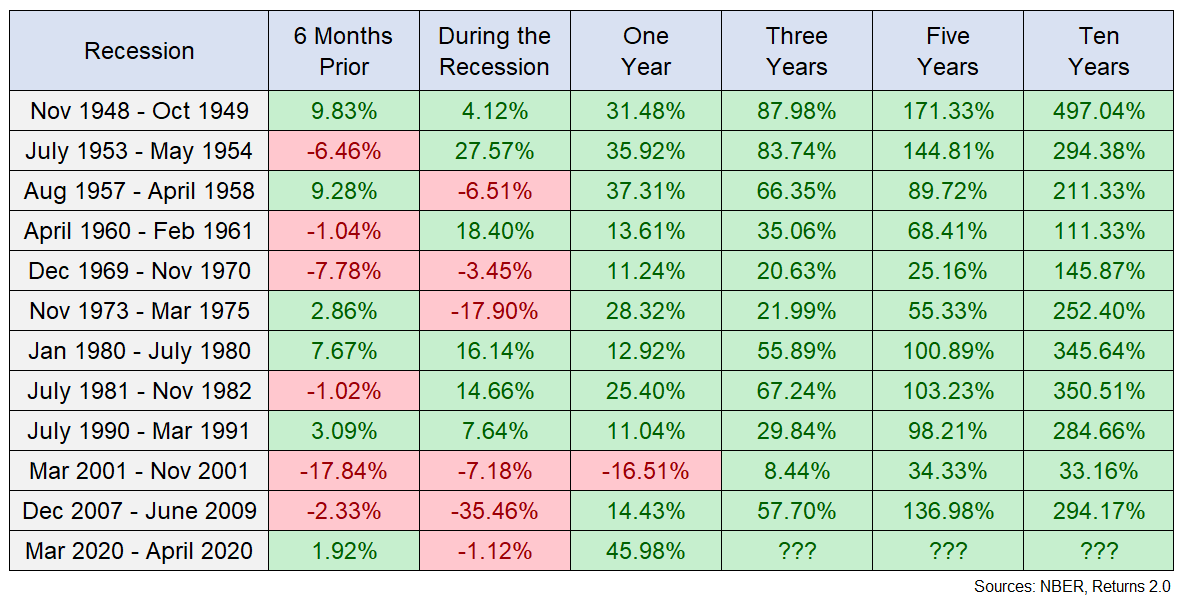

Again to shares – the chart beneath ought to give you some hope about why the longer term isn’t fairly as dour as you may suppose. Historical past tells us that shares do a whole lot of the repricing work AHEAD of recessions. Right here’s what occurred for the inventory market earlier than, throughout and after each recession since World Battle II by way of my colleague Ben Carlson. You possibly can learn his publish right here.

Most recessions don’t require catastrophic losses, as you may see. In some excessive instances issues get actually unhealthy. I might argue that they have already got gotten fairly unhealthy. Nothing is sneaking up on us – individuals have been speaking about recession all 12 months and inventory costs have already been adjusting for this risk because the first day of January.

It’s going to be okay. Put your head down, hold saving and investing, hold your value of dwelling in test, keep away from leverage, keep in mind that all bear markets have one factor in frequent: They finish.