Steve Reitmeister is not at all a permabear…however its laborious for him to surrender his economics background and switch away from the bearish proof in hand. Nevertheless, with the S&P 500 (SPY) up greater than 20% from the October lows its time for some sincere reflection of the present bull vs. bear case. That’s what one can find under together with a buying and selling plan for the weeks and months forward.

The S&P 500 (SPY) has been consolidating round 4,400 early in July after an enormous rally to finish June.

On the floor that doesn’t sound so spectacular. Gladly under the floor cash is rotating out of overblown mega caps into small and mid caps. That enhancing market breadth is a really bullish signal.

But not the whole lot is bullish. There are nonetheless quite a lot of indicators that time decidedly bearish. Which altogether makes issues VERY CONFUSING.

I’ll do my greatest to offer a good and balanced overview of what’s taking place now so we are able to chart our course ahead.

Market Commentary

Let’s overview what’s bullish presently.

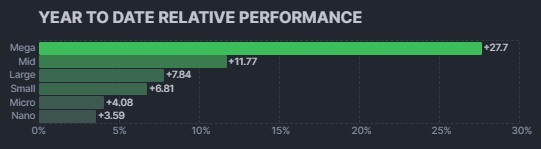

Value Motion: At first many buyers shrugged off the information that this was a brand new bull market given a higher than 20% rise from the October backside of three,577. That’s as a result of nearly all of the positive factors have been accruing to the Magnificent 7 mega caps whereas most smaller shares have been simply treading water.

Over the previous month that image has enormously improved resulting in extra positive factors throughout extra inventory teams:

No Recession at This Time: Traders maintain listening to about the opportunity of recession but with the overwhelming majority of related Q2 financial information in hand, the US economic system continues to muddle alongside.

This features a +2.3% prediction from the famed GDPNow Mannequin from the Atlanta Fed. The Bluechip Economists panel sees issues a bit extra subdued at +1.3%…however that prediction is up from solely +0.8% a month in the past. So, there could also be extra upside in that quantity earlier than it’s introduced in late August.

Jobs-A-Lots: Plain and easy, with out job loss there isn’t a recession. And as of the latest month-to-month employment reviews we’re seeing ample job provides that maintain the unemployment fee close to historic lows.

Now let’s juxtapose that versus an attention-grabbing slate of indicators that also level decidedly bearish.

Inverted Yield Curve: You already know this is likely one of the most constant indicators that factors to future recessions as you will note within the chart under:

Observe that EVERY TIME the yield curve inverts {that a} recession follows. And now respect that the yield curve is probably the most inverted it has been because the early 1980’s when the market was riddled with recessions and bear markets. Onerous to see that an not give it critical credence.

Don’t Combat the Fed: That is everybody’s favourite chant when the economic system goes within the dumpster and the Fed lowers charges to enhance the economic system. That is additionally a magical tonic for inventory costs.

But now we’ve got the precise reverse the place the Fed is proactively stepping on the brakes of the economic system to stamp out the flames of excessive inflation. Even now 16 months into their fee hike cycle the work isn’t carried out with seemingly 2 extra will increase to come back beginning with the July 26th assembly.

Fed officers have been extremely clear that they might reasonably have a recession than enable inflation to turn into entrenched. Taken one other manner…they are going to maintain elevating charges till they get inflation beneath management. This additionally provides up if you respect that 12 of the final 15 fee hike cycles led to recession.

Now respect that probably the most persistent type of inflation, is wage inflation given an impressively sturdy employment market. So for the Fed to win the ultimate battle over inflation they seemingly must maintain elevating charges til there may be job loss. That could be a Pandoras Field that when opened often results in a lot higher job loss > recession > bear market.

Which means that the present optimistic of a powerful labor market is what’s going to truly maintain the Fed working additional time to reverse course in an effort to bury excessive inflation as soon as and for all. This suits in with Steve Liesman’s assertion on CNBC that the Fed is “going to maintain elevating charges til they break one thing.”

Who’s Proper and Who’s Improper?

The elemental bearish case is compelling…however the optimistic value motion is tough to disregard. And really daily that there’s not damaging information the pull of FOMO rally has extra folks bidding up shares presently.

Thus, so much depends upon the following set of market transferring occasions akin to:

7/12 CPI Report: Not simply the headline yr over yr comparability issues. Traders must look into the present tempo of inflation that’s higher seen in month over month information. In addition to the composition of Sticky vs. Versatile inflation parts. This report will inform give buyers extra clues about how a lot more durable the Fed must struggle to finish excessive inflation.

7/26 Fed Charge Hike Conferences: It’s a forgone conclusion that the Fed shall be mountain climbing charges one other 25 foundation factors on the assembly. So what actually issues is the statements and hawkish tone of Powell on the press convention that follows. If he nonetheless thinks this fee hike cycle ends with a recession then buyers ought to most likely pay attention up.

Q2 Earnings Season: Earnings expectations are very low with Wall Avenue predicting a 12% yr over yr decline in company earnings. But going ahead buyers are presently anticipating an earnings rebound that many assume is a bit too optimistic.

So the actual key to this earnings season isn’t the % of firms that beat or miss expectations in Q2. Relatively, it’s earnings estimate revisions to future quarters that can have the best influence on inventory costs.

On that entrance, let me share with you the current feedback of famous earnings knowledgeable, Nick Raich from EarningsScout.com:

- Inflation and Fed financial coverage stay the important thing drivers for future company earnings and in the end inventory costs.

- With hopes for rate of interest cuts fading as the cruel actuality the Fed will maintain rates of interest greater for longer, we’re measuring weakening EPS estimate revisions among the many early 2Q 2023 reporters.

- In complete, 15 out of the primary 18 S&P 500 firms reporting 2Q 2023 had their subsequent quarter EPS estimates fall afterwards.

- With no rate of interest cuts on the horizon and a fee hike anticipated later this month, it’s uncertain that S&P 500 EPS expectations will see any enchancment this earnings season.

- Our recommendation? Keep underweight shares

And My Buying and selling Plan Is…

With my economics background, and the teachings of historical past, there isn’t a manner for me to not see the present surroundings as essentially bearish.

However, I can’t deny some points of the bullish story. Plus how usually the optimistic value motion of shares is a number one indicator of a flip in financial information as a result of it improves sentiment and buying choices that spur the economic system.

This retains me in a balanced portfolio posture that’s roughly 50% invested within the inventory market. Nevertheless, the shares that I’m centered on are small caps which might be lastly beginning to take the baton from mega caps to guide the pack. Which means shopping for the Magnificent 7 and outpacing the market sport plan of the primary half of 2023 is performed out…time for worthy others to guide.

As extra information emerge it can turn into extra obvious if the market is really bullish or bearish. With that can come applicable modifications to my funding technique. My hope is that the bull story wins out and more than pleased to get again to gung ho bullish investing.

Nevertheless, if the bear is certainly going to come back out of hibernation, then we have to alter in that path. That features promoting our current winners to lock in earnings earlier than they rapidly get wiped off the boards.

What To Do Subsequent?

Uncover my full market outlook and buying and selling plan for the remainder of 2023. It’s all obtainable in my newest presentation:

2nd Half of 2023 Inventory Market Outlook >

Simply in case you might be curious, let me pull again the curtain just a little wider on the principle contents:

- Overview of…How Did We Get Right here?

- Bear Case

- Bull Case

- And the Winner Is??? (Spoiler: Bear case extra seemingly)

- Buying and selling Plan with Particular Trades Like…

- High 10 Small Cap Shares

- 4 Inverse ETFs

- And A lot Extra!

If these concepts attraction to you, then please click on under to entry this important presentation now:

2nd Half of 2023 Inventory Market Outlook >

Wishing you a world of funding success!

Steve Reitmeister…however everybody calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Complete Return

SPY shares rose $0.03 (+0.01%) in after-hours buying and selling Tuesday. Yr-to-date, SPY has gained 16.57%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

In regards to the Creator: Steve Reitmeister

Steve is best identified to the StockNews viewers as “Reity”. Not solely is he the CEO of the agency, however he additionally shares his 40 years of funding expertise within the Reitmeister Complete Return portfolio. Be taught extra about Reity’s background, together with hyperlinks to his most up-to-date articles and inventory picks.

The submit A Bearish Investor Ponders the Bull Case for Shares appeared first on StockNews.com